Market brief 21/06/2022

VIETNAM STOCK MARKET

1,172.47

1D -0.67%

YTD -21.75%

1,224.54

1D -0.08%

YTD -20.26%

264.62

1D -1.23%

YTD -44.17%

85.03

1D -0.48%

YTD -24.54%

376.77

1D 0.00%

YTD 0.00%

18,741.44

1D -6.03%

YTD -39.68%

Foreign investors net bought back 377 billion dong in the session of June 21. On HoSE , they were the strongest net buyers of VNM with 150 billion dong. Following that, REE and GAS were net bought at 83 billion dong and 69 billion dong respectively. On the other hand, HPG topped the list of foreign investors' net selling on HoSE with 214 billion dong. VND and MWG were net sold 55 billion dong and 32 billion dong respectively.

ETF & DERIVATIVES

20,600

1D -0.53%

YTD -20.25%

14,450

1D -0.62%

YTD -20.12%

15,130

1D -15.05%

YTD -20.37%

17,620

1D 6.98%

YTD -23.06%

15,350

1D 0.99%

YTD -31.72%

26,900

1D -0.55%

YTD -4.10%

15,500

1D -2.27%

YTD -27.84%

1,224

1D 0.39%

YTD 0.00%

1,225

1D 0.71%

YTD 0.00%

1,225

1D 0.56%

YTD 0.00%

1,228

1D 1.32%

YTD 0.00%

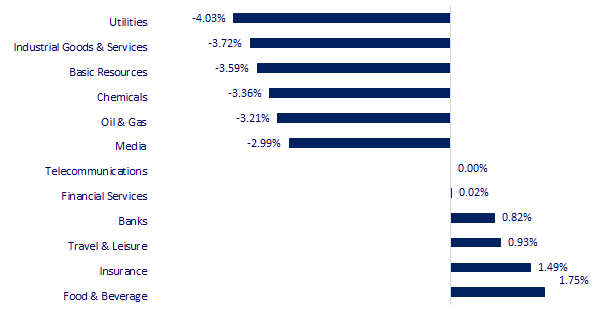

CHANGE IN PRICE BY SECTOR

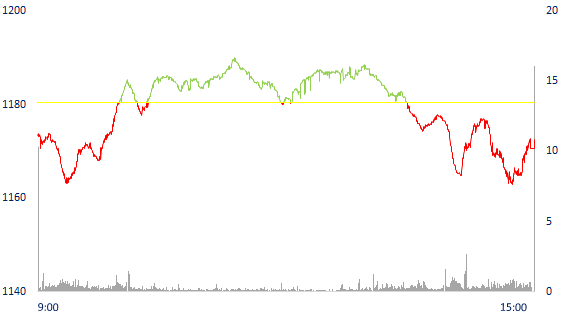

INTRADAY VNINDEX

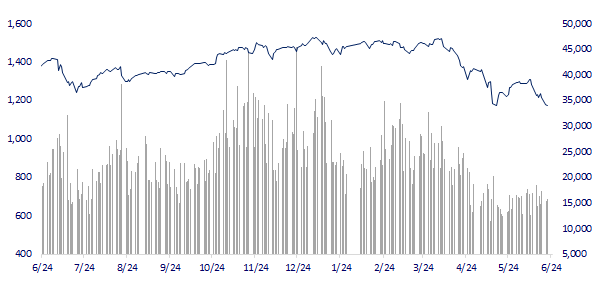

VNINDEX (12M)

GLOBAL MARKET

26,246.31

1D 1.84%

YTD -8.84%

3,306.72

1D -0.26%

YTD -9.15%

2,408.93

1D 0.75%

YTD -19.10%

21,559.59

1D 1.87%

YTD -7.86%

3,117.48

1D 0.68%

YTD -0.20%

1,574.52

1D 0.98%

YTD -5.01%

109.83

1D -0.51%

YTD 43.57%

1,835.30

1D -0.42%

YTD 0.80%

Asian stocks mixed in the session on June 21. The Reserve Bank of Australia (RBA) forecasts that inflation will peak later this year. In Japan, the Nikkei 225 index rose 1.84%. South Korea's Kospi index rose 0.75%. In China, the Shanghai Composite Index fell 0.26%. The Hang Seng Index increased by 1.87%, the strongest increase in the region.

