Market brief 10/03/2022

VIETNAM STOCK MARKET

1,479.08

1D 0.36%

YTD -1.28%

1,490.24

1D 0.07%

YTD -2.96%

447.64

1D 0.68%

YTD -5.56%

115.29

1D 1.69%

YTD 2.32%

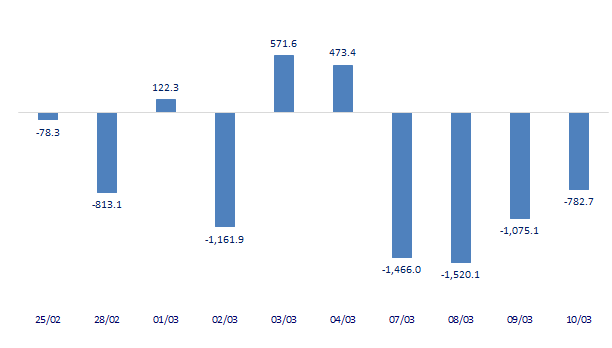

-782.70

1D 0.00%

YTD 0.00%

26,826.91

1D -27.46%

YTD -13.66%

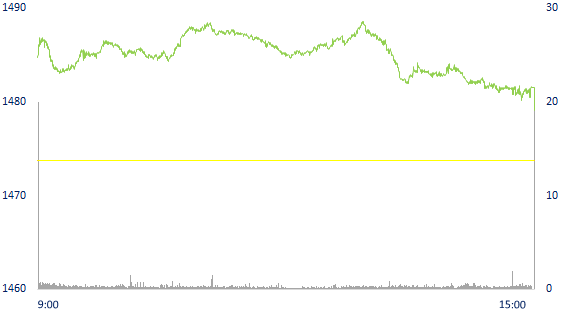

At the end of today's session, market liquidity decreased compared to the previous session, the total matched value reached 25,103 billion dong, down 28%, of which, the matched value on HoSE alone decreased by 30% and reached 20,386 billion dong. . Foreign investors net sold more than 700 billion dong on HoSE today.

ETF & DERIVATIVES

25,150

1D 0.60%

YTD -2.63%

17,580

1D 0.29%

YTD -2.82%

18,680

1D 4.88%

YTD -1.68%

22,500

1D 0.27%

YTD -1.75%

21,980

1D 0.14%

YTD -2.22%

28,450

1D 0.18%

YTD 1.43%

19,700

1D -0.96%

YTD -8.29%

1,490

1D 0.07%

YTD 0.00%

1,486

1D -0.23%

YTD 0.00%

1,490

1D -0.05%

YTD 0.00%

1,540

1D 0.00%

YTD 0.00%

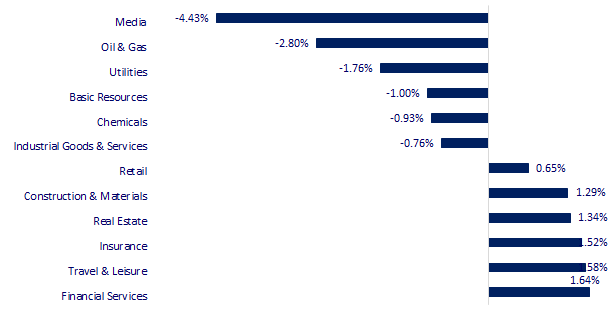

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

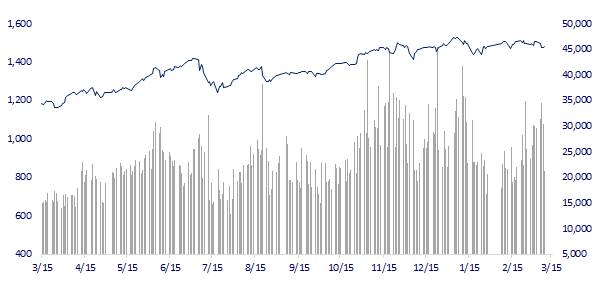

VNINDEX (12M)

GLOBAL MARKET

25,690.40

1D 0.46%

YTD -10.77%

3,296.09

1D 1.22%

YTD -9.44%

2,680.32

1D 2.21%

YTD -9.99%

20,890.26

1D -0.36%

YTD -10.72%

3,240.73

1D 1.42%

YTD 3.75%

1,647.08

1D 0.21%

YTD -0.64%

113.53

1D 4.03%

YTD 48.41%

2,004.10

1D 1.20%

YTD 10.07%

Asian stocks mostly went up, Nikkei 225 gained 0.46%. The Chinese market went up with Shanghai Composite up 1.22%, Shenzhen Component up 2,179%. Hong Kong's Hang Seng fell 0.36%. South Korea's Kospi index rose 2.21%.

