Market brief 06/04/2022

VIETNAM STOCK MARKET

1,522.90

1D 0.19%

YTD 1.64%

1,557.11

1D 1.16%

YTD 1.39%

446.83

1D -2.03%

YTD -5.73%

116.84

1D -0.73%

YTD 3.69%

84.79

1D 0.00%

YTD 0.00%

35,671.05

1D 32.09%

YTD 14.80%

Foreign investors net bought back 85 billion dong in session 6/4. DXG was bought the most by foreign investors on HoSE with 73 billion dong. STB and SSI saw a net buying of 72 billion dong and 66 billion dong, respectively. Meanwhile, HCM was sold the most on this floor with 53 billion dong. GAS and NLG were net sold 41 billion dong and 35 billion dong respectively.

ETF & DERIVATIVES

25,800

1D -0.39%

YTD -0.12%

18,070

1D 1.06%

YTD -0.11%

18,630

1D 4.60%

YTD -1.95%

22,850

1D 0.22%

YTD -0.22%

22,000

1D -1.61%

YTD -2.14%

31,950

1D -0.31%

YTD 13.90%

20,560

1D 1.03%

YTD -4.28%

1,528

1D 0.63%

YTD 0.00%

1,535

1D 0.92%

YTD 0.00%

1,540

1D 1.10%

YTD 0.00%

1,540

1D 0.98%

YTD 0.00%

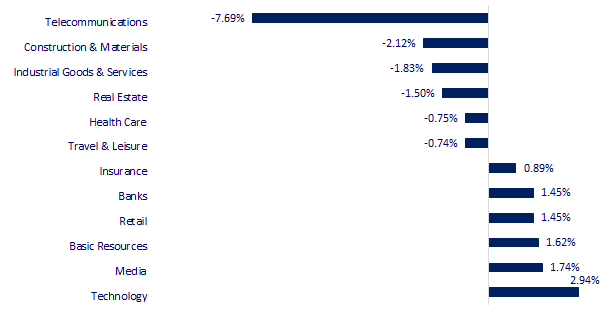

CHANGE IN PRICE BY SECTOR

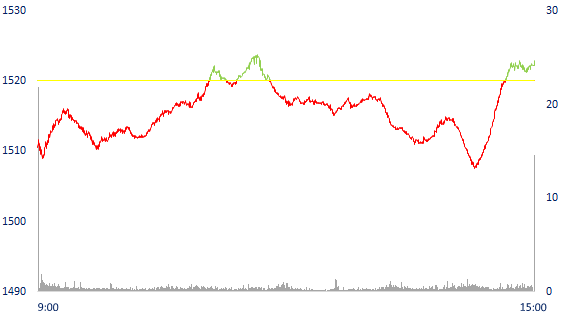

INTRADAY VNINDEX

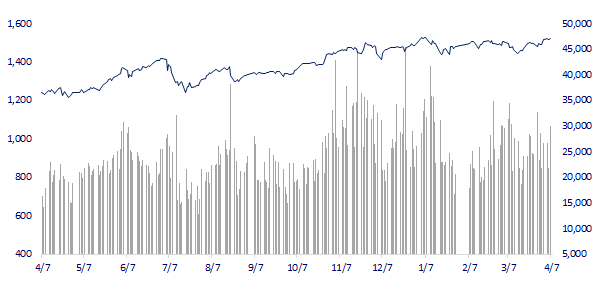

VNINDEX (12M)

GLOBAL MARKET

27,350.30

1D -1.58%

YTD -5.01%

3,283.43

1D 0.02%

YTD -9.79%

2,735.03

1D -0.88%

YTD -8.15%

22,080.52

1D -1.87%

YTD -5.63%

3,422.95

1D -0.64%

YTD 9.58%

1,701.18

1D 0.00%

YTD 2.63%

103.31

1D -1.30%

YTD 35.05%

1,920.00

1D -0.53%

YTD 5.45%

Asian stocks fell along with Wall Street. In Japan, Nikkei fell 1.58%. The Chinese market was mixed in the first session after two days of public holidays. Shanghai Composite increased 0.02%, Shenzhen Component down 0.45%. Hong Kong's Hang Seng fell 1.87%. South Korea's Kospi index fell 0.88%.

