Morning brief 22/06/2022

VIETNAM STOCK MARKET

1,169.27

1D -0.27%

YTD -21.96%

1,227.18

1D 0.22%

YTD -20.09%

269.39

1D 1.80%

YTD -43.17%

85.63

1D 0.71%

YTD -24.01%

56.09

1D 0.00%

YTD 0.00%

16,034.99

1D -14.44%

YTD -48.39%

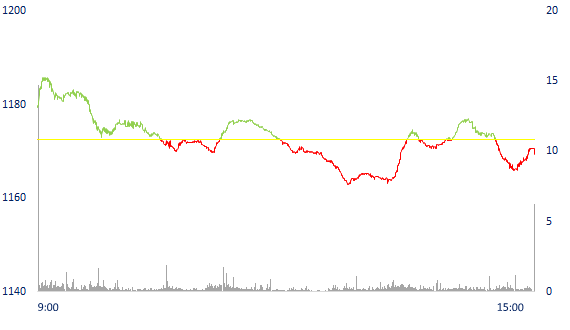

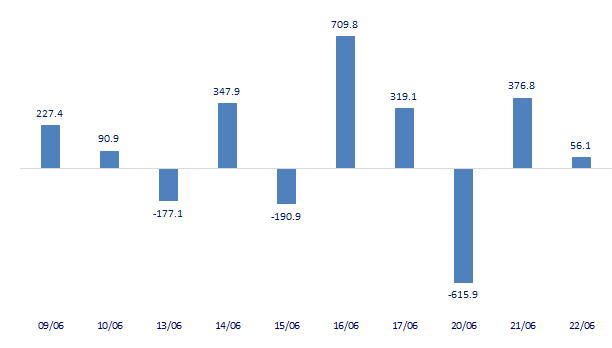

Banking, real estate and securities stocks raced to the ceiling. Market liquidity decreased compared to the previous session. The total matched value reached VND 14,200 billion, down 9.9%, of which, the matched value on HoSE alone decreased by 12.3% to VND 11,914 billion. Foreign investors net bought about 56 billion dong.

ETF & DERIVATIVES

20,900

1D 1.46%

YTD -19.09%

14,510

1D 0.42%

YTD -19.79%

15,210

1D -14.60%

YTD -19.95%

17,650

1D 0.17%

YTD -22.93%

15,400

1D 0.33%

YTD -31.49%

26,980

1D 0.30%

YTD -3.81%

15,390

1D -0.71%

YTD -28.35%

1,220

1D -0.36%

YTD 0.00%

1,220

1D -0.43%

YTD 0.00%

1,220

1D -0.40%

YTD 0.00%

1,216

1D -0.98%

YTD 0.00%

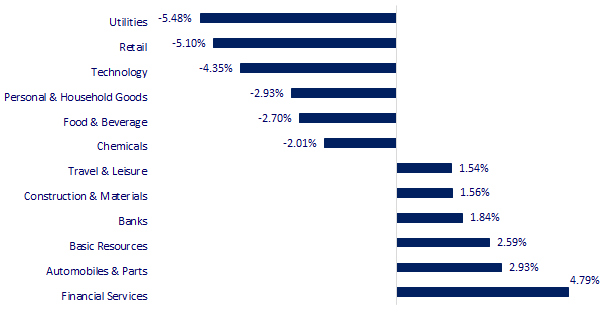

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

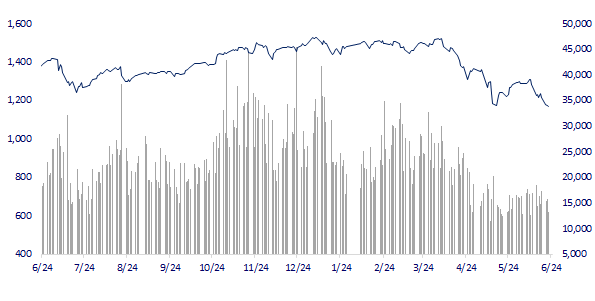

VNINDEX (12M)

