Morning brief 02/03/2022

GLOBAL MARKET

33,294.95

1D -1.76%

YTD -8.53%

4,306.26

1D -1.54%

YTD -9.89%

13,532.46

1D -1.59%

YTD -14.03%

33.32

1D 10.51%

7,330.20

1D -1.72%

YTD -0.98%

13,904.85

1D -3.85%

YTD -12.46%

6,396.49

1D -3.94%

YTD -10.83%

107.67

1D 11.56%

YTD 40.75%

1,938.35

1D 1.74%

YTD 6.46%

US stocks fell on Tuesday (March 1), the first day of March, as oil prices soared and investors continued to watch the war between Russia and Ukraine. At the end of the session, the Dow Jones index dropped 597.65 points (equivalent to 1.76%) to 33,294.95 points. The S&P 500 lost 1.55% to 4,306.26 points, and the Nasdaq Composite dropped 1.59% to 13,532.46 points.

VIETNAM ECONOMY

2.56%

1D (bps) 1

YTD (bps) 175

5.60%

1.57%

1D (bps) 8

YTD (bps) 56

2.22%

1D (bps) 7

YTD (bps) 22

22,955

1D (%) 0.04%

YTD (%) 0.07%

26,116

1D (%) -0.64%

YTD (%) -1.33%

3,684

1D (%) -0.03%

YTD (%) 0.71%

Last week, the SBV released data on credit growth, total means of payment and capital mobilization in 2021, in which both M2 money supply and capital mobilization have significantly improved compared to the preliminary figures. released at the end of last year. Specifically, M2 growth reached 10.7% compared to the beginning of the year (compared to 8.93%, as of December 24), while capital mobilization growth was recorded at 9.24% (compared to the previous year). 8.44% as of December 24).

VIETNAM STOCK MARKET

1,498.78

1D 0.58%

YTD 0.03%

1,520.12

1D 0.19%

YTD -1.02%

443.56

1D 0.71%

YTD -6.42%

112.38

1D 0.16%

YTD -0.27%

122.27

31,420.75

1D 12.12%

YTD 1.12%

Propriety trading group net sold more than 400 billion dong in February. PT sold very strongly FUEVFVND with 452b dong. After that, MSN was net sold 162b dong. VHM and VIC both have a net selling value of over 100b dong. Meanwhile, TCB saw the strongest net buying with 314b dong. E1VFVN30 ETF certificates were bought with a net of 209b dong.

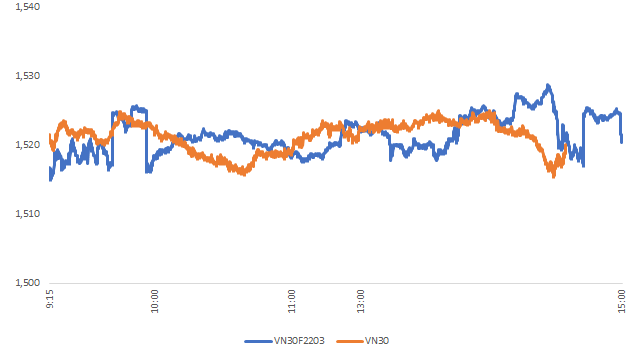

INTRADAY

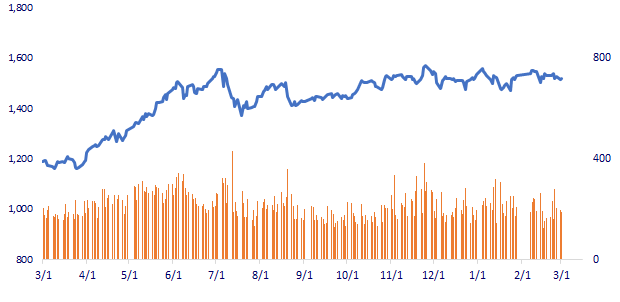

VN30 (12M)

SELECTED NEWS

- WB predicts Vietnam to achieve the highest growth in income and trade in RCEP

- Japanese investors choose Vietnam because of political stability and macroeconomic stability

- The growth of people's deposits in banks is only 1/3 of before the epidemic

- Countries strive to increase oil supply and reduce dependence on Russia

- In response to sanctions, Russia banned dozens of countries from using its airspace

- The US and other countries consider releasing strategic oil reserves after the oil price exceeds 100 USD/barrel

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.