Market brief 29/04/2022

VIETNAM STOCK MARKET

1,366.80

1D 1.17%

YTD -8.78%

1,417.31

1D 1.17%

YTD -7.71%

365.83

1D 1.56%

YTD -22.82%

104.31

1D 1.58%

YTD -7.43%

115.94

1D 0.00%

YTD 0.00%

21,479.41

1D 33.88%

YTD -30.87%

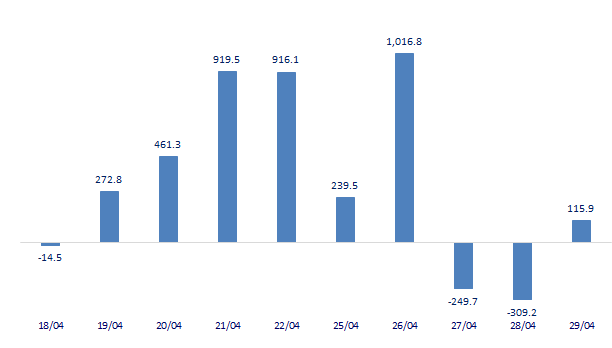

Foreign investors net bought back more than 116 billion dong in the last session of April. NLG was the biggest net buying by foreign investors on HoSE with 158 billion dong. After that, VCB was also net bought 147 billion dong. Meanwhile, VHM was sold the most with 186 billion dong. GEX and VIC were both net sold over 40 billion dong.

ETF & DERIVATIVES

23,960

1D 0.29%

YTD -7.24%

16,650

1D 2.08%

YTD -7.96%

18,780

1D 5.45%

YTD -1.16%

21,400

1D 0.61%

YTD -6.55%

19,800

1D -1.05%

YTD -11.92%

28,850

1D 1.58%

YTD 2.85%

18,640

1D -0.21%

YTD -13.22%

1,416

1D 1.72%

YTD 0.00%

1,405

1D 0.98%

YTD 0.00%

1,410

1D 1.07%

YTD 0.00%

1,409

1D 1.22%

YTD 0.00%

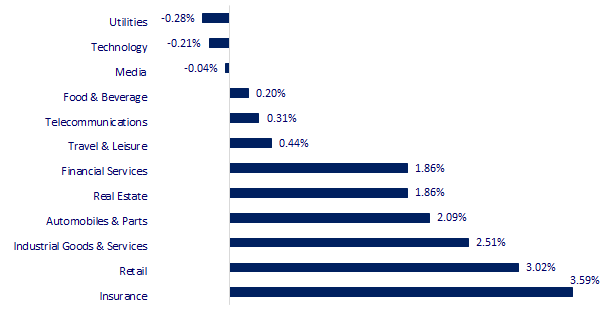

CHANGE IN PRICE BY SECTOR

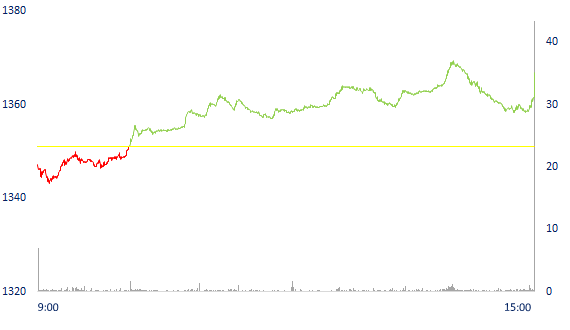

INTRADAY VNINDEX

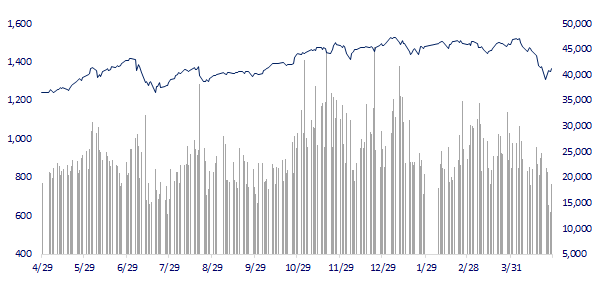

VNINDEX (12M)

GLOBAL MARKET

26,847.90

1D 0.00%

YTD -6.75%

3,047.06

1D 2.41%

YTD -16.28%

2,695.05

1D 1.03%

YTD -9.49%

21,089.39

1D 4.61%

YTD -9.87%

3,356.90

1D 0.65%

YTD 7.47%

1,667.44

1D -0.02%

YTD 0.59%

106.49

1D 1.58%

YTD 39.20%

1,917.00

1D 0.71%

YTD 5.28%

Asian stock markets all rallied in trading on April 29. Hong Kong's Hang Seng Index rose 4.61%, leading gains in the region's major stock markets. In China, the Shanghai Composite index gained 2.41%. South Korea's Kospi index gained 1.03%. The Japanese stock market is closed for a holiday today.

