Market brief 27/05/2022

VIETNAM STOCK MARKET

1,285.45

1D 1.33%

YTD -14.20%

1,335.68

1D 2.00%

YTD -13.03%

311.17

1D -0.68%

YTD -34.35%

95.29

1D 0.36%

YTD -15.43%

140.81

1D 0.00%

YTD 0.00%

18,606.06

1D 14.92%

YTD -40.12%

Session 27/05, securities company's propriety trading saw a strong net buying of more than 1 trillion dong. The buying force was strong in the VN30 group. In which, PNJ, FPT, MWG, REE were net bought over 100 billion dong. VN30 banking stocks including ACB, TCB, VPB, MBB, and TPB were also strongly net bought.

ETF & DERIVATIVES

22,390

1D 2.10%

YTD -13.32%

15,690

1D 1.62%

YTD -13.27%

16,550

1D -7.07%

YTD -12.89%

19,960

1D 2.36%

YTD -12.84%

17,700

1D 1.14%

YTD -21.26%

28,700

1D 4.36%

YTD 2.32%

16,990

1D -0.06%

YTD -20.90%

1,318

1D 2.08%

YTD 0.00%

1,324

1D 2.10%

YTD 0.00%

1,323

1D 1.66%

YTD 0.00%

1,283

1D 0.00%

YTD 0.00%

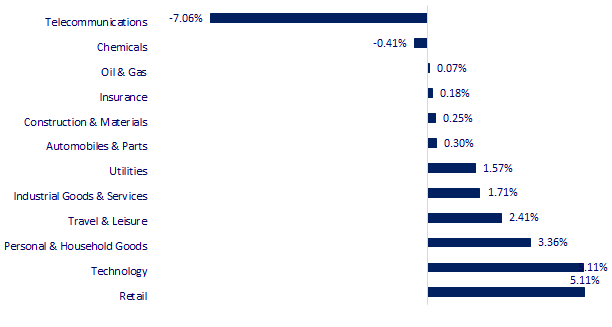

CHANGE IN PRICE BY SECTOR

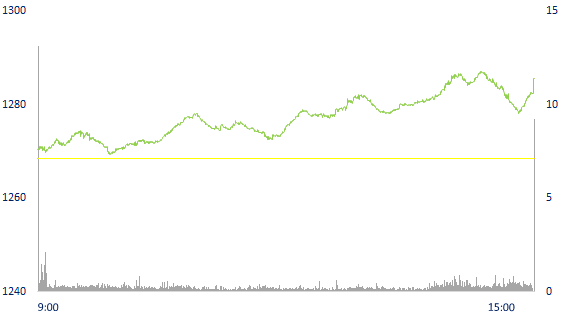

INTRADAY VNINDEX

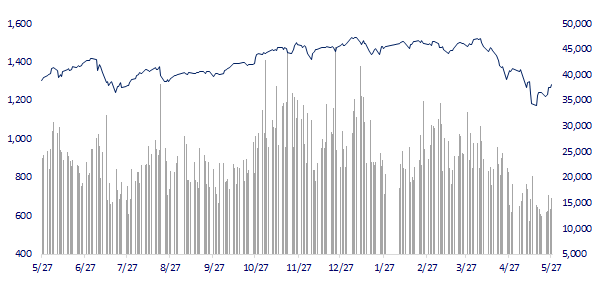

VNINDEX (12M)

GLOBAL MARKET

26,781.68

1D -0.25%

YTD -6.98%

3,130.24

1D 0.23%

YTD -14.00%

2,638.05

1D 0.98%

YTD -11.40%

20,697.36

1D -0.26%

YTD -11.54%

3,230.55

1D 0.67%

YTD 3.42%

1,638.75

1D 0.31%

YTD -1.14%

113.34

1D -0.94%

YTD 48.16%

1,856.90

1D 0.43%

YTD 1.98%

Asian stocks mixed on May 27. Hong Kong's Hang Seng Index fell 0.26%. The Shanghai Composite Index rose 0.23%. Japan's Nikkei 225 index fell 0.25%. In South Korea, the Kospi index rose 0.98%.

