Market brief 09/05/2022

VIETNAM STOCK MARKET

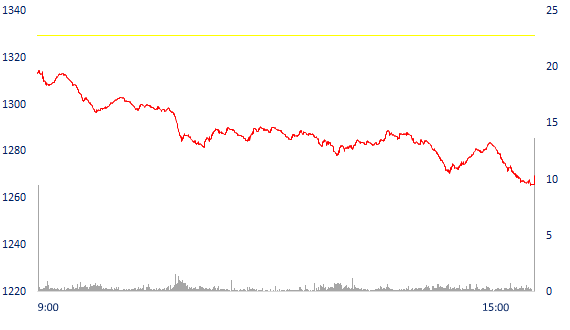

1,269.62

1D -4.49%

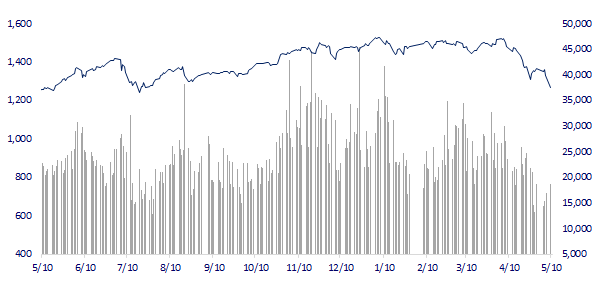

YTD -15.26%

1,314.04

1D -4.31%

YTD -14.43%

323.39

1D -5.84%

YTD -31.77%

96.50

1D -5.28%

YTD -14.36%

588.83

1D 0.00%

YTD 0.00%

21,743.47

1D 12.89%

YTD -30.02%

Domestic individual investors continued to be net buyers of 835 billion dong on HoSE in the trading week of May 4-6 and in terms of order matching, this capital flow was net buying 1,021 billion dong. They were the strongest net buyers of DIG with 315 billion dong. After that, STB was also net bought nearly 288 billion dong. Stocks including NVL, KDH, TCB and VNM were all net bought over 100 billion dong.

ETF & DERIVATIVES

22,000

1D -4.31%

YTD -14.83%

15,330

1D -5.14%

YTD -15.26%

18,440

1D 3.54%

YTD -2.95%

19,000

1D -6.27%

YTD -17.03%

19,000

1D -3.70%

YTD -15.48%

26,300

1D -6.34%

YTD -6.24%

18,400

1D -1.60%

YTD -14.34%

1,306

1D -3.98%

YTD 0.00%

1,303

1D -5.36%

YTD 0.00%

1,310

1D -3.74%

YTD 0.00%

1,308

1D -3.96%

YTD 0.00%

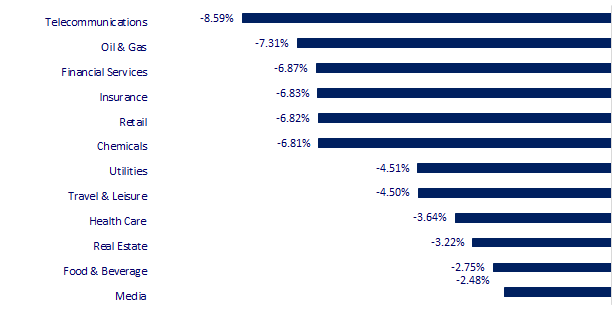

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

26,319.34

1D -2.53%

YTD -8.59%

3,004.14

1D 0.09%

YTD -17.46%

2,610.81

1D -1.27%

YTD -12.32%

20,001.96

1D 0.00%

YTD -14.51%

3,275.07

1D -0.51%

YTD 4.85%

1,604.49

1D -1.54%

YTD -3.21%

106.83

1D -3.44%

YTD 39.65%

1,859.03

1D -1.28%

YTD 2.10%

Asian markets mixed, investors awaited China trade data for April. In Japan, the Nikkei 225 index fell 2.53%, partly due to Fast Retailing's share price falling more than 5%. In mainland China, the market showed signs of improvement after falling at the beginning of the session. The Shanghai Composite Index rose 0.09%.

