Market brief 01/04/2022

VIETNAM STOCK MARKET

1,516.44

1D 1.63%

YTD 1.21%

1,542.47

1D 2.25%

YTD 0.44%

454.10

1D 1.00%

YTD -4.20%

117.19

1D 0.13%

YTD 4.00%

410.99

1D 0.00%

YTD 0.00%

31,989.68

1D 9.64%

YTD 2.95%

Domestic individual investors continued to net buy 12,421 billion dong on HoSE in the first quarter of 2022, down 44% compared to the fourth quarter of 2021, of which only 5,325 billion dong came from order matching transactions. Thus, domestic individuals have been net buyers in all 5 quarters from the beginning of 2021 up to now with a total value of nearly 102,000 billion dong.

ETF & DERIVATIVES

25,880

1D 2.29%

YTD 0.19%

18,080

1D 1.86%

YTD -0.06%

18,680

1D 4.88%

YTD -1.68%

22,200

1D 0.91%

YTD -3.06%

22,500

1D 2.23%

YTD 0.09%

30,970

1D 2.96%

YTD 10.41%

20,210

1D 1.20%

YTD -5.91%

1,520

1D 1.95%

YTD 0.00%

1,518

1D 1.55%

YTD 0.00%

1,518

1D 1.61%

YTD 0.00%

1,525

1D 1.94%

YTD 0.00%

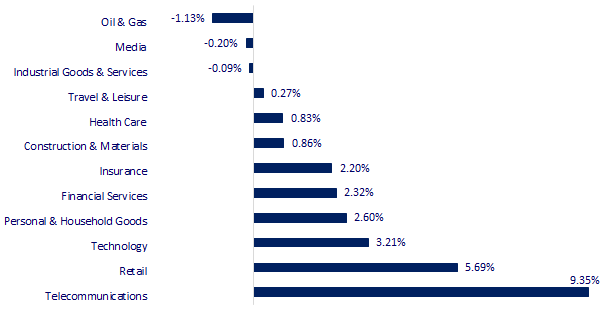

CHANGE IN PRICE BY SECTOR

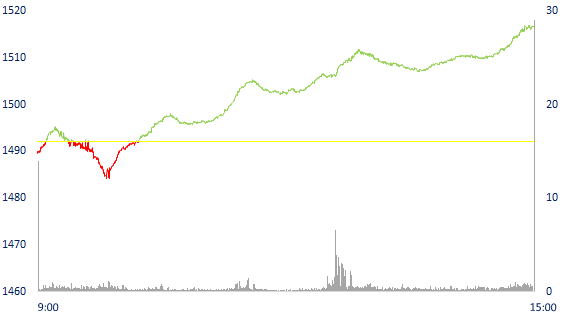

INTRADAY VNINDEX

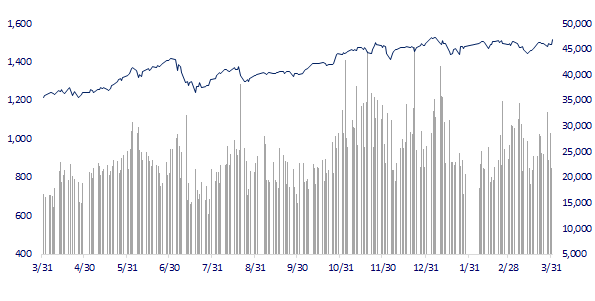

VNINDEX (12M)

GLOBAL MARKET

27,665.98

1D 0.31%

YTD -3.91%

3,282.72

1D 0.94%

YTD -9.81%

2,739.85

1D -0.65%

YTD -7.99%

22,039.55

1D 2.13%

YTD -5.80%

3,419.11

1D 0.31%

YTD 9.46%

1,701.31

1D 0.36%

YTD 2.64%

99.23

1D -1.13%

YTD 29.71%

1,925.50

1D -0.40%

YTD 5.75%

China manufacturing PMI Caixin/Markit the worst since February 2020, Asian stocks mixed. In Japan, the Nikkei 225 gained 0.31%. The Chinese market went up with Shanghai Composite up 0.94%, Shenzhen Component up 0.905%. Hong Kong's Hang Seng increased by 2.13%, the strongest increase in the region. The Kospi index fell 0.65%.

