Market brief 05/04/2022

VIETNAM STOCK MARKET

1,520.03

1D -0.31%

YTD 1.45%

1,539.20

1D -0.57%

YTD 0.23%

456.10

1D -0.56%

YTD -3.77%

117.70

1D 0.03%

YTD 4.46%

-292.95

1D 0.00%

YTD 0.00%

27,004.24

1D -14.06%

YTD -13.09%

Foreign investors boosted a net selling of 293 billion dong on April 5. Foreign investors on HoSE were the strongest net sellers of VHM with 68 billion dong. VIC and HPG were net sold at 60 billion dong and 47 billion dong respectively. Meanwhile, NVL was the strongest net bought with 52 billion dong. Internal ETF certificates FUEVFVND were bought the most with 27 billion dong.

ETF & DERIVATIVES

25,900

1D -0.77%

YTD 0.27%

17,880

1D -0.61%

YTD -1.16%

18,550

1D 4.15%

YTD -2.37%

22,800

1D 1.33%

YTD -0.44%

22,360

1D 1.45%

YTD -0.53%

32,050

1D -0.62%

YTD 14.26%

20,350

1D -0.25%

YTD -5.26%

1,519

1D -0.11%

YTD 0.00%

1,521

1D 0.16%

YTD 0.00%

1,523

1D 0.33%

YTD 0.00%

1,525

1D 0.02%

YTD 0.00%

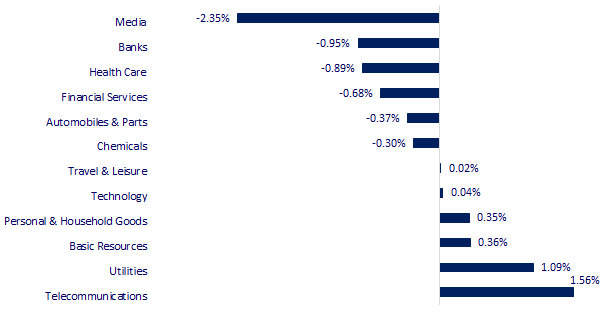

CHANGE IN PRICE BY SECTOR

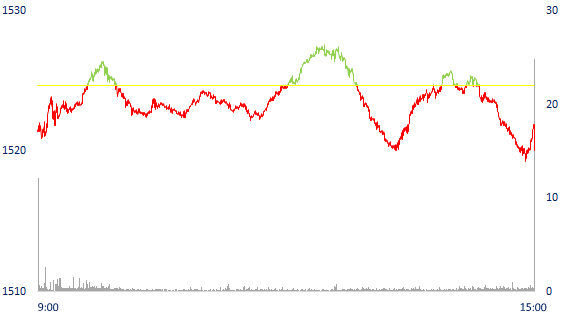

INTRADAY VNINDEX

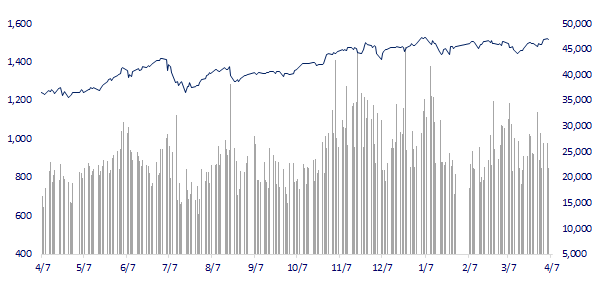

VNINDEX (12M)

GLOBAL MARKET

27,787.98

1D 0.27%

YTD -3.49%

3,282.72

1D 0.00%

YTD -9.81%

2,759.20

1D 0.24%

YTD -7.34%

22,502.31

1D 0.00%

YTD -3.83%

3,445.01

1D 0.20%

YTD 10.29%

1,701.18

1D -0.10%

YTD 2.63%

104.67

1D -0.12%

YTD 36.82%

1,930.30

1D -0.03%

YTD 6.01%

Australia made interest rate decisions, Asian stocks rose. In Japan, the Nikkei 225 gained 0.27%. Mainland China and Hong Kong markets are on holiday. South Korea's Kospi index rose 0.24%.