VIETNAM ECONOMY

1.70%

1D (bps) 7

YTD (bps) 89

5.60%

2.41%

1D (bps) -6

YTD (bps) 140

2.99%

YTD (bps) 99

23,170

1D (%) -0.02%

YTD (%) 1.00%

1D (%) -

YTD (%) -

3,481

1D (%) -0.83%

YTD (%) -4.84%

According to a report by the Ministry of Planning and Investment, this year's estimated state budget payment until April 30 is more than 95,724 billion VND, reaching nearly 18.5% of the plan assigned by the Prime Minister for the whole year, approximately the same period last year (reaching nearly 18.7%). According to the Ministry of Planning and Investment, there are 17 ministries and central agencies that have not yet disbursed capital plans in the first 4 months of the year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Proposal to extend VND 20,000 billion of special consumption tax on domestically produced cars

- Disbursement of public investment capital in 4 months is estimated at 18.5% of the year plan

- The supply of gasoline and oil in the second quarter is expected to be 1.5 million m3 in excess

- G7 agrees to increase economic pressure on Russia

- China: Export growth slowest in 2 years

- Europe accepts to buy natural gas at exceptionally high prices

VN30

BANK

77,900

1D -1.89%

5D -3.71%

Buy Vol. 2,183,500

Sell Vol. 2,730,100

34,450

1D -6.89%

5D -7.52%

Buy Vol. 3,238,000

Sell Vol. 3,722,700

25,150

1D -6.85%

5D -9.37%

Buy Vol. 7,667,400

Sell Vol. 9,757,200

38,600

1D -6.99%

5D -12.27%

Buy Vol. 15,534,200

Sell Vol. 16,955,000

31,800

1D -6.88%

5D -13.35%

Buy Vol. 29,890,900

Sell Vol. 37,710,700

26,200

1D -6.43%

5D -12.08%

Buy Vol. 24,831,300

Sell Vol. 23,092,900

23,000

1D -4.37%

5D -9.09%

Buy Vol. 5,622,300

Sell Vol. 6,962,000

31,600

1D -5.95%

5D -5.95%

Buy Vol. 3,509,300

Sell Vol. 3,963,100

23,750

1D -6.86%

5D -14.26%

Buy Vol. 27,672,400

Sell Vol. 42,576,200

30,600

1D -1.29%

5D -6.42%

Buy Vol. 7,001,200

Sell Vol. 7,835,600

By the end of the first quarter, BIDV still held the top position of the bank attracting the most customer deposits with more than 1.39 million billion of customer deposits. The runner-up is VietinBank with more than 1.21 million billion. The third place belongs to Vietcombank when attracting more than 1.18 million billion from customers. In fourth place is SCB, holding 559 trillion in customer deposits. Following is Sacombank with 458 trillion. MB ranks in the top 6 with customer deposits of 390 trillion. ACB followed with 386 trillion in deposits.

REAL ESTATE

78,500

1D -2.85%

5D -4.27%

Buy Vol. 4,035,300

Sell Vol. 5,678,400

42,900

1D -6.94%

5D -10.44%

Buy Vol. 1,329,500

Sell Vol. 1,902,900

59,300

1D -2.79%

5D -4.51%

Buy Vol. 2,531,900

Sell Vol. 2,992,500

PDR: cooperates with leading names such as Centara Hotels & Resorts, GSA, Meinhardt, ACONS, Red Design to develop the Ngo May beach resort real estate complex in Quy Nhon.

OIL & GAS

104,900

1D -4.46%

5D -1.04%

Buy Vol. 929,700

Sell Vol. 1,196,500

12,950

1D -6.83%

5D -1.52%

Buy Vol. 21,730,500

Sell Vol. 31,831,200

42,600

1D -6.99%

5D -11.25%

Buy Vol. 3,118,100

Sell Vol. 3,970,600

GAS: In the first 4 months of 2022, total revenue is estimated at 37,460 billion VND, profit before tax is 5,696 billion VND, profit after tax is 4,544 billion VND; exceeded the plan by 41 - 87%.

VINGROUP

79,100

1D -0.88%

5D -1.13%

Buy Vol. 3,160,800

Sell Vol. 4,627,200

68,000

1D -1.02%

5D 4.62%

Buy Vol. 7,450,700

Sell Vol. 9,195,400

28,200

1D -4.73%

5D -8.74%

Buy Vol. 9,494,700

Sell Vol. 10,676,500

VIC: At the end of Q1, loans and finance lease liabilities were VND30,199b; loans and long-term lease debt 109,349b dong, an increase of 7,300b dong.

FOOD & BEVERAGE

70,000

1D -0.28%

5D -5.66%

Buy Vol. 3,824,900

Sell Vol. 4,116,500

114,900

1D -1.79%

5D -0.95%

Buy Vol. 1,587,700

Sell Vol. 2,010,300

160,100

1D -4.42%

5D -1.23%

Buy Vol. 318,600

Sell Vol. 333,800

VNM: was in the top stocks that were bought the most by foreign investors in the last trading week with a value of more than 100 billion dong.