VIETNAM ECONOMY

0.37%

YTD (bps) -44

5.60%

2.62%

YTD (bps) 161

3.17%

YTD (bps) 117

23,455

1D (%) 0.38%

YTD (%) 2.24%

24,958

1D (%) -0.96%

YTD (%) -5.71%

3,539

1D (%) -0.06%

YTD (%) -3.25%

According to the Association of Seafood Exporters and Producers (VASEP), in the first five months of the year, pangasius export turnover reached $1.2 billion, up nearly 90% over the same period last year. With this growth momentum, VASEP believes that pangasius exports in 2022 can reach $2.6 billion, up 62.5% compared to the target of $1.6 billion set at the beginning of 2022.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Pangasius exports are on a strong recovery momentum, forecast to reach $2.6 billion in 2022

- Vietnam's public debt will not exceed 60% of GDP by 2030

- International flight passengers skyrocketed by more than 45% after 1 month

- 15 EU member states call for promotion of free trade agreements

- Inflation in the EU hit a new record

- Germany is about to bring coal plants back as Russia cuts off gas supplies

VN30

BANK

77,700

1D 2.24%

5D 0.91%

Buy Vol. 1,582,000

Sell Vol. 1,698,000

30,300

1D 2.71%

5D -6.19%

Buy Vol. 2,279,200

Sell Vol. 2,060,200

23,050

1D 1.99%

5D -8.71%

Buy Vol. 7,532,600

Sell Vol. 7,392,300

33,000

1D 0.00%

5D -7.69%

Buy Vol. 6,827,400

Sell Vol. 7,983,700

27,200

1D 0.37%

5D -5.72%

Buy Vol. 11,579,100

Sell Vol. 10,793,900

22,450

1D -0.22%

5D -11.96%

Buy Vol. 12,521,500

Sell Vol. 10,391,800

23,600

1D -0.63%

5D -5.22%

Buy Vol. 2,578,300

Sell Vol. 2,608,500

25,650

1D 2.40%

5D -3.21%

Buy Vol. 4,837,600

Sell Vol. 4,864,800

19,200

1D 1.86%

5D -8.13%

Buy Vol. 19,454,200

Sell Vol. 17,790,400

23,000

1D 0.44%

5D -4.56%

Buy Vol. 6,027,600

Sell Vol. 4,067,100

TCB: has just successfully raised a syndicated loan worth up to 1 billion USD, marking a new milestone in the bank's foreign capital mobilization. To date, this is the largest medium and long-term credit of a Vietnamese financial institution in the international capital market. This is the third time Techcombank has approached the foreign capital market, after completing the first loan of $500 million in 2020 and a second loan of $800 million in 2021.

REAL ESTATE

75,500

1D 0.00%

5D -1.44%

Buy Vol. 2,959,400

Sell Vol. 4,475,200

38,650

1D 0.26%

5D -0.90%

Buy Vol. 995,800

Sell Vol. 1,434,600

50,500

1D 1.20%

5D 1.20%

Buy Vol. 2,516,300

Sell Vol. 2,332,300

Ninh Binh Department of Planning and Investment is looking for investors for Yen Binh urban area project. Land area of 49.9 ha with 1,114 lots of adjacent houses, 89 lots of houses and villas.

OIL & GAS

119,500

1D -4.17%

5D -5.16%

Buy Vol. 3,402,800

Sell Vol. 4,103,500

13,950

1D -7.00%

5D -8.52%

Buy Vol. 48,435,000

Sell Vol. 74,405,900

39,000

1D -0.64%

5D -9.51%

Buy Vol. 1,102,800

Sell Vol. 1,296,100

PLX: Vietnam's gasoline price is the 84th lowest in the world, higher than gasoline prices in the US, Japan, Australia, and Indonesia, ranking third in Southeast Asia

VINGROUP

75,000

1D -0.79%

5D -2.09%

Buy Vol. 2,517,500

Sell Vol. 3,246,000

65,000

1D 0.00%

5D -1.52%

Buy Vol. 3,865,900

Sell Vol. 4,569,600

28,000

1D -2.44%

5D -3.95%

Buy Vol. 3,459,500

Sell Vol. 3,728,700

VIC: In 2022, VinFast continues to hand over the VF e34 to customers in the Vietnam market and prepares for the handover of VF 8, VF 9 to the global market from the end of the year.

FOOD & BEVERAGE

73,700

1D 6.81%

5D 11.50%

Buy Vol. 7,915,900

Sell Vol. 6,298,900

111,000

1D 0.00%

5D 4.42%

Buy Vol. 1,280,500

Sell Vol. 1,602,400

155,000

1D 1.97%

5D 3.33%

Buy Vol. 292,300

Sell Vol. 296,500

MSN: Masan Group has closed the right to advance cash dividend at the rate of 8%. With 1.4 billion shares outstanding, the group plans to spend 1,120 billion dong to pay this dividend.

