Market brief 31/5/2022

VIETNAM STOCK MARKET

1,293.92

1D 0.66%

YTD -13.64%

1,342.87

1D 0.54%

YTD -12.56%

312.77

1D 0.51%

YTD -34.01%

95.71

1D 0.44%

YTD -15.06%

1,706.79

1D 0.00%

YTD 0.00%

19,340.24

1D 3.95%

YTD -37.76%

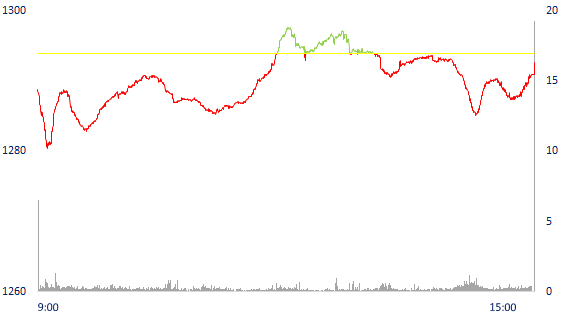

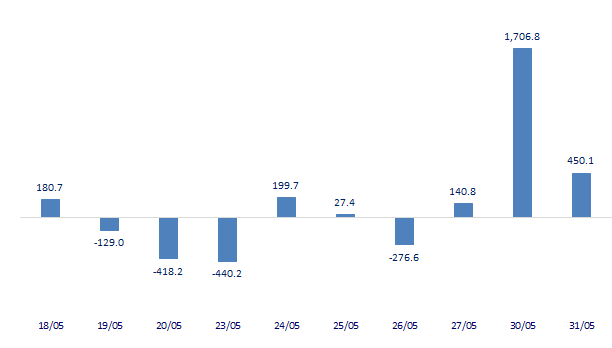

Oil and gas group decrease at the end of the session, banking and aviation stocks supported the market. Market liquidity decreased DoD. The total matched value reached 15,167 billion dong, down 12%, of which, the matched value on HoSE alone decreased by 15.5% to 12,758 billion dong. Foreign investors net bought more than 1,700 billion dong thanks to the agreement of FUEVFVND and FPT.

ETF & DERIVATIVES

22,600

1D 0.94%

YTD -12.50%

15,790

1D 0.64%

YTD -12.71%

17,000

1D -4.55%

YTD -10.53%

21,000

1D 5.21%

YTD -8.30%

18,000

1D 1.69%

YTD -19.93%

28,500

1D -0.70%

YTD 1.60%

17,080

1D 0.53%

YTD -20.48%

1,323

1D 0.41%

YTD 0.00%

1,324

1D 0.03%

YTD 0.00%

1,326

1D 0.23%

YTD 0.00%

1,283

1D 0.00%

YTD 0.00%

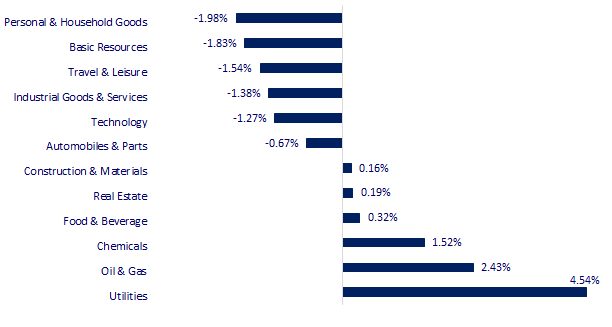

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

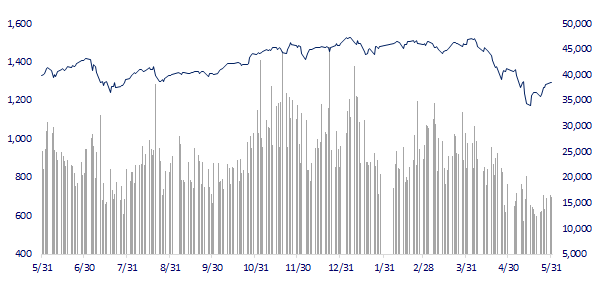

VNINDEX (12M)

GLOBAL MARKET

27,369.43

1D 0.36%

YTD -4.94%

3,149.06

1D 0.60%

YTD -13.48%

2,669.66

1D 1.20%

YTD -10.34%

21,123.93

1D 0.81%

YTD -9.72%

3,238.92

1D 0.26%

YTD 3.69%

1,653.61

1D 0.91%

YTD -0.24%

115.55

1D -0.22%

YTD 51.05%

1,853.15

1D 0.13%

YTD 1.78%

Asian stock markets rallied on May 30. Investors are waiting for the latest economic data to be released this week, which is expected to have many improvements. The Nikkei 225 index rose 0.36%. In Hong Kong, the Hang Seng Index rose 0.81%. Mainland China stocks also rallied, with the Shanghai Composite up 0.6 percent. South Korea's Kospi index rose 1.2%.

