Market brief 16/05/2022

VIETNAM STOCK MARKET

1,171.95

1D -0.91%

YTD -21.78%

1,215.08

1D -0.71%

YTD -20.88%

307.05

1D 1.54%

YTD -35.22%

93.20

1D -0.44%

YTD -17.29%

224.76

1D 0.00%

YTD 0.00%

16,750.38

1D -28.34%

YTD -46.09%

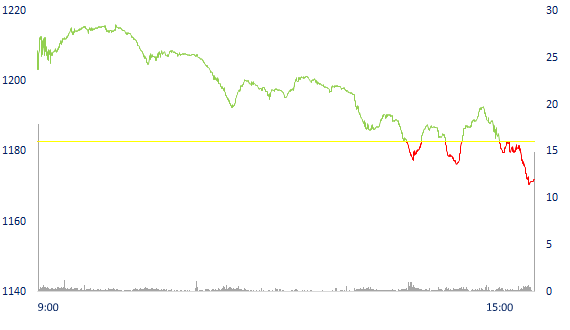

Selling pressure increased strongly, VN-Index dropped by nearly 11 points. Market liquidity dropped sharply compared to the previous session. The total matched value reached 15,548 billion dong, down 26%, of which, the matched value on HoSE alone decreased by 25% to 13,754 billion dong. Foreign investors net bought 224 billion dong.

ETF & DERIVATIVES

20,700

1D -3.72%

YTD -19.86%

14,240

1D -0.97%

YTD -21.28%

15,680

1D -11.96%

YTD -17.47%

17,000

1D -2.86%

YTD -25.76%

16,450

1D -6.90%

YTD -26.82%

24,500

1D -3.88%

YTD -12.66%

17,410

1D -4.34%

YTD -18.95%

1,221

1D -0.81%

YTD 0.00%

1,220

1D -0.49%

YTD 0.00%

1,219

1D -0.54%

YTD 0.00%

1,212

1D -1.06%

YTD 0.00%

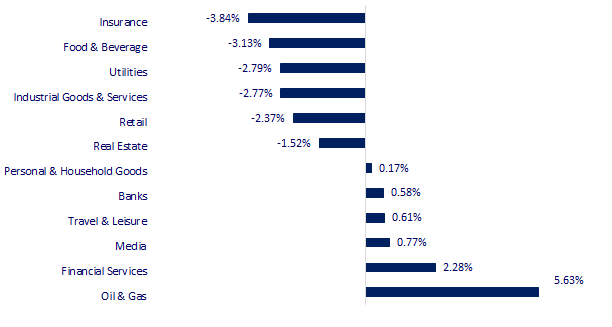

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

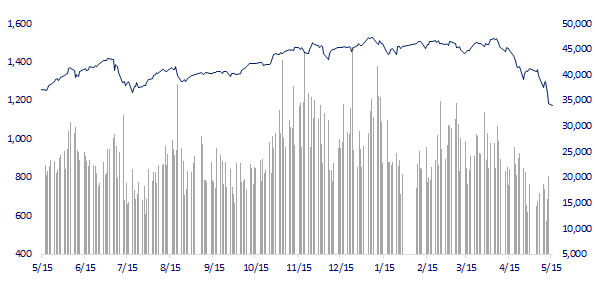

VNINDEX (12M)

GLOBAL MARKET

26,547.05

1D -0.67%

YTD -7.80%

3,073.75

1D -0.34%

YTD -15.55%

2,596.58

1D -0.29%

YTD -12.80%

19,950.21

1D -0.67%

YTD -14.73%

3,191.16

1D 0.00%

YTD 2.16%

1,584.38

1D 0.00%

YTD -4.42%

108.00

1D -0.03%

YTD 41.18%

1,802.20

1D -0.66%

YTD -1.02%

Asian stocks fell, China economic data disappointing. In China, the Shanghai Composite Index fell 0.34% to 3,073.75. In Hong Kong, the Hang Seng index continuously struggled in the first session of the week. This index gained at the beginning of the session but suddenly dropped after China released not-so-positive economic information. At the close, the index dropped, 0.67%, to 19,950.21 points.