VIETNAM ECONOMY

2.24%

1D (bps) -7

YTD (bps) 143

5.60%

1.56%

1D (bps) -13

YTD (bps) 55

2.27%

YTD (bps) 27

23,075

1D (%) 0.39%

YTD (%) 0.59%

25,660

1D (%) -0.04%

YTD (%) -3.05%

3,684

1D (%) -0.03%

YTD (%) 0.71%

According to the Prime Minister, administrative procedure reform has been strongly promoted even in the context of complicated epidemics. In 2021, the whole country has reduced and simplified 1,101 business regulations, approved a plan to reduce and simplify 924 regulations and amend and supplement 166 legal documents under its management. State management of 7 ministries.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Government proposes to use 5,570 billion VND of public investment reserve for Ho Chi Minh Road

- Prime Minister: Vietnam has reduced and simplified more than 1,000 business regulations

- Price and fee pressure: Businesses are in a state of disarray

- Sanctions put an end to Russian banks' global ambitions

- US House of Representatives approves budget to avoid the risk of government shutdown

- UAE will call on OPEC+ to increase production

VN30

BANK

83,500

1D 0.60%

5D -2.34%

Buy Vol. 1,850,900

Sell Vol. 1,585,500

40,950

1D 1.11%

5D -4.32%

Buy Vol. 2,962,400

Sell Vol. 2,797,800

32,100

1D 0.31%

5D -1.53%

Buy Vol. 7,750,800

Sell Vol. 10,093,900

49,250

1D 0.31%

5D -0.81%

Buy Vol. 6,461,900

Sell Vol. 9,337,400

36,750

1D -0.27%

5D -1.87%

Buy Vol. 15,798,800

Sell Vol. 19,278,700

31,050

1D 0.98%

5D -6.19%

Buy Vol. 19,957,800

Sell Vol. 20,176,400

26,950

1D -0.19%

5D -4.60%

Buy Vol. 6,835,100

Sell Vol. 7,640,000

39,000

1D 0.52%

5D -6.02%

Buy Vol. 3,246,100

Sell Vol. 4,263,700

31,550

1D 1.45%

5D -0.94%

Buy Vol. 20,209,500

Sell Vol. 23,768,000

32,900

1D 0.61%

5D -1.64%

Buy Vol. 3,333,000

Sell Vol. 5,158,100

According to the leader of the State Bank of Vietnam, the outstanding credit outstanding balance from the first days of the year shows that the capital flow has been cleared and the recovery ability of enterprises after the epidemic is quite positive. According to the results of the credit trend survey of the State Bank in December 2021, credit is expected to reach 5.3% in the first quarter of 2022 and is forecast to increase by 14.1% in the whole of 2022.

REAL ESTATE

77,000

1D 0.65%

5D -1.28%

Buy Vol. 6,950,800

Sell Vol. 7,925,200

51,500

1D 0.59%

5D -5.68%

Buy Vol. 1,098,400

Sell Vol. 1,253,800

88,100

1D 0.11%

5D 0.11%

Buy Vol. 3,821,300

Sell Vol. 4,924,800

NVL: Novaland wants to plan and propose to invest in a super project in Lam Dong. Accordingly, the project is named Dak Long Thuong lake in Bao Lam district, with a research scale of 30,000ha.

OIL & GAS

118,500

1D -3.03%

5D -1.82%

Buy Vol. 1,864,300

Sell Vol. 2,039,400

16,600

1D -0.90%

5D -3.49%

Buy Vol. 22,106,500

Sell Vol. 37,339,600

61,300

1D -2.70%

5D -2.39%

Buy Vol. 5,675,800

Sell Vol. 5,557,000

POW plans to divest all 30,805,200 shares of Viet Lao Power Joint Stock Company (VLP) to reduce its ownership from 8.64% to 0% of charter capital.