VIETNAM ECONOMY

2.09%

1D (bps) 1

YTD (bps) 128

5.60%

1.91%

YTD (bps) 90

2.43%

1D (bps) 3

YTD (bps) 43

23,015

1D (%) 0.11%

YTD (%) 0.33%

25,842

1D (%) 0.20%

YTD (%) -2.37%

3,665

1D (%) 0.11%

YTD (%) 0.19%

In the economic update report on East Asia and the Pacific with the theme "Fighting the storm" just released, the World Bank lowered its forecast for Vietnam's economic growth to 5.3% instead of 6.5%. as before. Even in a worse scenario, the WB also thinks that this year, Vietnam's economy may grow by 4%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- World Bank lowers Vietnam's economic growth forecast to 5.3%

- Prime Minister asked to focus on promoting disbursement of public investment capital

- Container freight for long-term contracts nearly doubled over the same period

- Russia is still shipping gas to Europe

- PBOC expands digital yuan pilot plan to more cities

- Saudi Arabia raises oil prices to record highs

VN30

BANK

83,000

1D 0.48%

5D 1.34%

Buy Vol. 1,076,900

Sell Vol. 1,132,100

43,300

1D -2.15%

5D 2.12%

Buy Vol. 4,871,200

Sell Vol. 5,013,800

32,350

1D -1.52%

5D 1.09%

Buy Vol. 9,925,100

Sell Vol. 10,392,800

49,050

1D -1.21%

5D 0.31%

Buy Vol. 9,705,800

Sell Vol. 10,589,500

38,300

1D -1.79%

5D 5.22%

Buy Vol. 25,340,100

Sell Vol. 29,549,400

32,650

1D -1.06%

5D 2.03%

Buy Vol. 17,001,700

Sell Vol. 19,578,600

28,750

1D -1.20%

5D 4.36%

Buy Vol. 4,607,400

Sell Vol. 6,419,200

40,800

1D -1.09%

5D 1.24%

Buy Vol. 8,210,000

Sell Vol. 8,084,200

31,800

1D -1.24%

5D -1.55%

Buy Vol. 13,526,500

Sell Vol. 15,310,900

33,000

1D -1.49%

5D 2.01%

Buy Vol. 7,230,800

Sell Vol. 8,587,300

STB: Sacombank sets a profit target of 5,280 billion dong in 2022, no later than 2023, the backlog will be resolved to pay dividends to shareholders. Sacombank said that as of December 31, 2021, the bank's retained consolidated profit is VND 9,000 billion, equivalent to nearly 50% of Sacombank's charter capital, this is the amount that can be used to pay dividends to shareholders.

REAL ESTATE

87,700

1D 1.39%

5D 6.30%

Buy Vol. 8,125,100

Sell Vol. 8,390,400

52,000

1D -1.52%

5D -2.62%

Buy Vol. 2,159,200

Sell Vol. 2,396,800

93,000

1D 0.11%

5D 1.09%

Buy Vol. 4,349,700

Sell Vol. 4,501,400

KDH: sets profit target to increase 16% in 2022, expected dividend of 10% in shares for 2021. In addition, KDH also plans to issue 9.6 million ESOP shares at the price of 24,000 VND/share.

OIL & GAS

114,300

1D 1.69%

5D 2.14%

Buy Vol. 1,718,400

Sell Vol. 1,482,500

16,350

1D 0.93%

5D 0.62%

Buy Vol. 19,737,700

Sell Vol. 28,028,300

56,100

1D -0.18%

5D -0.53%

Buy Vol. 1,683,800

Sell Vol. 2,835,400

The Oil and Gas group had some prosperity in the context of a strong recovery in world oil prices. Stocks like CNG, GAS, PGS, PVB, PVD, PXS, BSR, POW... all increased today.

VINGROUP

82,300

1D -0.48%

5D 1.86%

Buy Vol. 4,968,800

Sell Vol. 6,686,000

76,400

1D 0.13%

5D -0.13%

Buy Vol. 7,473,200

Sell Vol. 7,880,100

33,650

1D -1.17%

5D 3.38%

Buy Vol. 5,197,700

Sell Vol. 7,058,900

VIC: announced the audited consolidated financial statements. Accordingly, the undistributed after-tax profit in 2021 will change from a loss of 453.7 billion dong to a profit of 367 billion dong.

FOOD & BEVERAGE

80,400

1D -2.19%

5D 6.49%

Buy Vol. 3,551,500

Sell Vol. 4,852,900

151,600

1D 1.07%

5D 5.28%

Buy Vol. 1,621,700

Sell Vol. 1,543,300

166,200

1D -0.18%

5D 5.19%

Buy Vol. 109,400

Sell Vol. 158,200

MSN: closing the list of shareholders to issue 236 million bonus shares. Issuing value at par value of 2,361 billion VND.

