Market brief 17/03/2022

VIETNAM STOCK MARKET

1,461.34

1D 0.14%

YTD -2.47%

1,469.92

1D -0.19%

YTD -4.28%

446.16

1D 0.00%

YTD -5.87%

115.94

1D -0.09%

YTD 2.89%

114.89

1D 0.00%

YTD 0.00%

25,216.58

1D 13.08%

YTD -18.84%

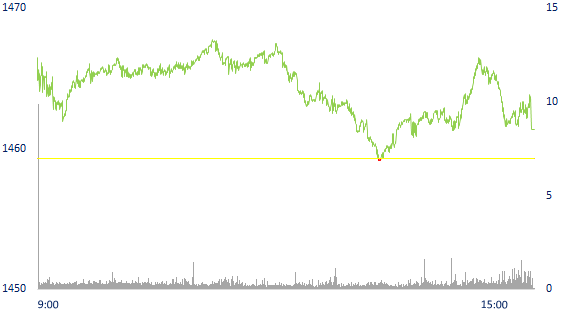

Basic commodity stocks were sold strongly, VN-Index increased slightly in the derivative maturity session. Market liquidity increased compared to the previous session. The total matched value reached 22,912 billion dong, up 17.3%, of which, the matched value on HoSE alone increased by 20% to 19,698 billion dong. Foreign investors net bought again 115 billion dong on HoSE.

ETF & DERIVATIVES

24,860

1D 0.08%

YTD -3.76%

17,350

1D 0.00%

YTD -4.09%

18,550

1D 4.15%

YTD -2.37%

21,600

1D 0.00%

YTD -5.68%

22,200

1D 0.91%

YTD -1.25%

28,180

1D 1.37%

YTD 0.46%

19,500

1D -0.10%

YTD -9.22%

1,472

1D 0.40%

YTD 0.00%

1,472

1D 0.42%

YTD 0.00%

1,472

1D 0.03%

YTD 0.00%

1,540

1D 0.00%

YTD 0.00%

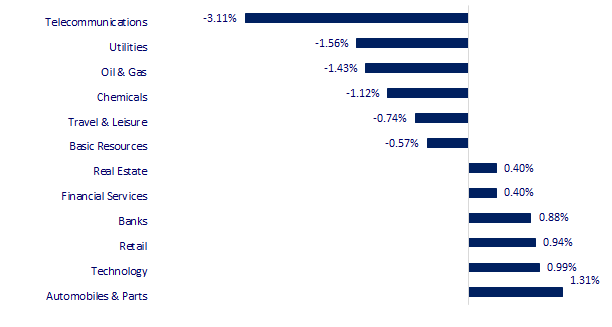

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

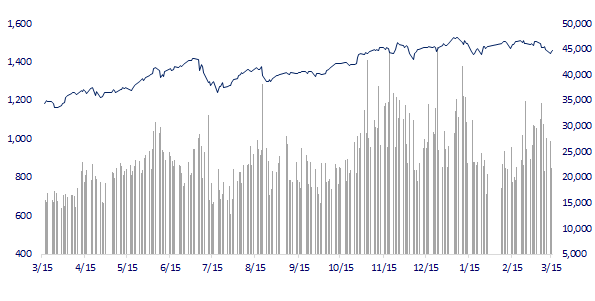

VNINDEX (12M)

GLOBAL MARKET

26,652.89

1D 0.40%

YTD -7.43%

3,215.04

1D 1.40%

YTD -11.67%

2,694.51

1D 1.33%

YTD -9.51%

21,501.23

1D 2.12%

YTD -8.11%

3,322.71

1D 0.97%

YTD 6.37%

1,681.76

1D 0.83%

YTD 1.46%

99.53

1D 3.23%

YTD 30.10%

1,944.30

1D 0.52%

YTD 6.78%

Asian stocks rose, Hong Kong continued to lead the region. In Japan, the Nikkei 225 gained 0.4%. China's stock market rose with Shanghai Composite up 1.4%, Shenzhen Component up 2,408%. Hong Kong's Hang Seng rose 2.12%, leading the region. South Korea's Kospi index rose 1.33%.