VIETNAM ECONOMY

0.53%

1D (bps) -21

YTD (bps) -28

5.60%

2.53%

1D (bps) -4

YTD (bps) 152

3.07%

1D (bps) -2

YTD (bps) 107

23,400

1D (%) 0.32%

YTD (%) 2.01%

25,382

1D (%) -0.91%

YTD (%) -4.10%

3,548

1D (%) 0.48%

YTD (%) -3.01%

After the first 5 months of the year, the total state budget revenue has reached 806.4 trillion dong, equaling 57.1% of the estimate and increasing by 18.7% over the same period last year. In which, revenue from crude oil exceeded 4.4% of the yearly estimate and increased by nearly 91% over the same period last year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Extension of time limit for paying tax and land rent in 2022

- Nearly 148 trillion VND of public investment capital realized in the first 5 months, up 9.5%

- State budget has more than 217 trillion dong after 5 months

- EU reveals the reason why it is impossible to completely embargo Russian oil

- Russia admits it needs to spend a "huge" amount of money on a special military operation

- The US economy has signaled that prices have slowed down

VN30

BANK

78,000

1D 0.78%

5D 4.84%

Buy Vol. 2,131,300

Sell Vol. 2,259,400

35,750

1D 1.27%

5D 7.20%

Buy Vol. 1,749,500

Sell Vol. 2,676,300

27,300

1D 1.11%

5D 9.20%

Buy Vol. 7,751,400

Sell Vol. 5,925,900

37,750

1D 0.80%

5D 8.32%

Buy Vol. 8,142,300

Sell Vol. 8,884,000

31,600

1D 1.61%

5D 7.85%

Buy Vol. 20,490,800

Sell Vol. 18,181,700

28,100

1D 0.36%

5D 6.84%

Buy Vol. 11,529,200

Sell Vol. 14,360,300

25,850

1D 0.19%

5D 6.82%

Buy Vol. 3,084,300

Sell Vol. 4,207,800

33,000

1D 2.17%

5D 10.00%

Buy Vol. 8,471,800

Sell Vol. 9,246,700

22,800

1D 2.47%

5D 12.04%

Buy Vol. 29,890,300

Sell Vol. 29,492,200

31,950

1D 0.47%

5D 12.30%

Buy Vol. 3,430,000

Sell Vol. 6,170,100

TCB: Techcombank last week applied a new deposit interest rate schedule for individual customers, from May 23, 2022. For over-the-counter deposit, Techcombank's highest interest rate is 6.2%/year, 36-month term, for VIP 1, an increase of 0.3%/year compared to the previous one. With online deposit, the highest interest rate is 6.5%/year. This bank also adds interest rates of about 0.3-0.45 percentage points in many other terms. This is one of Techcombank's strongest interest rate adjustments in more than half a year. In previous times, TCB usually only slightly increased/reduced interest rates, about 0.1-0.2 percentage points.

REAL ESTATE

78,700

1D 0.38%

5D 3.01%

Buy Vol. 3,598,400

Sell Vol. 4,015,500

42,400

1D -0.35%

5D 3.67%

Buy Vol. 1,500,200

Sell Vol. 1,766,800

55,300

1D 1.84%

5D 4.34%

Buy Vol. 3,765,500

Sell Vol. 3,700,400

NVL: Approved the list of 02 foreign investors to buy 5,543 convertible bonds and 231 bonds with warrants with a total value of VND 5,774 billion.

OIL & GAS

110,000

1D 0.00%

5D 6.28%

Buy Vol. 1,147,500

Sell Vol. 1,427,300

13,450

1D 0.75%

5D 5.49%

Buy Vol. 25,272,800

Sell Vol. 24,584,700

43,400

1D 1.88%

5D 7.83%

Buy Vol. 2,029,700

Sell Vol. 2,843,800

GAS: The consortium with the participation of KOGAS Korea , CUIYC Singapore, National Petroleum Company of Thailand PTT and Atrium Fund wants to cooperate with PV GAS.

