Market brief 26/04/2022

VIETNAM STOCK MARKET

1,310.92

1D -4.95%

YTD -12.51%

1,366.39

1D -5.40%

YTD -11.03%

337.51

1D -6.02%

YTD -28.79%

99.54

1D -4.43%

YTD -11.66%

1,016.78

1D 0.00%

YTD 0.00%

25,522.33

1D -11.59%

YTD -17.86%

Foreign investors' trade on April 26 was quite positive when they bought more than 1,022 billion dong in the whole market. In which, foreign investors made a breakthrough net buying of 1,043 billion dong on HoSE, buying power focused on VNM, DGC, DPM, BVH... In contrast, NVL stock was under the strongest net selling pressure with 85 billion dong. VHM was also net sold 61 billion dong

ETF & DERIVATIVES

23,550

1D 2.04%

YTD -8.83%

16,390

1D 1.86%

YTD -9.40%

17,350

1D -2.58%

YTD -8.68%

20,610

1D 5.05%

YTD -10.00%

20,000

1D 2.30%

YTD -11.03%

28,380

1D 3.20%

YTD 1.18%

19,150

1D 6.15%

YTD -10.85%

1,389

1D 2.29%

YTD 0.00%

1,389

1D 2.89%

YTD 0.00%

1,393

1D 3.03%

YTD 0.00%

1,391

1D 2.80%

YTD 0.00%

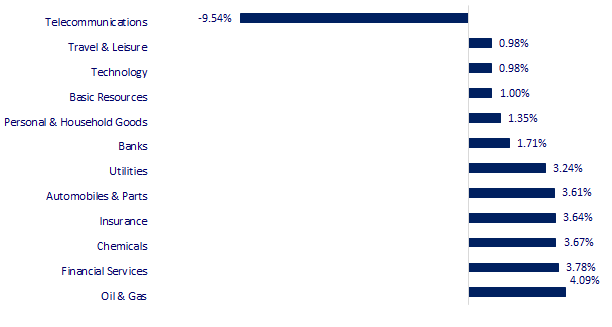

CHANGE IN PRICE BY SECTOR

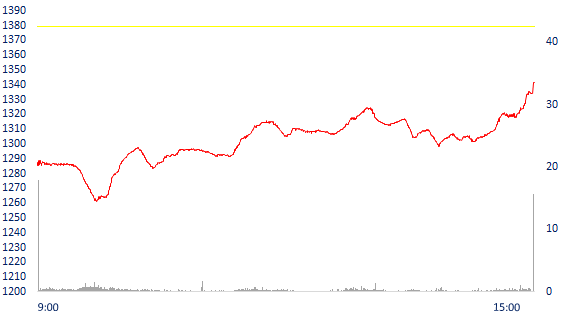

INTRADAY VNINDEX

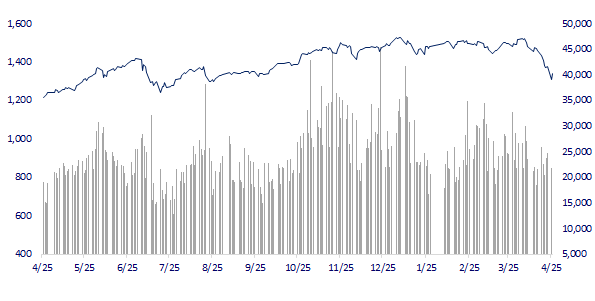

VNINDEX (12M)

GLOBAL MARKET

26,700.11

1D 0.41%

YTD -7.26%

2,886.43

1D -1.44%

YTD -20.70%

2,668.31

1D 0.42%

YTD -10.39%

19,934.71

1D 0.33%

YTD -14.80%

3,322.05

1D -0.53%

YTD 6.35%

1,668.97

1D -0.38%

YTD 0.68%

98.17

1D 0.48%

YTD 28.33%

1,907.60

1D -0.10%

YTD 4.77%

Chinese stocks continued their decline on April 26 as investors feared that Beijing would impose a blockade on a large scale. The Shanghai composite index fell 1.44% to 2,886.43 points. The Shenzhen component index fell 1.66% to 10,206.64 points. The CSI 300 index also fell 0.81% to 3,784.12 points. The Hang Seng Index (Hong Kong) ended the session up 0.15% to 19,898.74 points, after losing nearly 3% previously.

