Market brief 25/02/2022

VIETNAM STOCK MARKET

1,498.89

1D 0.27%

YTD 0.04%

1,526.50

1D 0.29%

YTD -0.60%

440.16

1D 1.21%

YTD -7.14%

112.66

1D 0.30%

YTD -0.02%

-78.30

1D 0.00%

YTD 0.00%

30,690.78

1D -27.95%

YTD -1.23%

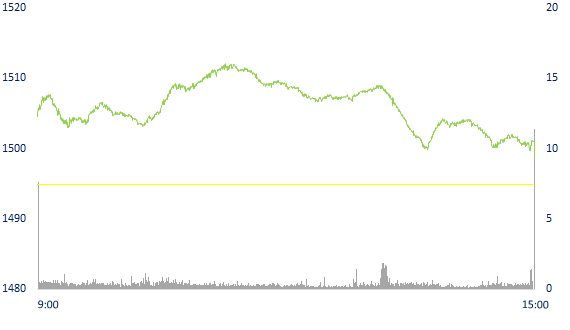

Market liquidity today dropped sharply compared to the previous session. The total matched value reached 29,272 billion dong, down 29%, of which, the matched value on HoSE alone decreased 28% to 24,595 billion dong. Foreign investors net sold slightly more than 60 billion dong on HoSE.

ETF & DERIVATIVES

25,500

1D 0.39%

YTD -1.28%

17,950

1D 0.28%

YTD -0.77%

18,890

1D 6.06%

YTD -0.58%

22,700

1D -0.87%

YTD -0.87%

23,070

1D 2.08%

YTD 2.62%

29,500

1D 2.43%

YTD 5.17%

20,060

1D 0.50%

YTD -6.61%

1,512

1D 0.77%

YTD 0.00%

1,507

1D 0.18%

YTD 0.00%

1,517

1D 0.15%

YTD 0.00%

1,540

1D 0.00%

YTD 0.00%

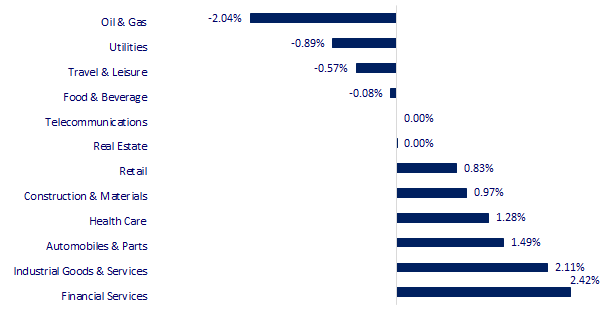

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

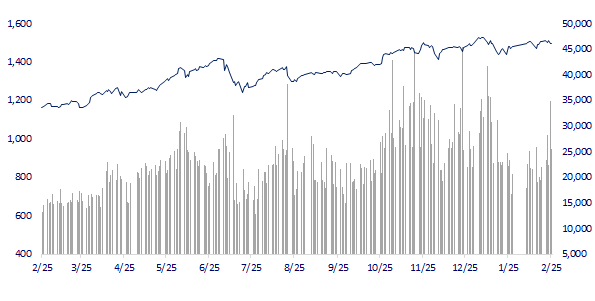

VNINDEX (12M)

GLOBAL MARKET

26,476.50

1D 0.50%

YTD -8.04%

3,451.41

1D 0.63%

YTD -5.18%

2,676.76

1D 1.06%

YTD -10.10%

22,767.18

1D -0.75%

YTD -2.69%

3,294.47

1D 0.56%

YTD 5.47%

1,679.90

1D 1.03%

YTD 1.34%

92.53

1D -2.83%

YTD 20.95%

1,912.65

1D 0.09%

YTD 5.04%

Asian stocks mostly rose after Wall Street's rally. In Japan, the Nikkei 225 gained 0.5%. The Chinese market rose with the Shanghai Composite up 0.63%, Shenzhen Component up 1.21%. Hong Kong's Hang Seng fell 0.75%. South Korea's Kospi index increased 1.06%, Kosdaq increased 1.06%.