VINGROUP

78,500

1D 0.64%

5D 1.42%

Buy Vol. 2,797,000

Sell Vol. 2,577,600

70,500

1D 1.15%

5D 5.70%

Buy Vol. 4,309,400

Sell Vol. 5,528,600

29,950

1D 0.50%

5D 9.51%

Buy Vol. 4,304,000

Sell Vol. 5,339,500

VIC: VinFast issued nearly 690m dividend preference shares, increasing charter capital to more than 57,000b dong. After release, VinFast Singapore's ownership rate decreased to 87.9%.

FOOD & BEVERAGE

72,500

1D -0.68%

5D 9.35%

Buy Vol. 3,109,600

Sell Vol. 3,911,100

110,000

1D 0.00%

5D 5.26%

Buy Vol. 904,100

Sell Vol. 1,379,400

153,400

1D -0.39%

5D -0.45%

Buy Vol. 299,600

Sell Vol. 295,600

SAB: has a policy of paying a cash dividend of 35% in cash for many years, even after 2 years of business operations severely affected by the Covid-19 pandemic and Decree 100.

OTHERS

132,500

1D 4.33%

5D 6.00%

Buy Vol. 1,741,000

Sell Vol. 1,316,100

132,500

1D 4.33%

5D 6.00%

Buy Vol. 1,741,000

Sell Vol. 1,316,100

111,300

1D -0.45%

5D 15.34%

Buy Vol. 5,313,800

Sell Vol. 6,445,000

145,200

1D -1.02%

5D 11.01%

Buy Vol. 2,220,300

Sell Vol. 2,230,800

120,500

1D -1.47%

5D 15.31%

Buy Vol. 1,975,900

Sell Vol. 2,130,600

25,450

1D -0.20%

5D 7.38%

Buy Vol. 2,440,000

Sell Vol. 2,501,200

29,900

1D 0.00%

5D 12.83%

Buy Vol. 28,778,100

Sell Vol. 28,680,500

35,450

1D 0.00%

5D -3.54%

Buy Vol. 26,005,400

Sell Vol. 29,691,700

MWG: Bach Hoa Xanh accumulated a loss of nearly 5,000 billion dong before the private placement. The chain's revenue in 2021 reached VND 28,216 billion, a net loss of VND 1,188 billion. By the end of 2021, the accumulated loss was VND 4,950 billion, equity reached VND 7,852 billion while owner's contributed capital was VND 12,801 billion.

Market by numbers

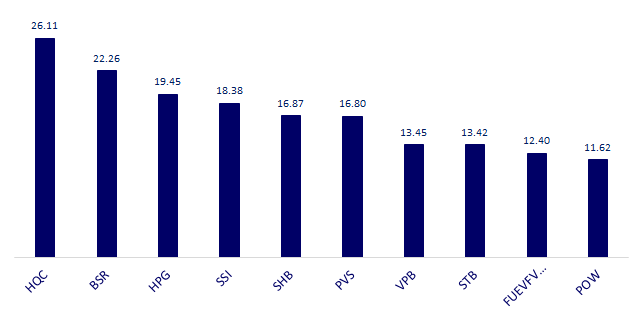

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

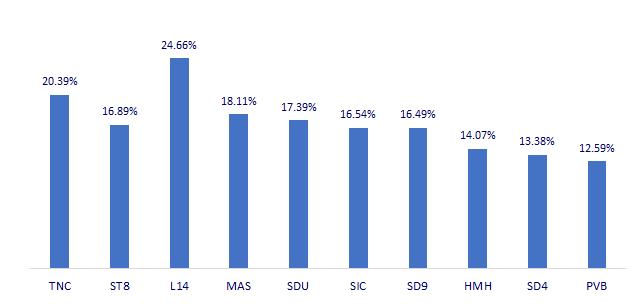

TOP INCREASES 3 CONSECUTIVE SESSIONS

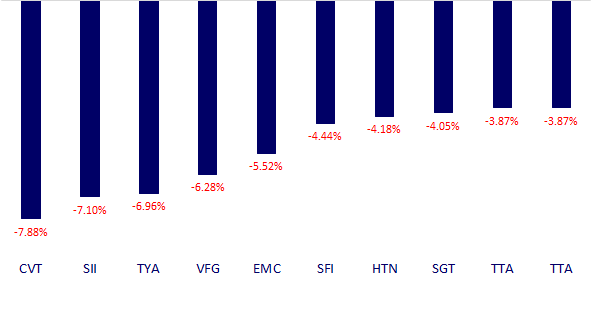

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.