OTHERS

124,000

1D -3.13%

5D -4.54%

Buy Vol. 684,500

Sell Vol. 951,800

124,000

1D -3.13%

5D -4.54%

Buy Vol. 684,500

Sell Vol. 951,800

94,000

1D -6.19%

5D -10.48%

Buy Vol. 6,872,700

Sell Vol. 6,900,600

136,400

1D -6.96%

5D -8.58%

Buy Vol. 3,482,200

Sell Vol. 4,046,400

99,100

1D -6.95%

5D -8.24%

Buy Vol. 1,445,700

Sell Vol. 2,194,900

24,950

1D -6.90%

5D -13.52%

Buy Vol. 2,700,200

Sell Vol. 4,847,300

26,850

1D -6.93%

5D -19.97%

Buy Vol. 27,416,700

Sell Vol. 33,959,700

39,950

1D -4.43%

5D -7.74%

Buy Vol. 36,534,000

Sell Vol. 39,592,200

MWG: recorded a record revenue of VND 36,467 billion in Q1, up 18% QoQ. Profit after tax is 1,445 billion dong, up 8% and is the second highest in the history of operation. The 3 chains The Gioi Di Dong, Dien May Xanh and Topzone alone contributed VND 30,000 billion, up 21% over the same period last year. Bach Hoa Xanh chain achieved VND 6,040 billion in revenue, up 2% compared to the first quarter of 2021; An Khang pharmacy chain recorded 3.7 times more sales than the same period last year.

Market by numbers

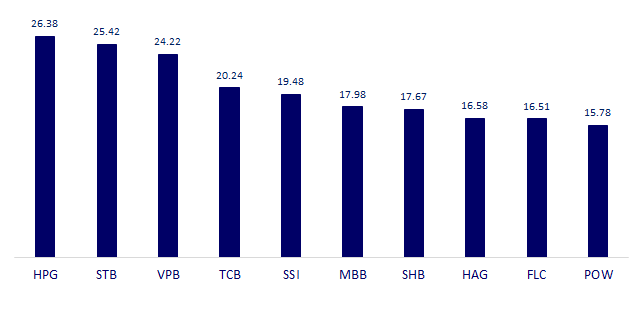

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

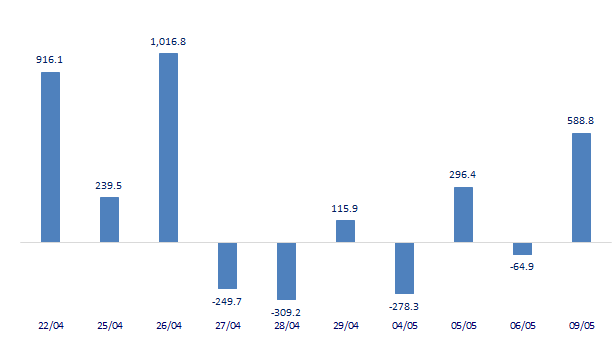

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

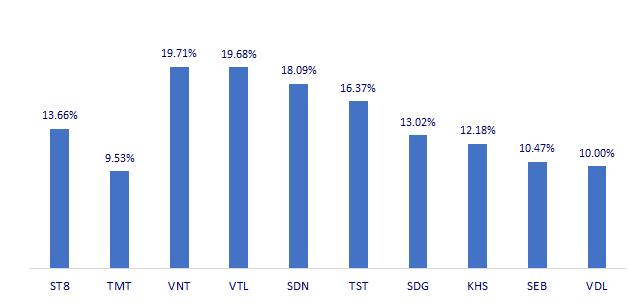

TOP INCREASES 3 CONSECUTIVE SESSIONS

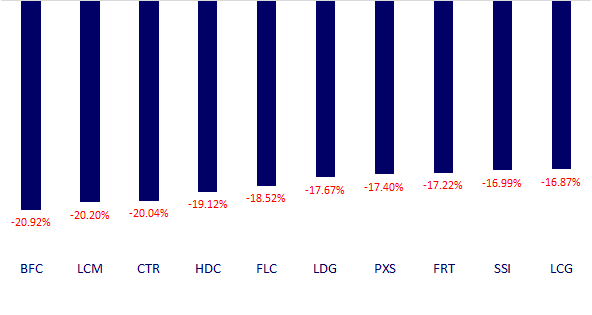

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.