VIETNAM ECONOMY

2.10%

1D (bps) 1

YTD (bps) 129

5.60%

1.91%

YTD (bps) 90

2.43%

YTD (bps) 43

23,085

1D (%) 0.30%

YTD (%) 0.63%

25,390

1D (%) -1.75%

YTD (%) -4.07%

3,664

1D (%) -0.03%

YTD (%) 0.16%

Vietnam's economy update report in the first quarter has just been released, ADB forecasts that Vietnam's economy will recover and grow by 6.5% this year, and increase by 6.7% next year, thanks to high vaccination rates, strong promotion trade activities and continue to implement expansionary monetary and fiscal policies.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Ministry of Industry and Trade maintains the application of anti-dumping measures on cold-rolled stainless steel

- ADB forecasts Vietnam's GDP to grow by 6.5% this year

- Ho Chi Minh City's economy increased by nearly 1.9% after 2 quarters of deep decline

- Coal prices rise 11% after EU plans to ban imports from Russia

- Russian President criticizes European countries' pressure on Gazprom

- US prevents Russia from paying $600 million in debt, increasing Moscow's risk of default

VN30

BANK

84,600

1D 1.93%

5D 3.17%

Buy Vol. 3,459,200

Sell Vol. 2,892,400

43,500

1D 0.46%

5D -0.11%

Buy Vol. 6,235,100

Sell Vol. 5,049,700

32,600

1D 0.77%

5D 1.72%

Buy Vol. 11,737,200

Sell Vol. 9,429,400

49,900

1D 1.73%

5D 1.53%

Buy Vol. 14,974,700

Sell Vol. 12,109,100

39,950

1D 4.31%

5D 8.56%

Buy Vol. 60,929,400

Sell Vol. 61,860,000

33,350

1D 2.14%

5D 2.14%

Buy Vol. 28,389,700

Sell Vol. 30,733,500

29,000

1D 0.87%

5D 2.47%

Buy Vol. 14,837,600

Sell Vol. 9,875,800

41,150

1D 0.86%

5D 2.88%

Buy Vol. 10,506,300

Sell Vol. 10,369,100

32,350

1D 1.73%

5D 0.31%

Buy Vol. 20,611,400

Sell Vol. 20,727,500

33,200

1D 0.61%

5D 1.84%

Buy Vol. 6,927,500

Sell Vol. 7,225,100

TPB: TPBank has set a target that by the end of 2022, it will reach total assets of VND 350,000 billion, an increase of 20% compared to the beginning of the year. Charter capital increased by 33% to VND 21,090 billion. Total deposits and outstanding loans increased by 12% and 18%, respectively, to VND292,579 billion and VND188,800 billion. Pre-tax profit in 2022 is expected to increase by 36% compared to 2021, reaching VND 8,200 billion.

REAL ESTATE

86,300

1D -1.60%

5D 7.88%

Buy Vol. 9,574,500

Sell Vol. 10,795,900

51,000

1D -1.92%

5D -3.04%

Buy Vol. 3,231,100

Sell Vol. 2,748,800

93,000

1D 0.00%

5D 2.54%

Buy Vol. 4,501,600

Sell Vol. 4,961,500

NVL: BOD submitted the 2022 plan including net revenue of VND 35,974b, up 141% compared 2021; profit after tax is 6,500b dong, up 88%. NVL temporarily does not have a 2022 dividend plan.

OIL & GAS

113,700

1D -0.52%

5D 3.27%

Buy Vol. 1,382,200

Sell Vol. 1,664,200

16,400

1D 0.31%

5D 2.82%

Buy Vol. 23,368,800

Sell Vol. 26,204,200

56,000

1D -0.18%

5D 1.82%

Buy Vol. 2,349,500

Sell Vol. 2,999,400

Gas prices increased in many US states. The average price per gallon of gasoline in California is $5.8, the highest in the US.

VINGROUP

80,500

1D -2.19%

5D -0.74%

Buy Vol. 7,804,600

Sell Vol. 9,581,700

76,300

1D -0.13%

5D 0.66%

Buy Vol. 6,328,300

Sell Vol. 6,733,800

33,600

1D -0.15%

5D 3.38%

Buy Vol. 8,336,800

Sell Vol. 10,526,700

VHM: iShares ETF continues to sell VHM. Specifically, this fund sold 74,900 VHM shares, accordingly, the proportion of VHM fund on April 1, 2022 was 2.66%.

