Market brief 13/04/2022

VIETNAM STOCK MARKET

1,477.20

1D 1.51%

YTD -1.41%

1,525.39

1D 1.21%

YTD -0.67%

427.45

1D 1.53%

YTD -9.82%

113.30

1D 0.68%

YTD 0.55%

1,551.68

1D 0.00%

YTD 0.00%

26,018.76

1D 3.34%

YTD -16.26%

Session 13/04: MWG was net bought by foreign investors up to 1,500 billion dong and most of it was done through put-through method. GEX is behind with a net buying value of more than 85 billion dong. VIC and GMD were net bought 64 billion dong and 47 billion dong respectively. On the other side, VHM was sold the most with 94.5 billion dong. DGC and HPG were net sold 51 billion dong and 47 billion dong respectively.

ETF & DERIVATIVES

25,900

1D 0.00%

YTD 0.27%

17,950

1D 1.07%

YTD -0.77%

18,980

1D 6.57%

YTD -0.11%

22,790

1D 3.59%

YTD -0.48%

22,050

1D -0.54%

YTD -1.91%

30,800

1D 2.67%

YTD 9.80%

19,930

1D -0.35%

YTD -7.22%

1,511

1D 0.51%

YTD 0.00%

1,515

1D 0.60%

YTD 0.00%

1,518

1D 0.64%

YTD 0.00%

1,520

1D 0.68%

YTD 0.00%

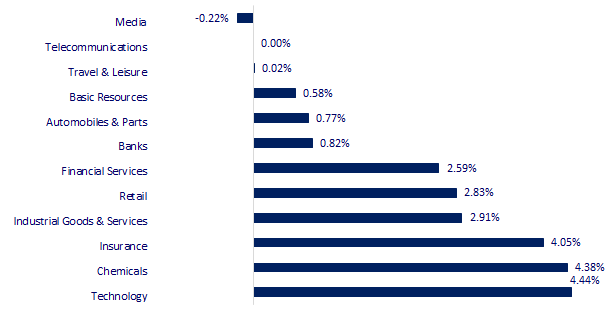

CHANGE IN PRICE BY SECTOR

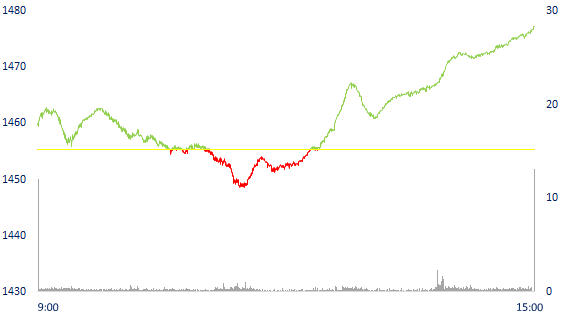

INTRADAY VNINDEX

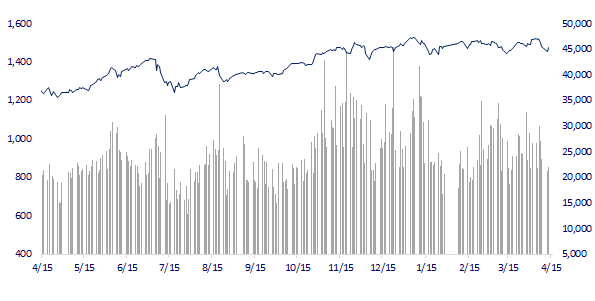

VNINDEX (12M)

GLOBAL MARKET

26,843.49

1D 0.60%

YTD -6.77%

3,186.82

1D -0.83%

YTD -12.44%

2,716.49

1D 1.86%

YTD -8.77%

21,374.37

1D 1.03%

YTD -8.65%

3,342.22

1D 0.36%

YTD 7.00%

1,674.34

1D 0.00%

YTD 1.01%

102.58

1D 1.73%

YTD 34.09%

1,977.90

1D 0.51%

YTD 8.63%

New Zealand raised interest rates, Asian stocks mixed. In Japan, the Nikkei 225 gained 0.6%. The Chinese market fell with the Shanghai Composite down 0.83%. Hong Kong's Hang Seng rose 1.03%. China today released March trade data showing that exports rose more than expected, in dollar terms, up 14.7% year-on-year. Imports fell 0.1%, significantly lower than the forecast for an 8% increase.

