Market brief 02/06/2022

VIETNAM STOCK MARKET

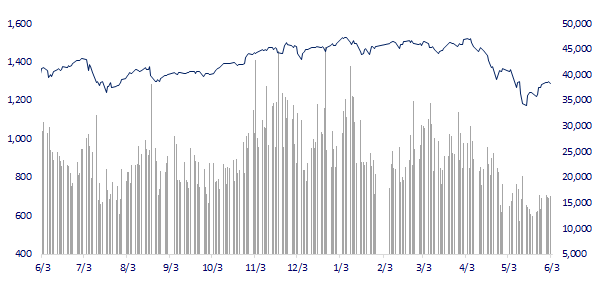

1,288.62

1D -0.84%

YTD -13.99%

1,325.49

1D -0.75%

YTD -13.69%

311.77

1D -1.14%

YTD -34.22%

94.32

1D -0.82%

YTD -16.29%

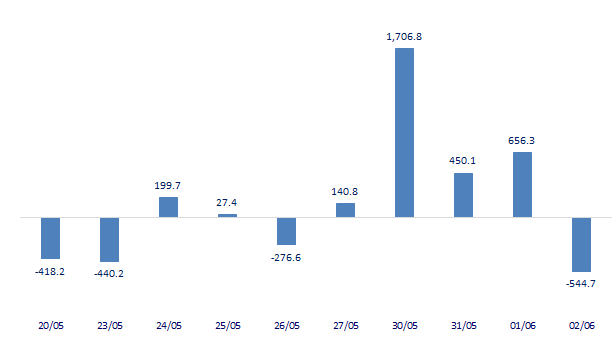

-544.66

1D 0.00%

YTD 0.00%

19,766.79

1D 4.73%

YTD -36.38%

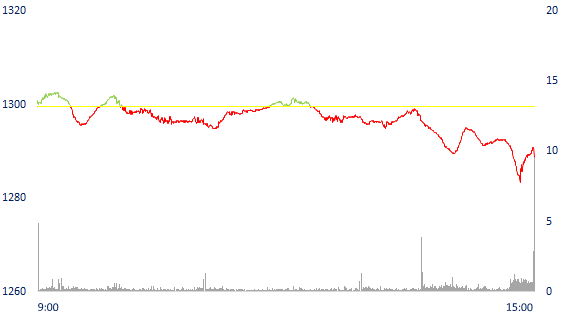

Many large stocks were sold strongly, VN-Index dropped by nearly 11 points. Market liquidity improved compared to yesterday. The total matched value reached 17,847 billion dong, up 7.66%, of which, the matched value on HoSE alone increased 4.4% to 14,782 billion dong. Foreign investors net sold more than 544 billion dong in the whole market today.

ETF & DERIVATIVES

22,300

1D -1.55%

YTD -13.67%

15,620

1D -0.76%

YTD -13.65%

16,490

1D -7.41%

YTD -13.21%

19,000

1D -5.00%

YTD -17.03%

17,500

1D -1.80%

YTD -22.15%

28,430

1D 0.28%

YTD 1.35%

17,010

1D 0.00%

YTD -20.81%

1,314

1D -0.51%

YTD 0.00%

1,311

1D -0.96%

YTD 0.00%

1,314

1D -0.90%

YTD 0.00%

1,315

1D -0.83%

YTD 0.00%

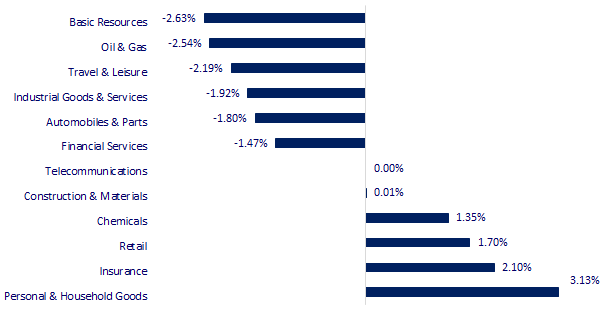

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,413.88

1D 0.02%

YTD -4.79%

3,195.46

1D 0.42%

YTD -12.21%

2,658.99

1D -1.00%

YTD -10.70%

21,082.13

1D 0.05%

YTD -9.90%

3,226.72

1D -0.53%

YTD 3.30%

1,647.67

1D -0.74%

YTD -0.60%

112.34

1D -0.12%

YTD 46.85%

1,858.65

1D 0.57%

YTD 2.08%

Asian stocks mixed in the session 2/6. Australia's April trade surplus was higher than expected. Hong Kong's Hang Seng Index rose 0.05%. In China, the Shanghai Composite Index fell 0.42% to 3,195.46 points. The Nikkei 225 (Japan) gained 0.02%. South Korea's Kospi falls 1%

