Market brief 05/05/2022

VIETNAM STOCK MARKET

1,360.68

1D 0.89%

YTD -9.18%

1,404.88

1D 1.10%

YTD -8.52%

358.75

1D -0.62%

YTD -24.31%

103.82

1D -0.19%

YTD -7.86%

296.40

1D 0.00%

YTD 0.00%

17,799.18

1D 5.70%

YTD -42.72%

Foreign investors net bought back nearly 300 billion dong in session 5/5. NLG topped the list of foreign investors' net buying on HoSE with 155 billion dong. VHM and CTG were net bought 82 billion dong and 70 billion dong respectively. Meanwhile, VNM was sold the most with 36 billion dong. BCM and DGW were net sold 32 billion dong and 21 billion dong respectively.

ETF & DERIVATIVES

23,550

1D 0.21%

YTD -8.83%

16,500

1D 1.04%

YTD -8.79%

17,460

1D -1.97%

YTD -8.11%

21,750

1D 6.10%

YTD -5.02%

19,630

1D -4.24%

YTD -12.68%

28,600

1D 0.00%

YTD 1.96%

19,150

1D -0.31%

YTD -10.85%

1,398

1D 0.54%

YTD 0.00%

1,400

1D 1.09%

YTD 0.00%

1,399

1D 0.95%

YTD 0.00%

1,403

1D 1.41%

YTD 0.00%

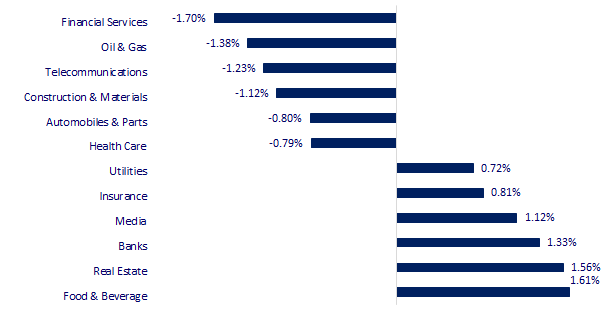

CHANGE IN PRICE BY SECTOR

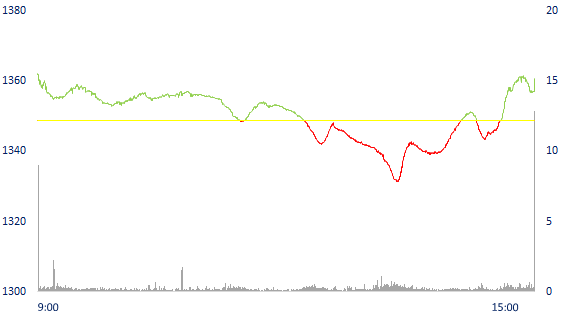

INTRADAY VNINDEX

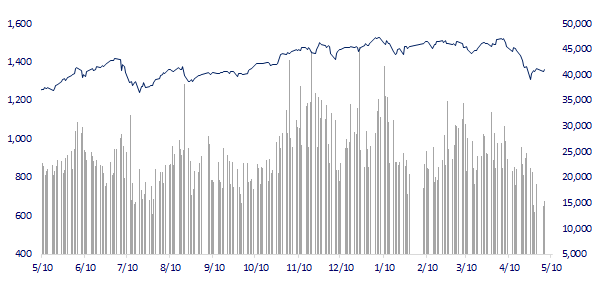

VNINDEX (12M)

GLOBAL MARKET

26,818.53

1D 0.00%

YTD -6.85%

3,067.76

1D 0.68%

YTD -15.72%

2,677.57

1D 0.00%

YTD -10.08%

20,793.40

1D -1.48%

YTD -11.13%

3,343.57

1D -0.17%

YTD 7.04%

1,643.30

1D -0.54%

YTD -0.86%

107.90

1D -0.27%

YTD 41.05%

1,895.57

1D -0.33%

YTD 4.11%

Asian stock markets were mixed at the beginning of the session 5/5. Last night, the US Federal Reserve (Fed) officially raised interest rates with the highest increase in two decades. Hong Kong's Hang Seng Index fell 1.48%. Chinese stocks reopened for trading after the holiday. The Shanghai composite index rose 0.68%. Markets in Japan and South Korea are closed for a holiday.

