Market brief 16/03/2022

VIETNAM STOCK MARKET

1,459.33

1D 0.45%

YTD -2.60%

1,472.69

1D 0.26%

YTD -4.10%

446.18

1D 0.60%

YTD -5.87%

116.04

1D 0.42%

YTD 2.98%

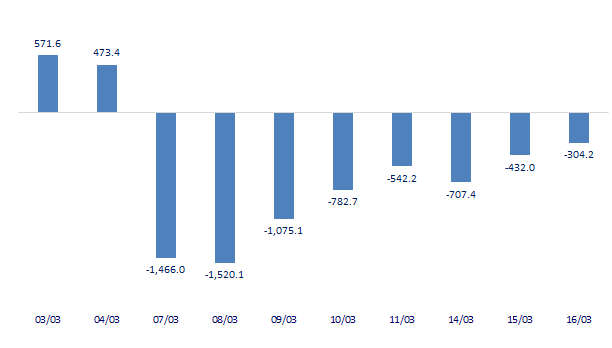

-304.18

1D 0.00%

YTD 0.00%

22,299.21

1D -15.14%

YTD -28.23%

Foreign investors today bought 24 million shares, worth 1,219 billion dong, while selling 31.6 million shares, worth 1,520 billion dong. Total net selling volume was at 7.5 million shares, equivalent to a net selling value of 304 billion dong. On HoSE, foreign investors continued to net sell nearly 300 billion dong, equivalent to a net selling volume of 7.5 million shares.

ETF & DERIVATIVES

24,840

1D 0.57%

YTD -3.83%

17,350

1D 0.58%

YTD -4.09%

18,550

1D 4.15%

YTD -2.37%

21,600

1D 0.00%

YTD -5.68%

22,000

1D -0.63%

YTD -2.14%

27,800

1D 0.72%

YTD -0.89%

19,520

1D 1.14%

YTD -9.12%

1,466

1D 0.36%

YTD 0.00%

1,466

1D 0.57%

YTD 0.00%

1,472

1D 0.50%

YTD 0.00%

1,540

1D 0.00%

YTD 0.00%

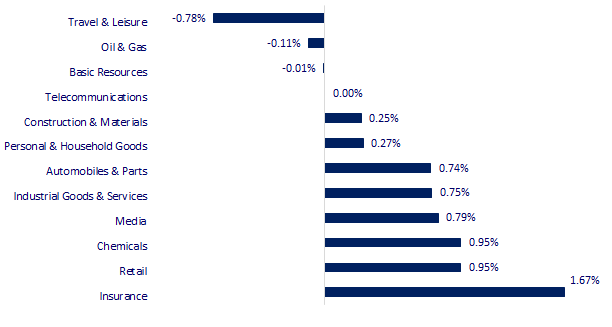

CHANGE IN PRICE BY SECTOR

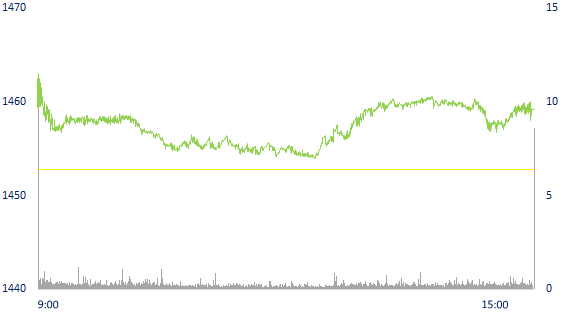

INTRADAY VNINDEX

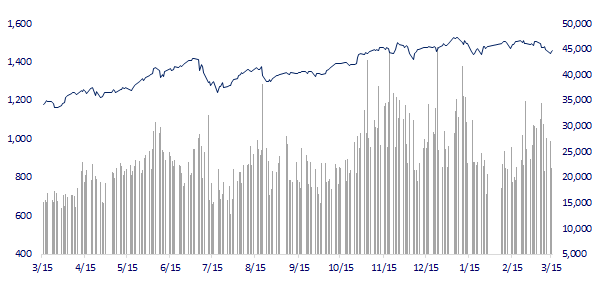

VNINDEX (12M)

GLOBAL MARKET

25,762.01

1D 0.39%

YTD -10.52%

3,170.71

1D 3.48%

YTD -12.89%

2,659.23

1D 1.44%

YTD -10.69%

20,087.50

1D 6.68%

YTD -14.15%

3,290.90

1D 1.70%

YTD 5.35%

1,667.92

1D 1.43%

YTD 0.62%

96.12

1D -0.88%

YTD 25.65%

1,923.25

1D 0.06%

YTD 5.63%

Asian stocks rose, Hong Kong recovered nearly 6.9%. In Japan, the Nikkei 225 gained 0.39%. The Chinese market went up with Shanghai Composite up 3.48%, Shenzhen Component up 4.019%. Hong Kong's Hang Seng rose 6.68%. South Korea's Kospi index rose 1.44%.