VIETNAM ECONOMY

1.29%

1D (bps) -76

YTD (bps) 48

5.60%

2.42%

1D (bps) 8

YTD (bps) 141

2.98%

YTD (bps) 98

-

1D (%) -

YTD (%) -

25,282

1D (%) -0.92%

YTD (%) -4.48%

3,580

1D (%) -0.33%

YTD (%) -2.13%

A positive signal for many related costs, VND interest rates on the interbank market have continuously fallen deeply last week. Featured in overnight VND interest rates. After stabilizing at a "new ground" of over 2%/year for a long time, in the middle of last week, the market recorded overnight interest rates leaving the 2% mark. This movement continued to show stronger until the end of the week.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Ministry of Transport announced 10 new seaports

- Hanoi: Promoting night economy through walking street of Thien Quang lake

- Hau Giang proposes to add 12 renewable energy projects to Power Plan VIII

- IMF: Asia faces economic stagnation amid tensions in Ukraine

- The price of raw wood products has increased sharply from over 35% to more than 50% in a short time

- Malaysia is expected to benefit from Indonesia's palm oil export ban

VN30

BANK

80,500

1D -1.59%

5D 3.60%

Buy Vol. 2,755,100

Sell Vol. 3,167,100

36,900

1D 2.93%

5D -2.77%

Buy Vol. 4,673,500

Sell Vol. 3,083,400

27,650

1D 1.10%

5D -3.83%

Buy Vol. 10,767,000

Sell Vol. 10,750,400

41,500

1D 1.10%

5D -5.03%

Buy Vol. 20,435,200

Sell Vol. 17,095,100

36,400

1D 6.28%

5D 1.68%

Buy Vol. 38,203,200

Sell Vol. 33,451,500

29,350

1D 4.45%

5D 0.17%

Buy Vol. 29,185,900

Sell Vol. 22,076,100

24,500

1D 4.03%

5D -5.41%

Buy Vol. 8,486,300

Sell Vol. 6,110,900

34,950

1D 1.30%

5D -3.45%

Buy Vol. 6,367,100

Sell Vol. 6,082,400

27,400

1D 2.24%

5D -0.36%

Buy Vol. 22,511,400

Sell Vol. 17,654,800

30,900

1D 1.31%

5D -2.37%

Buy Vol. 10,887,300

Sell Vol. 8,225,400

TPB: TPBank has set a target that by the end of 2022, it will reach total assets of VND 350,000 billion, an increase of 20% compared to the beginning of the year. Charter capital increased by 33% to VND 21,090 billion. Total deposits and outstanding loans increased by 12% and 18%, respectively, to VND292,579 billion and VND188,800 billion. Pre-tax profit in 2022 is expected to increase by 36% compared to 2021, reaching VND 8,200 billion.

REAL ESTATE

81,000

1D 1.12%

5D -1.22%

Buy Vol. 5,670,000

Sell Vol. 5,915,100

46,950

1D 2.07%

5D -6.29%

Buy Vol. 2,388,700

Sell Vol. 1,890,500

62,700

1D 1.13%

5D -0.40%

Buy Vol. 3,579,300

Sell Vol. 3,513,600

KDH: Report the results of the issue of shares to pay dividends with the expected number of shares to be issued 178.876,205 shares, the performance ratio is 36.3%

OIL & GAS

109,000

1D 4.31%

5D -4.30%

Buy Vol. 1,225,300

Sell Vol. 1,142,700

13,000

1D 4.42%

5D -3.70%

Buy Vol. 36,222,700

Sell Vol. 25,745,900

47,800

1D 2.58%

5D -6.27%

Buy Vol. 3,717,600

Sell Vol. 2,938,200

PLX: Announcement of the date of the 2022 Annual General Meeting of Shareholders, which is expected to be on June 8, 2022

VINGROUP

78,000

1D 2.36%

5D -1.02%

Buy Vol. 5,614,500

Sell Vol. 5,635,900

65,000

1D 3.17%

5D -5.66%

Buy Vol. 10,452,100

Sell Vol. 8,331,500

31,050

1D 6.88%

5D 0.65%

Buy Vol. 10,547,400

Sell Vol. 8,120,600

VRE: Notice that the last registration date to make interest payment for Term 07 of Bonds BONDVCR042025 is 12/05/2022

FOOD & BEVERAGE

75,900

1D 3.27%

5D -0.13%

Buy Vol. 6,187,900

Sell Vol. 5,701,700

116,000

1D 0.00%

5D -3.73%

Buy Vol. 3,055,600

Sell Vol. 3,485,100

169,000

1D 6.69%

5D 0.06%

Buy Vol. 786,700

Sell Vol. 716,200

VNM: 2022 revenue target is 64,070 billion dong and pre-tax profit plan is 12,000 billion dong, equivalent to 105% and 93% compared to 2021.

