Market brief 23/06/2022

VIETNAM STOCK MARKET

1,188.88

1D 1.68%

YTD -20.65%

1,240.58

1D 1.09%

YTD -19.22%

277.18

1D 2.89%

YTD -41.52%

86.70

1D 1.25%

YTD -23.06%

350.86

1D 0.00%

YTD 0.00%

12,328.63

1D -23.11%

YTD -60.32%

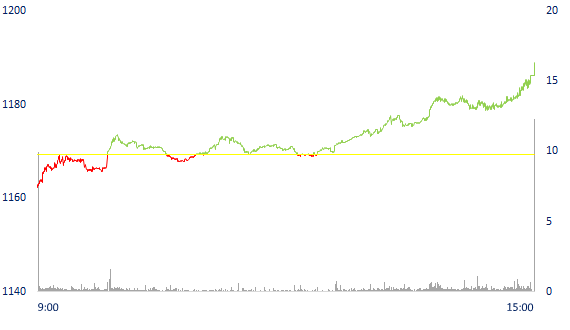

VN-Index increased by nearly 20 points, matched value on HoSE was less than 9,000 billion dong. Market liquidity was low with a total matched value of 10,325 billion dong, down 27.3% compared to the previous session, of which, matched value on HoSE was only 8,859 billion dong. Foreign investors net bought about 350 billion dong.

ETF & DERIVATIVES

20,750

1D -0.72%

YTD -19.67%

14,600

1D 0.62%

YTD -19.29%

15,190

1D -14.71%

YTD -20.05%

18,360

1D 4.02%

YTD -19.83%

15,520

1D 0.78%

YTD -30.96%

27,190

1D 0.78%

YTD -3.07%

15,510

1D 0.78%

YTD -27.79%

1,221

1D 0.05%

YTD 0.00%

1,230

1D 0.82%

YTD 0.00%

1,227

1D 0.58%

YTD 0.00%

1,228

1D 0.97%

YTD 0.00%

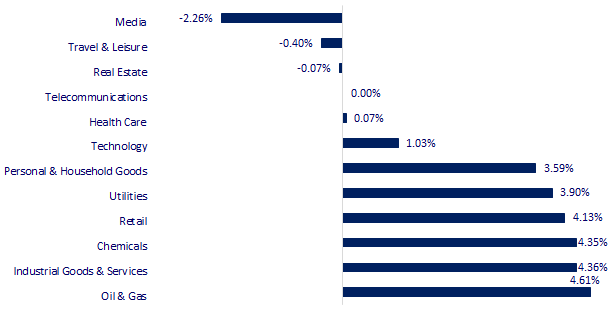

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

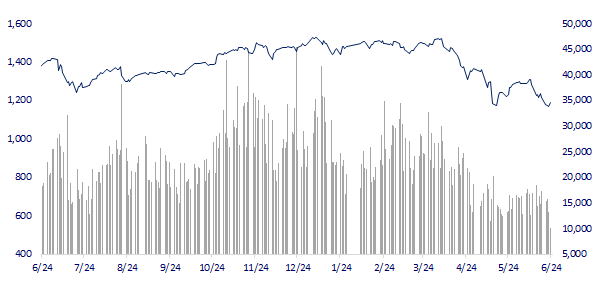

VNINDEX (12M)

GLOBAL MARKET

26,171.25

1D -0.55%

YTD -9.10%

3,320.15

1D 1.62%

YTD -8.78%

2,314.32

1D -1.22%

YTD -22.28%

21,273.87

1D 0.02%

YTD -9.08%

3,092.80

1D -0.02%

YTD -0.99%

1,557.61

1D -0.15%

YTD -6.03%

105.70

1D 1.97%

YTD 38.17%

1,830.70

1D -0.38%

YTD 0.54%

Asian stocks ended mixed, with China leading the gain. The Shanghai Composite Index rose 1.62% to 3,320.15 points. In Hong Kong, the Hang Seng index rose 0.02%. The Nikkei 225 in Japan fell 0.55%. In South Korea, the Kospi index fell 1.22%.