VIETNAM ECONOMY

2.18%

1D (bps) 5

YTD (bps) 137

5.60%

1.70%

1D (bps) 1

YTD (bps) 69

2.27%

1D (bps) -41

YTD (bps) 27

23,095

1D (%) 0.35%

YTD (%) 0.68%

25,598

1D (%) -0.79%

YTD (%) -3.29%

3,671

1D (%) 0.27%

YTD (%) 0.36%

According to preliminary statistics of the General Department of Customs, in February, Vietnam exported 128,069 tons of fertilizer, equivalent to 71.31 million USD, down 43.4% in volume, down 58.5% in turnover compared to the previous month. Compared to the same period last year, the export of this item increased by 58.3% in volume and 182% in value.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam earned more than 70 million USD from fertilizer exports, down nearly 60% compared to January

- The Ministry of Industry and Trade requires businesses to double the amount of gasoline in the second quarter

- Deputy Prime Minister: Build more oil refineries in Vung Tau to proactively supply

- Russia officially withdraws from the Council of Europe

- China says it does not want to be affected by US sanctions against Russia

- Russians rushed to buy gold without VAT, causing the central bank to temporarily stop hoarding

VN30

BANK

82,500

1D 1.73%

5D -0.60%

Buy Vol. 2,470,400

Sell Vol. 1,452,500

41,600

1D -1.19%

5D 2.72%

Buy Vol. 2,325,000

Sell Vol. 2,785,800

32,000

1D 0.16%

5D 0.00%

Buy Vol. 6,671,700

Sell Vol. 8,234,000

49,050

1D 0.93%

5D -0.10%

Buy Vol. 8,202,800

Sell Vol. 7,456,600

36,800

1D -0.27%

5D -0.14%

Buy Vol. 12,041,600

Sell Vol. 17,021,600

32,100

1D 1.58%

5D 4.39%

Buy Vol. 22,096,500

Sell Vol. 22,014,000

27,150

1D -0.18%

5D 0.56%

Buy Vol. 7,124,400

Sell Vol. 12,788,400

39,750

1D -0.38%

5D 2.45%

Buy Vol. 4,174,000

Sell Vol. 7,439,200

32,900

1D 0.61%

5D 5.79%

Buy Vol. 18,959,500

Sell Vol. 22,629,400

32,800

1D 0.00%

5D 0.31%

Buy Vol. 5,947,500

Sell Vol. 5,933,800

MBB: In 2022, MB has a credit growth plan of 20% and prepares for sudden growth scenarios. In the previous year, bank credit growth reached 25%. MB's credit growth rate up to now is about 10%, relatively fast compared to the granted limit, it is expected that the consolidated profit in the first quarter will reach about 5,500 billion VND and the figure will be realized in 2 months, adhered to this goal.

REAL ESTATE

77,400

1D 1.04%

5D 1.18%

Buy Vol. 5,804,400

Sell Vol. 5,827,200

50,600

1D 1.20%

5D -1.17%

Buy Vol. 1,543,100

Sell Vol. 1,107,700

85,800

1D -0.58%

5D -2.50%

Buy Vol. 3,313,000

Sell Vol. 3,273,500

PDR: Phat Dat borrowed USD 30 million from abroad to pour into a condotel project in Ba Ria-Vung Tau. This foreign loan is entitled to convert the outstanding principal into common shares.

OIL & GAS

109,200

1D 1.11%

5D -10.64%

Buy Vol. 1,176,400

Sell Vol. 1,055,000

16,300

1D -0.61%

5D -2.69%

Buy Vol. 21,102,100

Sell Vol. 25,572,500

56,200

1D 0.36%

5D -10.79%

Buy Vol. 2,994,200

Sell Vol. 2,995,900

POW: PV Power signed an EPC contract for Nhon Trach 3 and 4 power plants, valued at more than USD 940 million; in which, the domestic part accounted for 39%.

