Market brief 09/06/2022

VIETNAM STOCK MARKET

1,307.80

1D -0.01%

YTD -12.71%

1,342.92

1D 0.07%

YTD -12.55%

312.74

1D 0.58%

YTD -34.02%

94.89

1D -0.12%

YTD -15.79%

227.44

1D 0.00%

YTD 0.00%

16,020.67

1D -20.24%

YTD -48.44%

Foreign investors were net buyers for the fourth consecutive session with a value of more than 227 billion dong. Foreign investors on HoSE saw a strong net buying of STB with 82.3 billion dong. DXG and DPM were net bought 69 billion dong and 67 billion dong respectively. On the other side, VCB was sold the most with 51 billion dong. VHM and VNM were net sold 45 billion dong and 32 billion dong respectively.

ETF & DERIVATIVES

22,450

1D 0.22%

YTD -13.09%

15,800

1D 0.51%

YTD -12.66%

16,470

1D -7.52%

YTD -13.32%

19,200

1D -1.03%

YTD -16.16%

17,350

1D -2.53%

YTD -22.82%

29,400

1D -0.27%

YTD 4.81%

16,500

1D -3.96%

YTD -23.18%

1,334

1D 0.19%

YTD 0.00%

1,334

1D 0.32%

YTD 0.00%

1,336

1D 0.35%

YTD 0.00%

1,335

1D 0.17%

YTD 0.00%

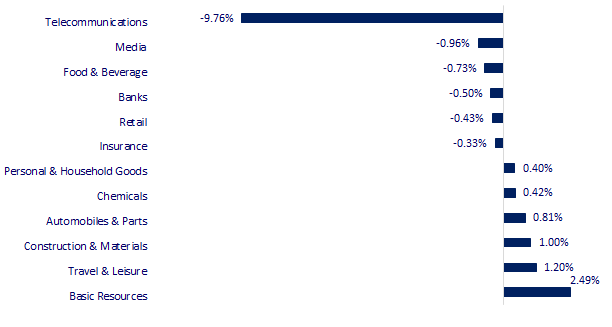

CHANGE IN PRICE BY SECTOR

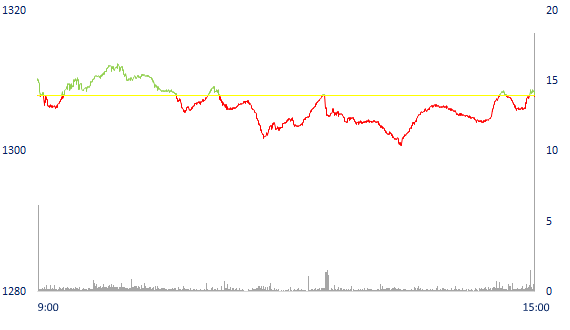

INTRADAY VNINDEX

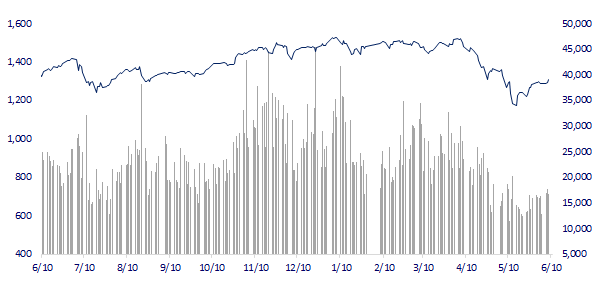

VNINDEX (12M)

GLOBAL MARKET

28,246.53

1D 0.00%

YTD -1.89%

3,238.95

1D -0.76%

YTD -11.01%

2,625.44

1D -0.03%

YTD -11.83%

21,869.05

1D -0.78%

YTD -6.53%

3,209.62

1D -0.50%

YTD 2.75%

1,641.34

1D 0.27%

YTD -0.98%

121.88

1D -0.49%

YTD 59.32%

1,851.10

1D -0.24%

YTD 1.66%

Asian stocks mostly fell on June 9. Traders await China's trade data, which is due to be released later today. In China, the Shanghai Composite Index fell 0.76%. Hong Kong's Hang Seng Index fell 0.78%. The Kospi (South Korea) index fell 0.03%.

