Market brief 28/014/2022

VIETNAM STOCK MARKET

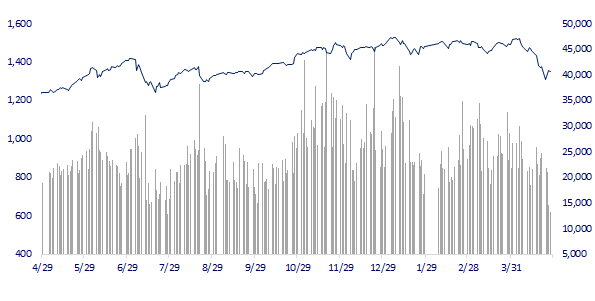

1,350.99

1D -0.21%

YTD -9.83%

1,400.88

1D -0.08%

YTD -8.78%

360.20

1D 0.87%

YTD -24.01%

102.69

1D 1.30%

YTD -8.87%

-309.22

1D 0.00%

YTD 0.00%

16,043.78

1D -7.51%

YTD -48.37%

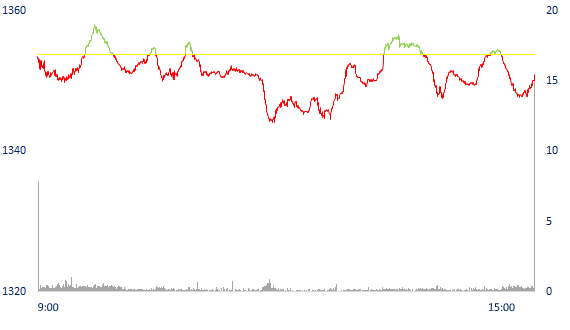

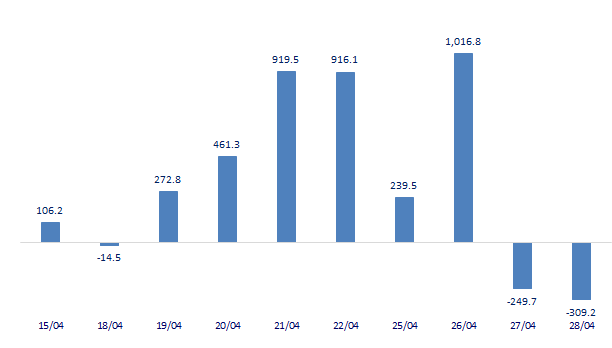

Session 28/04: Market liquidity decreased compared to the previous session and remained at a low level. The total matched value reached 13,976 billion dong, down 5.9%, of which, the matched value on HoSE alone decreased by 5.5% to 12,261 billion dong. Foreign investors today net sold more than 309 billion dong on the whole market.

ETF & DERIVATIVES

23,890

1D -0.46%

YTD -7.51%

16,310

1D -1.39%

YTD -9.84%

17,950

1D 0.79%

YTD -5.53%

21,270

1D 3.76%

YTD -7.12%

20,010

1D 0.05%

YTD -10.99%

28,400

1D 0.00%

YTD 1.25%

18,680

1D 0.38%

YTD -13.04%

1,392

1D -0.57%

YTD 0.00%

1,391

1D -0.72%

YTD 0.00%

1,395

1D -0.45%

YTD 0.00%

1,392

1D -0.64%

YTD 0.00%

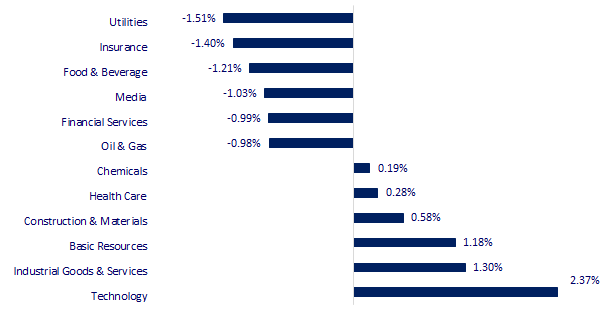

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

26,847.90

1D 1.16%

YTD -6.75%

2,975.48

1D 0.58%

YTD -18.25%

2,667.49

1D 1.08%

YTD -10.42%

20,276.17

1D 1.08%

YTD -13.34%

3,335.09

1D 0.43%

YTD 6.77%

1,667.74

1D 0.35%

YTD 0.61%

102.46

1D 1.00%

YTD 33.93%

1,888.03

1D 0.23%

YTD 3.69%

Asian stocks rallied on April 28, as investors watched the market reaction after Japan's latest monetary policy decision. The Shanghai Composite Index rose 0.58% to 2,975.48. In Hong Kong, the Hang Seng index rose 1.08% to 20,276.17 points.