VIETNAM ECONOMY

0.48%

1D (bps) 15

YTD (bps) -33

5.60%

2.57%

1D (bps) 3

YTD (bps) 156

3.13%

1D (bps) 7

YTD (bps) 113

23,415

1D (%) 0.32%

YTD (%) 2.07%

25,224

1D (%) -0.87%

YTD (%) -4.70%

3,547

1D (%) 0.20%

YTD (%) -3.03%

At the regular press conference on the socio-economic situation in May and May, the People's Committee of Ho Chi Minh City said that as of May 25, the disbursement rate of public investment capital reached VND 4,300 billion out of the total allocated capital this year. is 45,000 billion VND, equivalent to 13.5%. This figure is lower than the national disbursement rate of 22.4%, according to the previous estimate of the Ministry of Finance.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- In 5 months, Ho Chi Minh City disbursed nearly 14% of the annual public investment capital plan, lower than the national average

- Banks have not been granted more room yet, credit growth has started to cool down

- Delegates propose to continue reducing taxes on gasoline

- OPEC + considers excluding Russia from the production plan, oil prices 'cooled down'

- US: Manufacturing sector grew faster in May

- Sri Lankan inflation hits record

VN30

BANK

79,000

1D -1.86%

5D 3.00%

Buy Vol. 914,500

Sell Vol. 1,814,500

34,700

1D -1.28%

5D -1.14%

Buy Vol. 1,469,600

Sell Vol. 1,848,300

27,750

1D 0.00%

5D 3.93%

Buy Vol. 9,605,500

Sell Vol. 8,866,500

36,400

1D -1.22%

5D -0.82%

Buy Vol. 5,525,400

Sell Vol. 6,442,900

30,250

1D -1.94%

5D -2.58%

Buy Vol. 14,642,800

Sell Vol. 14,212,200

27,200

1D -1.45%

5D -1.63%

Buy Vol. 9,941,900

Sell Vol. 12,284,700

26,000

1D -0.57%

5D 1.76%

Buy Vol. 3,156,900

Sell Vol. 4,523,500

32,000

1D 0.00%

5D 1.27%

Buy Vol. 4,449,400

Sell Vol. 5,191,200

21,550

1D -3.15%

5D -3.79%

Buy Vol. 23,193,000

Sell Vol. 26,505,200

25,350

1D 1.89%

5D 4.41%

Buy Vol. 6,121,600

Sell Vol. 7,136,800

As of March 31, Techcombank is holding VND 76,782 billion of debt securities of economic organizations, up 22.2% compared to the end of 2021 and leading among the inspected banks. Following, TPBank owns 27,633 billion dong, up 48.4%. Third place is SHB with 16,408 billion dong, up 169%. Ranked 4th, Baoviet Bank kept VND 15,500 billion, up more than 25%. The 5th place belongs to PVcombank with 11,834 billion VND of bonds of economic organizations, up 37.7%.

REAL ESTATE

78,900

1D 1.15%

5D 1.15%

Buy Vol. 3,213,700

Sell Vol. 3,883,700

41,000

1D -2.38%

5D -1.09%

Buy Vol. 1,193,800

Sell Vol. 1,595,900

54,200

1D -0.55%

5D 1.12%

Buy Vol. 2,854,400

Sell Vol. 3,122,900

NVL: Received a $250m investment from an investment fund group led by Warburg Pincus. NVL will use the raised capital to further expand the land bank and complete the development of projects.

OIL & GAS

118,900

1D -1.74%

5D 10.50%

Buy Vol. 2,253,600

Sell Vol. 2,544,300

13,550

1D -2.87%

5D 3.04%

Buy Vol. 16,806,900

Sell Vol. 25,298,000

43,500

1D -2.25%

5D 2.23%

Buy Vol. 2,012,500

Sell Vol. 2,400,700

Shanghai lifted the blockade, oil prices increased. Brent crude oil price rose $0.69, or 0.6%, to $116.29 a barrel. WTI oil price increased 0.59 USD, or 0.5%, to 115.26 USD/barrel.

