Market brief 26/05/2022

VIETNAM STOCK MARKET

1,268.57

1D 0.01%

YTD -15.33%

1,309.50

1D -0.09%

YTD -14.73%

313.29

1D -0.51%

YTD -33.90%

94.95

1D 0.18%

YTD -15.73%

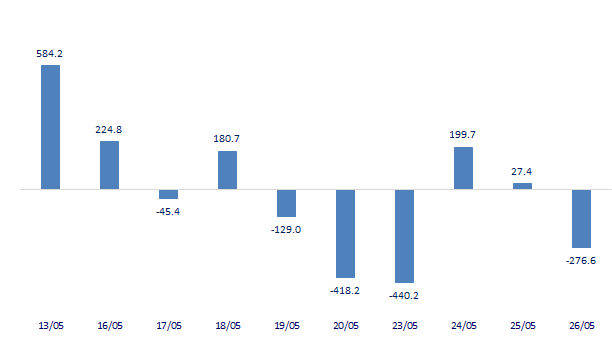

-276.55

1D 0.00%

YTD 0.00%

16,190.91

1D -17.88%

YTD -47.89%

Foreign investors net sold again 276 billion dong on May 26. HPG was sold the most on HoSE with 103 billion dong. VIC and DXG were net sold at 65 billion dong and 57 billion dong respectively. On the other hand, domestic ETF certificates FUEVFVND were bought the most with 208 billion dong. DGC ranked second in the list of foreign investors' net buying with 32 billion dong.

ETF & DERIVATIVES

21,930

1D -0.32%

YTD -15.10%

15,440

1D 0.26%

YTD -14.65%

16,430

1D -7.75%

YTD -13.53%

19,500

1D 2.15%

YTD -14.85%

17,500

1D 0.34%

YTD -22.15%

27,500

1D 1.51%

YTD -1.96%

17,000

1D 1.80%

YTD -20.86%

1,291

1D -0.38%

YTD 0.00%

1,297

1D -0.14%

YTD 0.00%

1,301

1D 0.12%

YTD 0.00%

1,283

1D 0.00%

YTD 0.00%

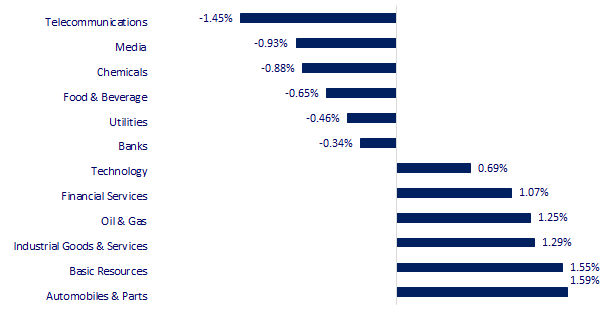

CHANGE IN PRICE BY SECTOR

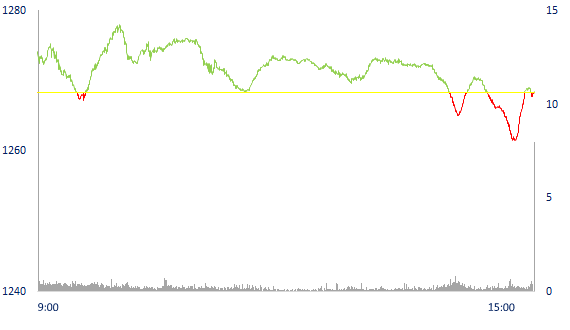

INTRADAY VNINDEX

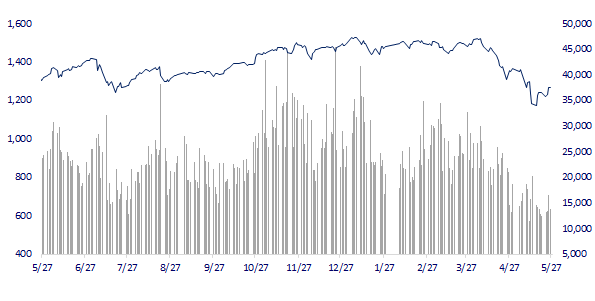

VNINDEX (12M)

GLOBAL MARKET

26,604.84

1D -0.38%

YTD -7.60%

3,123.11

1D 0.50%

YTD -14.20%

2,612.45

1D -0.18%

YTD -12.26%

20,116.20

1D 0.07%

YTD -14.02%

3,209.18

1D 0.93%

YTD 2.74%

1,633.73

1D 0.53%

YTD -1.44%

111.31

1D 0.69%

YTD 45.50%

1,842.44

1D -0.48%

YTD 1.19%

Asian stocks mixed after a rally in the US. The Shanghai Composite Index gained 0.5% while the Hang Seng Index gained 0.07%. In Japan, the Nikkei 225 lost 0.38%. South Korea's Kospi index fell 0.18%.