OTHERS

129,000

1D -1.53%

5D -9.85%

Buy Vol. 1,012,600

Sell Vol. 968,300

129,000

1D -1.53%

5D -9.85%

Buy Vol. 1,012,600

Sell Vol. 968,300

104,300

1D 0.87%

5D -6.88%

Buy Vol. 9,611,000

Sell Vol. 8,346,300

148,800

1D 2.69%

5D -4.62%

Buy Vol. 4,109,300

Sell Vol. 4,067,500

107,400

1D 0.37%

5D -9.67%

Buy Vol. 1,962,500

Sell Vol. 1,853,600

28,500

1D 3.83%

5D -18.57%

Buy Vol. 4,183,100

Sell Vol. 3,404,900

34,500

1D 2.83%

5D -1.43%

Buy Vol. 22,749,200

Sell Vol. 20,576,500

41,200

1D 1.10%

5D -4.85%

Buy Vol. 41,011,300

Sell Vol. 34,491,700

HPG: Hoa Phat Group achieved VND 44,400 billion in revenue in Q1/2022, up 41% over the same period. Profit after tax reached VND 8,200 billion, up 17% compared to the first quarter of 2021. Iron and steel production and steel products contribute 90% to the Group's overall results

Market by numbers

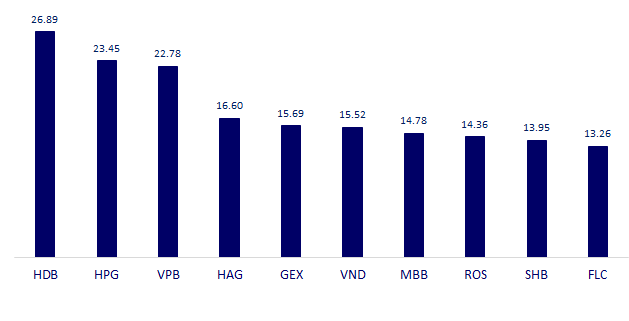

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

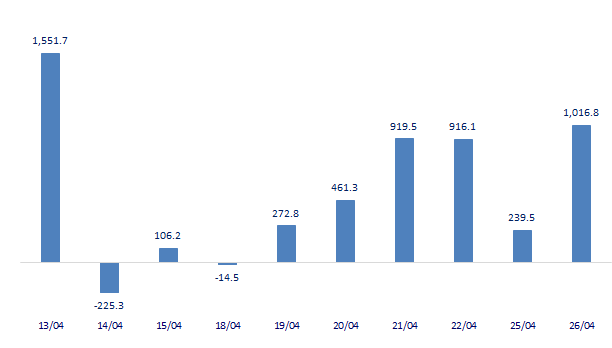

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

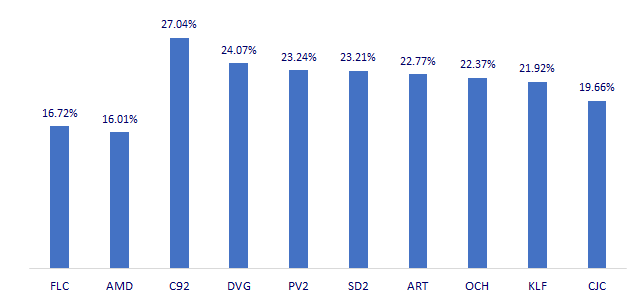

TOP INCREASES 3 CONSECUTIVE SESSIONS

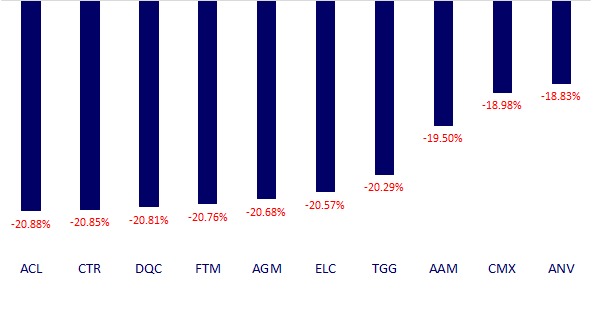

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.