FOOD & BEVERAGE

79,300

1D -1.37%

5D 4.07%

Buy Vol. 6,824,400

Sell Vol. 7,183,300

153,800

1D 1.45%

5D 6.81%

Buy Vol. 2,161,800

Sell Vol. 2,300,600

169,500

1D 1.99%

5D 7.35%

Buy Vol. 570,300

Sell Vol. 443,200

VNM: sets a target of total revenue in 2022 to increase by nearly 5% to VND 64,070 billion. However, profit after tax is expected to be 9,770 billion VND, down 8% compared to 2021.

OTHERS

141,000

1D -0.35%

5D 0.36%

Buy Vol. 811,300

Sell Vol. 747,000

141,000

1D -0.35%

5D 0.36%

Buy Vol. 811,300

Sell Vol. 747,000

113,000

1D 3.67%

5D 6.60%

Buy Vol. 7,639,400

Sell Vol. 6,230,000

158,800

1D 2.32%

5D 9.97%

Buy Vol. 4,989,100

Sell Vol. 4,646,700

118,100

1D 0.25%

5D 9.05%

Buy Vol. 2,979,000

Sell Vol. 4,028,400

37,000

1D 1.65%

5D 9.31%

Buy Vol. 5,947,800

Sell Vol. 7,904,400

44,600

1D 0.68%

5D 5.44%

Buy Vol. 15,457,900

Sell Vol. 16,820,300

47,250

1D 2.49%

5D 3.85%

Buy Vol. 46,733,400

Sell Vol. 52,747,900

HPG: announced that crude steel production in March reached 762,000 tons, up 9% over the same period. Sales volume of construction steel, hot rolled coil and billet was 832,000 tons, up 18% month on month. In which, construction steel for the first time in history recorded 511,000 tons, 7% higher than the peak of 2021..

Market by numbers

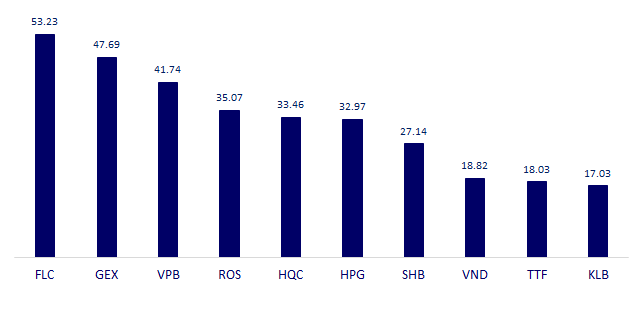

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

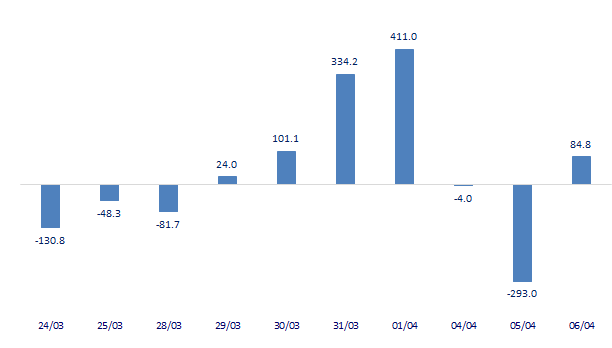

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

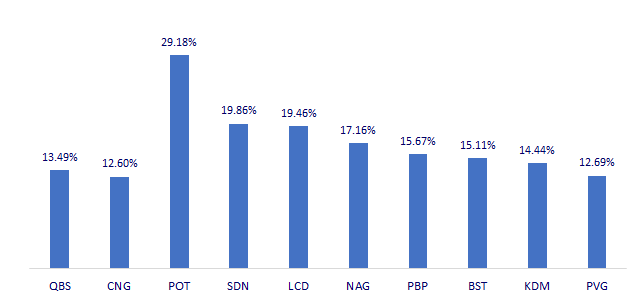

TOP INCREASES 3 CONSECUTIVE SESSIONS

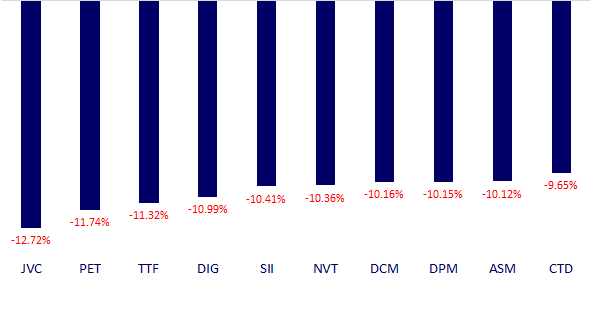

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.