VIETNAM ECONOMY

2.56%

1D (bps) -1

YTD (bps) 175

5.60%

1.43%

1D (bps) 9

YTD (bps) 42

2.11%

1D (bps) 8

YTD (bps) 11

23,045

1D (%) 0.28%

YTD (%) 0.46%

25,958

1D (%) -1.35%

YTD (%) -1.93%

3,684

1D (%) 0.14%

YTD (%) 0.71%

According to the plan guided by the circular, the State Bank and the Ministry of Finance can allocate limits to banks when the disbursement is close to reaching the maximum level. It is expected that the maximum funding source for the program implementation is VND 40,000 billion, equivalent to an average loan balance of VND 1 million billion per year with interest rate support.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- It is expected to allocate VND 40,000 billion to support interest rates in the final stage

- PwC: M&A activity hits a record with 62,000 deals in 2021, forecast to continue growing in 2022

- Imported an additional 2.4 million m3 of petroleum in the second quarter

- Ukraine's central bank restricts cash withdrawals and bans foreign currency purchases, people switch to cryptocurrencies

- Affected by the Russia-Ukraine conflict, gas supplies may be disrupted globally

- China injects $46 billion into financial system amid Russia-Ukraine conflict

VN30

BANK

85,100

1D -0.23%

5D -2.41%

Buy Vol. 2,598,300

Sell Vol. 2,327,700

44,550

1D -0.11%

5D -0.34%

Buy Vol. 3,819,800

Sell Vol. 4,086,300

33,850

1D 0.00%

5D -2.17%

Buy Vol. 16,764,300

Sell Vol. 18,484,800

50,700

1D 0.40%

5D -1.74%

Buy Vol. 11,099,500

Sell Vol. 12,985,400

38,200

1D 3.52%

5D 6.41%

Buy Vol. 71,775,500

Sell Vol. 77,127,700

34,100

1D 0.29%

5D 4.44%

Buy Vol. 29,852,300

Sell Vol. 34,437,400

29,250

1D 1.56%

5D -0.85%

Buy Vol. 7,366,800

Sell Vol. 8,117,900

41,950

1D 1.70%

5D 2.82%

Buy Vol. 13,946,900

Sell Vol. 19,445,900

33,000

1D 0.30%

5D -1.05%

Buy Vol. 29,827,200

Sell Vol. 35,645,800

34,350

1D -0.29%

5D 1.48%

Buy Vol. 8,329,800

Sell Vol. 11,896,600

Many banks have recently revealed their 2022 dividend plan. In that context, foreign investors tend to be net buyers at some banks with high payout ratios and attractive valuations such as VIB , OCB, CTG... In 2022, VIB plans to increase its charter capital to over 21,000 billion dong, up 35.7%. In which, the bank plans to distribute 35% bonus shares to shareholders from equity. At the meeting taking place in early April, ACB also has a plan to increase charter capital by shares. Specific plans have not been announced but in 2020 and 2021 this bank has issued shares to pay dividends at the rate of 30% and 25% respectively.

REAL ESTATE

76,300

1D 0.39%

5D -2.80%

Buy Vol. 5,675,300

Sell Vol. 4,922,000

53,300

1D 0.95%

5D -1.30%

Buy Vol. 1,426,600

Sell Vol. 1,487,700

87,500

1D -1.24%

5D -4.06%

Buy Vol. 3,135,000

Sell Vol. 3,563,500

NVL: Regarding the IPO plan, Nova Consumer plans to offer 10.9 million shares to the public for the first time, equivalent to 10% of capital. Minimum offering price is 43,462 VND/share.

OIL & GAS

117,200

1D -1.51%

5D 0.17%

Buy Vol. 1,884,900

Sell Vol. 2,385,900

17,850

1D 0.56%

5D -3.77%

Buy Vol. 31,532,500

Sell Vol. 34,499,700

62,400

1D -1.58%

5D 4.35%

Buy Vol. 5,297,300

Sell Vol. 5,108,200

PLX: ENEOS Corporation registered to transfer all 65.7 million PLX shares, equivalent to 5.08%. The implementation period is from February 25, 2021 to March 26, 2021

VINGROUP

79,100

1D -1.25%

5D -3.77%

Buy Vol. 5,120,700

Sell Vol. 5,524,500

78,300

1D -0.38%

5D -1.76%

Buy Vol. 4,567,500

Sell Vol. 6,113,200

34,000

1D 0.00%

5D 1.19%

Buy Vol. 7,406,400

Sell Vol. 8,565,300

VHM: VHM's land is 16,800 hectares as of September 2021, the highest among listed real estate developers, about 3 times higher than the second is NVL.

