Market brief 20/06/2022

VIETNAM STOCK MARKET

1,180.40

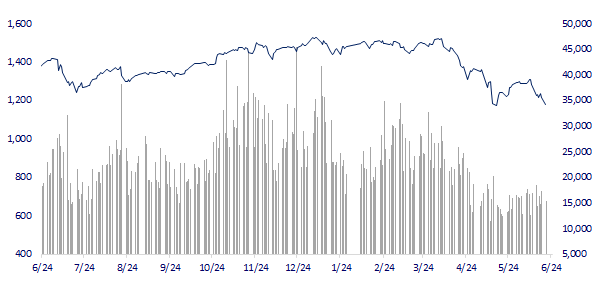

1D -3.03%

YTD -21.22%

1,225.56

1D -2.58%

YTD -20.20%

267.92

1D -4.33%

YTD -43.48%

85.44

1D -1.91%

YTD -24.17%

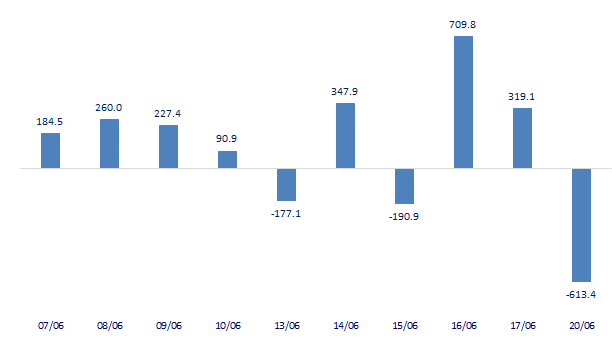

-613.40

1D 0.00%

YTD 0.00%

19,943.73

1D -2.35%

YTD -35.81%

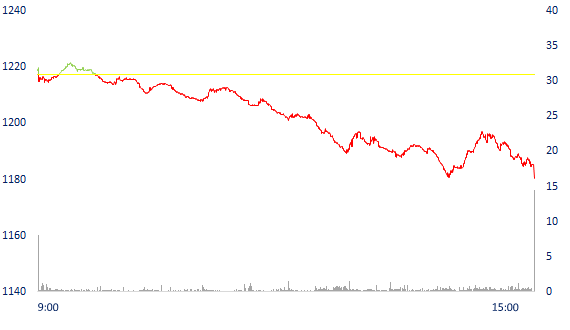

A series of stocks hit the floor, VN-Index dropped nearly 37 points. Market liquidity decreased compared to last Friday session. The total matched value reached 17,071 billion dong, down 4%, of which, the matched value on HoSE alone decreased by 5.8% to 14,734 billion dong. Foreign investors net sold 600 billion dong on HoSE.

ETF & DERIVATIVES

20,710

1D -3.22%

YTD -19.82%

14,540

1D -2.02%

YTD -19.62%

15,000

1D -15.78%

YTD -21.05%

16,470

1D -6.42%

YTD -28.08%

15,200

1D -6.29%

YTD -32.38%

27,050

1D -2.45%

YTD -3.57%

15,860

1D -5.60%

YTD -26.16%

1,220

1D -1.96%

YTD 0.00%

1,216

1D -1.91%

YTD 0.00%

1,218

1D -2.07%

YTD 0.00%

1,212

1D -2.67%

YTD 0.00%

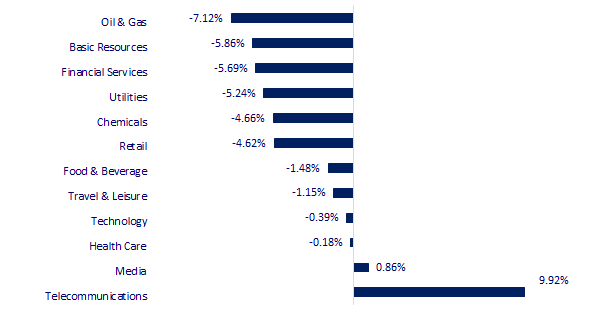

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

25,771.22

1D 0.56%

YTD -10.49%

3,315.43

1D -0.04%

YTD -8.91%

2,391.03

1D -2.04%

YTD -19.70%

21,163.91

1D 0.94%

YTD -9.55%

3,096.40

1D -0.05%

YTD -0.87%

1,559.21

1D -0.01%

YTD -5.94%

108.25

1D 0.74%

YTD 41.50%

1,841.75

1D 0.00%

YTD 1.15%

Asian stocks fell, China kept interest rates unchanged. In South Korea, the Kospi index fell 2.04%, leading the decline in the region. Chinese stocks were mixed as the Shanghai Composite Index fell 0.041%. Hong Kong's Hang Seng Index rebounded 0.94%. Japan's Nikkei 225 index rose 0.56%.

