Market brief 06/05/2022

VIETNAM STOCK MARKET

1,360.68

1D 0.89%

YTD -9.18%

1,404.88

1D 1.10%

YTD -8.52%

358.75

1D -0.62%

YTD -24.31%

103.82

1D -0.19%

YTD -7.86%

-64.92

1D 0.00%

YTD 0.00%

17,799.18

1D 5.70%

YTD -42.72%

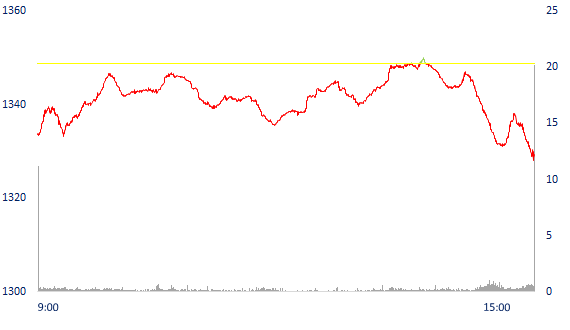

Many stocks were sold off, VN-Index dropped more than 31 points. Market liquidity is still very low. The total matched value reached 16,724 billion dong, up 2% compared to the previous session, of which, the matched value on HoSE alone increased by 2.5% to 14,792 billion dong. Foreign investors net sold about 65 billion dong.

ETF & DERIVATIVES

22,990

1D -2.38%

YTD -10.99%

16,160

1D -2.06%

YTD -10.67%

17,690

1D -0.67%

YTD -6.89%

20,270

1D -6.80%

YTD -11.48%

19,730

1D 0.51%

YTD -12.23%

28,080

1D -1.82%

YTD 0.11%

18,700

1D -2.35%

YTD -12.94%

1,360

1D -2.70%

YTD 0.00%

1,377

1D -1.61%

YTD 0.00%

1,361

1D -2.68%

YTD 0.00%

1,362

1D -2.89%

YTD 0.00%

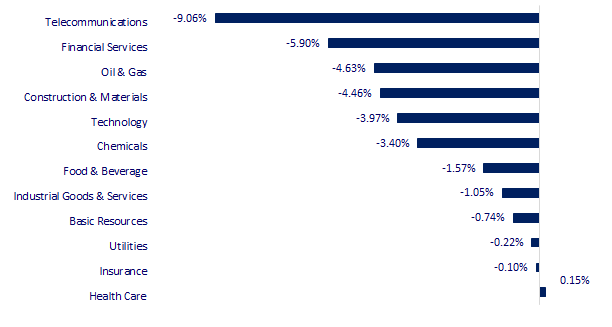

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

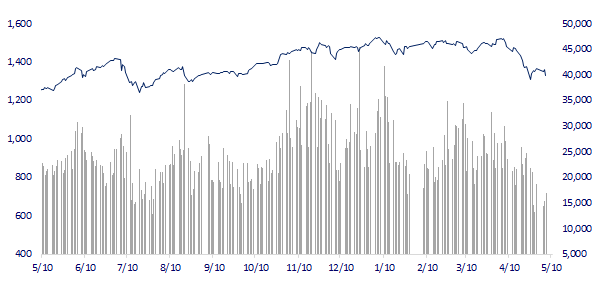

VNINDEX (12M)

GLOBAL MARKET

27,003.56

1D 0.94%

YTD -6.21%

3,001.56

1D -2.16%

YTD -17.53%

2,644.51

1D -1.23%

YTD -11.19%

20,001.96

1D -1.41%

YTD -14.51%

3,291.89

1D -1.55%

YTD 5.38%

1,629.58

1D -0.83%

YTD -1.69%

110.64

1D 2.30%

YTD 44.63%

1,883.13

1D 0.84%

YTD 3.42%

Asian stocks fell, Japan upstream. Hong Kong's Hang Seng Index fell 1.41% to 20,001.96 points. In China, the Shanghai Composite Index fell 2.16% to 3,001.56 points. South Korea's Kospi index fell 1.23% to 2,644.51 points.

