Market brief 17/06/2022

VIETNAM STOCK MARKET

1,217.30

1D -1.56%

YTD -18.75%

1,258.03

1D -1.74%

YTD -18.08%

280.06

1D -2.68%

YTD -40.91%

87.10

1D -2.41%

YTD -22.70%

634.79

1D 0.00%

YTD 0.00%

20,425.20

1D 16.44%

YTD -34.26%

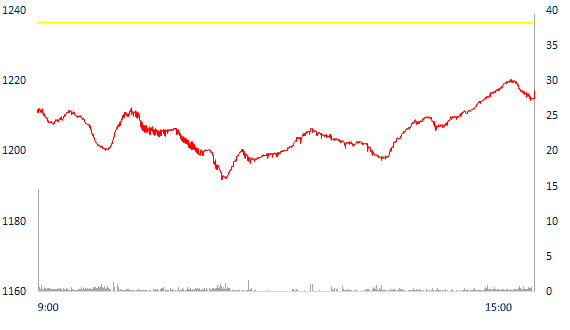

VN-Index dropped more than 19 points in the session of unstructured ETFs. Market liquidity increased compared to the previous session with a total matched value of 17,797 billion dong, up 11.3%, of which, matched value on HoSE alone increased by 13.2% to 15,637 billion dong. Foreign investors net bought nearly 635 billion dong.

ETF & DERIVATIVES

21,400

1D -2.28%

YTD -17.15%

14,840

1D -1.98%

YTD -17.97%

16,100

1D -9.60%

YTD -15.26%

17,600

1D -6.93%

YTD -23.14%

16,220

1D 0.00%

YTD -27.85%

27,730

1D -1.74%

YTD -1.14%

16,800

1D -0.24%

YTD -21.79%

1,244

1D -0.66%

YTD 0.00%

1,240

1D -1.59%

YTD 0.00%

1,244

1D -1.25%

YTD 0.00%

1,245

1D -3.17%

YTD 0.00%

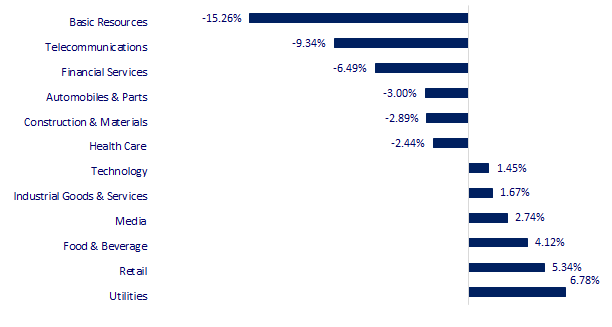

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

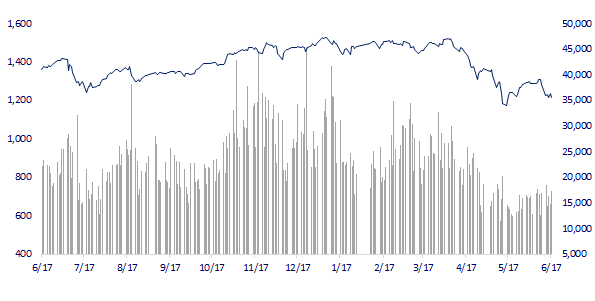

VNINDEX (12M)

GLOBAL MARKET

25,963.00

1D 0.51%

YTD -9.82%

3,316.79

1D 0.96%

YTD -8.87%

2,440.93

1D -0.43%

YTD -18.02%

21,075.00

1D 0.57%

YTD -9.93%

3,098.09

1D 0.02%

YTD -0.82%

1,559.39

1D -0.11%

YTD -5.93%

117.94

1D 0.90%

YTD 54.17%

1,849.45

1D 0.02%

YTD 1.57%

Asian stocks mixed after the decline of US stocks on June 17 session in the context of investors worried that the drastic tightening of monetary policy globally could drag the world economy into recession. withdrawal. In Japan, the Nikkei 225 index rose 0.51%. South Korea's Kospi index fell 0.43%. In China, the Shanghai Composite Index rose 0.96%. Hong Kong's Hang Seng Index rose 0.57%.