VIETNAM ECONOMY

2.05%

1D (bps) 5

YTD (bps) 124

5.60%

2.58%

1D (bps) 2

YTD (bps) 157

3.12%

YTD (bps) 112

23,315

1D (%) 0.34%

YTD (%) 1.63%

23,315

1D (%) -5.91%

YTD (%) -11.91%

3,471

1D (%) -0.03%

YTD (%) -5.11%

The central coastal region is expected to be prioritized to attract concentrated steel enterprises, followed by the Red River Delta. The use of technology in investment and steel production activities in the coming time must be new, energy-saving and high-yield technology and equipment.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Priority is given to concentrated development of the steel industry in the Central Coast region

- Many large global financial funds are ready to participate in the energy transition in Vietnam

- 14 million Vietnamese have passports for Covid-19 vaccine

- China: Many economic indicators drop due to the impact of zero Covid

- IEA: Renewable energy will hit a new record in 2022

- US, Europe race to improve food supply chains after India bans wheat exports

VN30

BANK

74,200

1D 1.64%

5D -4.75%

Buy Vol. 2,877,800

Sell Vol. 2,346,000

32,200

1D 1.26%

5D -6.53%

Buy Vol. 2,356,500

Sell Vol. 1,930,100

24,550

1D 2.72%

5D -2.39%

Buy Vol. 8,497,300

Sell Vol. 8,102,000

32,600

1D -3.55%

5D -15.54%

Buy Vol. 16,611,300

Sell Vol. 18,813,600

29,000

1D 0.00%

5D -8.81%

Buy Vol. 17,695,500

Sell Vol. 19,733,900

24,600

1D 2.07%

5D -6.11%

Buy Vol. 11,750,300

Sell Vol. 11,142,700

22,500

1D 1.35%

5D -2.17%

Buy Vol. 5,340,800

Sell Vol. 3,899,100

31,000

1D 3.33%

5D -1.90%

Buy Vol. 3,206,000

Sell Vol. 5,468,000

19,050

1D -6.85%

5D -19.79%

Buy Vol. 54,633,100

Sell Vol. 54,890,900

27,600

1D 0.36%

5D -9.80%

Buy Vol. 8,346,400

Sell Vol. 8,193,800

VPB: In terms of bad debt/loan balance, 11/26 banks reported a decrease compared to the beginning of the year. VPBank (VPB) remained at the top of the table with the ratio of bad debt to consolidated loan balance increasing from 4.57% at the beginning of the year to 4.83%. On the parent bank only, the ratio of bad debt to outstanding loans also increased from 2.01% at the beginning of the year to 2.27%.

REAL ESTATE

75,000

1D 0.00%

5D -4.46%

Buy Vol. 3,123,800

Sell Vol. 3,209,200

39,300

1D 0.00%

5D -8.39%

Buy Vol. 1,310,700

Sell Vol. 1,607,200

54,600

1D 1.87%

5D -7.93%

Buy Vol. 2,559,100

Sell Vol. 2,508,700

KDH: From April 13 to May 12, the Vietnam Market Access Stock Investment Fund bought and matched 115,000 KDH shares, raising the holding rate to 0.18%, equivalent to 1.13 million shares.

OIL & GAS

95,000

1D -5.00%

5D -9.44%

Buy Vol. 1,566,800

Sell Vol. 1,625,300

11,600

1D 1.31%

5D -10.42%

Buy Vol. 18,480,500

Sell Vol. 16,062,200

39,100

1D 4.69%

5D -8.22%

Buy Vol. 3,204,600

Sell Vol. 2,020,400

GAS: PV Gas and AES Corporation received the investment certificate and business registration of the Son My LNG terminal project

VINGROUP

77,000

1D -1.28%

5D -2.65%

Buy Vol. 2,910,600

Sell Vol. 4,194,800

65,800

1D -3.24%

5D -3.24%

Buy Vol. 6,877,100

Sell Vol. 10,143,300

26,250

1D 3.75%

5D -6.91%

Buy Vol. 7,893,100

Sell Vol. 6,043,600

VIC: Accumulated from August 23, 2018 to December 31, 2021, Vingroup allocated 7,180 billion VND for Belt 2. The project has a total investment of 9,459 billion VND, started in April 2018.

