Market brief 24/02/2022

VIETNAM STOCK MARKET

1,494.85

1D -1.15%

YTD -0.23%

1,522.04

1D -1.09%

YTD -0.89%

434.88

1D -1.73%

YTD -8.25%

112.32

1D -1.05%

YTD -0.32%

-185.97

1D 0.00%

YTD 0.00%

42,596.70

1D 53.92%

YTD 37.09%

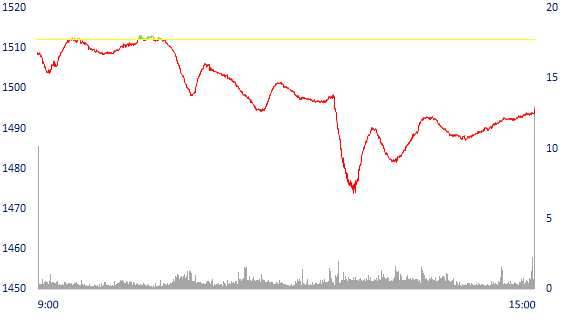

Massively bottom-fishing cash flow in one hour stimulated HOSE's liquidity to surpass 35,000 billion for the first time after Tet. At the time of the sharpest drop of 39 points, HOSE's capitalization evaporated more than 152,000 billion dong. Thus, in just over 1 hour, the large cash flow in to catch the bottom, HOSE has regained more than 84,000 billion in capitalization.

ETF & DERIVATIVES

25,400

1D -1.47%

YTD -1.66%

17,900

1D -1.10%

YTD -1.05%

18,500

1D 3.87%

YTD -2.63%

22,900

1D 0.44%

YTD 0.00%

22,600

1D -0.40%

YTD 0.53%

28,800

1D -3.13%

YTD 2.67%

19,960

1D -0.70%

YTD -7.08%

1,500

1D -0.60%

YTD 0.00%

1,504

1D -1.05%

YTD 0.00%

1,515

1D -0.95%

YTD 0.00%

1,540

1D 0.00%

YTD 0.00%

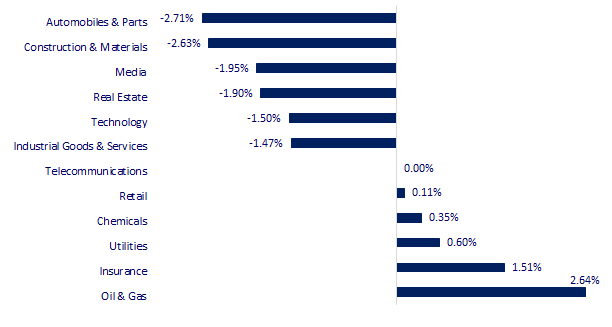

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

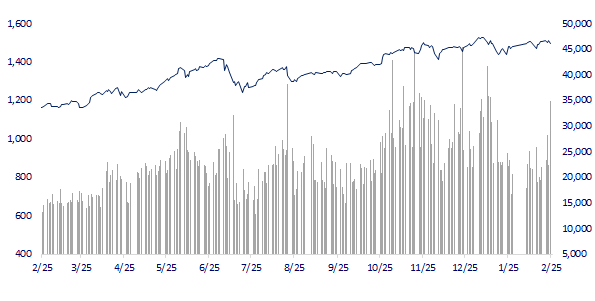

VNINDEX (12M)

GLOBAL MARKET

25,970.82

1D -1.03%

YTD -9.80%

3,429.96

1D -1.70%

YTD -5.76%

2,648.80

1D -2.60%

YTD -11.04%

22,901.56

1D -1.63%

YTD -2.12%

3,276.06

1D -3.45%

YTD 4.88%

1,662.72

1D -1.99%

YTD 0.31%

99.95

1D 7.31%

YTD 30.65%

1,972.60

1D 3.00%

YTD 8.34%

Ukraine tensions escalate, Asian stocks fall. In Japan, the Nikkei 225 fell 1.03%. The Chinese market fell with the Shanghai Composite down 1.7%. Hong Kong's Hang Seng fell 1.63%. South Korea's Kospi index fell 2.6%.

