Market brief 01/03/2022

VIETNAM STOCK MARKET

1,498.78

1D 0.58%

YTD 0.03%

1,520.12

1D 0.19%

YTD -1.02%

443.56

1D 0.71%

YTD -6.42%

112.38

1D 0.16%

YTD -0.27%

122.27

1D 0.00%

YTD 0.00%

31,420.75

1D 12.12%

YTD 1.12%

In February 2022, although foreign investors maintained a net selling position, the value decreased significantly compared to the previous month, so the pressure on the general market was more modest. Total net selling volume was at 25m shares, equivalent to a value of VND 243.4b (down 91% MoM). Thus, foreign investors have been net sellers for 7 consecutive months with a total value of nearly 40,000b dong.

ETF & DERIVATIVES

25,600

1D -0.78%

YTD -0.89%

17,860

1D -0.22%

YTD -1.27%

18,720

1D 5.11%

YTD -1.47%

22,300

1D -0.09%

YTD -2.62%

22,850

1D 0.66%

YTD 1.65%

28,800

1D -2.37%

YTD 2.67%

20,060

1D 0.30%

YTD -6.61%

1,502

1D -0.18%

YTD 0.00%

1,506

1D 0.09%

YTD 0.00%

1,516

1D 0.29%

YTD 0.00%

1,540

1D 0.00%

YTD 0.00%

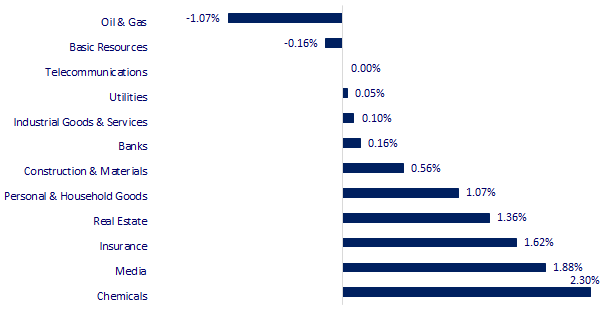

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

26,844.72

1D -0.61%

YTD -6.76%

3,488.83

1D 0.77%

YTD -4.15%

2,699.18

1D 0.00%

YTD -9.35%

22,761.71

1D 0.09%

YTD -2.72%

3,278.63

1D 1.12%

YTD 4.96%

1,694.28

1D 0.54%

YTD 2.21%

98.77

1D 2.34%

YTD 29.11%

1,926.50

1D 1.12%

YTD 5.81%

Asian stocks are mixed, investors continue to monitor the situation in Ukraine. In Japan, the Nikkei 225 fell 0.61%. The Chinese market rallied with the Shanghai Composite up 0.77%. Hong Kong's Hang Seng rose 0.38%. China today released the February manufacturing purchasing managers index (PMI) with the official manufacturing PMI of 50.2 points, beating forecasts of 49.9 points and up slightly from 50.1 points in January.

VIETNAM ECONOMY

2.56%

1D (bps) 1

YTD (bps) 175

5.60%

1.57%

1D (bps) 8

YTD (bps) 56

2.22%

1D (bps) 7

YTD (bps) 22

23,035

1D (%) 0.39%

YTD (%) 0.41%

25,924

1D (%) -1.37%

YTD (%) -2.06%

3,684

1D (%) -0.03%

YTD (%) 0.71%

The Purchasing Managers' Index (PMI) of Vietnam's manufacturing industry reached 54.3 points in February, compared with 53.7 points in January, up for the fourth consecutive month. Business conditions have improved over the past five months, after being disrupted by the Delta wave of the COVID-19 pandemic in 2021.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- February PMI reached 54.3 points, manufacturing activity continued to recover

- International visitors to Vietnam soar

- The Prime Minister asked to restructure weak and loss-making state-owned corporations

- Western oil and gas giants left behind tens of billions of dollars when withdrawing from Russia