VIETNAM ECONOMY

1.63%

1D (bps) 7

YTD (bps) 82

5.60%

2.47%

1D (bps) 6

YTD (bps) 146

2.99%

1D (bps) -4

YTD (bps) 99

23,175

1D (%) 0.37%

YTD (%) 1.02%

24,749

1D (%) -0.71%

YTD (%) -6.49%

3,510

1D (%) -0.23%

YTD (%) -4.05%

According to a report of the Ministry of Industry and Trade, the total retail sales of goods and service revenue in the past 4 months had a remarkable growth compared to the same period last year, goods were abundant, purchasing power tended to increase. Retail sales of goods in the first four months of the year increased by 7.6% over the same period last year and food and foodstuffs alone increased by 13.2% due to rising commodity prices.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The State Bank of Vietnam consults on amending regulations on refinancing of special bonds of VAMC

- Merchandise retail market has high growth again

- Pangasius exports skyrocket, seafood industry continues to be bountiful

- Fed creates volatility in financial markets: 3 consequences of tightening financial conditions

- Market is concerned about supply, oil prices rise

- Simultaneously raising interest rates, it is BoE's turn to raise it to a 13-year high

VN30

BANK

79,400

1D -1.98%

5D -1.85%

Buy Vol. 1,182,500

Sell Vol. 1,472,300

37,000

1D -3.14%

5D -0.67%

Buy Vol. 2,716,100

Sell Vol. 2,675,800

27,000

1D -3.23%

5D -2.70%

Buy Vol. 3,934,200

Sell Vol. 4,654,500

41,500

1D -2.58%

5D -5.68%

Buy Vol. 8,675,300

Sell Vol. 7,515,500

34,150

1D -3.94%

5D -6.95%

Buy Vol. 22,256,500

Sell Vol. 20,416,100

28,000

1D -3.45%

5D -6.04%

Buy Vol. 14,588,700

Sell Vol. 13,401,500

24,050

1D -4.37%

5D -4.94%

Buy Vol. 4,094,200

Sell Vol. 3,732,700

33,600

1D -1.75%

5D 0.00%

Buy Vol. 3,111,000

Sell Vol. 5,161,200

25,500

1D -5.20%

5D -7.94%

Buy Vol. 21,774,200

Sell Vol. 25,533,500

31,000

1D -2.21%

5D -5.20%

Buy Vol. 4,397,000

Sell Vol. 3,326,700

CTG: Q1/2022, net interest income decreased by 4.7% y/y, to VND10,145 billion. Net profit from service activities decreased by 0.4% to 1,278.1 billion dong. Trading securities posted a profit of 56.4 billion dong, down 68%, while investment securities trading lost 232.8 billion dong (the same period lost 110.2 billion dong). Foreign exchange activities recorded a profit increase of 1.3 times, to VND 783.6 billion, profit from other activities increased 4.2 times, to VND 1,877.5 billion.

REAL ESTATE

80,800

1D -0.49%

5D -1.46%

Buy Vol. 4,447,500

Sell Vol. 4,953,000

46,100

1D 0.00%

5D -3.76%

Buy Vol. 1,675,900

Sell Vol. 1,891,300

61,000

1D -0.81%

5D -1.77%

Buy Vol. 2,247,700

Sell Vol. 2,374,500

NVL: From May 11 to June 9, Nova Group JSC, registered to receive 106.65 million shares of NVL, raising its holdings to 637.17 million shares, accounting for 32.17% of the capital.

OIL & GAS

109,800

1D 0.37%

5D 3.58%

Buy Vol. 1,060,700

Sell Vol. 1,300,300

13,900

1D -1.77%

5D 5.70%

Buy Vol. 28,703,100

Sell Vol. 26,117,100

45,800

1D -3.78%

5D -4.58%

Buy Vol. 1,699,600

Sell Vol. 1,984,800

PLX: Q1/2022 with net revenue of VND67,020b, up 75%. COGS increased more than 84%, so gross profit decreased by 18.2% to 2,777b dong. Gross profit margin decreased from 8.87% to 4.14%.

VINGROUP

79,800

1D -0.25%

5D -0.25%

Buy Vol. 2,756,800

Sell Vol. 3,535,200

68,700

1D -0.15%

5D 5.69%

Buy Vol. 8,070,100

Sell Vol. 9,658,300

29,600

1D -2.31%

5D -4.21%

Buy Vol. 8,997,500

Sell Vol. 10,052,600

VIC: At the end of Q1, loans and finance lease liabilities were VND30,199b; loans and long-term lease debt 109,349b dong, an increase of 7,300b dong.

FOOD & BEVERAGE

70,200

1D -2.64%

5D -5.39%

Buy Vol. 3,927,600

Sell Vol. 3,572,000

117,000

1D -1.68%

5D 0.86%

Buy Vol. 1,606,700

Sell Vol. 1,466,300

167,500

1D -1.12%

5D 3.33%

Buy Vol. 295,500

Sell Vol. 330,400

SAB: Regarding the increase in product prices this year, SAB leaders said that there are many reasons such as competition, raw material prices, and a more premium product portfolio.

