Market brief 24/06/2022

VIETNAM STOCK MARKET

1,188.88

1D 1.68%

YTD -20.65%

1,240.58

1D 1.09%

YTD -19.22%

277.18

1D 2.89%

YTD -41.52%

86.70

1D 1.25%

YTD -23.06%

-80.21

1D 0.00%

YTD 0.00%

12,340.61

1D -23.04%

YTD -60.28%

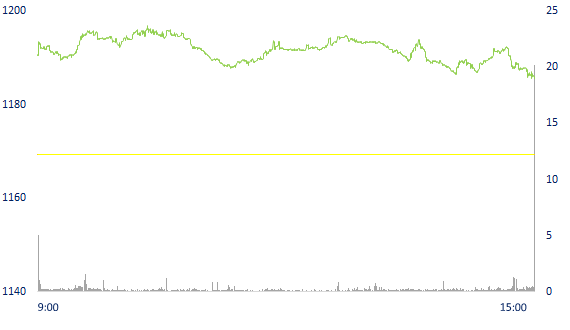

Many large stocks were under strong selling pressure at the end of the session, VN-Index dropped. Market liquidity continued to decrease compared to the previous session. The total matched value reached 9,880 billion dong, down 4%, of which, the matched value on HoSE decreased 4% to 8,476 billion dong. Foreign investors net sold about 80 billion dong.

ETF & DERIVATIVES

20,790

1D 0.19%

YTD -19.51%

14,550

1D -0.34%

YTD -19.57%

15,420

1D -13.42%

YTD -18.84%

17,250

1D -6.05%

YTD -24.67%

15,700

1D 1.16%

YTD -30.16%

26,800

1D -1.43%

YTD -4.46%

15,880

1D 2.39%

YTD -26.07%

1,228

1D 0.61%

YTD 0.00%

1,226

1D -0.33%

YTD 0.00%

1,225

1D -0.15%

YTD 0.00%

1,227

1D -0.07%

YTD 0.00%

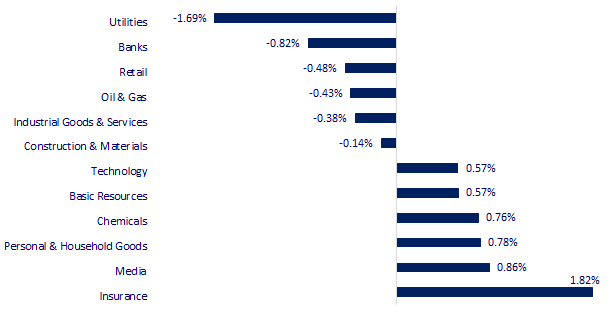

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

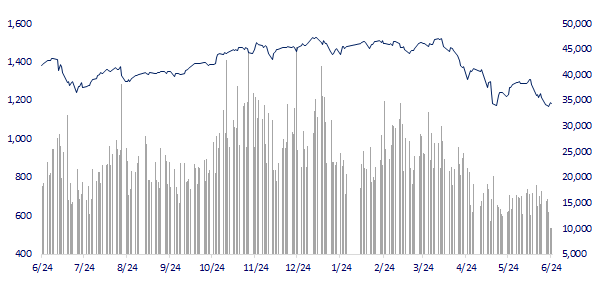

VNINDEX (12M)

GLOBAL MARKET

26,458.50

1D 0.35%

YTD -8.10%

3,334.67

1D 0.44%

YTD -8.38%

2,357.95

1D 1.89%

YTD -20.81%

21,632.90

1D 0.12%

YTD -7.54%

3,111.65

1D 0.61%

YTD -0.39%

1,564.31

1D 0.43%

YTD -5.63%

105.69

1D 0.87%

YTD 38.16%

1,828.20

1D 0.13%

YTD 0.41%

Asia - Pacific stocks simultaneously gained in the session on June 24. The Hang Seng Index (Hong Kong) rose 0.12%. In China, the Shanghai Composite Index rose 0.44%. The Kospi (South Korea) index rose 1.89%. In Japan, the Nikkei 225 gained 0.35%.