VINGROUP

78,900

1D -0.50%

5D 1.54%

Buy Vol. 3,948,400

Sell Vol. 4,517,500

69,500

1D -1.14%

5D 4.12%

Buy Vol. 4,380,000

Sell Vol. 6,345,700

29,950

1D -0.33%

5D 1.18%

Buy Vol. 3,028,200

Sell Vol. 4,855,000

VIC: VinFast also issued 600m dividend preference shares to increase capital from VND50,497b to VND 56,497b. Accordingly, VinFast is the largest capital scale in the Vingroup ecosystem.

FOOD & BEVERAGE

71,100

1D -1.11%

5D -0.28%

Buy Vol. 2,328,000

Sell Vol. 3,138,500

114,300

1D -0.61%

5D 5.25%

Buy Vol. 821,600

Sell Vol. 920,900

153,000

1D -0.07%

5D 0.00%

Buy Vol. 239,400

Sell Vol. 264,700

MSN: Masan leaders are about to be rewarded with 7 million shares for ESOP shares at the price of 10,000 VND/share. These shares will be restricted to transfer within 1 year.

OTHERS

128,700

1D -1.98%

5D 2.96%

Buy Vol. 986,000

Sell Vol. 1,185,700

128,700

1D -1.98%

5D 2.96%

Buy Vol. 986,000

Sell Vol. 1,185,700

111,500

1D -0.27%

5D 5.59%

Buy Vol. 3,583,400

Sell Vol. 6,075,000

147,700

1D 1.51%

5D 6.26%

Buy Vol. 3,099,900

Sell Vol. 3,130,100

123,200

1D 5.03%

5D 7.79%

Buy Vol. 4,073,000

Sell Vol. 4,833,700

25,800

1D 2.58%

5D 1.78%

Buy Vol. 4,120,500

Sell Vol. 4,123,800

29,000

1D -1.86%

5D -1.53%

Buy Vol. 31,127,000

Sell Vol. 40,258,400

33,150

1D -3.49%

5D -5.29%

Buy Vol. 40,105,900

Sell Vol. 44,041,900

MWG: 4 months' revenue reached VND47,908b, up 18% and fulfilled 34% of the year plan. Profit after tax reached VND1,819b dong, up 8% and fulfilling 29% of the year plan. An Khang pharmacy has 250 pharmacies by the end of April. Cumulative sales are 3.7 times higher than the same period last year. The average revenue of each stable operating pharmacy is 700-800 million/month for the independent model and 400-500 million/month for the model next to Bach Hoa Xanh store.

Market by numbers

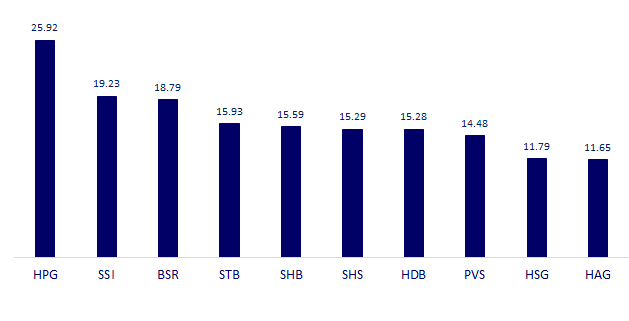

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

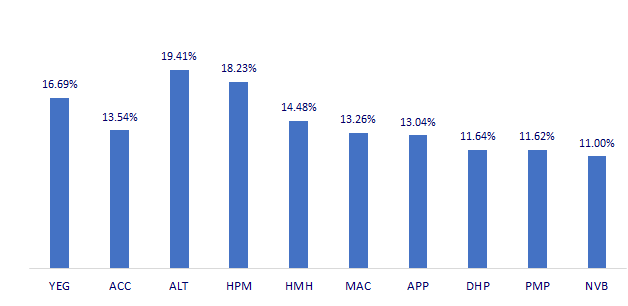

TOP INCREASES 3 CONSECUTIVE SESSIONS

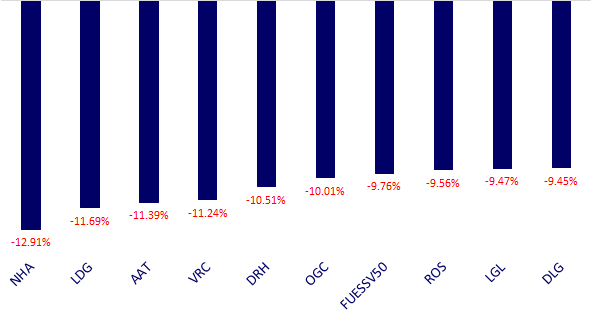

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.