VIETNAM ECONOMY

2.08%

1D (bps) 7

YTD (bps) 127

5.60%

1.91%

1D (bps) -1

YTD (bps) 90

2.40%

1D (bps) -3

YTD (bps) 40

23,055

1D (%) 0.33%

YTD (%) 0.50%

25,684

1D (%) -1.27%

YTD (%) -2.96%

3,660

1D (%) -0.27%

YTD (%) 0.05%

According to the General Statistics Office, Vietnam's investment abroad in the first three months of 2022 has 24 projects newly granted investment certificates with a total capital of 180.2 million USD from the Vietnamese side, an increase of 28. 5% over the same period last year; There were 3 times of projects with capital adjustment increasing by 31.2 million USD, down by 92.8%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnamese enterprises investing abroad increased by 28.5% in Q1/2022

- PMI in March fell to 51.7 points, input costs increased fastest in nearly 11 years

- Hai Phong's economic growth was twice the national average in the first quarter of 2022

- IMF: Sanctions on Russia threaten to erode US dollar dominance

- Russia threatens to close the gas valve if it does not pay in rubles, Europe reacts strongly

- US urges countries to open strategic oil reserves

VN30

BANK

82,800

1D 0.85%

5D 0.36%

Buy Vol. 1,764,500

Sell Vol. 1,311,000

44,350

1D 1.95%

5D 2.07%

Buy Vol. 5,671,400

Sell Vol. 6,946,400

33,050

1D 1.85%

5D 2.64%

Buy Vol. 14,688,000

Sell Vol. 16,070,600

50,300

1D 1.51%

5D 2.13%

Buy Vol. 13,812,600

Sell Vol. 15,028,500

38,600

1D 3.76%

5D 5.03%

Buy Vol. 56,665,800

Sell Vol. 55,386,600

33,300

1D 1.06%

5D 4.72%

Buy Vol. 29,104,700

Sell Vol. 34,310,400

29,450

1D 3.88%

5D 5.37%

Buy Vol. 21,101,800

Sell Vol. 12,960,300

41,250

1D 2.74%

5D 3.38%

Buy Vol. 15,425,700

Sell Vol. 15,915,000

32,200

1D 1.58%

5D -4.31%

Buy Vol. 17,226,500

Sell Vol. 17,911,600

33,400

1D 1.06%

5D 2.14%

Buy Vol. 8,844,800

Sell Vol. 9,466,900

HDB: In 2021, total operating income exceeded VND 16,758 billion, up 22% over the same period last year, of which service income increased sharply by 103% thanks to the positive contribution of insurance and payment services. Operational costs are optimized through digital transformation, customer journey digitization and process automation, contributing to improving labor productivity. Capital costs are also reduced. Performance indicators such as ROE and ROA reached 23.3% and 1.9% respectively, higher than the previous year.

REAL ESTATE

82,600

1D 3.12%

5D -1.20%

Buy Vol. 7,672,700

Sell Vol. 5,786,800

53,600

1D 1.52%

5D 0.56%

Buy Vol. 2,845,500

Sell Vol. 2,117,700

92,700

1D 3.58%

5D -1.59%

Buy Vol. 5,082,300

Sell Vol. 4,849,800

NVL: will contribute more VND2,000b to Da Lat Valley Real Estate Company, accounting for 72.62% of charter capital, equivalent to becoming the parent company of Da Lat Valley Real Estate.

OIL & GAS

109,700

1D 1.29%

5D -0.90%

Buy Vol. 991,100

Sell Vol. 781,200

16,000

1D 0.95%

5D -3.61%

Buy Vol. 19,832,600

Sell Vol. 19,296,900

55,100

1D -0.18%

5D -1.61%

Buy Vol. 3,020,600

Sell Vol. 2,991,200

Petrol prices from 0:00 on April 1, the price of gasoline E5 RON 92 decreased by 1,021 VND/liter to 27,309 VND/liter. RON 95 gasoline decreased by 1,039 VND/liter, to 28,153 VND/liter.

VINGROUP

82,100

1D 1.11%

5D 1.36%

Buy Vol. 3,860,700

Sell Vol. 5,528,000

76,200

1D 0.53%

5D 0.40%

Buy Vol. 6,534,300

Sell Vol. 7,552,500

34,050

1D 1.79%

5D 4.13%

Buy Vol. 11,519,300

Sell Vol. 10,750,300

VHM: Consolidated profit after tax in 2021 increased by more than VND10,742b, an increase of 38% compared to 2020 mainly due to gross profit from real estate project transfer activities.

FOOD & BEVERAGE

81,700

1D 0.99%

5D 8.64%

Buy Vol. 9,108,700

Sell Vol. 13,136,500

146,500

1D 3.02%

5D 0.07%

Buy Vol. 1,486,000

Sell Vol. 1,474,700

165,300

1D 3.96%

5D 4.95%

Buy Vol. 692,000

Sell Vol. 771,400

MSN: the last registration date for the 20% share bonus is April 13. The Group will issue 236 million shares, charter capital is expected to increase to VND 14,166 billion.