VIETNAM ECONOMY

0.37%

YTD (bps) -44

5.60%

2.62%

1D (bps) 9

YTD (bps) 161

3.17%

1D (bps) 5

YTD (bps) 117

23,447

1D (%) 0.29%

YTD (%) 2.21%

24,903

1D (%) -0.90%

YTD (%) -5.91%

3,542

1D (%) 0.34%

YTD (%) -3.17%

Data just released by the General Department of Customs shows that Vietnam had a trade deficit of 1.7 billion USD in May and a trade surplus of 434 million USD after 5 months. In May, export turnover reached 30.92 billion USD, down 7.2% compared to the previous month. Meanwhile, if in 5 months, export turnover reached 153.29 billion USD, up 16.7% over the same period.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- General Department of Customs: Trade balance deficit of 1.7 billion USD in May

- Deputy Governor Dao Minh Tu: The State Bank of Vietnam continues to keep the operating interest rates unchanged

- Proposal to reduce environmental protection tax in order to reduce gasoline prices, budget deficit immediately 1,400 billion VND

- Controversial low interest rate policy in Japan

- Finance Minister Janet Yellen is confident in the US economy's ability to "avoid" a recession

- A tumultuous summer in Europe

VN30

BANK

76,000

1D -0.13%

5D -0.52%

Buy Vol. 1,913,800

Sell Vol. 2,378,800

29,500

1D -6.65%

5D -7.67%

Buy Vol. 1,190,600

Sell Vol. 1,766,700

22,600

1D -4.03%

5D -10.50%

Buy Vol. 6,499,300

Sell Vol. 7,995,500

33,000

1D -4.35%

5D -8.33%

Buy Vol. 5,942,700

Sell Vol. 6,496,200

27,100

1D -2.87%

5D -5.74%

Buy Vol. 14,537,300

Sell Vol. 13,829,900

22,500

1D -3.43%

5D -12.28%

Buy Vol. 15,692,300

Sell Vol. 15,244,600

23,750

1D -3.46%

5D -3.26%

Buy Vol. 2,376,200

Sell Vol. 3,818,700

25,050

1D -1.76%

5D -9.40%

Buy Vol. 5,207,700

Sell Vol. 6,080,000

18,850

1D -6.91%

5D -8.50%

Buy Vol. 27,718,700

Sell Vol. 26,309,000

22,900

1D -0.87%

5D -4.18%

Buy Vol. 6,506,200

Sell Vol. 6,507,200

SBV leaders said that after the Fed adjusted interest rates on June 15 with the largest adjustment since 1994, the domestic market fluctuated very slightly, deposit and lending interest rates remained stable.

REAL ESTATE

75,500

1D -0.26%

5D -0.66%

Buy Vol. 3,843,300

Sell Vol. 4,976,400

38,550

1D -1.15%

5D -3.38%

Buy Vol. 1,200,100

Sell Vol. 1,556,300

49,900

1D -0.80%

5D -0.20%

Buy Vol. 2,218,500

Sell Vol. 2,448,900

KDH: From May 19 to June 17, VinaCapital sold 13,600 KDH units, reducing its ownership to 131,000 shares.

OIL & GAS

124,700

1D -6.94%

5D 5.68%

Buy Vol. 2,474,100

Sell Vol. 3,529,400

15,000

1D -6.83%

5D -1.64%

Buy Vol. 46,177,700

Sell Vol. 63,761,600

39,250

1D -6.32%

5D -6.55%

Buy Vol. 1,899,700

Sell Vol. 2,269,300

PLX: Due to high gasoline prices, most of the stabilization funds of petroleum trading units are negative. Petrolimex's stabilization fund as of June 13, 2022 was negative 49 billion dong.