VIETNAM ECONOMY

1.40%

1D (bps) -3

YTD (bps) 59

5.60%

2.38%

1D (bps) 2

YTD (bps) 137

3.00%

1D (bps) 6

YTD (bps) 100

23,170

1D (%) 0.29%

YTD (%) 1.00%

24,574

1D (%) -1.41%

YTD (%) -7.16%

3,542

1D (%) -0.67%

YTD (%) -3.17%

According to the latest information from the Ministry of Planning and Investment, as of April 20, the total newly registered capital, adjusted and contributed capital to buy shares, buy capital contributions of foreign investors in the past 4 months reached more than USD10.8b. In which, realized capital of FDI was estimated at USD5.92b, up 7.6% over the same period in 2021.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam attracted nearly 11 billion USD of FDI in the first 4 months of the year

- Savings deposits increase when interest rates go up

- The Government requires an early policy to support workers returning to work

- Global inflation continues to be high due to unresolved supply chain issues

- China is trying to prevent a stock market downturn

- USD and Russian ruble hit 2-year high, British pound hit 21-month low, Bitcoin plunges

VN30

BANK

81,500

1D 0.00%

5D 3.95%

Buy Vol. 1,234,900

Sell Vol. 1,255,900

36,700

1D -1.34%

5D -4.68%

Buy Vol. 1,576,600

Sell Vol. 2,066,900

28,200

1D -0.35%

5D -2.76%

Buy Vol. 4,507,400

Sell Vol. 4,827,300

42,300

1D 1.68%

5D -2.98%

Buy Vol. 8,649,900

Sell Vol. 7,915,400

36,500

1D 1.53%

5D 2.82%

Buy Vol. 21,553,900

Sell Vol. 23,736,200

29,450

1D -0.84%

5D -1.83%

Buy Vol. 10,329,000

Sell Vol. 12,557,600

25,200

1D 0.80%

5D 1.20%

Buy Vol. 4,346,900

Sell Vol. 5,001,500

33,600

1D -3.45%

5D -3.45%

Buy Vol. 3,276,600

Sell Vol. 3,097,700

27,700

1D -1.77%

5D 0.18%

Buy Vol. 10,328,300

Sell Vol. 16,469,200

31,000

1D 0.32%

5D -1.59%

Buy Vol. 3,483,800

Sell Vol. 2,565,700

MBB: In the first quarter of this year, the bank recorded a pre-tax profit of VND5,909 billion, up 29% over the same period in 2021. Many business segments of MB had high growth results. In which, Q1 net interest income reached VND8,385 billion, up 41% over the same period, mainly due to strong increase in loan interest income and interest income from debt securities investment. Profit from service activities of MB in Q1 increased 4.8% to 1,117 billion dong. Currently, revenue from insurance services makes the largest contribution to MB's service revenue.

REAL ESTATE

81,700

1D 0.49%

5D 2.00%

Buy Vol. 4,213,400

Sell Vol. 4,425,800

47,000

1D 0.00%

5D -2.08%

Buy Vol. 780,100

Sell Vol. 938,000

62,000

1D 0.00%

5D -2.21%

Buy Vol. 2,507,900

Sell Vol. 2,697,600

The report of the Ministry of Construction on the real estate market shows that, in Q1/2022, the average real estate transaction price of the whole market is always in an uptrend.

OIL & GAS

107,700

1D -2.97%

5D 2.57%

Buy Vol. 465,400

Sell Vol. 890,600

12,800

1D -1.16%

5D -3.76%

Buy Vol. 12,357,200

Sell Vol. 22,844,000

47,800

1D -1.04%

5D -4.97%

Buy Vol. 1,376,100

Sell Vol. 1,362,600

Oil prices increased slightly on April 27 when concerns about supply shortages have not been improved. Brent oil futures rose $0.33 to $105.32 a barrel.

