Market brief 15/03/2022

VIETNAM STOCK MARKET

1,452.74

1D 0.45%

YTD -3.04%

1,468.89

1D 0.53%

YTD -4.35%

443.52

1D 1.59%

YTD -6.43%

115.56

1D 0.44%

YTD 2.56%

-431.95

1D 0.00%

YTD 0.00%

26,277.78

1D -21.71%

YTD -15.43%

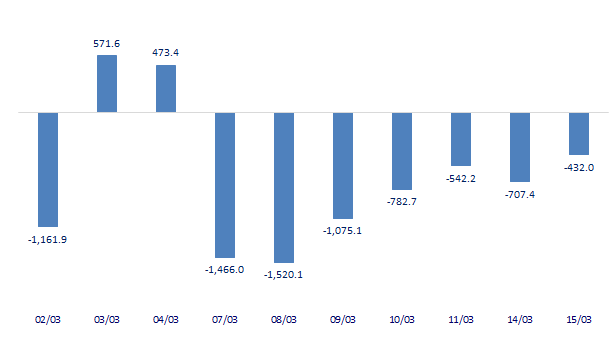

Foreign investors continued to net sell nearly 432 billion dong on HoSE on March 15. HPG was sold the most by foreign investors on HoSE with a value of 115 billion dong. VIC, VCB and VHM all had a net selling value of more than 90 billion dong. Meanwhile, STB was bought the most with 124 billion dong. VPB and VJC were net bought 68 billion dong and 65 billion dong respectively.

ETF & DERIVATIVES

24,700

1D 0.82%

YTD -4.37%

17,250

1D 0.23%

YTD -4.64%

18,590

1D 4.38%

YTD -2.16%

21,600

1D 0.00%

YTD -5.68%

22,140

1D 2.88%

YTD -1.51%

27,600

1D 0.55%

YTD -1.60%

19,300

1D -3.26%

YTD -10.15%

1,461

1D 0.06%

YTD 0.00%

1,458

1D -0.05%

YTD 0.00%

1,465

1D 0.08%

YTD 0.00%

1,540

1D 0.00%

YTD 0.00%

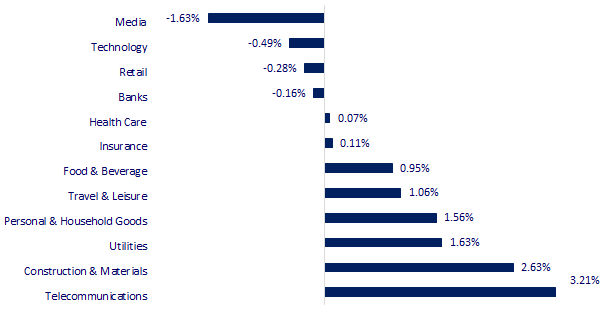

CHANGE IN PRICE BY SECTOR

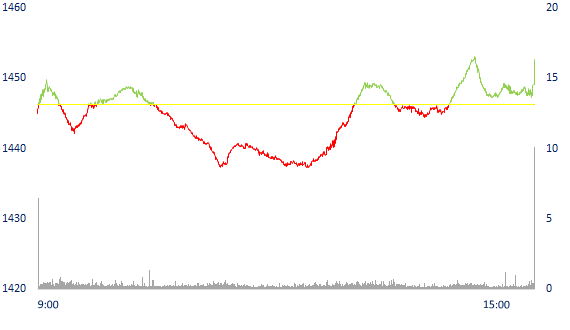

INTRADAY VNINDEX

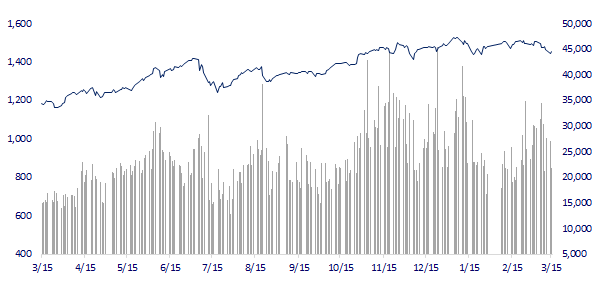

VNINDEX (12M)

GLOBAL MARKET

25,346.48

1D 0.04%

YTD -11.97%

3,063.97

1D -4.95%

YTD -15.82%

2,621.53

1D -0.91%

YTD -11.96%

18,415.08

1D -2.04%

YTD -21.30%

3,236.04

1D 0.12%

YTD 3.60%

1,644.36

1D -0.95%

YTD -0.80%

96.75

1D -1.70%

YTD 26.47%

1,923.95

1D -1.09%

YTD 5.67%

Asian stocks mixed, China market continued to go down. In Japan, the Nikkei 225 gained 0.04%. The Chinese market fell with Shanghai Composite down 4.95%, Shenzhen Component down 4,363%. Hong Kong's Hang Seng fell 2.04%. South Korea's Kospi index fell 0.91%.