VIETNAM ECONOMY

0.37%

YTD (bps) -44

5.60%

2.53%

1D (bps) -7

YTD (bps) 152

3.12%

1D (bps) -3

YTD (bps) 112

23,460

1D (%) 0.36%

YTD (%) 2.27%

24,872

1D (%) -1.30%

YTD (%) -6.03%

3,536

1D (%) 0.00%

YTD (%) -3.34%

For the domestic market, the total retail sales of goods and services in May 2022 increased by 22.6%, the second consecutive month with a growth rate above double digits. Generally in 5 months, an increase of 9.7% over the same period last year, if excluding the price factor, the increase of 6.3% (the same period decreased by 1%).

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Import and export prospered, the whole country had 27 export products exceeding 1 billion USD

- Proposing to develop a law on regional minimum wages

- US enterprises "poured" 60 million USD into Da Nang Hi-tech Park

- The Bank of England continues to raise interest rates for the 5th time in a row

- US strengthens sanctions on Iran, oil prices increase

- Fed lowers US economic forecast after unusual rate hike decision

VN30

BANK

76,100

1D -3.79%

5D -2.06%

Buy Vol. 2,024,100

Sell Vol. 1,868,400

31,600

1D -2.17%

5D -6.51%

Buy Vol. 2,054,700

Sell Vol. 2,152,900

23,550

1D -4.66%

5D -13.10%

Buy Vol. 7,187,700

Sell Vol. 6,330,900

34,500

1D -4.30%

5D -9.09%

Buy Vol. 7,895,600

Sell Vol. 8,275,500

27,900

1D -3.79%

5D -9.71%

Buy Vol. 22,460,800

Sell Vol. 20,577,600

23,300

1D -6.43%

5D -15.27%

Buy Vol. 28,643,500

Sell Vol. 27,380,700

24,600

1D -1.40%

5D -5.02%

Buy Vol. 3,592,300

Sell Vol. 3,390,200

25,500

1D -4.85%

5D -14.14%

Buy Vol. 5,269,100

Sell Vol. 4,867,000

20,250

1D -3.57%

5D -7.53%

Buy Vol. 24,997,100

Sell Vol. 21,080,100

23,100

1D -4.15%

5D -8.33%

Buy Vol. 5,727,600

Sell Vol. 4,646,000

BID: BIDV announces the auction of assets of Ninh Thuan Agricultural Products Export Joint Stock Company (Nitagrex). The bank said that as of February 22, 2019, the total outstanding debt of businesses at BIDV Ninh Thuan branch was more than 103 billion VND, of which the principal debt was 80.3 billion VND, the rest was interest and penalty interest. The starting price BIDV offered for sale was 45 billion dong, equal to 56% of the original debt of the enterprise at the bank. This debt has been offered for sale by BIDV since 2019 but has not yet recorded the transaction results.

REAL ESTATE

75,700

1D -2.32%

5D -1.69%

Buy Vol. 4,105,100

Sell Vol. 5,549,800

39,000

1D -0.26%

5D -4.76%

Buy Vol. 1,509,300

Sell Vol. 1,151,600

50,300

1D -0.98%

5D -4.55%

Buy Vol. 2,431,900

Sell Vol. 2,531,100

PDR: Proposing research and survey to finance the planning of urban areas in Di Linh town and Gung Re commune, Lam Dong province with an area of 318 hectares.

OIL & GAS

134,000

1D 4.69%

5D 12.89%

Buy Vol. 3,162,400

Sell Vol. 2,642,400

16,100

1D 4.55%

5D 7.33%

Buy Vol. 78,688,000

Sell Vol. 76,657,600

41,900

1D -0.36%

5D -6.89%

Buy Vol. 2,177,400

Sell Vol. 2,040,500

PLX: Expected 5-month accumulated pre-tax profit is about 1,340 billion VND, fulfilling 44% of the year plan and the ability to achieve the production plan progress.

VINGROUP

76,600

1D 0.00%

5D -1.79%

Buy Vol. 5,253,300

Sell Vol. 4,928,700

66,000

1D 0.00%

5D -3.37%

Buy Vol. 4,591,700

Sell Vol. 4,734,600

29,350

1D 0.51%

5D -3.77%

Buy Vol. 3,938,600

Sell Vol. 4,450,000

VHM: Vinhomes clearly classifies 3 social housing prices, corresponding to the selling price of VND 300 million, VND 400-700 million and VND 950 million.