VINGROUP

77,900

1D -0.13%

5D 0.52%

Buy Vol. 2,557,500

Sell Vol. 3,213,400

64,500

1D -0.77%

5D 0.78%

Buy Vol. 9,346,200

Sell Vol. 9,843,700

29,850

1D -2.13%

5D -2.13%

Buy Vol. 5,338,300

Sell Vol. 6,015,400

VRE: Q1/2022, VRE's profit after tax increased by 209.9% compared to Q4/2021, down by 51% QoQ. Investment property rental revenue reached VND 1,246 billion, up nearly 40% compared to Q4/2021.

FOOD & BEVERAGE

74,300

1D -0.93%

5D -0.93%

Buy Vol. 3,150,500

Sell Vol. 3,194,600

116,500

1D -2.10%

5D -5.28%

Buy Vol. 1,166,100

Sell Vol. 1,971,600

165,000

1D -2.37%

5D -2.77%

Buy Vol. 124,700

Sell Vol. 376,900

MSN: Q1/2022 consolidated net revenue reached VND 18,189 billion, down 8.9% compared to VND 19,977 billion in Q1/2021 due to the impact of the suspension of animal feed consolidation.

OTHERS

129,000

1D 0.00%

5D -5.49%

Buy Vol. 539,800

Sell Vol. 539,000

129,000

1D 0.00%

5D -5.49%

Buy Vol. 539,800

Sell Vol. 539,000

105,500

1D 2.43%

5D -5.80%

Buy Vol. 4,610,100

Sell Vol. 4,635,300

145,000

1D -1.49%

5D -6.75%

Buy Vol. 2,297,800

Sell Vol. 2,661,100

106,200

1D -0.75%

5D -10.76%

Buy Vol. 818,200

Sell Vol. 1,373,800

28,750

1D -1.20%

5D -5.74%

Buy Vol. 1,987,900

Sell Vol. 2,179,700

33,500

1D -2.62%

5D -7.07%

Buy Vol. 9,455,300

Sell Vol. 12,287,200

43,100

1D 1.41%

5D -0.58%

Buy Vol. 30,582,000

Sell Vol. 24,913,000

MWG: The orientation of businesses with Bach Hoa Xanh this year is not to open new stores and only open stores that have been planned in advance and have signed space lease contracts. Mr. Nguyen Duc Tai, Chairman of the Board of Directors of MWG, admitted that the service quality at Bach Hoa Xanh is not as good as the other two chains of MWG, namely The Gioi Di Dong and Dien May Xanh.

Market by numbers

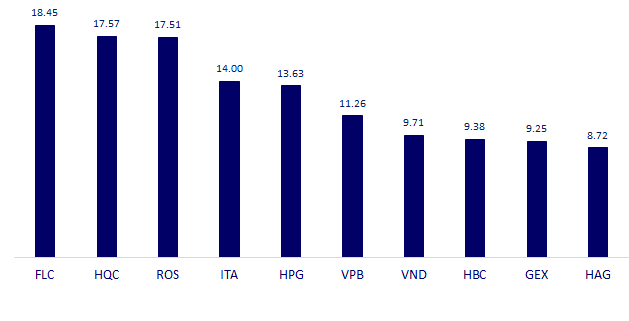

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

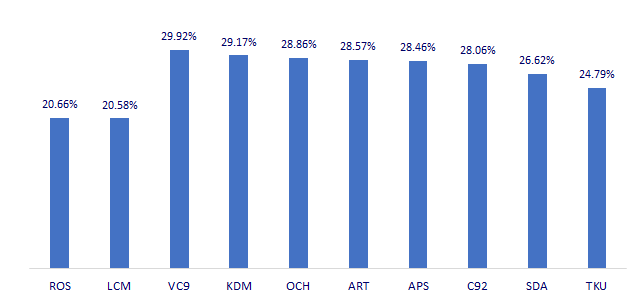

TOP INCREASES 3 CONSECUTIVE SESSIONS

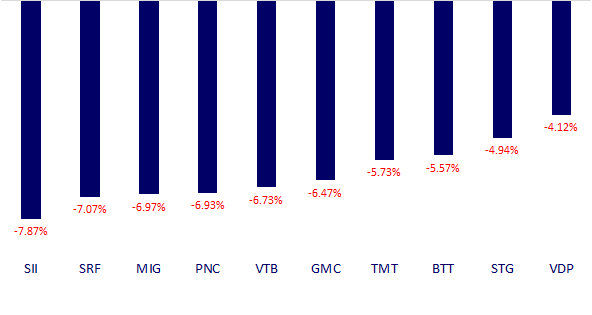

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.