VIETNAM ECONOMY

0.37%

YTD (bps) -44

5.60%

2.57%

1D (bps) -5

YTD (bps) 156

3.17%

YTD (bps) 117

23,470

1D (%) 0.38%

YTD (%) 2.31%

24,885

1D (%) -1.66%

YTD (%) -5.98%

3,536

1D (%) -0.03%

YTD (%) -3.34%

In the economic growth report of the second quarter just released, UOB bank forecast that Vietnam's GDP in the second and third quarters will increase by 6% and 7.6%, respectively. Accordingly, this bank kept its forecast of GDP growth of 6.5% this year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- UOB forecasts Vietnam's second-quarter GDP to increase by 6%

- The State Bank wants to block mortgage lending for real estate in the future

- The risk of banks having money but not being able to lend

- There are growing concerns that the global economy will fall into recession

- Russia prioritizes preventing nuclear conflict

- Real estate threatens China's economy

VN30

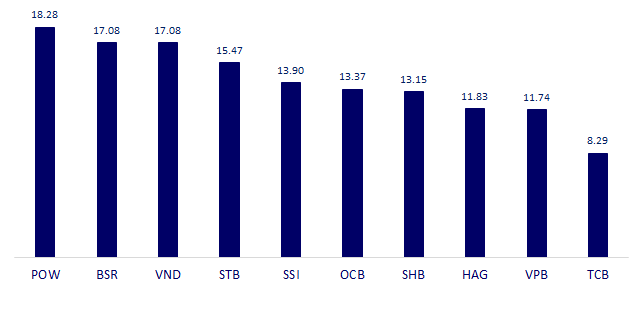

BANK

75,900

1D -0.13%

5D -4.05%

Buy Vol. 1,453,400

Sell Vol. 1,092,000

31,000

1D 1.64%

5D -4.02%

Buy Vol. 896,600

Sell Vol. 852,000

25,250

1D 6.99%

5D 2.23%

Buy Vol. 7,858,700

Sell Vol. 6,168,200

35,950

1D 3.30%

5D -0.28%

Buy Vol. 8,707,800

Sell Vol. 7,838,100

28,450

1D 0.18%

5D -1.90%

Buy Vol. 8,782,500

Sell Vol. 7,838,100

24,050

1D 2.56%

5D -3.41%

Buy Vol. 10,436,800

Sell Vol. 8,543,800

23,500

1D -0.42%

5D -5.81%

Buy Vol. 1,892,700

Sell Vol. 1,525,000

26,500

1D 1.15%

5D -1.12%

Buy Vol. 3,181,200

Sell Vol. 2,652,700

21,300

1D 3.90%

5D 1.43%

Buy Vol. 25,266,000

Sell Vol. 28,243,200

23,750

1D 0.00%

5D -1.45%

Buy Vol. 5,432,800

Sell Vol. 3,523,300

HDB: Thanks to the successful increase of charter capital in 2021, HDBank has raised the CAR to 14.4%. In addition, the loan/deposit ratio (LDR) has always remained at a safe level for many years, which is the premise for the analysis team to predict that HDBank's credit growth this year will reach over 18%. Following the recovery of the economy after the epidemic, HDBank recorded a growth in customer loans in the first quarter of 10.8%, customer deposits at 9.9%, ranking second in terms of deposit attraction rate in the first quarter (after VPBank with 13.4%).

REAL ESTATE

74,900

1D -0.79%

5D -3.35%

Buy Vol. 3,330,400

Sell Vol. 4,535,400

38,100

1D -1.04%

5D -2.56%

Buy Vol. 1,066,000

Sell Vol. 796,000

52,200

1D 0.77%

5D 2.76%

Buy Vol. 2,072,100

Sell Vol. 1,940,500

PDR: announced that it has approved the policy of transferring 89% shares to own Project 197 Dien Bien Phu - Binh Thanh, Ho Chi Minh City

OIL & GAS

116,800

1D 5.04%

5D -8.75%

Buy Vol. 2,466,300

Sell Vol. 1,990,900

13,900

1D 6.92%

5D -9.74%

Buy Vol. 40,778,300

Sell Vol. 26,852,500

40,700

1D 3.04%

5D -3.21%

Buy Vol. 952,700

Sell Vol. 695,900

GAS: GAS estimated a profit of nearly 7,000b dong, up 59% HoH. Production and supply of LPG and condensate all exceeded the plan by 6 months but dry gas did not meet.