VIETNAM ECONOMY

1.56%

1D (bps) 19

YTD (bps) 75

5.60%

2.41%

1D (bps) 4

YTD (bps) 140

3.03%

1D (bps) 5

YTD (bps) 103

23,170

1D (%) 0.28%

YTD (%) 1.00%

24,772

1D (%) -1.33%

YTD (%) -6.41%

3,538

1D (%) -0.20%

YTD (%) -3.28%

Among 27 banks on the stock exchange, 17 banks have submitted plans to increase capital, with an additional amount of about $2.8 billion. The size of the bank's capital increased by about 20%, 30% and the highest 65%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam accounts for 15% of the total online shopping market in ASEAN

- The banking system will increase capital by nearly $2.8 billion this year

- More than 84,000 billion VND invested in 3 key highway projects

- EU targets Russia's global oil trade with shipping sanctions

- Iceland has biggest interest rate hike since 2008

- US trade deficit hits record high

VN30

BANK

81,000

1D 1.38%

5D -0.61%

Buy Vol. 1,535,200

Sell Vol. 1,922,600

38,200

1D 2.55%

5D 4.09%

Buy Vol. 2,968,700

Sell Vol. 2,838,100

27,900

1D 3.33%

5D -1.06%

Buy Vol. 7,677,700

Sell Vol. 6,926,400

42,600

1D 1.43%

5D 0.71%

Buy Vol. 9,658,500

Sell Vol. 9,537,500

35,550

1D -0.70%

5D -2.60%

Buy Vol. 16,701,700

Sell Vol. 20,780,700

29,000

1D 0.35%

5D -1.53%

Buy Vol. 11,282,200

Sell Vol. 11,372,300

25,150

1D 1.41%

5D -0.20%

Buy Vol. 3,475,200

Sell Vol. 3,578,500

34,200

1D 6.88%

5D 1.79%

Buy Vol. 11,482,600

Sell Vol. 9,990,800

26,900

1D 0.56%

5D -2.89%

Buy Vol. 19,653,200

Sell Vol. 20,460,700

31,700

1D -0.16%

5D 2.26%

Buy Vol. 4,674,600

Sell Vol. 5,018,700

STB: recorded a decrease in net interest income of nearly 9% QoQ, to VND 2,739 billion. The bank said that net interest income decreased due to an increase in outstanding loans, but lower lending rates QoQ and increased allocation of outstanding interest, so lending interest income decreased. Meanwhile, net profit from service activities increased by more than 83%, to VND 1,535 billion, profit from foreign exchange business also recorded an increase of nearly 44% to VND 298 billion. Other activities reported a sudden profit of more than 9 times over the same period, from 58 billion to 545 billion dong.

REAL ESTATE

81,200

1D 0.87%

5D -0.61%

Buy Vol. 3,397,400

Sell Vol. 3,962,000

46,100

1D -0.86%

5D -1.91%

Buy Vol. 1,219,900

Sell Vol. 1,260,200

61,500

1D 0.00%

5D -0.81%

Buy Vol. 2,874,300

Sell Vol. 3,103,600

NVL: Q1/2022 profit increased by 49% from handover of projects: NovaWorld Phan Thiet, NovaHills Mui Ne, NovaWorld Ho Tram, Soho Residence, Victoria Village, Aqua City and Saigon Royal.

OIL & GAS

109,400

1D 1.30%

5D 1.58%

Buy Vol. 669,700

Sell Vol. 1,071,400

14,150

1D 0.71%

5D 10.55%

Buy Vol. 26,766,600

Sell Vol. 28,609,700

47,600

1D -2.16%

5D -0.42%

Buy Vol. 2,437,300

Sell Vol. 2,700,300

POW: Q1/2022, PV Power earned VND803.5 billion in profit after tax, up 41.9% over the same period and exceeding 8.1% of the set profit target.

VINGROUP

80,000

1D 0.38%

5D 2.70%

Buy Vol. 3,028,000

Sell Vol. 4,105,200

68,800

1D 6.67%

5D 6.67%

Buy Vol. 10,769,200

Sell Vol. 11,148,100

30,300

1D 1.17%

5D 1.51%

Buy Vol. 3,855,200

Sell Vol. 4,618,300

VIC: VinFast sold a total of more than 6.7 thousand cars in the first quarter, of which VinFast Fadil continued to be the most popular model in March.

FOOD & BEVERAGE

72,100

1D -0.55%

5D -2.96%

Buy Vol. 2,857,200

Sell Vol. 2,870,400

119,000

1D 5.22%

5D 2.15%

Buy Vol. 1,324,000

Sell Vol. 1,495,300

169,400

1D 3.61%

5D 2.67%

Buy Vol. 251,000

Sell Vol. 354,000

VNM: Q1/2022, the domestic market recorded a net revenue of VND11,658b, up 4.3% over the same period. In which, domestic revenue of the parent company reached VND 10,234 billion, up 4%.