VIETNAM ECONOMY

0.93%

1D (bps) -11

YTD (bps) 12

5.60%

2.49%

1D (bps) -3

YTD (bps) 148

3.03%

1D (bps) -4

YTD (bps) 103

23,430

1D (%) 0.39%

YTD (%) 2.14%

25,298

1D (%) -1.04%

YTD (%) -4.42%

3,519

1D (%) -0.48%

YTD (%) -3.80%

The SBV has just issued Circular 03/2022/TT-NHNN guiding commercial banks to support interest rates according to Decree No. 31/2022/ND-CP dated May 20, 2022 of the Government on interest rate support from the state budget for loans of enterprises, cooperatives and business households. Thus, only a few days after the decree was issued, the State Bank quickly organized instructions to implement this important stimulus program.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The State Bank quickly guides the implementation of interest rate support

- Vietnam is in the Top 3 countries with the highest tourism development capacity in the world

- Hai Phong promotes investment with French enterprises

- The Fed may raise interest rates by 1% after the next two meetings

- US: Government budget deficit is expected to decrease to 1 trillion USD

- Central Bank of Russia cuts interest rates from 14% to 11%

VN30

BANK

76,700

1D -0.39%

5D 0.92%

Buy Vol. 1,421,600

Sell Vol. 1,624,100

35,100

1D 0.57%

5D 1.30%

Buy Vol. 3,035,600

Sell Vol. 2,676,200

26,700

1D -0.74%

5D 2.30%

Buy Vol. 7,723,100

Sell Vol. 9,298,100

36,700

1D 0.55%

5D 2.51%

Buy Vol. 8,465,300

Sell Vol. 9,081,100

31,050

1D -1.43%

5D 1.97%

Buy Vol. 15,549,100

Sell Vol. 17,688,300

27,650

1D -1.43%

5D 3.36%

Buy Vol. 12,557,900

Sell Vol. 15,361,200

25,550

1D -0.39%

5D 5.14%

Buy Vol. 3,039,300

Sell Vol. 4,061,400

31,600

1D -0.94%

5D 1.44%

Buy Vol. 2,291,200

Sell Vol. 2,713,100

22,400

1D -1.54%

5D 2.99%

Buy Vol. 29,989,500

Sell Vol. 37,647,400

30,350

1D 1.17%

5D 6.12%

Buy Vol. 4,300,000

Sell Vol. 5,059,000

CTG: some banks have not classified their debts appropriately. Specifically, after the audit, VietinBank's group 1 debt balance decreased by 243.94 billion VND, while the group 2, 3, 4, and 5 loans increased by 166.10 billion VND; 34.72 billion VND; VND 15.93 billion and VND 27.19 billion respectively. PGBank reduced the outstanding loans of group 1 by 45.49 billion dong, increased the outstanding loans of group 2 by 34.07 billion dong, group 3 increased by 9.62 billion dong, group 4 increased by 0.35 billion dong and group 5 increased by 1.45 billion dong.

REAL ESTATE

78,000

1D -1.14%

5D 0.00%

Buy Vol. 4,106,700

Sell Vol. 4,641,100

41,450

1D 1.34%

5D -0.12%

Buy Vol. 1,642,800

Sell Vol. 1,370,300

53,600

1D 1.52%

5D -0.74%

Buy Vol. 3,664,300

Sell Vol. 3,426,400

Leading in inventory is NVL with more than 120 trillion VND (up 9%). In terms of growth, KDH's inventory increased by 48% after 3 months, at more than 11 trillion dong.

OIL & GAS

107,600

1D -0.74%

5D 1.70%

Buy Vol. 997,500

Sell Vol. 1,382,800

13,150

1D -1.87%

5D 2.73%

Buy Vol. 23,120,000

Sell Vol. 25,300,900

42,550

1D 2.78%

5D 5.06%

Buy Vol. 3,258,000

Sell Vol. 2,966,000

The influx of cheaper Russian gas has pressured other regional suppliers such as Kazakhstan and Uzbekistan to cut prices.