VIETNAM ECONOMY

1.37%

1D (bps) -3

YTD (bps) 56

5.60%

2.34%

1D (bps) -4

YTD (bps) 133

2.97%

1D (bps) -3

YTD (bps) 97

23,178

1D (%) 0.37%

YTD (%) 1.04%

24,692

1D (%) -0.76%

YTD (%) -6.71%

3,554

1D (%) 0.54%

YTD (%) -2.84%

On average, in the first 4 months of 2022, CPI increased by 2.1% over the same period last year, higher than the increase of 0.89% in the first 4 months of 2021, but lower than the increase of the first 4 months of 2017-2020; core inflation increased by 0.97%. In the 0.18% increase of CPI in April 2022 compared to the previous month, there were 8 groups of goods and services with an increase in price index and 3 groups of goods with a decrease in price index.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- In the first four months of 2022, Vietnam has a trade deficit of 18 billion USD from China

- CPI in the first 4 months of 2022 increased by 2.1% over the same period last year

- For the first time, the number of newly established businesses reached 15,000

- US GDP unexpectedly dropped by 1.4% in the first quarter of 2022

- Gas distributors in Europe are preparing to open a ruble account

- French economy in the first quarter did not grow

VN30

BANK

80,900

1D -0.74%

5D -1.58%

Buy Vol. 2,227,400

Sell Vol. 2,504,900

37,250

1D 1.50%

5D -3.25%

Buy Vol. 2,392,400

Sell Vol. 2,809,500

27,750

1D -1.60%

5D -5.61%

Buy Vol. 9,519,100

Sell Vol. 9,938,400

44,000

1D 4.02%

5D -0.23%

Buy Vol. 14,401,900

Sell Vol. 14,254,400

36,700

1D 0.55%

5D -0.27%

Buy Vol. 24,009,900

Sell Vol. 28,442,900

29,800

1D 1.19%

5D -0.67%

Buy Vol. 15,227,000

Sell Vol. 13,430,900

25,300

1D 0.40%

5D 0.60%

Buy Vol. 4,446,800

Sell Vol. 3,966,200

33,600

1D 0.00%

5D -4.55%

Buy Vol. 5,477,700

Sell Vol. 4,995,000

27,700

1D 0.00%

5D -3.82%

Buy Vol. 16,891,100

Sell Vol. 19,619,200

32,700

1D 5.48%

5D 1.24%

Buy Vol. 7,586,000

Sell Vol. 7,945,900

CTG: consolidated pre-tax profit reached VND5,822 billion, down 28% compared to the same period last year. The main reason was that the bank's net interest income decreased by 5%, to nearly 10,146 billion dong, along with the provision for credit risk was 3.3 times higher than the same period, to nearly 4,427 billion dong. By the end of the first quarter, the bank's total assets reached VND 1,663 billion, an increase of nearly 9% compared to the beginning of 2022. Outstanding loans to customers increased by 8.7%, reaching more than VND 1,220 billion and customer deposits increased. 4.4%, reaching more than 1,221 billion VND.

REAL ESTATE

82,000

1D 0.37%

5D 1.23%

Buy Vol. 4,342,200

Sell Vol. 5,560,900

47,900

1D 1.91%

5D -2.24%

Buy Vol. 2,817,100

Sell Vol. 4,953,300

62,100

1D 0.16%

5D -4.31%

Buy Vol. 2,505,500

Sell Vol. 2,628,600

PDR: The current total land bank is up to 5,804ha, which can meet development in the next 5-10 years. 2021 is the year PDR recorded a boom in land fund, 13 times higher than the previous year.

OIL & GAS

106,000

1D -1.58%

5D -5.61%

Buy Vol. 1,024,900

Sell Vol. 1,225,000

13,150

1D 2.73%

5D -1.50%

Buy Vol. 25,078,400

Sell Vol. 24,019,900

48,000

1D 0.42%

5D -4.19%

Buy Vol. 1,568,900

Sell Vol. 1,644,600

Ending Thursday's session, the Brent oil contract advanced 2.2% to 107.59 USD/barrel. WTI oil contract added 3.3% to 105.36 USD/barrel.