VIETNAM ECONOMY

0.74%

1D (bps) -19

YTD (bps) -7

5.60%

2.57%

1D (bps) 8

YTD (bps) 156

3.09%

1D (bps) 6

YTD (bps) 109

23,405

1D (%) 0.24%

YTD (%) 2.03%

25,267

1D (%) -1.50%

YTD (%) -4.54%

3,529

1D (%) 0.43%

YTD (%) -3.53%

According to the SBV, deposits into the banking system grew positively in the first quarter of 2022. Specifically, the customer's deposit balance at the end of March 2022 reached more than 11.33 million billion VND, an increase of more than 390,000 billion VND compared to the end of 2021, equivalent to an increase of 3.6%. In which, deposits of residents reached more than 5.47 million billion VND, an increase of nearly 174,000 billion VND, equivalent to an increase of 3.28%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Deputy Governor: 'SBV does not tighten credit for real estate and securities'

- Idle cash flow is changing direction

- FDI in the first 5 months of 2022: Newly registered capital decreased, but contributed capital to buy shares increased sharply

- US GDP fell 1.5%

- Ruble lost more than 10% of its value after Russia cut interest rates, USD and gold also fell

- Korea continues to raise interest rates to combat inflation

VN30

BANK

77,400

1D 0.91%

5D 2.79%

Buy Vol. 1,298,100

Sell Vol. 1,490,000

35,300

1D 0.57%

5D 2.32%

Buy Vol. 1,722,600

Sell Vol. 2,036,900

27,000

1D 1.12%

5D 4.25%

Buy Vol. 7,432,600

Sell Vol. 7,594,400

37,450

1D 2.04%

5D 4.90%

Buy Vol. 9,413,600

Sell Vol. 9,942,600

31,100

1D 0.16%

5D 1.63%

Buy Vol. 17,727,600

Sell Vol. 18,216,700

28,000

1D 1.27%

5D 3.70%

Buy Vol. 13,079,800

Sell Vol. 15,324,800

25,800

1D 0.98%

5D 5.95%

Buy Vol. 4,057,400

Sell Vol. 3,654,600

32,300

1D 2.22%

5D 2.87%

Buy Vol. 6,394,100

Sell Vol. 8,683,500

22,250

1D -0.67%

5D 3.01%

Buy Vol. 28,351,300

Sell Vol. 27,793,600

31,800

1D 4.78%

5D 9.47%

Buy Vol. 8,110,900

Sell Vol. 7,507,600

ACB: ACB plans to issue nearly 675.5 million shares to pay dividends in 2021 to shareholders, equivalent to 25%. The holder of the right to receive shares will not be allowed to transfer this right. The source used to increase charter capital from profit can be used to pay dividends after having fully set aside funds and the remaining profit of the previous year that has not been divided according to the audited financial statements as of December 31, 2021.

REAL ESTATE

78,400

1D 0.51%

5D 0.77%

Buy Vol. 4,316,000

Sell Vol. 5,727,200

42,550

1D 2.65%

5D 2.78%

Buy Vol. 2,111,300

Sell Vol. 2,204,500

54,300

1D 1.31%

5D 0.93%

Buy Vol. 2,636,400

Sell Vol. 2,820,600

KDH: KDH is enterprise with the highest loan growth after the first 3 months of 2022 with 99% and 74%, to VND 2,367 billion and VND 4,434 billion.

OIL & GAS

110,000

1D 2.23%

5D 5.26%

Buy Vol. 1,089,300

Sell Vol. 1,231,000

13,350

1D 1.52%

5D 4.30%

Buy Vol. 40,232,800

Sell Vol. 28,979,600

42,600

1D 0.12%

5D 5.19%

Buy Vol. 1,758,000

Sell Vol. 2,235,300

GAS: At the parent company PV Gas has a large balance of investment and development fund with VND 18,597.25 billion but has not yet developed a plan and plan to use the Fund.

VINGROUP

78,000

1D 0.39%

5D 0.26%

Buy Vol. 2,669,800

Sell Vol. 3,278,400

69,700

1D 1.46%

5D 4.34%

Buy Vol. 4,898,300

Sell Vol. 5,253,900

29,800

1D 0.68%

5D 8.96%

Buy Vol. 4,115,400

Sell Vol. 5,615,000

VIC: Vingroup will provide a guarantee and use its owned assets as security for all of VinFast's payment obligations related to VND 2,000 billion of bonds issued by VinFast in 2022.

FOOD & BEVERAGE

73,000

1D 2.38%

5D 7.20%

Buy Vol. 4,895,100

Sell Vol. 6,457,100

110,000

1D 1.29%

5D 2.04%

Buy Vol. 1,274,700

Sell Vol. 1,427,700

154,000

1D 0.65%

5D -1.60%

Buy Vol. 387,300

Sell Vol. 448,400

SAB: In 2022, Sabeco's market share will continue to expand thanks to its wide distribution network, covering the North and rural areas less affected by the Covid-19 outbreak.