VIETNAM ECONOMY

2.57%

1D (bps) 6

YTD (bps) 176

5.60%

1.34%

1D (bps) 4

YTD (bps) 33

2.03%

1D (bps) -15

YTD (bps) 3

23,060

1D (%) 0.40%

YTD (%) 0.52%

25,968

1D (%) -1.97%

YTD (%) -1.89%

3,681

1D (%) -0.03%

YTD (%) 0.63%

According to the General Department of Customs, the total import and export value of Vietnam's goods from February 1 to February 15 reached 21.41b USD, down 33.8% (equivalent to 10.92b USD) compared to half the end of January, mainly due to the Tet holiday. In which, the total import-export value of FDI enterprises reached USD 56.91b, up 6.9% (up to USD 3.7b), the import-export value of domestic enterprises was 24.78b USD, up 17% (up 3.59b USD) over the same period in 2021.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam has a trade deficit of 2.53 billion USD until mid-February

- The Ministry of Transport requested to shorten the progress of component projects of the North - South expressway

- The local oil shortage will soon be resolved

- The Fed's path to raising interest rates becomes more precarious with tensions in Ukraine

- Military tension escalates, stocks sell-off, oil price surpasses $100/barrel

- Iran delivers more oil to ships in preparation for a revived nuclear deal

VN30

BANK

85,300

1D -1.84%

5D -2.51%

Buy Vol. 3,279,900

Sell Vol. 2,854,300

44,600

1D -2.19%

5D -3.04%

Buy Vol. 5,871,900

Sell Vol. 6,053,600

33,850

1D -2.87%

5D -3.01%

Buy Vol. 25,781,300

Sell Vol. 27,000,200

50,500

1D -2.32%

5D -3.26%

Buy Vol. 24,485,300

Sell Vol. 24,962,700

36,900

1D 2.79%

5D 1.65%

Buy Vol. 55,038,600

Sell Vol. 66,670,300

34,000

1D -1.02%

5D 2.41%

Buy Vol. 50,313,600

Sell Vol. 54,289,900

28,800

1D -2.87%

5D -3.19%

Buy Vol. 27,182,500

Sell Vol. 25,354,400

41,250

1D -3.17%

5D 0.24%

Buy Vol. 7,944,300

Sell Vol. 11,718,400

32,900

1D -2.08%

5D -2.95%

Buy Vol. 49,210,400

Sell Vol. 51,543,300

34,450

1D -0.43%

5D 0.44%

Buy Vol. 13,626,000

Sell Vol. 14,243,700

According to statistics, 3 state-owned banks including Vietcombank, BIDV and VietinBank are dominating the deposit market share. In which, BIDV is leading with 1,361 million billion VND mobilized from customers in 2021, up 12.87% over the same period. BIDV also led the market in customer lending (including lending to domestic economic organizations and individuals) with VND 1,291 million billion, up 11.30% over the same period. With the above level of loans and deposits, BIDV's customer loan interest income reached VND 87,535 billion, up 3% over the same period.

REAL ESTATE

76,000

1D -1.81%

5D -3.80%

Buy Vol. 3,666,800

Sell Vol. 3,881,200

52,800

1D -2.40%

5D -3.83%

Buy Vol. 2,524,400

Sell Vol. 3,190,300

88,600

1D -1.56%

5D -3.70%

Buy Vol. 3,750,000

Sell Vol. 4,138,500

NVL: Novaland set up a subsidiary to build a 23,500-hectare project in Dak Nong. Novaland plans to contribute 51 billion dong to own 51% of Novaland Dat Tam Real Estate Investment.

OIL & GAS

119,000

1D 1.71%

5D 0.25%

Buy Vol. 2,880,000

Sell Vol. 3,608,800

17,750

1D -2.20%

5D -4.57%

Buy Vol. 47,511,200

Sell Vol. 50,792,500

63,400

1D 1.44%

5D 5.67%

Buy Vol. 9,143,800

Sell Vol. 11,440,000

As noted by Bloomberg, amid the sudden escalation of tensions between Russia and Ukraine, the price of Brent oil has crossed the threshold of 100 USD/barrel for the first time since 2014.

VINGROUP

80,100

1D -2.91%

5D -3.61%

Buy Vol. 9,343,700

Sell Vol. 9,778,700

78,600

1D -1.01%

5D -2.72%

Buy Vol. 8,862,600

Sell Vol. 10,174,900

34,000

1D -2.58%

5D -1.31%

Buy Vol. 19,900,800

Sell Vol. 19,329,300

VHM: opened the final sale of 18,000 apartments at Vinhomes Grand Park, Ocean Park and Smart City projects. From 2022, VHM plans to launch 3 new projects to the market.