OTHERS

140,900

1D 0.28%

5D -1.47%

Buy Vol. 962,700

Sell Vol. 923,800

140,900

1D 0.28%

5D -1.47%

Buy Vol. 962,700

Sell Vol. 923,800

111,000

1D 3.74%

5D 15.99%

Buy Vol. 7,335,900

Sell Vol. 6,468,300

156,000

1D 7.00%

5D 12.31%

Buy Vol. 6,801,700

Sell Vol. 5,295,000

117,200

1D 6.06%

5D 8.32%

Buy Vol. 5,303,200

Sell Vol. 5,574,200

34,550

1D 1.62%

5D -0.43%

Buy Vol. 3,488,200

Sell Vol. 3,358,600

42,900

1D 2.14%

5D -1.27%

Buy Vol. 13,952,600

Sell Vol. 13,475,600

45,700

1D 1.33%

5D -1.51%

Buy Vol. 37,659,700

Sell Vol. 32,647,100

BVH: Consolidated profit after tax in 2021 grew by 21.4%; Asset scale continued to grow, reaching nearly 170,000 billion VND, equivalent to more than 7 billion USD. Bao Viet is currently the enterprise with the leading asset scale in the insurance market, reaching nearly 170,000 billion VND, equivalent to more than 7 billion USD. Total consolidated revenue in 2021 reached VND 50,380 billion, up 2.8% compared to 2020; consolidated profit after tax reached VND 2,003 billion, up 21.4% compared to 2020.

Market by numbers

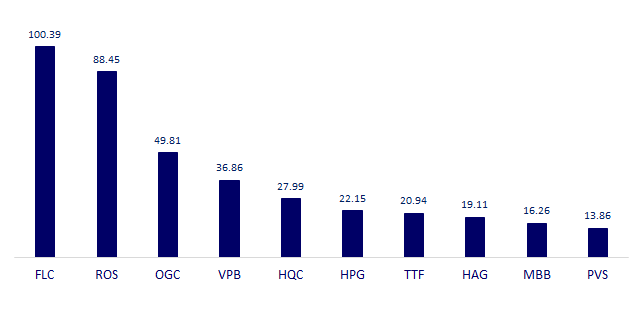

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

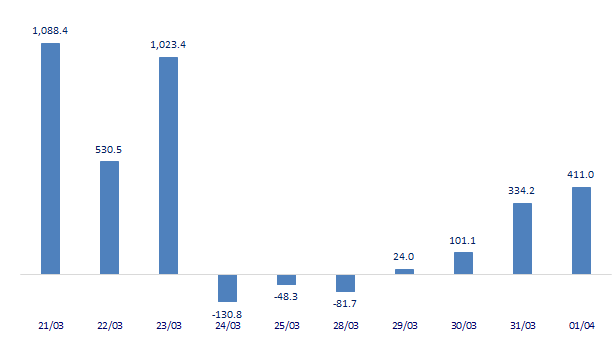

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

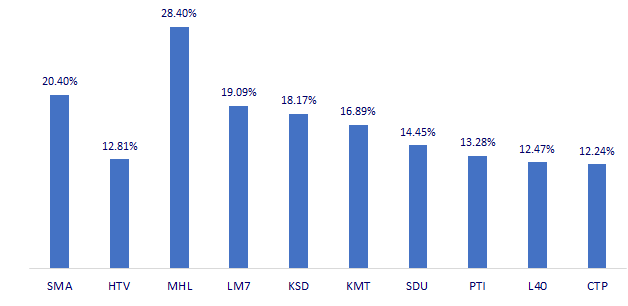

TOP INCREASES 3 CONSECUTIVE SESSIONS

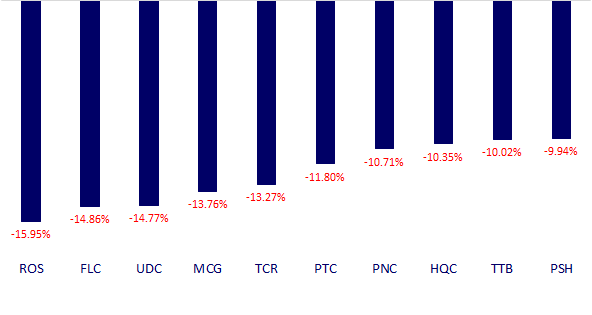

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.