VIETNAM ECONOMY

2.13%

1D (bps) 2

YTD (bps) 132

5.60%

1.69%

1D (bps) 1

YTD (bps) 68

2.68%

1D (bps) 38

YTD (bps) 68

23,100

1D (%) 0.28%

YTD (%) 0.70%

25,599

1D (%) -0.82%

YTD (%) -3.28%

3,660

1D (%) -0.19%

YTD (%) 0.05%

Generally for the first two months of the year, the total import and export turnover of goods was estimated at 109.6 billion USD, up 14% over the same period last year, of which exports increased by 12%; imports increased by 17%. Trade balance in the first 2 months of the year has a trade deficit of 581 million USD, of which the domestic economic sector has a deficit of 2.3 billion USD; the foreign-invested sector (including crude oil) had a trade surplus of nearly 2.9 billion USD.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam spent more than 1 billion USD importing gasoline in the first 2 months of the year

- Nghi Son Refinery and Petrochemical Plant is not included in the scenario of petroleum supply management in the second quarter

- In the first 2 months of the year, nearly 190 businesses with a scale of over 100 billion dong temporarily stopped doing business

- Russia suspends activities at the Parliamentary Assembly of the Council of Europe

- India says it will be ready to release more oil reserves

- US is concerned about Russia-China 'link'

VN30

BANK

81,100

1D -3.68%

5D -0.49%

Buy Vol. 3,436,600

Sell Vol. 3,787,900

42,100

1D 1.94%

5D 1.20%

Buy Vol. 2,731,900

Sell Vol. 2,634,200

31,950

1D 0.16%

5D -0.31%

Buy Vol. 6,756,600

Sell Vol. 6,688,800

48,600

1D 0.21%

5D -0.82%

Buy Vol. 6,350,400

Sell Vol. 6,667,700

36,900

1D 2.50%

5D -0.27%

Buy Vol. 22,458,300

Sell Vol. 18,107,300

31,600

1D -0.16%

5D 1.94%

Buy Vol. 17,289,300

Sell Vol. 17,154,700

27,200

1D 0.37%

5D -0.55%

Buy Vol. 4,388,800

Sell Vol. 4,667,300

39,900

1D 1.79%

5D 2.84%

Buy Vol. 11,667,400

Sell Vol. 15,185,300

32,700

1D 0.62%

5D 6.00%

Buy Vol. 32,963,100

Sell Vol. 37,135,200

32,800

1D 0.31%

5D 0.61%

Buy Vol. 4,829,000

Sell Vol. 6,410,000

VPB: AIA Life Insurance (AIA Vietnam) and VPBank announce the extension of the exclusive cooperation agreement to distribute insurance via banks from 15 years as originally planned to 19 years. Since the cooperation agreement on exclusive distribution of insurance was signed for the first time in 2017, VPBank has always been in the group of banks with the highest sales of life insurance and is currently ranked 3rd in the whole market. Up to now, AIA insurance distribution has been deployed in more than 250 branches of the bank.

REAL ESTATE

76,600

1D 0.13%

5D 0.79%

Buy Vol. 6,005,600

Sell Vol. 5,313,500

50,000

1D -0.40%

5D -4.03%

Buy Vol. 1,559,900

Sell Vol. 1,539,700

86,300

1D -1.37%

5D -0.92%

Buy Vol. 3,716,300

Sell Vol. 4,101,300

KDH: Due to negative cash flow of VND 2,015 billion at the end of 2021, KDH is boosting capital mobilization from bonds to lend to subsidiaries.

OIL & GAS

108,000

1D 1.89%

5D -10.52%

Buy Vol. 2,301,700

Sell Vol. 1,337,600

16,400

1D 4.79%

5D -4.65%

Buy Vol. 35,165,500

Sell Vol. 26,435,100

56,000

1D 0.18%

5D -8.65%

Buy Vol. 6,159,200

Sell Vol. 4,021,100

POW: can continue to divest two businesses this year with a total capital of nearly 350 billion dong. The revenue will supplement resources to implement projects such as Nhon Trach 3 & 4.