VIETNAM ECONOMY

2.19%

1D (bps) 1

YTD (bps) 138

5.60%

1.71%

1D (bps) 1

YTD (bps) 70

2.27%

YTD (bps) 27

23,085

1D (%) 0.30%

YTD (%) 0.63%

25,676

1D (%) -1.22%

YTD (%) -2.99%

3,671

1D (%) 0.00%

YTD (%) 0.36%

The national petroleum reserve fund can only meet demand for about 5-7 days. To ensure domestic supply, the Government has planned an oil refinery with a production scale of 10 million tons in Vung Tau, in addition to increasing the capacity of existing factories.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam is about to have an oil refinery with a scale of 10 million tons

- Philippines considers extending safeguard measures against cement imported from Vietnam

- Minister of Industry and Trade: If the tax tool still cannot control the price of gasoline, the welfare policy will be taken into account

- Inflation in Canada sets new record highs, prices rise violently

- President Putin: Russia does not need to print more money

- IEA downgrades oil demand outlook amid supply shortage from Russia

VN30

BANK

83,000

1D 0.61%

5D -0.60%

Buy Vol. 2,094,700

Sell Vol. 1,865,600

43,500

1D 4.57%

5D 6.23%

Buy Vol. 8,827,300

Sell Vol. 9,189,700

32,700

1D 2.19%

5D 1.87%

Buy Vol. 14,212,500

Sell Vol. 14,966,900

49,000

1D -0.10%

5D -0.51%

Buy Vol. 5,108,800

Sell Vol. 7,402,500

36,450

1D -0.95%

5D -0.82%

Buy Vol. 12,698,000

Sell Vol. 16,122,100

32,250

1D 0.47%

5D 3.86%

Buy Vol. 19,759,900

Sell Vol. 23,709,300

27,500

1D 1.29%

5D 2.04%

Buy Vol. 8,867,400

Sell Vol. 7,029,900

39,600

1D -0.38%

5D 1.54%

Buy Vol. 4,539,900

Sell Vol. 6,853,500

32,800

1D -0.30%

5D 3.96%

Buy Vol. 19,781,600

Sell Vol. 27,243,100

32,800

1D 0.00%

5D -0.30%

Buy Vol. 4,669,000

Sell Vol. 6,212,900

ACB: There will be an annual shareholder meeting on April 7 to discuss plans to increase capital, issue shares and some other issues. The bank will submit a plan to increase its charter capital from VND 27,019 billion to more than VND 33,774 billion by paying a 25% stock dividend. Implementation is expected in the third quarter. Regarding the business plan, ACB sets a target of pre-tax profit in 2022 to increase by 25%, reaching VND 15,018 billion. Total assets increased 11% to 588,187 billion dong. Customer deposits increased by 11% to VND 421,897 billion.

REAL ESTATE

76,600

1D -1.03%

5D -0.52%

Buy Vol. 5,089,300

Sell Vol. 6,259,700

51,400

1D 1.58%

5D -0.19%

Buy Vol. 2,046,900

Sell Vol. 1,829,100

86,400

1D 0.70%

5D -1.93%

Buy Vol. 3,900,700

Sell Vol. 3,595,500

NVL: The current land fund reaches 10,600 ha (early 2021 at 5,400 ha). Expected to launch 15,000 products in 2022

OIL & GAS

106,000

1D -2.93%

5D -10.55%

Buy Vol. 1,186,000

Sell Vol. 1,517,200

16,300

1D 0.00%

5D -1.81%

Buy Vol. 18,399,100

Sell Vol. 23,560,500

55,800

1D -0.71%

5D -8.97%

Buy Vol. 2,711,700

Sell Vol. 3,077,100

POW: PV Power plans to divest all of more than 2.8 million EIC shares, equivalent to 7.85% of capital. The transaction is expected to be executed by order matching method on HNX.

VINGROUP

78,400

1D 0.38%

5D -0.88%

Buy Vol. 4,648,700

Sell Vol. 5,870,500

74,000

1D -0.27%

5D -1.60%

Buy Vol. 5,369,800

Sell Vol. 6,822,800

32,250

1D 1.57%

5D 0.78%

Buy Vol. 4,417,700

Sell Vol. 5,551,800

VIC: VinFast has completed the issuance of VND5,000b of bonds from December 27, 2021 to March 8, 2022. Bonds have a par value of 100,000 VND, equivalent to a total volume of 50m bonds.