OTHERS

128,000

1D -2.14%

5D -1.46%

Buy Vol. 520,000

Sell Vol. 610,500

128,000

1D -2.14%

5D -1.46%

Buy Vol. 520,000

Sell Vol. 610,500

100,200

1D -4.30%

5D -4.57%

Buy Vol. 3,863,800

Sell Vol. 3,866,500

146,600

1D -1.87%

5D -1.74%

Buy Vol. 2,096,600

Sell Vol. 1,888,400

106,500

1D -3.18%

5D -1.39%

Buy Vol. 1,221,600

Sell Vol. 1,192,600

26,800

1D -4.96%

5D -7.11%

Buy Vol. 2,116,600

Sell Vol. 2,276,900

28,850

1D -6.94%

5D -14.01%

Buy Vol. 22,244,700

Sell Vol. 27,990,700

41,800

1D -0.59%

5D -3.46%

Buy Vol. 26,795,200

Sell Vol. 25,957,800

VJC: In Q1/2022, net revenue has shown signs of increasing 12% to 4,522b dong. However, COGS is still a burden for Vietjet when accounting for 4,779b dong, causing the company to continue to sink into a gross loss of 256b dong. (lower than the gross loss of the same period of 1,013b dong). Thanks to financial activities, which continued to contribute positively, VND 1,156b, although still down 17% over the same period.

Market by numbers

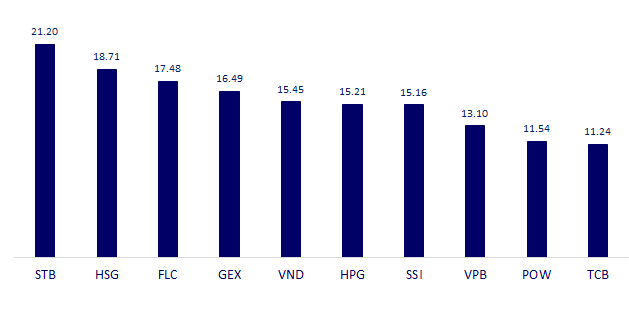

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

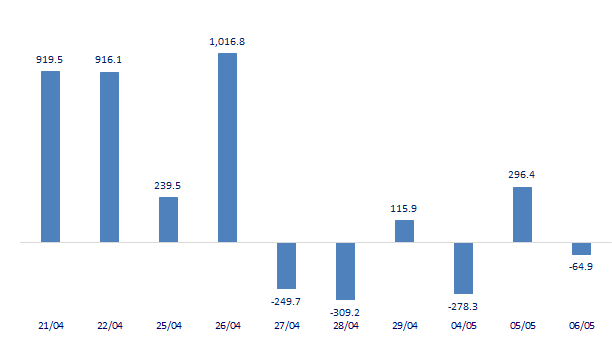

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

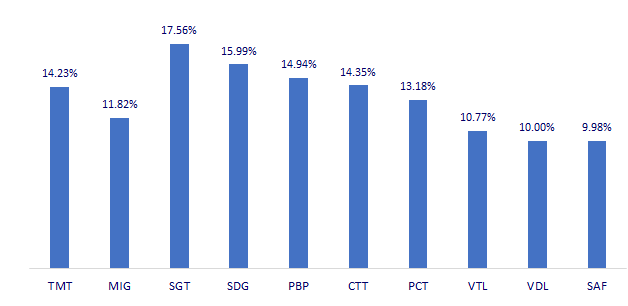

TOP INCREASES 3 CONSECUTIVE SESSIONS

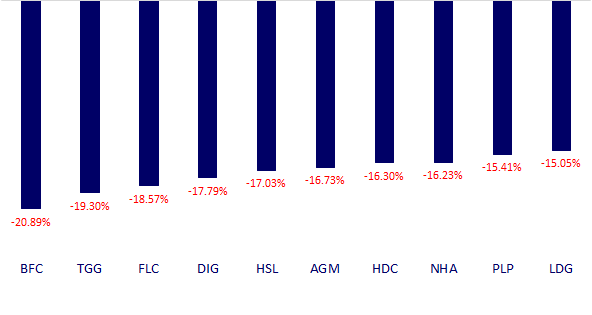

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.