VINGROUP

78,100

1D -0.26%

5D 0.13%

Buy Vol. 4,600,900

Sell Vol. 4,932,500

74,200

1D -0.40%

5D 0.27%

Buy Vol. 6,586,300

Sell Vol. 6,866,500

31,750

1D 0.00%

5D 0.47%

Buy Vol. 5,554,300

Sell Vol. 6,343,100

VIC and VHM were both the focus of foreign investors' net selling in today's session with the value of 115 billion dong and 74 billion dong respectively.

FOOD & BEVERAGE

77,300

1D 0.13%

5D 2.93%

Buy Vol. 3,355,800

Sell Vol. 3,770,100

140,500

1D -0.43%

5D -9.65%

Buy Vol. 1,008,800

Sell Vol. 883,000

154,000

1D 1.78%

5D -0.65%

Buy Vol. 344,300

Sell Vol. 181,700

VNM: In the March restructuring period, VNM will be the stock of ETFs that sold the most with 3.9 million shares.

OTHERS

147,000

1D -0.68%

5D 5.00%

Buy Vol. 1,396,700

Sell Vol. 1,475,300

147,000

1D -0.68%

5D 5.00%

Buy Vol. 1,396,700

Sell Vol. 1,475,300

91,600

1D 0.66%

5D -4.08%

Buy Vol. 2,252,000

Sell Vol. 2,009,100

131,400

1D 0.00%

5D -1.79%

Buy Vol. 1,708,400

Sell Vol. 1,941,000

102,800

1D -0.10%

5D -6.97%

Buy Vol. 1,371,000

Sell Vol. 1,102,500

33,700

1D -0.44%

5D -6.39%

Buy Vol. 2,275,200

Sell Vol. 2,172,000

43,800

1D 1.15%

5D -6.01%

Buy Vol. 12,610,000

Sell Vol. 13,894,300

46,200

1D 0.11%

5D -7.32%

Buy Vol. 20,206,600

Sell Vol. 22,373,600

MWG: has just announced the official cooperation with PT Erafone Artha Retailindo (Erafone), a subsidiary of Erajaya Group (Indonesia) to establish a joint venture PT Era Blue Elektronic with the brand "Era Blue". The first Era Blue store is expected to open in mid-2022 in Jakarta, combining the latest digital technologies with modern retail implementations and raising standards of installation visuals.

Market by numbers

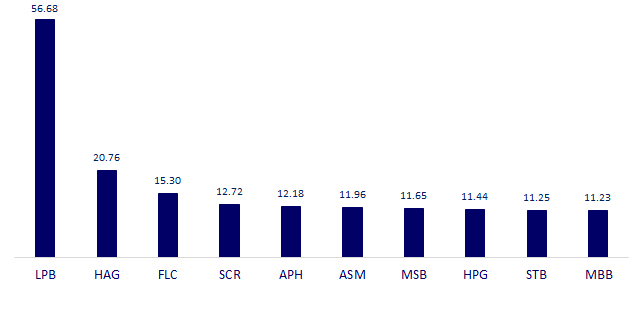

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

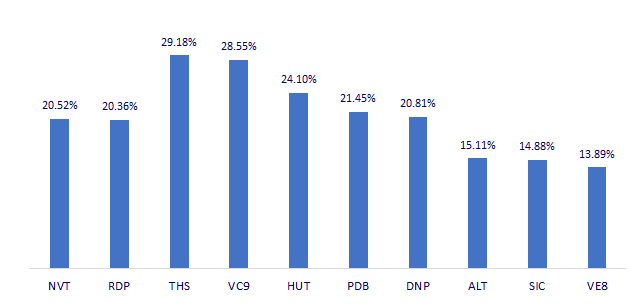

TOP INCREASES 3 CONSECUTIVE SESSIONS

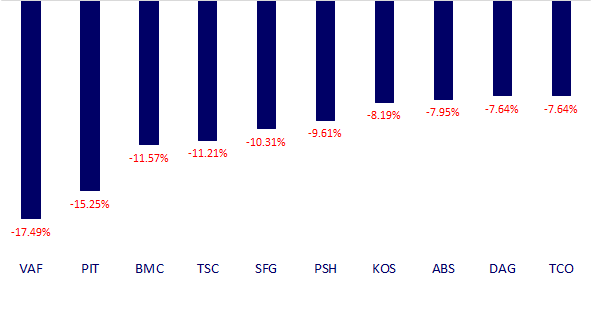

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.