VINGROUP

78,300

1D 0.00%

5D 0.51%

Buy Vol. 3,997,000

Sell Vol. 4,821,100

74,500

1D 0.00%

5D -0.13%

Buy Vol. 6,202,200

Sell Vol. 7,303,600

31,750

1D -0.78%

5D -2.31%

Buy Vol. 5,443,500

Sell Vol. 7,104,400

VIC: Want to borrow 400 million USD, Vingroup and Vinfast get a green syndicated loan of 500 million USD, in which HSBC cooperates with a number of other banks to provide this loan.

FOOD & BEVERAGE

77,200

1D 0.00%

5D 1.45%

Buy Vol. 3,285,000

Sell Vol. 2,742,200

141,100

1D 3.67%

5D -11.15%

Buy Vol. 2,176,100

Sell Vol. 1,554,400

151,300

1D -1.75%

5D -2.76%

Buy Vol. 273,900

Sell Vol. 255,700

MSN: Techcombank grants a maximum credit limit of VND 1,500 billion for Nui Phao Minerals and no more than VND 600 billion for Tungsten Masan.

OTHERS

148,000

1D 2.07%

5D 8.03%

Buy Vol. 1,807,400

Sell Vol. 1,766,100

148,000

1D 2.07%

5D 8.03%

Buy Vol. 1,807,400

Sell Vol. 1,766,100

91,000

1D -0.87%

5D -4.01%

Buy Vol. 3,133,300

Sell Vol. 3,416,400

131,400

1D -0.23%

5D -2.09%

Buy Vol. 1,787,400

Sell Vol. 1,734,800

102,900

1D 4.47%

5D -2.92%

Buy Vol. 1,663,300

Sell Vol. 1,157,000

33,850

1D 1.50%

5D -6.75%

Buy Vol. 1,874,500

Sell Vol. 1,731,900

43,300

1D 0.23%

5D -7.87%

Buy Vol. 14,955,300

Sell Vol. 14,320,500

46,150

1D 0.76%

5D -6.67%

Buy Vol. 37,173,100

Sell Vol. 34,443,200

- VJC: A representative of Vietjet Air said that this March, the airline will reopen and increase the frequency of a series of routes throughout the country, especially those to and from Phu Quoc, Nha Trang, and Can. Poetry, Da Nang ... to meet the needs of customers' travel, trade and tourism in the summer.

Market by numbers

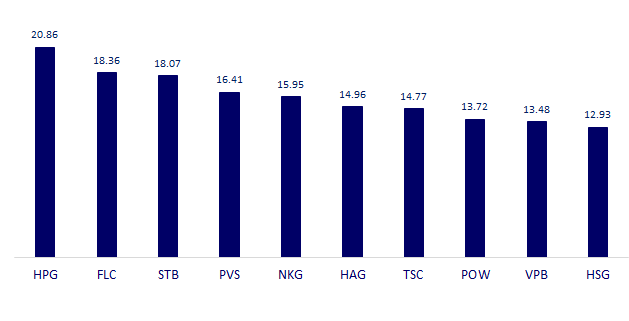

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

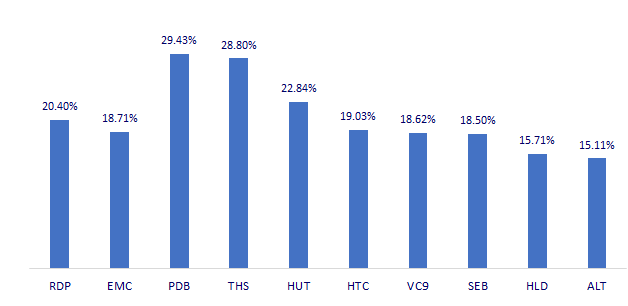

TOP INCREASES 3 CONSECUTIVE SESSIONS

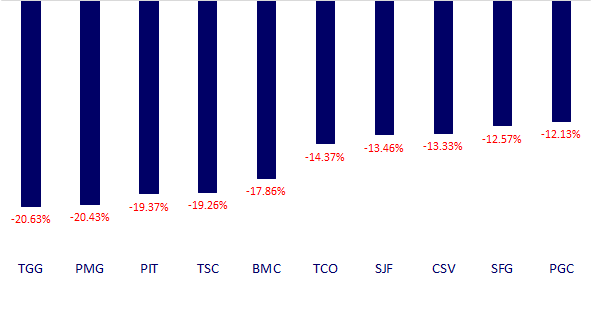

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.