VINGROUP

77,700

1D 0.00%

5D -0.26%

Buy Vol. 3,561,700

Sell Vol. 3,811,600

68,700

1D 1.18%

5D 2.54%

Buy Vol. 6,068,000

Sell Vol. 6,596,100

29,600

1D 0.51%

5D 8.03%

Buy Vol. 3,352,800

Sell Vol. 5,076,900

VIC: in Q1/2022 profit increased by 17% although the decrease in revenue thanks to a profit of more than 10tr dong from liquidation of financial investments and the transfer of subsidiaries.

FOOD & BEVERAGE

71,300

1D -0.83%

5D 3.33%

Buy Vol. 2,551,800

Sell Vol. 3,644,800

108,600

1D -1.72%

5D -1.63%

Buy Vol. 1,377,200

Sell Vol. 1,488,700

153,000

1D -0.65%

5D -6.08%

Buy Vol. 361,600

Sell Vol. 426,000

VNM: Tall Vietnam Milk Fund and Vinamilk officially kicked off the journey to give 1.9m glasses of milk to children in 2022, also a special milestone marking 15 years of this program.

OTHERS

125,000

1D -0.56%

5D -0.24%

Buy Vol. 748,600

Sell Vol. 758,300

125,000

1D -0.56%

5D -0.24%

Buy Vol. 748,600

Sell Vol. 758,300

105,600

1D 0.57%

5D 8.87%

Buy Vol. 2,733,500

Sell Vol. 3,398,600

139,000

1D 0.00%

5D 4.51%

Buy Vol. 1,164,000

Sell Vol. 1,292,700

114,300

1D -0.95%

5D 11.95%

Buy Vol. 946,000

Sell Vol. 1,957,900

25,350

1D 0.00%

5D 10.46%

Buy Vol. 3,009,700

Sell Vol. 2,904,200

29,450

1D 2.26%

5D 3.33%

Buy Vol. 54,477,100

Sell Vol. 50,018,600

35,000

1D 1.60%

5D -7.65%

Buy Vol. 29,532,500

Sell Vol. 28,367,300

HPG: After Dung Quat 2, the company is studying to build Dung Quat 3 steel factory with a capacity of 6 million tons/year, maybe not located in Dung Quat. Thus, Hoa Phat's total capacity will increase to 21 million tons, equivalent to Vietnam's current steel consumption demand. Hoa Phat will produce part of HRC here, in addition to U steel, Y steel. The project will be implemented after 2025.

Market by numbers

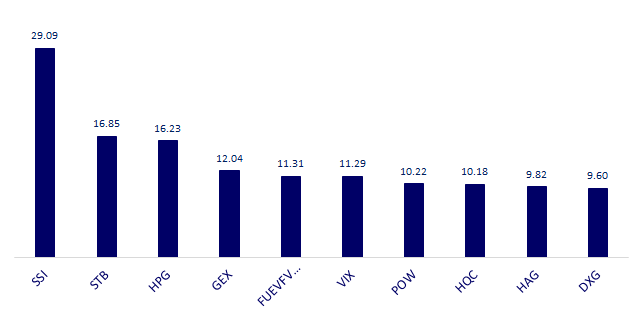

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

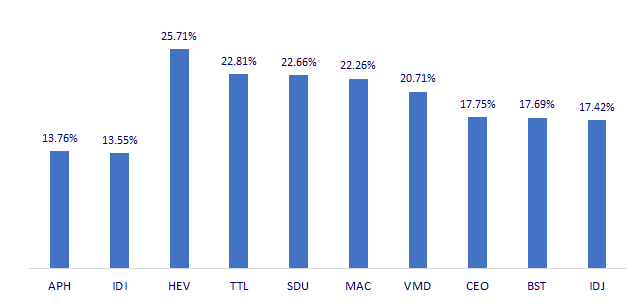

TOP INCREASES 3 CONSECUTIVE SESSIONS

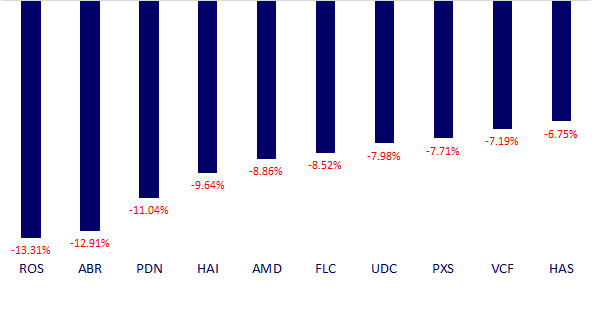

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.