OTHERS

130,800

1D 0.38%

5D 1.40%

Buy Vol. 565,400

Sell Vol. 561,400

130,800

1D 0.38%

5D 1.40%

Buy Vol. 565,400

Sell Vol. 561,400

104,700

1D 0.19%

5D -0.76%

Buy Vol. 3,688,500

Sell Vol. 3,665,000

149,400

1D -0.07%

5D 3.03%

Buy Vol. 1,950,400

Sell Vol. 2,277,300

110,000

1D 1.57%

5D 3.58%

Buy Vol. 970,900

Sell Vol. 1,241,400

28,200

1D 0.53%

5D -1.91%

Buy Vol. 2,631,600

Sell Vol. 2,482,400

31,000

1D -3.13%

5D -7.46%

Buy Vol. 17,537,100

Sell Vol. 18,805,000

42,050

1D 0.12%

5D -2.44%

Buy Vol. 20,978,500

Sell Vol. 22,315,600

MWG: At the end of Q1/2022, MWG recorded an amount of cash and cash equivalents of about VND 3,259 billion, including 508 billion in cash and more than 2,650 billion in bank deposits (a strong increase of 35% compared to the beginning year 2022). With the above balance, the Company earned nearly VND 211 billion in deposit interest in the first quarter of 2022. In addition, MWG is also recording more than 190 billion dong of loan interest and deposit interest in short-term receivables.

Market by numbers

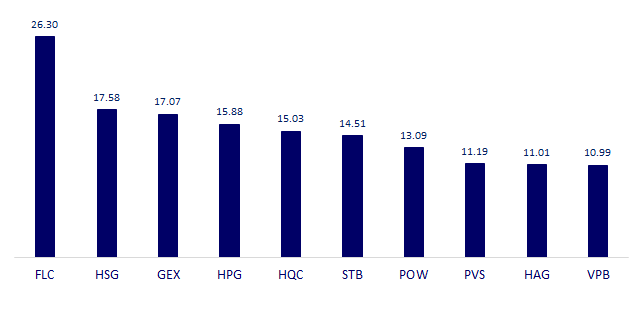

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

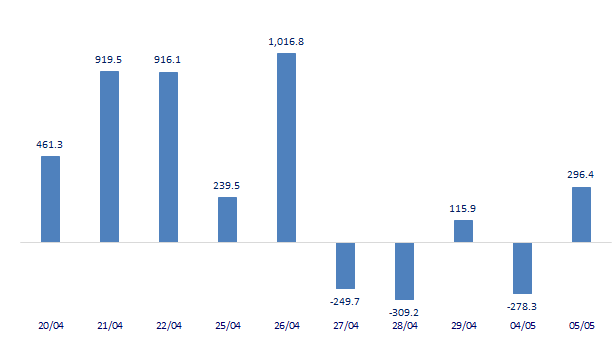

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

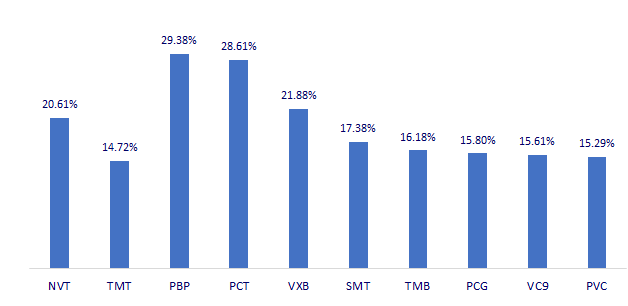

TOP INCREASES 3 CONSECUTIVE SESSIONS

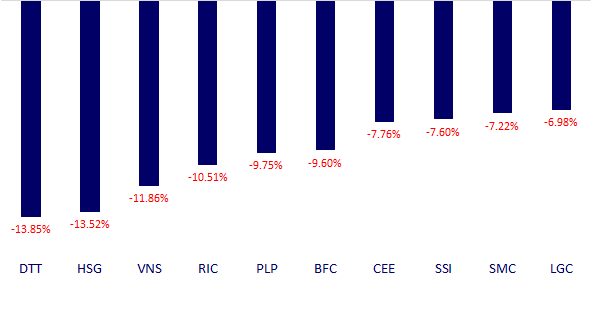

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.