VINGROUP

79,100

1D 1.41%

5D 0.13%

Buy Vol. 7,189,300

Sell Vol. 8,148,300

75,200

1D 1.62%

5D -3.59%

Buy Vol. 6,201,700

Sell Vol. 6,433,400

32,000

1D 1.27%

5D -2.14%

Buy Vol. 16,821,000

Sell Vol. 19,070,300

For electric vehicles, example is the VF e34, according to the manufacturer's announcement, the operating fee of the VF e34 electric car is still about 15% more economical than a petrol car.

FOOD & BEVERAGE

77,100

1D 2.66%

5D -1.66%

Buy Vol. 6,610,100

Sell Vol. 5,340,900

150,000

1D -3.54%

5D -5.72%

Buy Vol. 1,616,800

Sell Vol. 2,037,100

157,000

1D 1.29%

5D -6.04%

Buy Vol. 368,600

Sell Vol. 234,000

VNM: F&N Dairy Investments Pte. Ltd. continued to register to buy nearly 21 million VNM shares. Estimated transaction time from March 15, 2022 to April 13, 2022.

OTHERS

139,000

1D -0.71%

5D -3.07%

Buy Vol. 1,027,800

Sell Vol. 1,056,600

139,000

1D -0.71%

5D -3.07%

Buy Vol. 1,027,800

Sell Vol. 1,056,600

94,600

1D -0.94%

5D 1.28%

Buy Vol. 1,227,100

Sell Vol. 2,398,300

133,500

1D -0.22%

5D -2.20%

Buy Vol. 1,314,700

Sell Vol. 1,398,500

108,300

1D -1.99%

5D 4.72%

Buy Vol. 1,573,800

Sell Vol. 1,937,900

35,550

1D -1.25%

5D -2.07%

Buy Vol. 2,528,000

Sell Vol. 3,639,300

46,600

1D 0.00%

5D 2.42%

Buy Vol. 13,295,700

Sell Vol. 20,701,200

49,150

1D -1.40%

5D -1.90%

Buy Vol. 45,135,500

Sell Vol. 47,122,900

FPT: FPT wants to invest in 3 projects of 850ha in Khanh Hoa including FPT Technology and Education Urban Area in Phuoc Dong Commune - Vinh Thai (Nha Trang City) with a scale of 150 ha; Center for digital transformation and urban service in Tuan Le - Hon Ngang Bac Van Phong area with a scale of 350 ha; The complex of tourist resorts of experts in the area of Ho Na - Mui Doi (Van Phong Bay) with a scale of 350 hectares.

Market by numbers

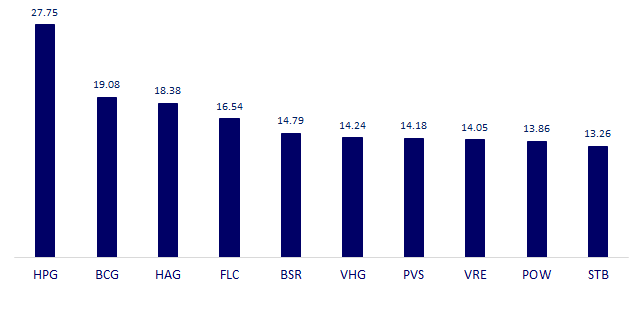

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

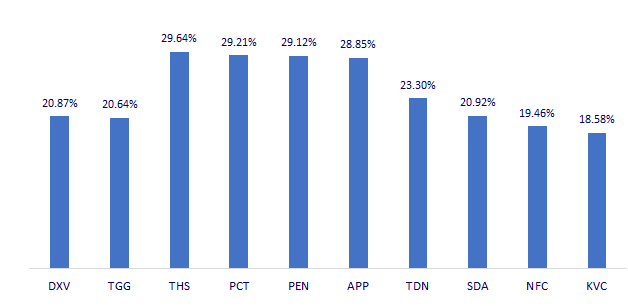

TOP INCREASES 3 CONSECUTIVE SESSIONS

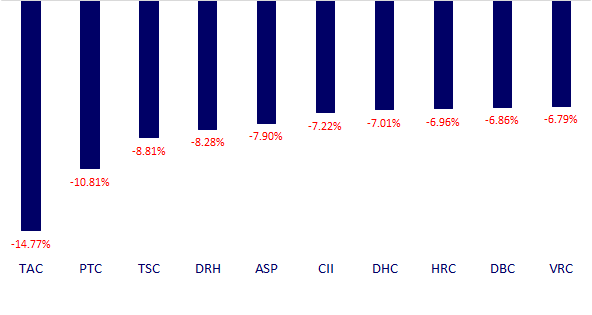

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.