GLOBAL MARKET

26,149.55

1D -0.02%

YTD -9.18%

3,267.20

1D -1.20%

YTD -10.24%

2,342.81

1D -2.74%

YTD -21.32%

21,008.34

1D -1.66%

YTD -10.21%

3,093.31

1D -0.78%

YTD -0.97%

1,560.02

1D -0.92%

YTD -5.89%

104.56

1D -2.36%

YTD 36.68%

1,833.95

1D 0.20%

YTD 0.72%

Asian stocks fall, BoJ favors ultra-low interest rate policy. In Japan, the Nikkei 225 index fell 0.02%. Korean stocks fell the most in the region. The Kospi index fell 2.74%. Chinese stocks were also in the red. The Shanghai Composite Index fell 1.2% to 3,267.20 points. Hong Kong's Hang Seng Index fell 1.66%.

VIETNAM ECONOMY

0.37%

YTD (bps) -44

5.60%

2.62%

YTD (bps) 161

3.17%

YTD (bps) 117

23,460

1D (%) 0.37%

YTD (%) 2.27%

24,888

1D (%) -0.99%

YTD (%) -5.97%

3,531

1D (%) 0.03%

YTD (%) -3.47%

The trading session on June 21 witnessed a remarkable move for the Vietnamese financial system when the State Bank (SBV) officially returned to the treasury bill channel after 2 consecutive years of being frozen. Accordingly, the State Bank sold 200 billion dong of 7-day bills at an interest rate of 0.3% per year, equivalent to a net withdrawal of 200 billion dong through this channel.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Ho Chi Minh City calls for investment in 197 projects in 2022

- The State Bank of Vietnam restarts the money-sucking channel after two years of freezing

- Removing obstacles in the implementation of reducing VAT to 8%

- UK inflation hit 9.1%

- Reuters: Fed may raise interest rates 75 basis points in July

- EC President warns EU not to return to coal use

VN30

BANK

76,000

1D -2.19%

5D -0.65%

Buy Vol. 1,668,100

Sell Vol. 1,965,600

30,500

1D 0.66%

5D -4.69%

Buy Vol. 2,400,900

Sell Vol. 2,278,900

23,600

1D 2.39%

5D -3.67%

Buy Vol. 5,124,800

Sell Vol. 5,250,500

34,800

1D 5.45%

5D -2.52%

Buy Vol. 10,402,900

Sell Vol. 8,826,200

28,400

1D 4.41%

5D -1.56%

Buy Vol. 12,323,400

Sell Vol. 11,010,600

23,450

1D 4.45%

5D -5.82%

Buy Vol. 17,711,200

Sell Vol. 14,607,000

23,600

1D 0.00%

5D -3.67%

Buy Vol. 2,039,000

Sell Vol. 2,570,100

26,200

1D 2.14%

5D -1.32%

Buy Vol. 2,658,500

Sell Vol. 3,083,000

20,500

1D 6.77%

5D -0.97%

Buy Vol. 24,644,600

Sell Vol. 17,959,600

23,750

1D 3.26%

5D 0.64%

Buy Vol. 5,806,700

Sell Vol. 3,962,700

ACB: ACB has risen and ranked first in terms of premiums (APE) in the first 4 months with a total APE premium of 565 billion dong. In 2021, the bank ranked 5th in terms of insurance premium revenue of about 1,300 billion VND. ACB signed a 15-year exclusive bancassurance contract with Sun Life in 2020

REAL ESTATE

75,500

1D 0.00%

5D -1.18%

Buy Vol. 3,078,800

Sell Vol. 4,017,500

38,500

1D -0.39%

5D 1.05%

Buy Vol. 855,300

Sell Vol. 1,000,800

51,800

1D 2.57%

5D 6.15%

Buy Vol. 2,881,400

Sell Vol. 2,704,000

NVL: Novaland implemented a stock bonus at the rate of 24.5% to increase capital to nearly 24,300 billion dong. Accordingly, NVL will issue nearly 477.7 million new shares.