VIETNAM ECONOMY

0.37%

YTD (bps) -44

5.60%

2.57%

YTD (bps) 156

3.17%

YTD (bps) 117

23,475

1D (%) 0.36%

YTD (%) 2.33%

24,962

1D (%) -0.95%

YTD (%) -5.69%

3,543

1D (%) 0.06%

YTD (%) -3.14%

Immediately after re-using the T-bill channel after two years of freezing, the State Bank made 3 consecutive net withdrawals with a scale of nearly VND50,000b. Specifically, after the auction of bills of VND10,000b, 7-day term and only VND200b matched (withdrawn) with the winning interest rate of 0.3%/year on June 21, consecutively In the sessions of June 22 and June 23, the State Bank withdrew VND19,400b and nearly VND30,000b, respectively with interest rates up to 0.7%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Seafood exports to the US reached over 1.1 billion USD

- Just restarted the money attraction channel, the State Bank has withdrawn nearly VND 50,000 billion from the system

- Deputy Prime Minister: Limiting the increase in gasoline prices in the operating periods

- Ukraine officially becomes EU candidate

- Russia cuts gas, 12 EU countries issue 'early warning'

- USD and gold rise on strong demand for safe-haven assets

VN30

BANK

75,000

1D -1.19%

5D -1.45%

Buy Vol. 1,343,700

Sell Vol. 1,403,600

31,200

1D 0.65%

5D -1.27%

Buy Vol. 2,058,500

Sell Vol. 2,334,700

24,750

1D -1.98%

5D 5.10%

Buy Vol. 4,671,400

Sell Vol. 6,382,600

35,500

1D -1.25%

5D 2.90%

Buy Vol. 4,651,300

Sell Vol. 6,186,400

28,150

1D -1.05%

5D 0.90%

Buy Vol. 5,762,100

Sell Vol. 7,527,800

23,700

1D -1.46%

5D 1.72%

Buy Vol. 7,295,100

Sell Vol. 8,217,200

23,000

1D -2.13%

5D -6.50%

Buy Vol. 3,245,300

Sell Vol. 3,328,000

26,000

1D -1.89%

5D 1.96%

Buy Vol. 1,843,500

Sell Vol. 1,868,700

21,200

1D -0.47%

5D 4.69%

Buy Vol. 20,306,900

Sell Vol. 26,018,900

23,800

1D 0.21%

5D 3.03%

Buy Vol. 2,690,100

Sell Vol. 3,217,000

VCB: Vietcombank announced the auction of land use rights in a land plot of more than 1,400 m2 in Tan Nhut commune (Binh Chanh district) with a starting price of VND 12.8 billion. The above property is the collateral for the debt of Viet Phong Metal Co., Ltd. This debt has been offered for sale by Vietcombank many times since the beginning of the year but has not yet recorded the results, the first time the sale in January the starting price offered by the bank was VND 13.7 billion.

REAL ESTATE

74,000

1D -1.20%

5D -2.25%

Buy Vol. 5,024,200

Sell Vol. 5,787,700

38,450

1D 0.92%

5D -1.41%

Buy Vol. 973,400

Sell Vol. 1,103,300

52,500

1D 0.57%

5D 4.37%

Buy Vol. 2,163,400

Sell Vol. 2,077,600

PDR: approved the transfer resolution of Astra City. After being transferred, Astral City will bring in VND 3,340 billion, helping PDR to target a pre-tax profit of VND 3,635 billion in 2022.

OIL & GAS

114,000

1D -2.40%

5D -14.93%

Buy Vol. 1,628,000

Sell Vol. 1,542,300

13,550

1D -2.52%

5D -15.84%

Buy Vol. 21,624,900

Sell Vol. 27,737,300

40,800

1D 0.25%

5D -2.63%

Buy Vol. 1,046,000

Sell Vol. 1,124,600

GAS: Total disbursement for construction investment in the first 6 months of the parent company is 1,381.1 billion VND; the whole company is 1,427.2 billion dong.

VINGROUP

74,600

1D 0.54%

5D -2.61%

Buy Vol. 2,372,800

Sell Vol. 3,484,100

63,200

1D 0.00%

5D -4.24%

Buy Vol. 3,969,400

Sell Vol. 4,009,900

27,550

1D -1.78%

5D -6.13%

Buy Vol. 1,516,000

Sell Vol. 1,842,200

VIC: Regarding the initial public offering (IPO) plan in the fourth quarter, VinFast aims to raise $2 billion.

