Morning brief 30/05/2022

GLOBAL MARKET

33,212.96

1D 1.76%

YTD -8.75%

4,158.24

1D 2.47%

YTD -12.98%

12,131.13

1D 3.33%

YTD -22.94%

28.48

1D 0.00%

7,585.46

1D 0.27%

YTD 2.46%

14,462.19

1D 1.62%

YTD -8.96%

6,515.75

1D 1.64%

YTD -9.17%

115.81

1D 1.21%

YTD 51.39%

1,850.80

1D 0.10%

YTD 1.65%

Investors paid off on Friday (May 27) from a painful sell-off as the Dow Jones and S&P 500 rebounded and closed their best week since November 2020. Ending Friday's session, the Dow Jones Industrial Average rose 575.77 points (or nearly 1.8%) to 33,212.96 points. The S&P 500 index advanced 2.5% to 4,158.24 points. The Nasdaq Composite added 3.3% to 12,131.13.

VIETNAM ECONOMY

0.74%

1D (bps) -19

YTD (bps) -7

5.60%

2.57%

1D (bps) 8

YTD (bps) 156

3.09%

1D (bps) 6

YTD (bps) 109

23,325

1D (%) -0.11%

YTD (%) 1.68%

25,614

1D (%) -0.15%

YTD (%) -3.23%

3,531

1D (%) 0.48%

YTD (%) -3.47%

According to a report from the GSO, the IIP in May 2022 was estimated to increase by 4% MoM and by 10.4% YoY, in which, the processing industry, manufacturing increased by 12.1%. Generally, in the first 5 months of 2022, IIP is estimated to increase by 8.3% over the same period last year (in the same period in 2021, it is estimated to increase by 10%). In which, the processing and manufacturing industry increased by 9.2% (in the same period in 2021, it increased by 12.5%).

VIETNAM STOCK MARKET

1,285.45

1D 1.33%

YTD -14.20%

1,335.68

1D 2.00%

YTD -13.03%

311.17

1D -0.68%

YTD -34.35%

95.29

1D 0.36%

YTD -15.43%

140.81

18,606.06

1D 14.92%

YTD -40.12%

In the week of May 23-27, the cash flow of domestic individuals and the propriety played a role in supporting the VN-Index, while domestic organizations and foreign investors had negative fluctuations. Domestic individual investors continued to net buy 432b dong on HoSE, down 75% compared to last week, of which only 42.5b dong was realized through order matching method.

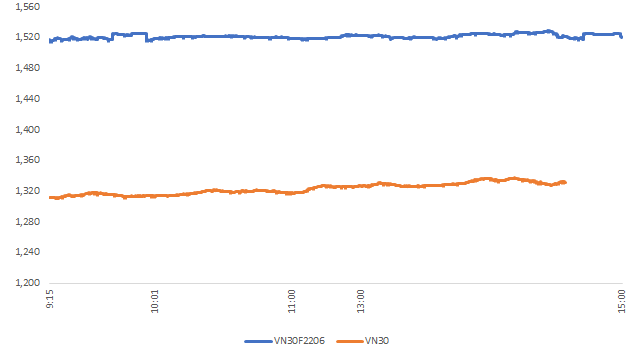

INTRADAY

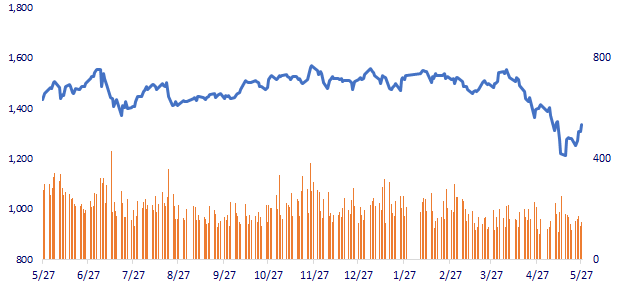

VN30 (12M)

SELECTED NEWS

- Money withdrawn from hot channels, increased to banks, overnight interest rates sunk

- The Government approved the policy of infrastructure investment in 5 industrial parks, with a total scale of 12,500 billion VND

- IIP in May 2022 increased by 4% compared to the previous month, concentrated in the processing and manufacturing industry

- In the face of objections from Hungary, the EU proposes to delay the ban on the main oil pipeline

- China: Shanghai and Beijing relax blockade measures

- President Putin spoke by phone with the leaders of France and Germany, criticizing the injection of weapons to Ukraine

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.