VINGROUP

75,600

1D -1.31%

5D -1.05%

Buy Vol. 2,909,600

Sell Vol. 3,829,800

65,000

1D -1.52%

5D -1.52%

Buy Vol. 4,052,200

Sell Vol. 4,880,900

28,700

1D -2.21%

5D -1.03%

Buy Vol. 3,166,600

Sell Vol. 3,585,000

VIC: Audited financial statements for 2021, VIC made a provision of VND 4,494 billion to pay for fees due to contract termination related to the decision to stop producing petrol cars

FOOD & BEVERAGE

69,000

1D 3.45%

5D 3.92%

Buy Vol. 4,763,000

Sell Vol. 4,194,700

111,000

1D -5.13%

5D 1.83%

Buy Vol. 1,116,800

Sell Vol. 1,634,400

152,000

1D -2.56%

5D -0.65%

Buy Vol. 96,900

Sell Vol. 127,700

VNM: Vinamilk is the only representative from Southeast Asia to share the sustainable development model "Green Farm" at the Global Dairy Conference

OTHERS

127,000

1D 1.68%

5D 1.68%

Buy Vol. 995,100

Sell Vol. 990,800

127,000

1D 1.68%

5D 1.68%

Buy Vol. 995,100

Sell Vol. 990,800

92,000

1D 0.00%

5D 6.73%

Buy Vol. 3,973,900

Sell Vol. 4,774,200

73,900

1D -4.89%

5D 5.57%

Buy Vol. 6,604,000

Sell Vol. 7,212,600

118,000

1D -3.28%

5D 5.08%

Buy Vol. 1,378,900

Sell Vol. 1,570,000

21,800

1D -3.96%

5D -10.29%

Buy Vol. 4,068,000

Sell Vol. 4,096,200

19,200

1D -6.80%

5D -26.01%

Buy Vol. 24,313,100

Sell Vol. 37,372,900

21,600

1D -6.90%

5D -10.25%

Buy Vol. 44,429,300

Sell Vol. 53,572,300

MWG: Mobile World's TopZone brand (authorized retailer of genuine Apple products in Vietnam) has just opened its 50th store after nearly 8 months of launch. These stores are present in big cities such as Ho Chi Minh City, Hanoi... and expand to Dak Lak, Kien Giang, Can Tho... TopZone aims to have 200 stores nationwide by the end of this year. Currently, the revenue of each TopZone store is 6 - 8 billion VND a month, even some stores have maintained a revenue of 10 billion VND a month.

Market by numbers

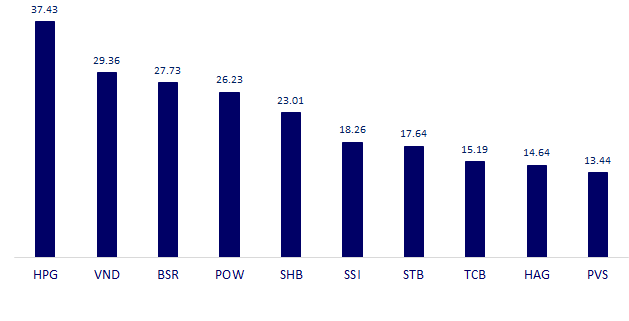

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

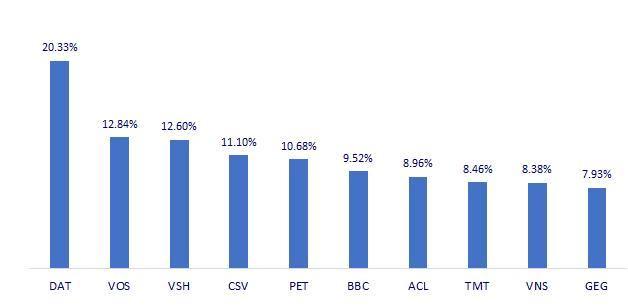

TOP INCREASES 3 CONSECUTIVE SESSIONS

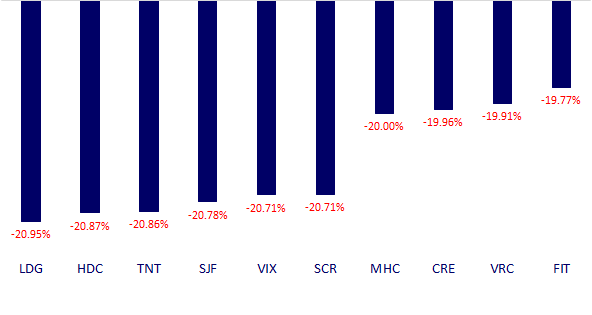

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.