VIETNAM ECONOMY

0.42%

YTD (bps) -39

5.60%

2.56%

1D (bps) 2

YTD (bps) 155

3.12%

1D (bps) -9

YTD (bps) 112

23,375

1D (%) 0.19%

YTD (%) 1.90%

25,263

1D (%) -1.20%

YTD (%) -4.55%

3,544

1D (%) 0.11%

YTD (%) -3.12%

According to a survey conducted by the German Chambers of Industry and Commerce with 4,200 German enterprises in 92 countries, 60.7% of German enterprises in Vietnam said that the production and business situation in Vietnam has not changed, 35.7% felt better and only 3.6% businesses had a decrease in activity.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Governor Nguyen Thi Hong: Do not let profiteering in the implementation of the 2% support package

- The Ministry of Finance continues to study and advise on tax reduction plans for gasoline

- German businesses are not satisfied with Vietnam's infrastructure

- Inflation in the euro area is the highest in history

- Ukraine stops exporting coal and gas

- Russia's May Inflation Drops

VN30

BANK

77,800

1D -1.77%

5D -1.52%

Buy Vol. 2,094,600

Sell Vol. 1,973,100

34,500

1D 0.58%

5D -0.58%

Buy Vol. 831,400

Sell Vol. 1,142,300

27,700

1D 0.00%

5D -0.18%

Buy Vol. 7,304,000

Sell Vol. 5,551,000

37,400

1D 0.40%

5D 2.75%

Buy Vol. 8,952,000

Sell Vol. 10,036,100

31,500

1D -0.94%

5D 4.13%

Buy Vol. 19,227,900

Sell Vol. 20,294,700

27,800

1D -0.54%

5D 2.21%

Buy Vol. 12,808,800

Sell Vol. 11,981,700

25,800

1D -0.58%

5D -0.77%

Buy Vol. 1,457,900

Sell Vol. 2,538,700

30,050

1D -0.66%

5D -6.09%

Buy Vol. 3,275,700

Sell Vol. 3,200,600

22,300

1D 3.24%

5D 3.48%

Buy Vol. 25,083,700

Sell Vol. 30,969,500

25,750

1D 0.19%

5D 1.58%

Buy Vol. 6,101,700

Sell Vol. 7,300,100

VCB: continues to announce the 15th auction of the debt of Viet Truong Son Co., Ltd. By the end of April 30, 2021, the total outstanding debt of Viet Truong Son is more than 33.3 billion VND, of which the principal is 12 billion dong, 21.3 billion dong of debt. The collateral for the debt includes land use rights and other assets attached to land in Da Lat city, Lam Dong province.

REAL ESTATE

76,500

1D 0.13%

5D -3.04%

Buy Vol. 3,371,400

Sell Vol. 3,239,900

41,050

1D -0.61%

5D 0.12%

Buy Vol. 1,273,900

Sell Vol. 1,415,100

53,200

1D 0.95%

5D -1.85%

Buy Vol. 2,361,700

Sell Vol. 2,471,000

NVL: Since the beginning of the year, Novaland has issued 5 bonds with a total value of VND7,057b. After the issuance, NVL's total debt increased from VND57,317b to VND63,091b.

OIL & GAS

127,600

1D -1.01%

5D 7.32%

Buy Vol. 2,374,300

Sell Vol. 2,314,300

15,900

1D 3.25%

5D 17.34%

Buy Vol. 70,225,800

Sell Vol. 61,535,100

46,900

1D 0.11%

5D 7.82%

Buy Vol. 1,417,500

Sell Vol. 1,739,900

POW: just announced May business results with a revenue of VND 2,433 billion, exceeding 26% of the monthly target and down 4% compared to the same period in 2021.

VINGROUP

78,100

1D 0.00%

5D -1.01%

Buy Vol. 2,700,700

Sell Vol. 3,062,500

68,300

1D -0.29%

5D -1.73%

Buy Vol. 5,049,700

Sell Vol. 6,609,400

30,900

1D 1.64%

5D 3.17%

Buy Vol. 2,453,300

Sell Vol. 2,888,000

VRE: may be sold 3 million shares by V.N.M ETF fund in the restructuring period from June 13-17, 2022

FOOD & BEVERAGE

70,200

1D -1.13%

5D -1.27%

Buy Vol. 1,972,700

Sell Vol. 2,234,100

118,500

1D -0.67%

5D 3.67%

Buy Vol. 1,199,300

Sell Vol. 1,285,300

157,000

1D -1.69%

5D 2.61%

Buy Vol. 244,500

Sell Vol. 253,500

MSN: Listing more than 7,083,207 ESOP shares, bringing the total number of outstanding shares to 1,423 million shares.

