Market brief 23/03/2022

VIETNAM STOCK MARKET

1,502.34

1D -0.10%

YTD 0.27%

1,505.59

1D -0.52%

YTD -1.96%

462.10

1D 0.16%

YTD -2.51%

116.58

1D -0.19%

YTD 3.46%

1,023.40

1D 0.00%

YTD 0.00%

33,800.32

1D -0.89%

YTD 8.78%

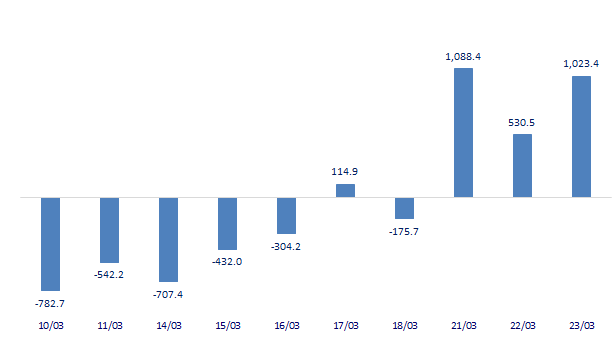

Foreign investors boosted their net buying of more than 1,000 billion dong in the session on March 23. Foreign investors on HoSE were still the strongest net buyers of DGC with 310 billion dong. MSN and GEX were net bought 152 billion dong and 113 billion dong respectively. On the other side, VNM was sold the most with 89 billion dong. DCM and VCI were net sold 71 billion dong and 59 billion dong respectively.

ETF & DERIVATIVES

25,270

1D -0.55%

YTD -2.17%

17,740

1D -0.39%

YTD -1.93%

18,500

1D 3.87%

YTD -2.63%

22,200

1D -0.89%

YTD -3.06%

22,290

1D 0.41%

YTD -0.85%

27,700

1D -3.65%

YTD -1.25%

19,950

1D -0.15%

YTD -7.12%

1,490

1D -0.35%

YTD 0.00%

1,494

1D 0.05%

YTD 0.00%

1,472

1D 0.00%

YTD 0.00%

1,540

1D 0.00%

YTD 0.00%

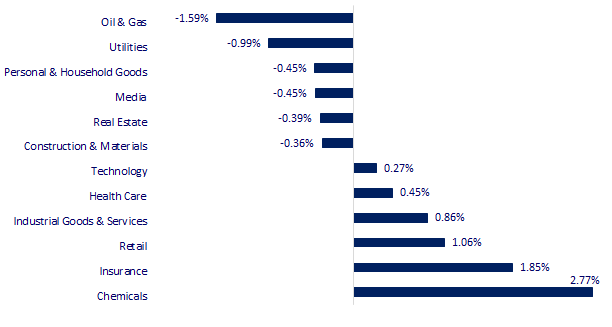

CHANGE IN PRICE BY SECTOR

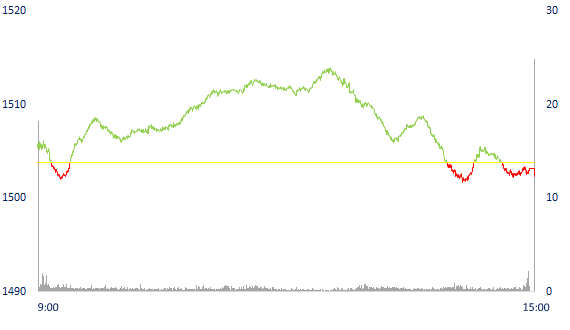

INTRADAY VNINDEX

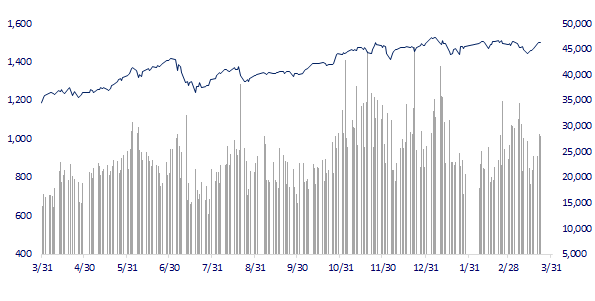

VNINDEX (12M)

GLOBAL MARKET

28,040.16

1D 0.43%

YTD -2.61%

3,271.03

1D 0.34%

YTD -10.13%

2,735.05

1D 0.92%

YTD -8.15%

22,154.08

1D 0.59%

YTD -5.32%

3,364.26

1D 0.42%

YTD 7.70%

1,677.95

1D 0.00%

YTD 1.23%

111.97

1D 1.99%

YTD 46.37%

1,933.25

1D 0.66%

YTD 6.18%

Asian stocks all rose. In Japan, the Nikkei 225 gained 0.43%. The Chinese market rose with Shanghai Composite up 0.34%, Shenzhen Component up 0.73%. Hong Kong's Hang Seng rose 0.59%. South Korea's Kospi index rose 0.92%.