OIL & GAS

111,200

1D -6.95%

5D -10.32%

Buy Vol. 2,508,200

Sell Vol. 3,727,200

13,000

1D -6.81%

5D -10.34%

Buy Vol. 56,231,600

Sell Vol. 72,401,600

39,500

1D 1.28%

5D -3.66%

Buy Vol. 1,041,800

Sell Vol. 1,172,500

PLX: belongs to the group will arrange to reduce the state ownership from 51-65% in period of 2021-2025. Based on the new guidance, the group will soon have a plan to reduce it below 65%.

VINGROUP

75,000

1D 0.00%

5D -2.22%

Buy Vol. 2,180,500

Sell Vol. 2,856,500

64,800

1D -0.31%

5D -1.67%

Buy Vol. 4,697,600

Sell Vol. 6,314,800

28,500

1D 1.79%

5D -1.38%

Buy Vol. 1,911,300

Sell Vol. 2,112,600

VIC: VinFast is ambitious to deliver 1 million electric cars globally in the next 5 years. VinFast may start building a factory in North Carolina in September this year.

FOOD & BEVERAGE

70,600

1D -4.21%

5D 9.46%

Buy Vol. 3,373,100

Sell Vol. 4,812,700

106,000

1D -4.50%

5D 0.00%

Buy Vol. 1,212,400

Sell Vol. 1,453,900

156,000

1D 0.65%

5D 2.63%

Buy Vol. 198,600

Sell Vol. 302,400

MSN: Saving on selling and administrative expenses and increasing gross profit margin is the key to making WinCommerce very close to the break-even point at the end of 2021.

OTHERS

129,300

1D 1.17%

5D 3.86%

Buy Vol. 1,115,800

Sell Vol. 1,124,700

129,300

1D 1.17%

5D 3.86%

Buy Vol. 1,115,800

Sell Vol. 1,124,700

84,500

1D -5.16%

5D -6.63%

Buy Vol. 4,238,300

Sell Vol. 5,012,800

69,800

1D -5.03%

5D -5.48%

Buy Vol. 6,330,400

Sell Vol. 8,241,000

116,000

1D -3.17%

5D -1.69%

Buy Vol. 1,922,100

Sell Vol. 1,915,600

21,800

1D 0.46%

5D -5.42%

Buy Vol. 2,610,500

Sell Vol. 2,395,900

17,700

1D 7.06%

5D -13.50%

Buy Vol. 34,340,600

Sell Vol. 12,083,300

21,500

1D 3.37%

5D -3.37%

Buy Vol. 35,723,300

Sell Vol. 31,880,500

HPG: To imagine the fierce fall of the leading steel stock, the $5.6 billion loss that Hoa Phat lost in just the past 8 months is more than 3 times the capitalization of two large securities companies. The market capitalization is VND and SSI combined and is equivalent to the total capitalization of 5 mid-range commercial banks such as VIB, MSB, OCB, LPB, and NCB.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

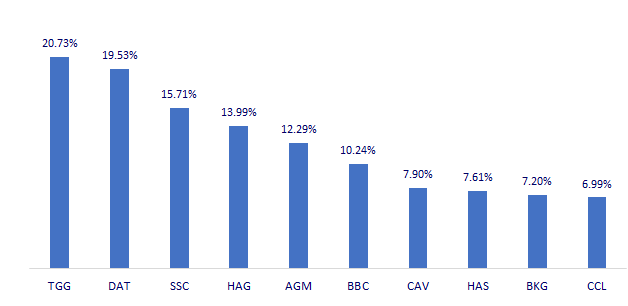

TOP INCREASES 3 CONSECUTIVE SESSIONS

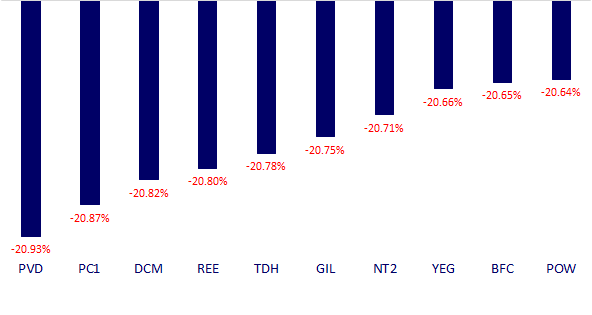

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.