VIETNAM ECONOMY

2.11%

YTD (bps) 130

5.60%

2.30%

1D (bps) 2

YTD (bps) 129

2.88%

1D (bps) 6

YTD (bps) 88

23,110

1D (%) 0.37%

YTD (%) 0.74%

25,223

1D (%) -1.25%

YTD (%) -4.70%

3,666

1D (%) 0.03%

YTD (%) 0.22%

The Vietnam General Confederation of Labor proposed to increase the regional minimum wage from over 7% to over 8% from July 1, 2022. The representative of the Vietnam General Confederation of Labor explained, “The increase in the regional minimum wage brings benefits to both employers and employees. The more difficult times are, the more we must secure the people and create confidence for the workers."

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Standard Chartered: Vietnam's recovery will be stronger in Q2

- Proposing to increase regional minimum wages from 7 to 8% from July 1, 2022

- Canadian expert affirmed that Vietnam will be an attractive strategic partner

- OPEC cuts global crude oil consumption and growth forecasts

- Sri Lanka declared default on all US$51 billion of foreign debt

- UK inflation hits a 30-year record

VN30

BANK

82,400

1D 0.00%

5D -2.60%

Buy Vol. 1,187,200

Sell Vol. 1,601,100

40,900

1D 1.11%

5D -5.98%

Buy Vol. 3,393,800

Sell Vol. 3,260,200

31,500

1D 1.61%

5D -3.37%

Buy Vol. 7,376,200

Sell Vol. 6,833,800

48,000

1D 0.00%

5D -3.81%

Buy Vol. 9,383,900

Sell Vol. 10,120,600

39,000

1D 0.00%

5D -2.38%

Buy Vol. 35,261,600

Sell Vol. 38,547,700

32,600

1D 1.09%

5D -2.25%

Buy Vol. 21,524,800

Sell Vol. 19,900,100

28,000

1D 0.72%

5D -3.45%

Buy Vol. 6,778,700

Sell Vol. 6,028,500

40,000

1D 5.12%

5D -2.79%

Buy Vol. 8,570,500

Sell Vol. 9,378,300

31,350

1D 1.79%

5D -3.09%

Buy Vol. 12,862,900

Sell Vol. 14,121,000

33,650

1D 0.60%

5D 1.36%

Buy Vol. 7,428,500

Sell Vol. 8,609,100

VCB: Currently, Vietcombank's individual CAR (December 31, 2021) is 9.4%, only 1.4 percentage points higher than the prescribed minimum level, which is much lower than that of joint stock commercial banks without state capital as well as banks in the ASEAN region.

REAL ESTATE

86,500

1D 1.76%

5D 0.23%

Buy Vol. 8,270,500

Sell Vol. 8,863,700

50,600

1D 1.00%

5D -0.78%

Buy Vol. 1,390,300

Sell Vol. 1,325,400

91,000

1D 1.11%

5D -2.15%

Buy Vol. 3,759,900

Sell Vol. 3,630,200

PDR: Phat Dat has approved the revenue target of VND 10,700 billion, 3 times higher than the previous year; profit after tax is 2,908 billion dong, up 56%

OIL & GAS

110,100

1D 1.10%

5D -3.17%

Buy Vol. 911,700

Sell Vol. 845,800

15,700

1D 0.64%

5D -4.27%

Buy Vol. 21,577,700

Sell Vol. 21,670,800

54,700

1D 0.18%

5D -2.32%

Buy Vol. 2,040,600

Sell Vol. 2,341,300

POW: With a capacity of 1,500 MW, Nhon Trach 3 & 4 projects have a total investment of 1.4 billion USD and are a key project in the Power Plan VII.

VINGROUP

82,200

1D 1.11%

5D 2.11%

Buy Vol. 4,240,400

Sell Vol. 5,502,800

73,100

1D 0.14%

5D -4.19%

Buy Vol. 5,669,700

Sell Vol. 6,017,300

31,850

1D 2.41%

5D -5.21%

Buy Vol. 5,903,100

Sell Vol. 4,401,600

VIC: According to Bloomberg, Vingroup's capitalization could reach $26 billion if VinFast IPO is successful

FOOD & BEVERAGE

77,200

1D 0.52%

5D -2.65%

Buy Vol. 3,947,200

Sell Vol. 3,746,200

126,900

1D 1.20%

5D -0.98%

Buy Vol. 1,347,900

Sell Vol. 1,675,400

163,500

1D 0.12%

5D -3.54%

Buy Vol. 285,800

Sell Vol. 223,800

MSN: Revenue growth in 2021 thanks to increases of 20% at Masan Consumer Holdings, 17.2% at Masan MEATLife, 82.7% at Masan High-Tech Materials.