VIETNAM ECONOMY

2.18%

1D (bps) 1

YTD (bps) 137

5.60%

1.88%

1D (bps) 1

YTD (bps) 87

2.41%

1D (bps) -2

YTD (bps) 41

23,095

1D (%) 0.35%

YTD (%) 0.68%

25,607

1D (%) -1.32%

YTD (%) -3.25%

3,660

1D (%) -0.08%

YTD (%) 0.05%

In the first half of March, the State Bank injected 2,107.63 billion dong into the banking system through a 14-day term purchase with an interest rate of 2.5%/year. Total maturity this month is 1,057 billion dong, bringing the amount of OMO in circulation to 1,050.63 trillion dong. Thus, all of this money will return to the State Bank before the end of March.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The State Bank sharply reduced the money injection into the market

- Government's financial strategy to 2030: Stock market capitalization reaches 120% of GDP

- Enterprises propose the Government to review and reduce procedures in the field of renewable energy

- US, UK reach agreement to end retaliatory tariffs on steel and aluminum

- The statement of the Fed president made investors sell gold

- The President of Ukraine will speak at the NATO Special Conference

VN30

BANK

84,900

1D 0.00%

5D 2.91%

Buy Vol. 1,518,500

Sell Vol. 1,716,200

43,400

1D -0.23%

5D 4.33%

Buy Vol. 4,137,100

Sell Vol. 4,565,500

32,850

1D -0.45%

5D 2.66%

Buy Vol. 6,444,000

Sell Vol. 10,237,300

49,600

1D -0.60%

5D 1.12%

Buy Vol. 5,337,400

Sell Vol. 8,496,600

36,650

1D -0.54%

5D -0.41%

Buy Vol. 12,660,200

Sell Vol. 19,983,000

32,150

1D -0.92%

5D 0.16%

Buy Vol. 16,643,600

Sell Vol. 19,004,900

28,000

1D -1.06%

5D 3.13%

Buy Vol. 5,241,100

Sell Vol. 8,015,500

40,050

1D -1.11%

5D 0.75%

Buy Vol. 5,666,000

Sell Vol. 7,879,200

34,000

1D -0.15%

5D 3.34%

Buy Vol. 26,297,900

Sell Vol. 31,341,000

33,200

1D -0.30%

5D 1.22%

Buy Vol. 3,423,800

Sell Vol. 5,580,400

In recent years, the bank has been promoting cooperation with insurance companies, seeing it as a potential channel to increase non-interest income, especially in the situation that the COVID-19 epidemic has made credit growth affected. Most recently, on December 27, 2021, Sacombank and Dai-ichi Life Vietnam Insurance Company signed an exclusive insurance agency contract. In December 2021, HDBank and FWD Vietnam officially signed an exclusive cooperation in distributing FWD Vietnam's insurance products through HDBank's nationwide system....

REAL ESTATE

83,800

1D -0.36%

5D 8.27%

Buy Vol. 9,940,500

Sell Vol. 9,969,000

53,000

1D 0.38%

5D 4.74%

Buy Vol. 2,196,000

Sell Vol. 2,592,900

90,300

1D -1.10%

5D 5.24%

Buy Vol. 3,834,400

Sell Vol. 4,098,700

NVL: As of the end of Q4.2021, NVL owns 10,600 hectares of land. In which, 20% is real estate in the center of Ho Chi Minh City and satellite urban areas and 80% is resort real estate

OIL & GAS

112,300

1D -2.35%

5D 2.84%

Buy Vol. 1,097,100

Sell Vol. 1,231,700

16,900

1D 2.42%

5D 3.68%

Buy Vol. 56,051,300

Sell Vol. 50,843,100

56,000

1D -1.41%

5D -0.36%

Buy Vol. 2,356,400

Sell Vol. 3,097,300

The warning that oil could reach $300 a barrel comes as the EU plans to discuss the imposition of an embargo on Russian crude.