- Russian banks in trouble after Russia-Ukraine tensions rise

- Geopolitical risks pose new challenge to IPO plans in Asia

VN30

BANK

85,000

1D 0.59%

5D -2.07%

Buy Vol. 2,159,000

Sell Vol. 1,878,900

44,100

1D 0.92%

5D -4.13%

Buy Vol. 3,759,500

Sell Vol. 4,407,100

33,300

1D 0.45%

5D -3.76%

Buy Vol. 15,750,800

Sell Vol. 13,664,900

50,300

1D -0.20%

5D -2.14%

Buy Vol. 11,327,800

Sell Vol. 11,445,400

37,750

1D -0.66%

5D 6.19%

Buy Vol. 24,666,900

Sell Vol. 27,885,800

34,000

1D -1.16%

5D -1.16%

Buy Vol. 24,691,100

Sell Vol. 31,875,800

28,550

1D -0.87%

5D -3.38%

Buy Vol. 12,946,700

Sell Vol. 10,833,000

42,800

1D 1.30%

5D 3.13%

Buy Vol. 16,095,200

Sell Vol. 18,982,600

32,650

1D -0.61%

5D -3.12%

Buy Vol. 25,590,600

Sell Vol. 29,622,400

33,850

1D -0.15%

5D -2.45%

Buy Vol. 9,454,500

Sell Vol. 9,582,400

In terms of growth rate, TCB has the highest growth in foreign exchange business revenue when in 2020 it only collects 745 million dong, and in 2021 it earns more than 231 billion dong in profit, mainly from reducing business losses. In terms of absolute numbers, Vietcombank is still the bank with the highest profit from foreign exchange trading with VND 4,275 billion thanks to an increase in spot foreign currency revenue of VND 1,363 billion (up 20%).

REAL ESTATE

75,400

1D 0.13%

5D -3.46%

Buy Vol. 5,202,400

Sell Vol. 4,587,200

54,100

1D 2.27%

5D 0.37%

Buy Vol. 3,137,500

Sell Vol. 2,952,800

84,500

1D -0.59%

5D -5.90%

Buy Vol. 4,492,100

Sell Vol. 4,199,500

KDH: Khang Dien will pour nearly 350 billion dong more to its subsidiary, Gia Phuoc Real Estate, even though its business cash flow in 2021 is negative billions of dong.

OIL & GAS

117,700

1D -0.25%

5D 1.03%

Buy Vol. 1,842,000

Sell Vol. 1,939,500

17,450

1D 0.58%

5D -1.97%

Buy Vol. 71,813,700

Sell Vol. 47,472,300

61,300

1D -1.61%

5D -1.13%

Buy Vol. 5,706,300

Sell Vol. 6,149,600

National Assembly Chairman Vuong Dinh Hue recently asked a number of NA agencies to supervise the situation of domestic petroleum supply and Nghi Son Refinery and Petrochemical Plant.

VINGROUP

79,200

1D 2.86%

5D -3.41%

Buy Vol. 6,632,600

Sell Vol. 5,883,100

78,000

1D 0.65%

5D -1.64%

Buy Vol. 4,280,500

Sell Vol. 5,165,100

33,500

1D 0.00%

5D -2.90%

Buy Vol. 8,037,600

Sell Vol. 7,493,400

VHM: In 2022, VHM will launch 03 new projects in the North. The largest project is Dream City with 460 ha, VinHomes Co Loa 383 ha and VinHomes Wonderpark (Dan Phuong).

FOOD & BEVERAGE

79,200

1D 1.02%

5D -1.00%

Buy Vol. 2,568,900

Sell Vol. 2,498,400

156,500

1D 0.32%

5D -0.63%

Buy Vol. 537,700

Sell Vol. 658,900

168,000

1D -1.06%

5D -0.24%

Buy Vol. 70,800

Sell Vol. 174,300

SAB: Sabeco's revenue in 2021 reached VND 26,374 billion, down 5.7% compared to the previous year. Due to high costs, profit after tax reached VND3,929 billion, down 20.4% over the same period.

OTHERS

140,900

1D 0.57%

5D -1.33%

Buy Vol. 1,018,300

Sell Vol. 960,100

140,900

1D 0.57%

5D -1.33%

Buy Vol. 1,018,300

Sell Vol. 960,100

93,400

1D 0.11%

5D 0.54%

Buy Vol. 1,551,100

Sell Vol. 2,672,900

136,000

1D 0.00%

5D -1.23%

Buy Vol. 1,906,900

Sell Vol. 2,177,400

105,000

1D 1.94%

5D -4.55%

Buy Vol. 4,056,800

Sell Vol. 2,106,600

35,700

1D 4.54%

5D 4.23%

Buy Vol. 7,956,200

Sell Vol. 7,537,100

46,000

1D 0.66%

5D 2.22%

Buy Vol. 16,249,500

Sell Vol. 17,018,100

46,900

1D -0.64%

5D 1.08%

Buy Vol. 33,512,200

Sell Vol. 54,379,600

BVH: For the whole year of 2021, net revenue from insurance business reached VND 37,301 billion, up 8% compared to 2020. In the company's revenue structure, net revenue from life insurance segment reached 30,545 billion VND and the non-life insurance segment reached 6,768 billion VND.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.