VINGROUP

74,200

1D -1.07%

5D -3.13%

Buy Vol. 2,408,400

Sell Vol. 4,379,800

63,200

1D -2.47%

5D -4.24%

Buy Vol. 7,639,800

Sell Vol. 8,989,500

28,050

1D -1.58%

5D -3.94%

Buy Vol. 1,343,800

Sell Vol. 1,424,800

VIC: VinFast can start building a factory in North Carolina in September this year, the investment in phase 1 is 2 billion USD and will create thousands of jobs for local workers.

FOOD & BEVERAGE

70,700

1D 0.14%

5D 3.97%

Buy Vol. 2,177,800

Sell Vol. 2,501,100

110,000

1D 3.77%

5D -0.63%

Buy Vol. 750,900

Sell Vol. 617,800

153,400

1D -1.67%

5D -1.92%

Buy Vol. 91,400

Sell Vol. 79,800

VNM: After 3 trading sessions at the beginning of the week, VNM's capitalization suddenly went upstream to increase its capitalization by 8.1 trillion dong.

OTHERS

128,200

1D -0.85%

5D 2.23%

Buy Vol. 788,400

Sell Vol. 881,600

128,200

1D -0.85%

5D 2.23%

Buy Vol. 788,400

Sell Vol. 881,600

85,500

1D 1.18%

5D -7.07%

Buy Vol. 3,620,000

Sell Vol. 3,214,600

72,500

1D 3.87%

5D -8.23%

Buy Vol. 8,194,000

Sell Vol. 8,091,300

120,500

1D 4.42%

5D -0.55%

Buy Vol. 1,859,600

Sell Vol. 997,600

22,700

1D 4.13%

5D -3.40%

Buy Vol. 1,881,700

Sell Vol. 1,732,600

18,500

1D 4.52%

5D -7.55%

Buy Vol. 22,441,900

Sell Vol. 23,939,600

21,800

1D 1.40%

5D -7.08%

Buy Vol. 12,486,600

Sell Vol. 13,448,000

HPG: Quang Ngai solves difficulties for Hoa Phat Dung Quat 2 project. As of June 20, Hoa Phat Dung Quat 2 project has 58 hectares of uncleared land, equivalent to 21% of the area. The main reason is that resettlement projects have not been completed, compensation mechanisms and policies are not consistent, leading to people not agreeing...

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

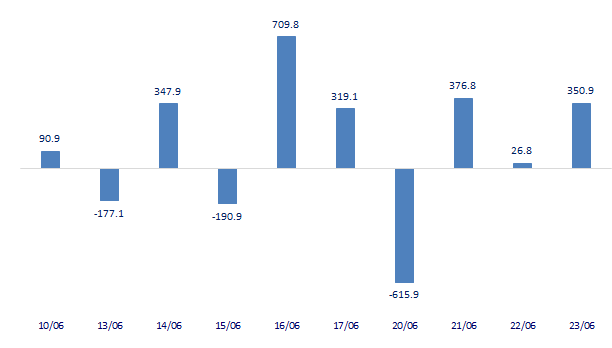

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

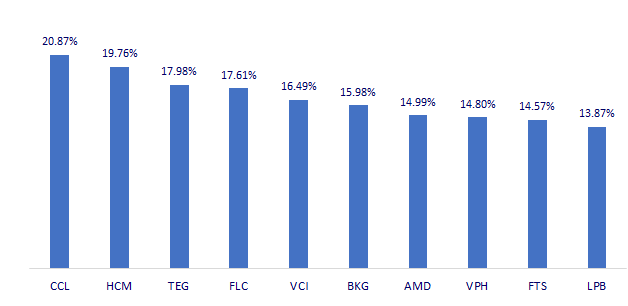

TOP INCREASES 3 CONSECUTIVE SESSIONS

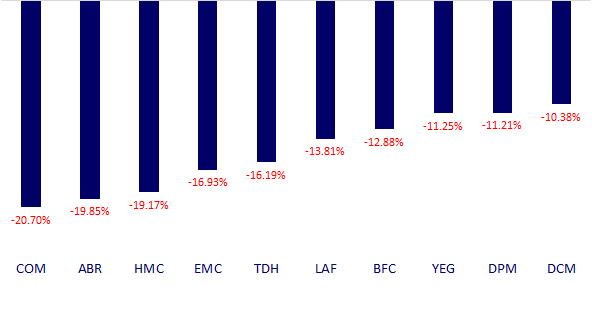

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.