FOOD & BEVERAGE

65,800

1D -0.45%

5D -6.00%

Buy Vol. 3,196,200

Sell Vol. 3,620,700

90,200

1D -6.91%

5D -21.50%

Buy Vol. 1,555,900

Sell Vol. 1,727,500

157,800

1D -3.01%

5D -1.44%

Buy Vol. 177,000

Sell Vol. 239,700

MSN: Masan currently has a great brand advantage when there are 12 product brands that are ranked No. 1 in different consumer goods industries.

OTHERS

126,000

1D 0.08%

5D 1.61%

Buy Vol. 755,700

Sell Vol. 813,500

126,000

1D 0.08%

5D 1.61%

Buy Vol. 755,700

Sell Vol. 813,500

93,200

1D -0.43%

5D -0.85%

Buy Vol. 2,795,700

Sell Vol. 3,452,000

123,000

1D -1.68%

5D -9.82%

Buy Vol. 2,019,000

Sell Vol. 2,395,900

98,000

1D 0.51%

5D -1.11%

Buy Vol. 775,100

Sell Vol. 543,400

21,850

1D 2.58%

5D -12.42%

Buy Vol. 4,443,200

Sell Vol. 2,955,200

27,300

1D 5.81%

5D 1.68%

Buy Vol. 34,024,400

Sell Vol. 21,231,900

36,300

1D 1.11%

5D -9.14%

Buy Vol. 39,928,900

Sell Vol. 46,858,200

VJC: MOVI company in cooperation with Vietjet has officially launched an expanded version of the product "Fly first - Pay later" applicable to all customers. This program is developed with the aim of helping customers who want to fly can experience this activity without paying in advance.

Market by numbers

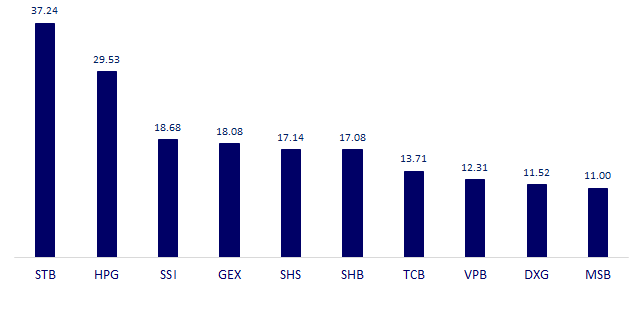

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

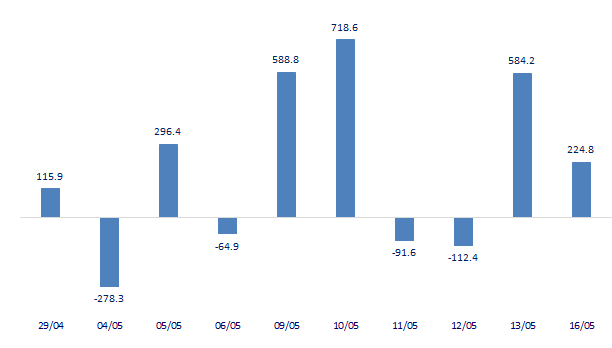

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

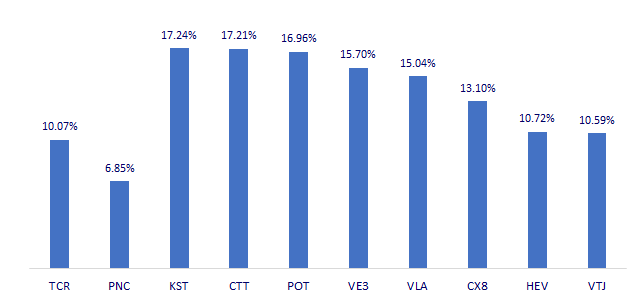

TOP INCREASES 3 CONSECUTIVE SESSIONS

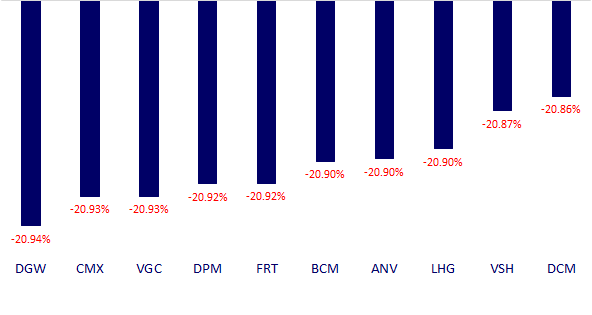

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.