FOOD & BEVERAGE

78,600

1D -1.75%

5D -2.72%

Buy Vol. 4,015,100

Sell Vol. 5,094,700

159,500

1D 1.46%

5D -2.15%

Buy Vol. 1,801,500

Sell Vol. 1,605,400

169,700

1D -0.06%

5D -0.47%

Buy Vol. 244,400

Sell Vol. 277,000

MSN: Phuc Long was injected with more than 300b dong by Techcombank after it was handed over to Masan. The credit has a term of 12 months, to invest in expanding the business network.

OTHERS

148,000

1D -0.13%

5D 4.52%

Buy Vol. 1,070,300

Sell Vol. 1,000,500

148,000

1D -0.13%

5D 4.52%

Buy Vol. 1,070,300

Sell Vol. 1,000,500

92,000

1D -1.08%

5D -0.86%

Buy Vol. 2,069,500

Sell Vol. 3,168,100

136,800

1D -0.73%

5D 1.71%

Buy Vol. 1,936,700

Sell Vol. 2,146,900

109,000

1D -0.55%

5D 1.02%

Buy Vol. 3,115,300

Sell Vol. 2,886,000

33,700

1D -1.61%

5D -0.88%

Buy Vol. 5,007,000

Sell Vol. 5,916,900

44,600

1D -1.55%

5D -0.89%

Buy Vol. 20,572,200

Sell Vol. 24,959,300

46,000

1D -1.50%

5D -1.08%

Buy Vol. 36,848,300

Sell Vol. 39,017,300

PNJ: Mr. Le Quang Phuc, a member of the Board of Directors, registered to sell 19,200 shares. Methods of deal-making and order-matching in the period from February 28 to March 28.

Market by numbers

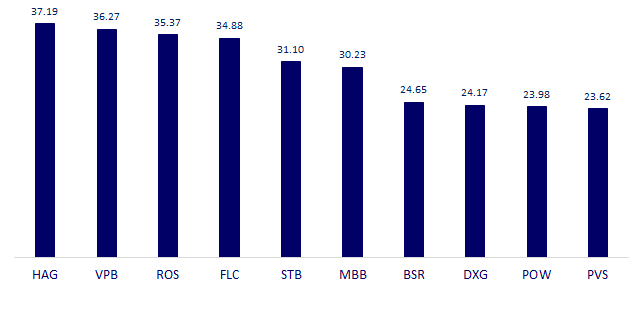

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

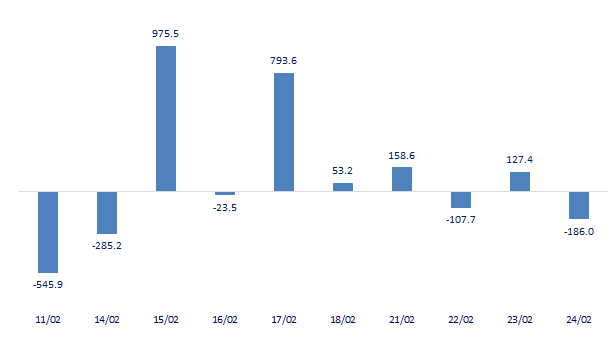

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

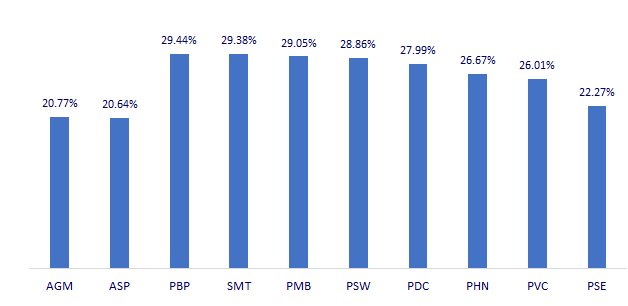

TOP INCREASES 3 CONSECUTIVE SESSIONS

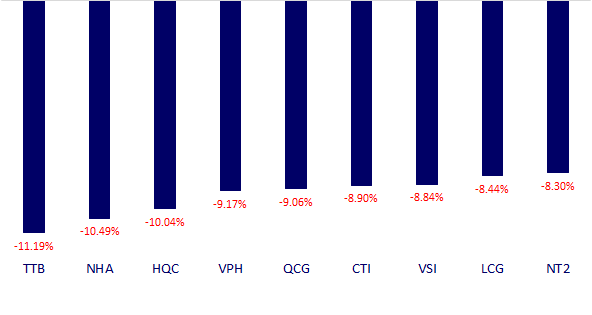

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.