OTHERS

141,500

1D -0.98%

5D -0.98%

Buy Vol. 889,000

Sell Vol. 1,012,700

141,500

1D -0.98%

5D -0.98%

Buy Vol. 889,000

Sell Vol. 1,012,700

109,000

1D -0.27%

5D 3.91%

Buy Vol. 3,076,500

Sell Vol. 3,469,700

155,200

1D 0.13%

5D 5.94%

Buy Vol. 2,367,800

Sell Vol. 2,301,700

117,800

1D 1.03%

5D 6.61%

Buy Vol. 1,067,500

Sell Vol. 1,704,500

36,400

1D -0.27%

5D 5.51%

Buy Vol. 4,991,700

Sell Vol. 9,333,400

44,300

1D -1.56%

5D 3.87%

Buy Vol. 11,261,000

Sell Vol. 18,974,200

46,100

1D 0.55%

5D 0.55%

Buy Vol. 20,624,500

Sell Vol. 23,802,300

SSI: SSI announces successful signing and completion of disbursement of unsecured loan contract from a group of foreign financial institutions worth USD 148 million. This is the largest foreign mortgage contract that a Vietnamese securities company has approached so far. Leading the loan arrangement and focal point are Union Bank of Taiwan (UBOT) and Taishin International Bank, supported by the SSI Investment Banking Service Division.

Market by numbers

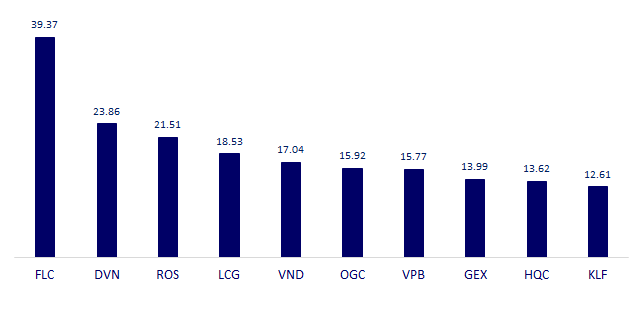

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

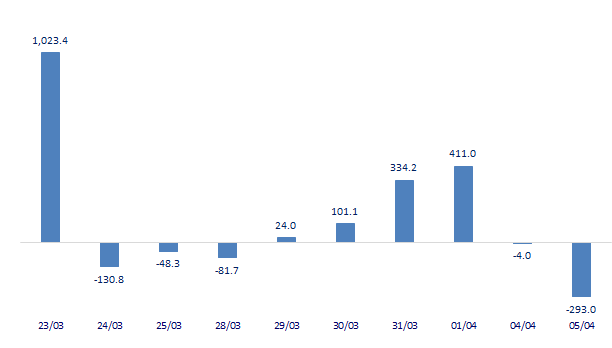

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

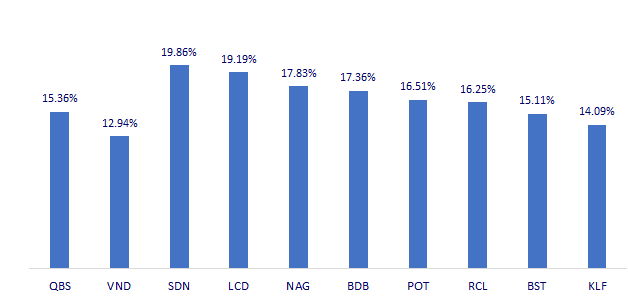

TOP INCREASES 3 CONSECUTIVE SESSIONS

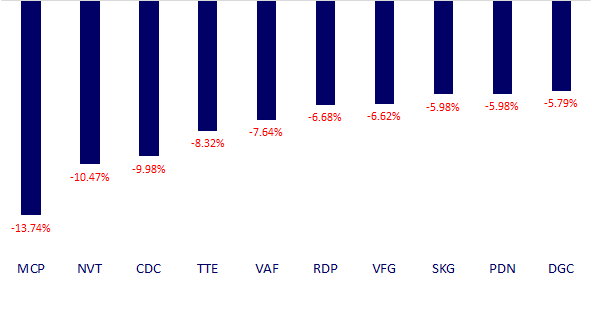

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.