Morning brief 23/06/2022

GLOBAL MARKET

30,483.13

1D -0.15%

YTD -16.25%

3,759.89

1D -0.13%

YTD -21.32%

11,053.08

1D -0.15%

YTD -29.78%

28.95

1D -4.11%

7,089.22

1D -0.88%

YTD -4.24%

13,144.28

1D -1.11%

YTD -17.25%

5,916.63

1D -0.81%

YTD -17.52%

103.66

1D -3.20%

YTD 35.50%

1,837.65

1D 0.40%

YTD 0.93%

US stocks fell slightly in the volatile session on Wednesday (June 22) as the market struggled to maintain the recovery momentum from the beginning of the session. Investors also consider comments from the Fed Chairman. Mr. Powell reiterated the Fed's stance against inflation. At the end of the session, the Dow Jones dropped 47.12 points (or 0.15%) to 30,483.13 points, reversing its decline in the last trading hour. The S&P 500 index lost 0.13% to 3,759.89 points. The Nasdaq Composite Index fell 0.15% to 11,053.08.

VIETNAM ECONOMY

0.37%

YTD (bps) -44

5.60%

2.62%

YTD (bps) 161

3.17%

YTD (bps) 117

23,380

1D (%) 0.03%

YTD (%) 1.92%

25,304

1D (%) 0.66%

YTD (%) -4.40%

3,537

1D (%) 0.20%

YTD (%) -3.31%

On June 21, the Trade Remedies Administration under the Ministry of Industry and Trade said that the US Department of Commerce (DOC) announced an extension of the time to consider applications for investigation into trade remedy evasion with respect to a number of products. steel pipe products - mainly under HS codes 7306.61 and 7306.30 - imported from Vietnam for an additional 15 days

VIETNAM STOCK MARKET

1,169.27

1D -0.27%

YTD -21.96%

1,227.18

1D 0.22%

YTD -20.09%

269.39

1D 1.80%

YTD -43.17%

85.63

1D 0.71%

YTD -24.01%

56.09

16,034.99

1D -14.44%

YTD -48.39%

Foreign investors traded cautiously in the session 22/6. On HoSE, they net bought 28.8b dong, down 92% compared to the previous session, corresponding to a net buying volume of 4.4m shares. ETF certificates FUEVFVND were bought the most with a value of 56b dong. HPG and STB were behind with a net buying value of VND 39b and VND 37b, respectively.

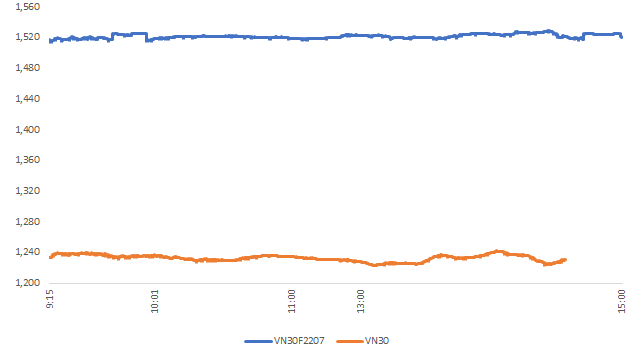

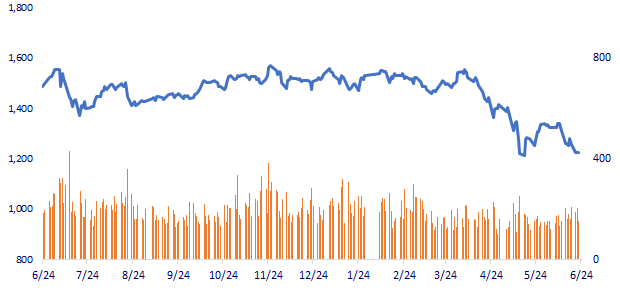

INTRADAY

VN30 (12M)

SELECTED NEWS

- US extends investigation against evasion of trade defense tax on steel pipes from Vietnam

- Import and export "decelerate", trade balance deficit is 1.42 billion USD

- Proposing nearly 10,000 billion VND to build more than 37km of Can Tho - Hau Giang expressway

- Europe reluctantly returns to coal after Russia squeezes gas supplies

- Mr. Joe Biden is optimistic about the US economy after talking with the former Treasury secretary

- Zero Covid makes China less attractive

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.