FOOD & BEVERAGE

66,700

1D -1.91%

5D -4.03%

Buy Vol. 4,792,600

Sell Vol. 4,082,900

117,000

1D 5.69%

5D 0.00%

Buy Vol. 2,711,200

Sell Vol. 2,315,300

156,000

1D -0.26%

5D -1.08%

Buy Vol. 240,500

Sell Vol. 296,900

VNM: Announced 7/7 is the last registration date to make a list of shareholders to pay the remaining dividend of 2021 (rate 9.5%) and advance the first dividend of 2022 (ratio 15 %)

OTHERS

124,900

1D -0.40%

5D -2.19%

Buy Vol. 741,300

Sell Vol. 951,200

124,900

1D -0.40%

5D -2.19%

Buy Vol. 741,300

Sell Vol. 951,200

92,000

1D 0.00%

5D 1.28%

Buy Vol. 4,724,600

Sell Vol. 4,126,500

77,700

1D -1.65%

5D 3.60%

Buy Vol. 6,316,100

Sell Vol. 6,913,000

122,000

1D 0.16%

5D 1.08%

Buy Vol. 2,993,500

Sell Vol. 2,072,500

22,700

1D -3.40%

5D -13.03%

Buy Vol. 3,949,800

Sell Vol. 2,911,400

20,600

1D -7.00%

5D -26.03%

Buy Vol. 26,091,700

Sell Vol. 34,636,800

23,200

1D -1.11%

5D -8.76%

Buy Vol. 45,642,700

Sell Vol. 52,300,000

FPT: just announced business results for the first 5 months of the year with net revenue of VND 16,227 billion, profit after tax of VND 2,598 billion; respectively increased 22.2% and 30.6% over the same period last year. In May, the company's revenue reached VND 3,236 billion, up 13.6% compared to May 2021; profit after tax increased by 25.1% to 517 billion dong.

Market by numbers

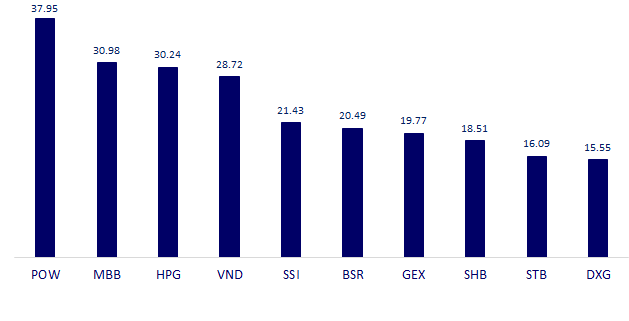

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

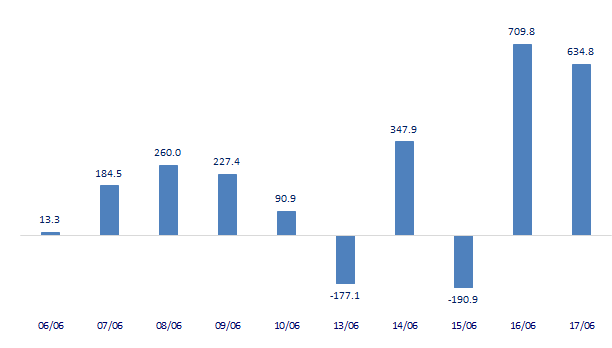

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

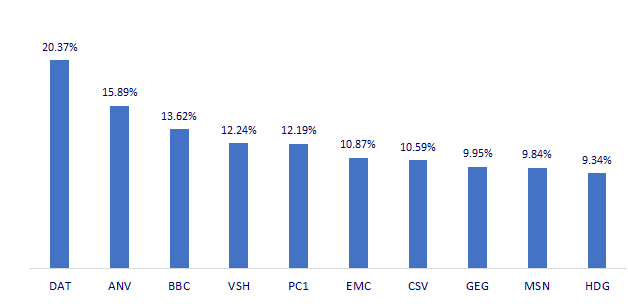

TOP INCREASES 3 CONSECUTIVE SESSIONS

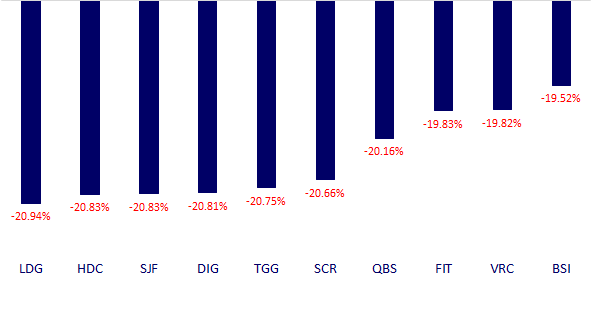

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.