OTHERS

138,100

1D 0.07%

5D -2.06%

Buy Vol. 880,200

Sell Vol. 1,118,800

138,100

1D 0.07%

5D -2.06%

Buy Vol. 880,200

Sell Vol. 1,118,800

115,100

1D 4.83%

5D 1.86%

Buy Vol. 5,344,600

Sell Vol. 5,128,300

156,200

1D 2.29%

5D -1.64%

Buy Vol. 9,609,700

Sell Vol. 7,570,900

116,000

1D 3.20%

5D -1.78%

Buy Vol. 1,855,700

Sell Vol. 1,601,900

34,500

1D 4.55%

5D -6.76%

Buy Vol. 4,499,100

Sell Vol. 3,454,500

42,550

1D 1.79%

5D -4.60%

Buy Vol. 14,079,900

Sell Vol. 14,096,500

45,200

1D 0.22%

5D -4.34%

Buy Vol. 21,319,700

Sell Vol. 21,007,300

HPG: In Dak Nong, Hoa Phat Group has researched, surveyed and planned to implement the Hoa Phat Aluminum - Aluminum - Wind Power Project. This complex, when put into operation, will contribute about 3,000 billion VND to the local budget and create jobs for thousands of local workers. Hoa Phat has surveyed quite carefully and looks forward to the province's support and companion to speed up the project's implementation.

Market by numbers

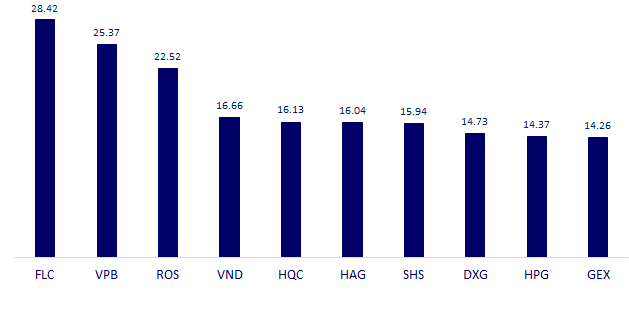

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

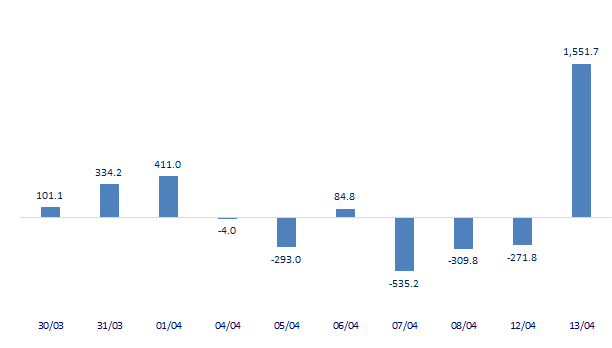

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

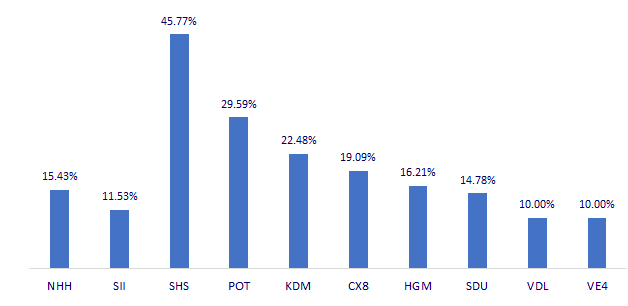

TOP INCREASES 3 CONSECUTIVE SESSIONS

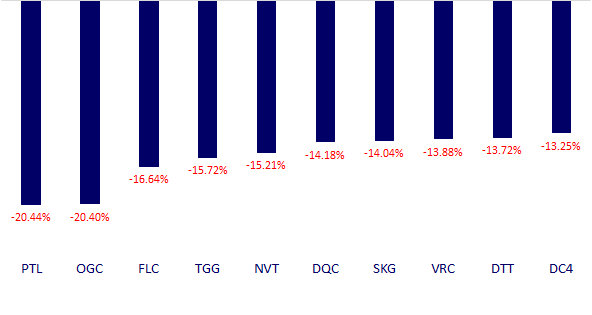

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.