Morning brief 08/04/2022

GLOBAL MARKET

34,583.57

1D 0.25%

YTD -4.99%

4,500.21

1D 0.43%

YTD -5.83%

13,897.30

1D 0.06%

YTD -11.72%

21.55

1D -2.49%

7,551.81

1D -0.47%

YTD 2.01%

14,078.15

1D -0.52%

YTD -11.37%

6,461.68

1D -0.57%

YTD -9.92%

96.64

1D -1.25%

YTD 26.33%

1,932.20

1D 0.46%

YTD 6.12%

US stocks recovered on Thursday (April 7), after two consecutive sessions of decline, as investors reassessed the latest plans of the US Federal Reserve (Fed) to tighten monetary policy and cope with rising inflation. Ending the session, the Dow Jones advanced 87.06 points (or 0.25%) to 34,583.57 points after falling 300 points at the beginning of the session. The S&P 500 added 0.43% to 4,500.21 points, and the Nasdaq Composite added 0.06% to 13,897.30 after falling for two consecutive sessions.

VIETNAM ECONOMY

2.10%

YTD (bps) 129

5.60%

2.12%

1D (bps) 21

YTD (bps) 111

2.66%

1D (bps) 23

YTD (bps) 66

22,998

1D (%) -0.03%

YTD (%) 0.25%

25,570

1D (%) -0.40%

YTD (%) -3.39%

3,661

1D (%) -0.11%

YTD (%) 0.08%

Currently, Vietnam's shipping fleet only accounts for 7% of the transport market share, the rest is in the hands of foreign shipping lines, and this is one of the reasons why logistics costs in Vietnam are now double compared with developed countries. The Vietnam Logistics Business Association (VLA) proposed to need $1.5 billion from different sources to develop a fleet of container ships operating on intra-Asian routes to be more proactive in import and export.

VIETNAM STOCK MARKET

1,502.35

1D -1.35%

YTD 0.27%

1,541.96

1D -0.97%

YTD 0.41%

441.61

1D -1.17%

YTD -6.83%

115.81

1D -0.88%

YTD 2.78%

-535.20

32,149.05

1D -9.87%

YTD 3.47%

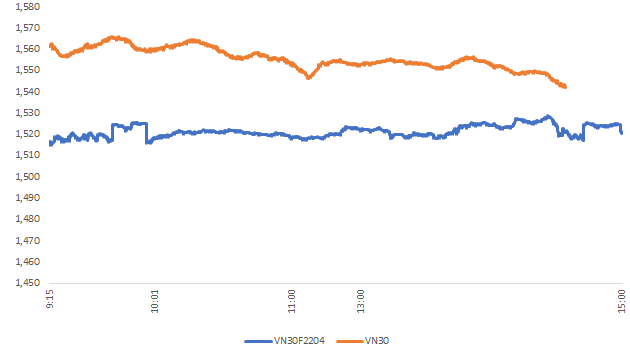

Banking stocks continued to be the focus in the morning session of April 7 when they were the main factors to prevent the market from falling too deeply. Leading the increase were MBB and VPB. Specifically, MBB had a spike of more than 3% at one point while VPBank's VPB also increased by 2% or so. The liquidity of both stocks is also at the highest level in the bank group.

INTRADAY

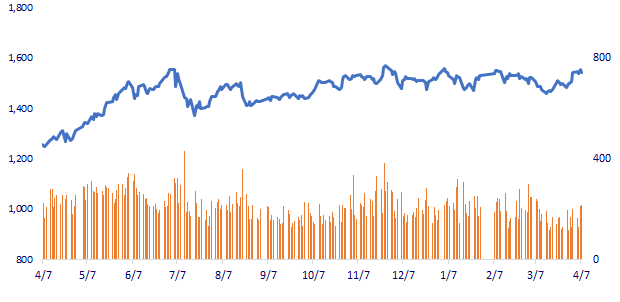

VN30 (12M)

SELECTED NEWS

- Vietnam needs to import 25 million tons of coal in 2022 for electricity and fertilizer

- Hanoi: Total development investment capital in the first quarter of 2022 reached VND 76,260 billion

- Vietnam needs more than 1 billion dollars to invest in a fleet of container ships going to intra-Asia routes

- Prices increased by more than 50% in 2 years, Canada banned foreigners from buying houses

- Fertilizer shortage aggravated by tensions in Ukraine

- WB: East Asia - Pacific countries can still offer a support package, due to relatively high real interest rates and low core inflation.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.