OTHERS

127,800

1D 0.63%

5D 2.40%

Buy Vol. 857,800

Sell Vol. 900,600

127,800

1D 0.63%

5D 2.40%

Buy Vol. 857,800

Sell Vol. 900,600

89,100

1D -3.15%

5D 0.00%

Buy Vol. 3,857,600

Sell Vol. 5,765,600

73,500

1D -0.54%

5D 2.44%

Buy Vol. 5,142,800

Sell Vol. 7,665,100

119,800

1D 1.53%

5D 3.28%

Buy Vol. 3,339,500

Sell Vol. 2,358,700

21,700

1D -0.46%

5D -12.32%

Buy Vol. 4,186,800

Sell Vol. 3,620,600

18,300

1D -4.69%

5D -24.85%

Buy Vol. 59,971,400

Sell Vol. 51,588,500

20,800

1D -3.70%

5D -9.29%

Buy Vol. 53,497,200

Sell Vol. 57,514,800

PNJ: announced May net revenue of 2,671 billion dong, up 68% over the same period last year; profit after tax is 141 billion dong, up 66%. PNJ said this result came from the ability to improvise and the efforts of the staff in the context of the general decline in the purchasing power of the retail industry. Accumulated 5 months, net revenue reached 15,583 billion, up 47%; profit after tax is 1,066 billion dong, up 47%. The company fulfilled 60.3% of the revenue plan and 76.5% of the year profit plan.

Market by numbers

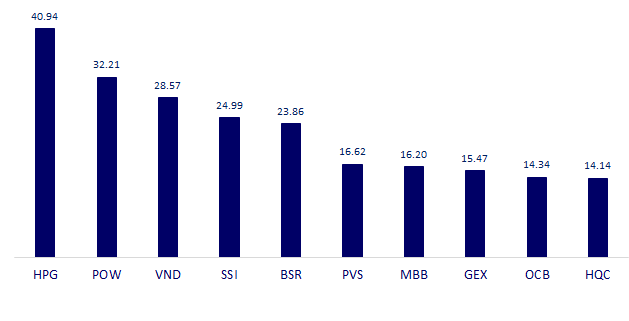

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

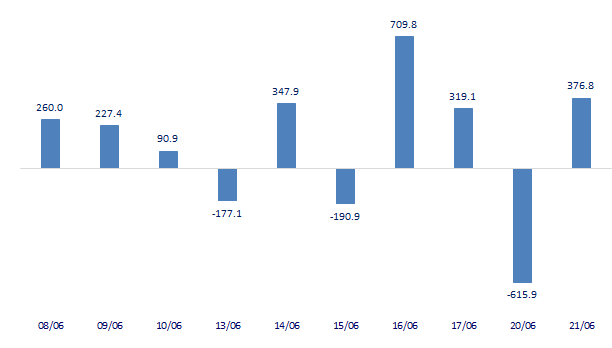

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

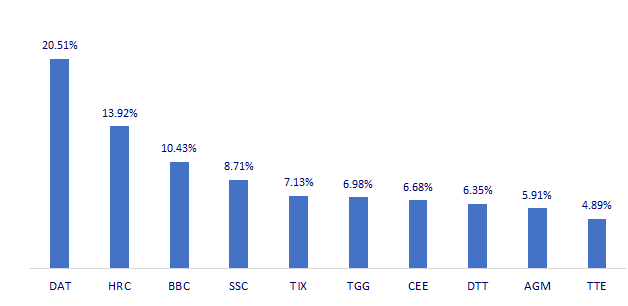

TOP INCREASES 3 CONSECUTIVE SESSIONS

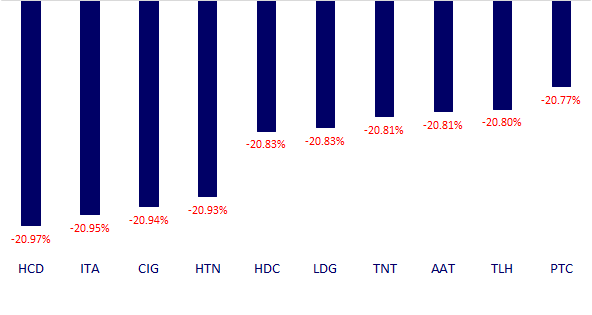

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.