VINGROUP

80,000

1D 2.70%

5D 2.96%

Buy Vol. 3,335,000

Sell Vol. 3,457,800

65,000

1D 0.78%

5D 0.46%

Buy Vol. 9,504,600

Sell Vol. 9,589,000

30,900

1D 3.52%

5D 0.00%

Buy Vol. 6,856,600

Sell Vol. 6,143,900

VHM: Total consolidated net revenue reached VND8,923b, coming from the handover of real estate in three big projects Vinhomes Ocean Park, Vinhomes Smart City, Vinhomes Grand Park.

FOOD & BEVERAGE

74,200

1D -0.13%

5D -2.24%

Buy Vol. 2,644,500

Sell Vol. 3,236,200

116,000

1D -0.43%

5D -5.92%

Buy Vol. 1,662,200

Sell Vol. 1,853,100

162,100

1D -1.76%

5D -4.82%

Buy Vol. 319,300

Sell Vol. 421,500

MSN: Masan Group aims to open 30,000 Mini Mall stores nationwide by 2025, including 10,000 offline points and 20,000 franchise points.

OTHERS

129,900

1D 0.70%

5D -6.01%

Buy Vol. 777,200

Sell Vol. 665,400

129,900

1D 0.70%

5D -6.01%

Buy Vol. 777,200

Sell Vol. 665,400

105,000

1D -0.47%

5D -5.49%

Buy Vol. 8,257,500

Sell Vol. 6,411,600

149,200

1D 2.90%

5D -4.24%

Buy Vol. 3,284,100

Sell Vol. 3,291,900

108,000

1D 1.69%

5D -6.09%

Buy Vol. 857,100

Sell Vol. 1,121,500

28,850

1D 0.35%

5D -2.20%

Buy Vol. 3,565,300

Sell Vol. 2,800,700

33,550

1D 0.15%

5D -6.93%

Buy Vol. 16,135,000

Sell Vol. 17,950,500

43,300

1D 0.46%

5D -1.14%

Buy Vol. 22,924,400

Sell Vol. 22,163,200

GVR: just announced the first quarter consolidated financial statements with net profit increasing 29% to VND 1,055.1 billion. Net revenue was flat at 4,893.5 billion dong, of which rubber latex production and trading contributed 61.2%, equivalent to 2,995.4 billion dong. Cost of goods sold at 3,423.3 billion dong, unchanged from the same period last year. Gross profit increased by 5.3% to 1,470.2 billion dong. Gross profit margin increased from 28.8% to 30%.

Market by numbers

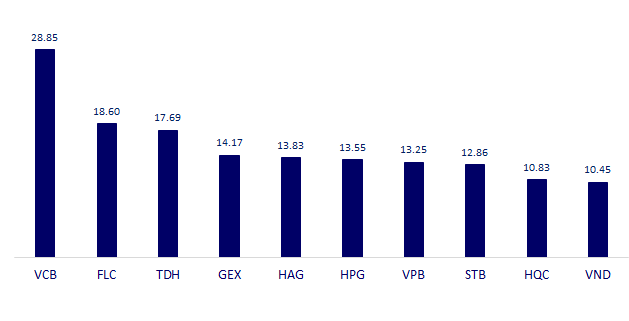

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

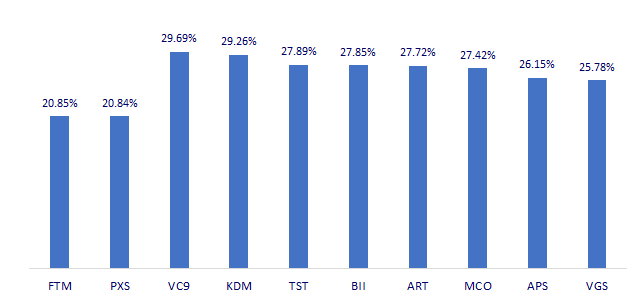

TOP INCREASES 3 CONSECUTIVE SESSIONS

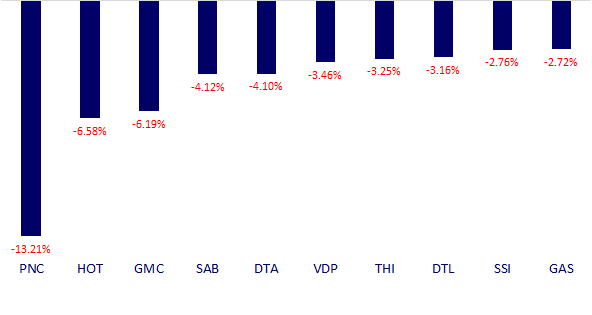

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.