VINGROUP

81,400

1D -0.97%

5D 4.23%

Buy Vol. 2,480,800

Sell Vol. 5,312,600

77,200

1D -1.03%

5D 4.04%

Buy Vol. 5,082,100

Sell Vol. 7,542,200

32,850

1D -1.05%

5D 3.46%

Buy Vol. 5,477,400

Sell Vol. 9,056,800

VIC: VinFast has successfully raised another 11,500 billion dong through the bond channel. The total outstanding debt of bonds issued by VinFast from 2019 to 2021 is VND 21,490 billion.

FOOD & BEVERAGE

76,100

1D -1.04%

5D -1.55%

Buy Vol. 5,335,100

Sell Vol. 5,891,600

147,000

1D -1.01%

5D 4.63%

Buy Vol. 2,648,200

Sell Vol. 2,654,700

157,500

1D 2.27%

5D 2.27%

Buy Vol. 303,200

Sell Vol. 230,600

VNM: Vinamilk has almost dominated the Vietnamese dairy market with over 55% market share, making this business almost no room for growth.

OTHERS

141,000

1D 0.14%

5D -4.08%

Buy Vol. 969,400

Sell Vol. 1,035,500

141,000

1D 0.14%

5D -4.08%

Buy Vol. 969,400

Sell Vol. 1,035,500

96,500

1D 0.10%

5D 5.35%

Buy Vol. 3,276,800

Sell Vol. 4,456,800

135,000

1D -0.15%

5D 2.74%

Buy Vol. 1,073,700

Sell Vol. 1,979,500

105,100

1D -1.78%

5D 2.24%

Buy Vol. 930,100

Sell Vol. 1,714,900

35,400

1D 2.16%

5D 5.04%

Buy Vol. 3,110,300

Sell Vol. 4,032,100

44,200

1D -0.34%

5D 0.91%

Buy Vol. 11,412,300

Sell Vol. 13,410,700

46,800

1D -0.21%

5D 1.30%

Buy Vol. 27,454,600

Sell Vol. 37,183,100

GVR: GVR is managing more than 402,000 hectares of rubber. As expected, GVR will spend about 100,000 ha for industrial parks, industrial clusters, and hi-tech agriculture. Binh Phuoc is also the province that GVR is aiming for. In places with favorable locations, having the same planning as the locality, GVR will support the conversion to improve land use.

Market by numbers

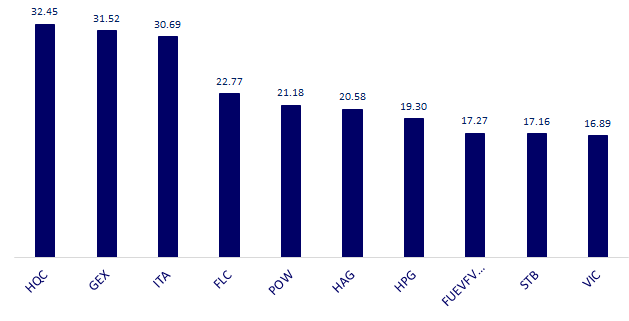

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

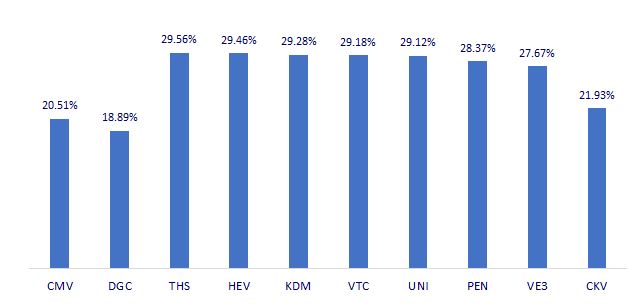

TOP INCREASES 3 CONSECUTIVE SESSIONS

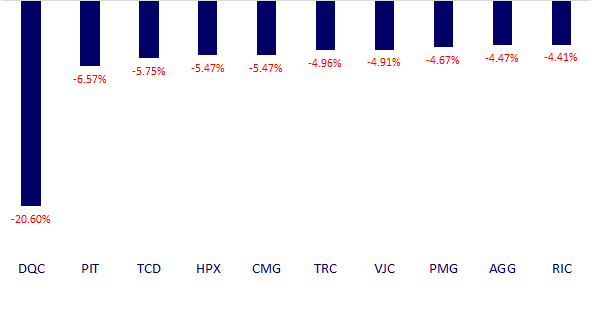

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.