FOOD & BEVERAGE

78,900

1D 0.38%

5D -2.11%

Buy Vol. 2,629,700

Sell Vol. 3,285,300

158,000

1D -0.94%

5D -3.25%

Buy Vol. 744,400

Sell Vol. 1,272,500

169,600

1D -0.06%

5D 0.12%

Buy Vol. 125,800

Sell Vol. 199,700

VNM: On December 23, 2021, VNM and Vilico received approval to invest dairy business in Hung Yen. Total investment is expected to be 4,600bVND with a designed capacity of 400m liters/year.

OTHERS

145,100

1D -1.96%

5D -2.62%

Buy Vol. 936,300

Sell Vol. 1,040,600

145,100

1D -1.96%

5D -2.62%

Buy Vol. 936,300

Sell Vol. 1,040,600

92,300

1D 0.33%

5D 0.11%

Buy Vol. 1,515,200

Sell Vol. 2,420,800

137,600

1D 0.58%

5D 2.69%

Buy Vol. 3,992,700

Sell Vol. 5,397,600

107,800

1D -1.10%

5D 0.75%

Buy Vol. 2,786,600

Sell Vol. 2,786,500

34,000

1D 0.89%

5D 1.19%

Buy Vol. 2,661,000

Sell Vol. 3,562,900

45,700

1D 2.47%

5D 1.11%

Buy Vol. 23,915,300

Sell Vol. 29,237,900

45,900

1D -0.22%

5D -2.44%

Buy Vol. 21,388,900

Sell Vol. 23,806,900

HPG: The Group has been granted a decision on investment policy for Hoa Phat Dung Quat 2 Project, with a total investment of 85 trillion VND, focusing on hot-rolled coil production. Construction is expected to start at the end of the first quarter and be completed by the end of 2024. At that time, the total output of Hoa Phat Dung Quat Steel will reach 11 million tons of steel per year, contributing about 18 trillion VND to the state budget.

Market by numbers

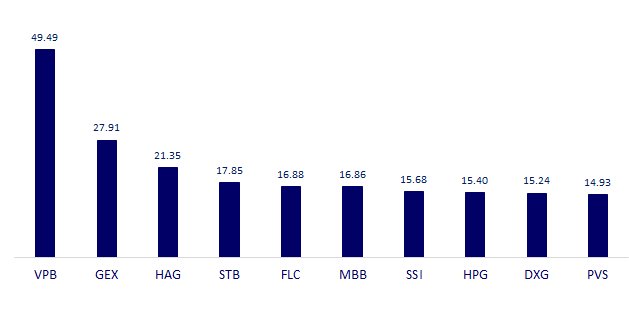

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

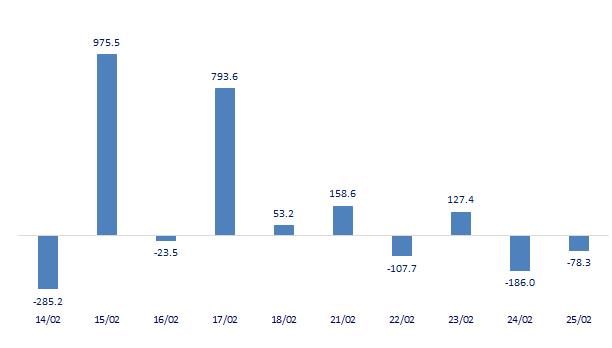

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

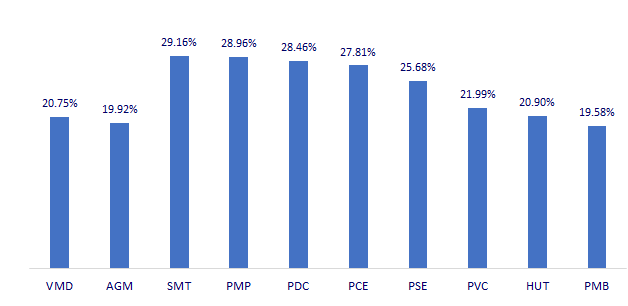

TOP INCREASES 3 CONSECUTIVE SESSIONS

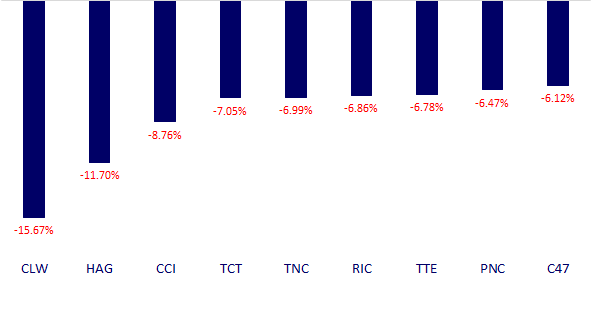

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.