FOOD & BEVERAGE

71,500

1D 1.13%

5D 7.20%

Buy Vol. 2,882,700

Sell Vol. 4,062,300

109,500

1D -0.45%

5D -6.41%

Buy Vol. 924,800

Sell Vol. 937,100

155,600

1D 1.43%

5D -0.26%

Buy Vol. 182,400

Sell Vol. 169,000

VNM: The goal of Vinamilk and Moc Chau Milk is to turn Moc Chau into the high-tech dairy capital of Vietnam, contributing to the development of economy and tourism

OTHERS

128,300

1D 0.08%

5D 2.72%

Buy Vol. 768,100

Sell Vol. 814,700

128,300

1D 0.08%

5D 2.72%

Buy Vol. 768,100

Sell Vol. 814,700

85,500

1D 0.00%

5D -7.07%

Buy Vol. 1,746,300

Sell Vol. 1,706,100

71,900

1D -0.83%

5D -7.46%

Buy Vol. 4,652,600

Sell Vol. 5,794,300

122,000

1D 1.24%

5D 0.52%

Buy Vol. 1,239,300

Sell Vol. 1,994,900

22,750

1D 0.22%

5D 0.22%

Buy Vol. 2,461,700

Sell Vol. 2,451,000

18,600

1D 0.54%

5D -0.05%

Buy Vol. 22,661,500

Sell Vol. 25,380,100

21,800

1D 0.00%

5D -6.03%

Buy Vol. 20,012,000

Sell Vol. 25,029,200

HPG: Hoa Phat Group Joint Stock Company wants to invest in the Bai Goc seaport project and the technical infrastructure project of Hoa Tam Industrial Park in Dong Hoa town. When put into operation, the project will contribute about 6,000 billion VND/year to the state budget and handle about 12,000 employees.

Market by numbers

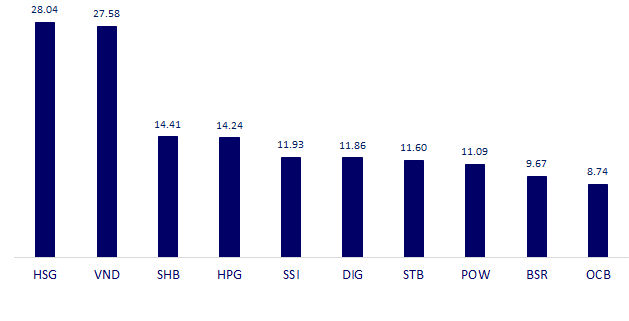

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

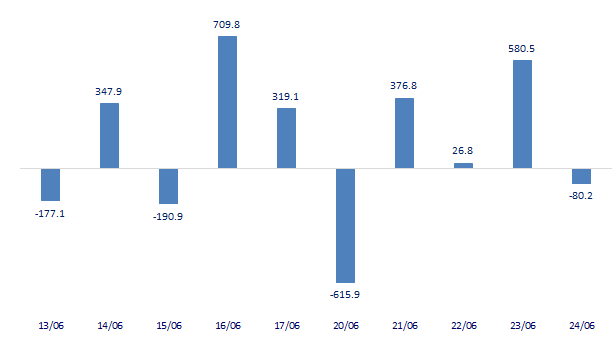

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

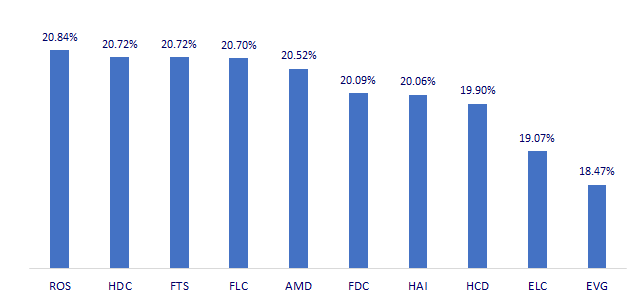

TOP INCREASES 3 CONSECUTIVE SESSIONS

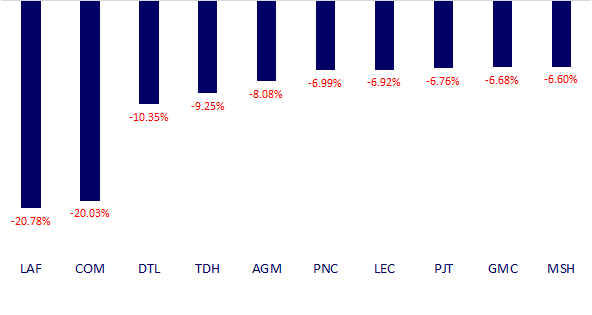

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.