OTHERS

127,000

1D 1.60%

5D 1.36%

Buy Vol. 1,091,700

Sell Vol. 980,500

127,000

1D 1.60%

5D 1.36%

Buy Vol. 1,091,700

Sell Vol. 980,500

111,800

1D 5.87%

5D 14.67%

Buy Vol. 5,683,800

Sell Vol. 6,665,900

146,700

1D 5.54%

5D 9.48%

Buy Vol. 3,788,100

Sell Vol. 3,911,700

122,300

1D 7.00%

5D 15.38%

Buy Vol. 3,241,000

Sell Vol. 3,318,400

25,500

1D 0.59%

5D 7.59%

Buy Vol. 2,939,000

Sell Vol. 3,420,900

29,900

1D 1.53%

5D 5.10%

Buy Vol. 41,264,800

Sell Vol. 39,211,800

35,450

1D 1.29%

5D -5.84%

Buy Vol. 29,472,600

Sell Vol. 30,010,200

HPG: HPG approved to pay 2021 dividend at the rate of 35%, of which 5% is in cash. In addition, HPG will also issue an additional 1.34 billion shares to pay the remaining dividend. The source of capital is taken from the undistributed after-tax profit on the audited financial statements of the last year. Expected release time is June to August this year. The total value at par value is 13,400 billion dong, thereby increasing the charter capital of the company to 58,147 billion dong.

Market by numbers

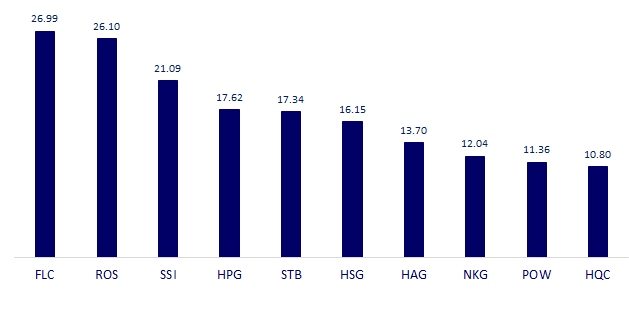

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

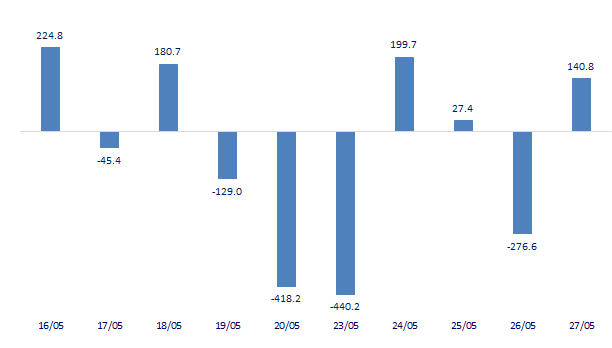

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

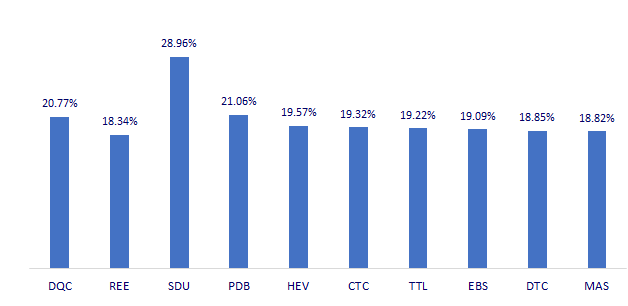

TOP INCREASES 3 CONSECUTIVE SESSIONS

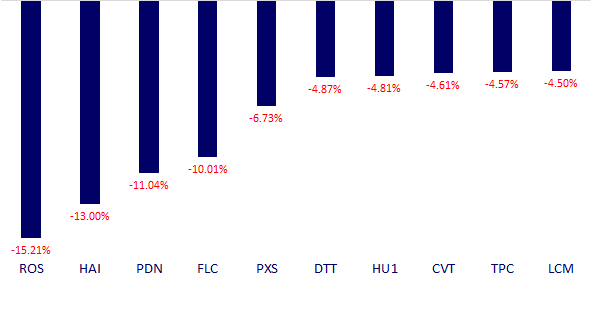

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.