OTHERS

127,800

1D 0.63%

5D -0.70%

Buy Vol. 847,000

Sell Vol. 784,100

127,800

1D 0.63%

5D -0.70%

Buy Vol. 847,000

Sell Vol. 784,100

115,300

1D 0.26%

5D 3.41%

Buy Vol. 3,067,200

Sell Vol. 4,157,400

152,800

1D -0.39%

5D 4.13%

Buy Vol. 2,379,700

Sell Vol. 2,469,100

128,500

1D 0.39%

5D 4.30%

Buy Vol. 1,127,000

Sell Vol. 1,710,900

27,450

1D 1.48%

5D 6.40%

Buy Vol. 4,519,800

Sell Vol. 5,484,200

29,000

1D -1.02%

5D 0.00%

Buy Vol. 13,947,400

Sell Vol. 22,077,000

33,800

1D 2.74%

5D 1.96%

Buy Vol. 49,221,800

Sell Vol. 46,453,200

VJC: In order to prepare for the post-epidemic recovery plan, Vietjet has signed a strategic partnership agreement with Airbus Group on the implementation of the ordered aircraft contract, cooperation in developing the wide-body fleet, and many other supports after the pandemic. Vietjet has invested in a fleet of wide-body Airbus A330-300 under the low-cost aviation model, opening a new phase of developing longer-range routes.

Market by numbers

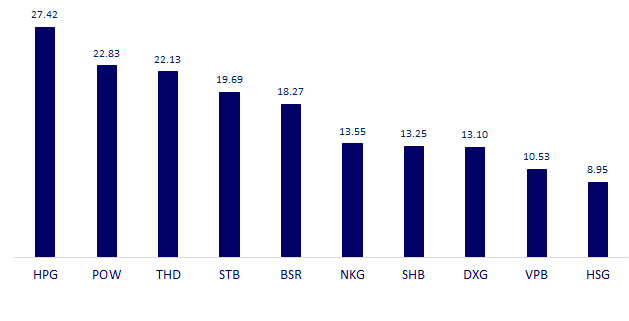

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

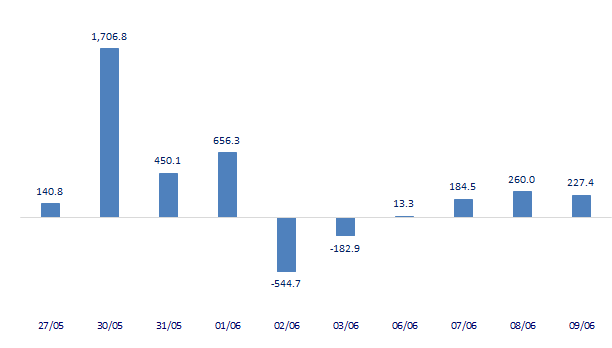

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

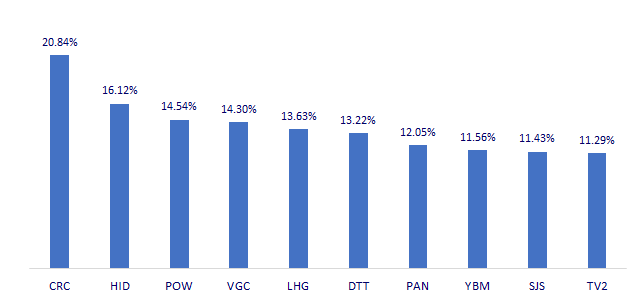

TOP INCREASES 3 CONSECUTIVE SESSIONS

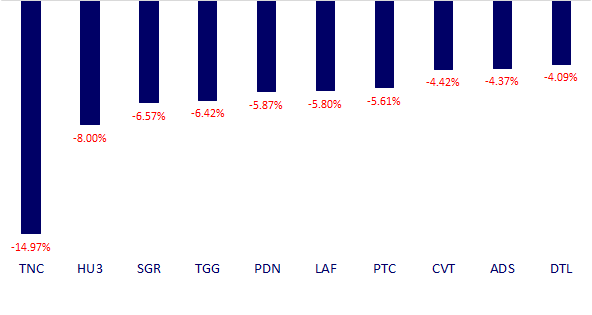

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.