FOOD & BEVERAGE

76,400

1D -1.16%

5D -0.91%

Buy Vol. 2,072,800

Sell Vol. 3,224,000

138,000

1D -1.78%

5D -8.00%

Buy Vol. 1,328,800

Sell Vol. 1,272,600

154,000

1D 0.00%

5D -1.91%

Buy Vol. 188,700

Sell Vol. 73,700

OTHERS

145,000

1D -1.36%

5D 4.32%

Buy Vol. 1,324,600

Sell Vol. 1,378,100

145,000

1D -1.36%

5D 4.32%

Buy Vol. 1,324,600

Sell Vol. 1,378,100

92,000

1D 0.44%

5D -2.75%

Buy Vol. 2,214,400

Sell Vol. 2,105,300

130,800

1D -0.46%

5D -2.02%

Buy Vol. 1,260,700

Sell Vol. 1,474,800

103,000

1D 0.19%

5D -4.89%

Buy Vol. 1,123,100

Sell Vol. 1,469,900

33,800

1D 0.30%

5D -4.92%

Buy Vol. 2,990,600

Sell Vol. 2,208,700

43,800

1D 0.00%

5D -6.01%

Buy Vol. 7,444,800

Sell Vol. 10,896,000

45,950

1D -0.54%

5D -6.51%

Buy Vol. 24,570,800

Sell Vol. 25,563,700

FPT: has just announced the documents of the 2022 Annual General Meeting of Shareholders. Accordingly, the Board of Directors submitted a plan to pay cash dividend in 2021 at the rate of 20%, advanced 10% and the remaining 10% after approval of the General Meeting of Shareholders. The expected distribution period is before the end of the third quarter. At the same time, the business will pay a stock dividend of 20% and be done along with the remaining 2021 cash dividend.

Market by numbers

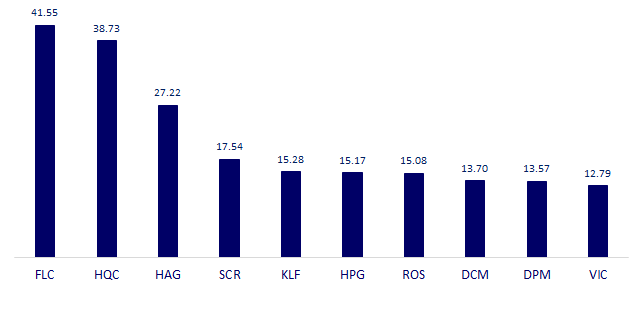

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

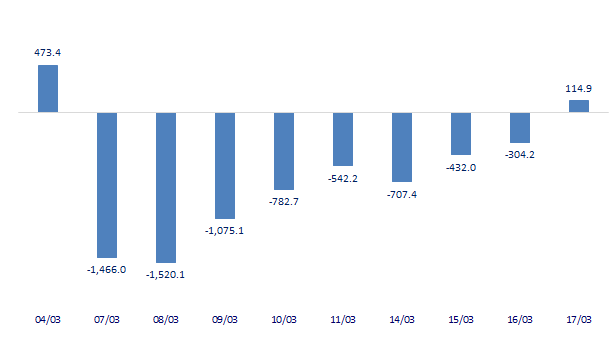

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

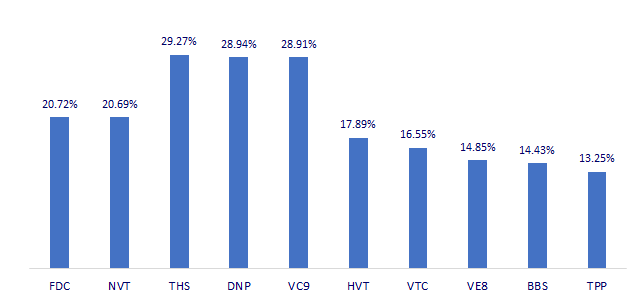

TOP INCREASES 3 CONSECUTIVE SESSIONS

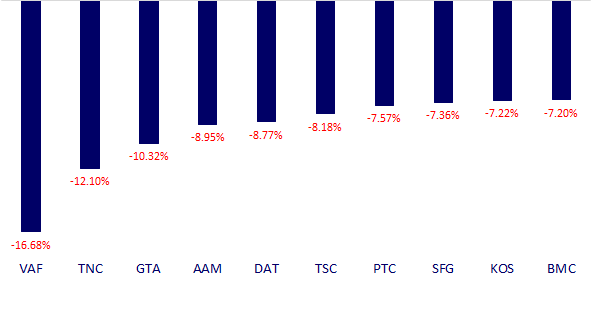

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.