Market brief 27/06/2022

VIETNAM STOCK MARKET

1,202.82

1D 1.17%

YTD -19.72%

1,256.67

1D 1.30%

YTD -18.17%

280.42

1D 1.17%

YTD -40.84%

88.14

1D 1.66%

YTD -21.78%

241.25

1D 0.00%

YTD 0.00%

14,151.57

1D 14.67%

YTD -54.46%

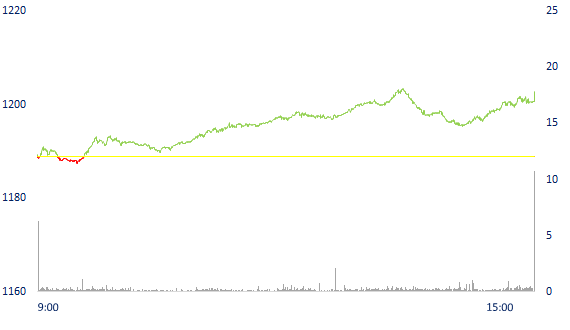

Banking stocks, securities and steel broke out, VN-Index surpassed the milestone of 1,200 points. Market liquidity remained quite low with a total matched value of 11,098 billion dong, up 12.3%, of which, matched value on HoSE alone increased by 15% to 9,757 billion dong. Foreign investors net bought 241 billion dong.

ETF & DERIVATIVES

21,110

1D 1.54%

YTD -18.27%

14,830

1D 1.92%

YTD -18.02%

15,370

1D -13.70%

YTD -19.11%

18,200

1D 5.51%

YTD -20.52%

15,910

1D 1.34%

YTD -29.23%

27,120

1D 1.19%

YTD -3.32%

15,850

1D -0.19%

YTD -26.21%

1,248

1D 1.64%

YTD 0.00%

1,246

1D 1.66%

YTD 0.00%

1,246

1D 1.67%

YTD 0.00%

1,248

1D 1.70%

YTD 0.00%

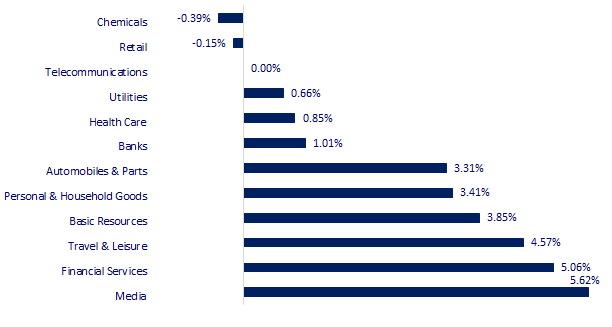

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

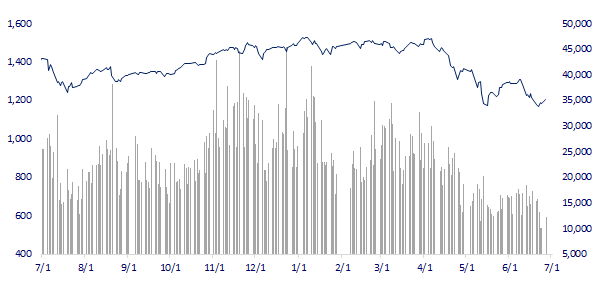

VNINDEX (12M)

GLOBAL MARKET

26,871.27

1D 0.44%

YTD -6.67%

3,379.19

1D 1.34%

YTD -7.16%

2,401.92

1D 1.86%

YTD -19.34%

22,229.52

1D 0.48%

YTD -4.99%

3,137.54

1D 0.83%

YTD 0.44%

1,580.20

1D 1.02%

YTD -4.67%

107.75

1D 0.54%

YTD 40.85%

1,840.05

1D 0.19%

YTD 1.06%

Asia - Pacific stocks all went up in the session on June 27. Hong Kong's Hang Seng Index rose 0.48%. In China, the Shanghai Composite Index gained 1.34%. Japan's Nikkei 225 index rose 0.44%. South Korea's Kospi index rose 1.86%.

VIETNAM ECONOMY

0.37%

YTD (bps) -44

5.60%

2.57%

YTD (bps) 156

3.17%

YTD (bps) 117

23,390

1D (%) -0.02%

YTD (%) 1.96%

25,305

1D (%) 0.05%

YTD (%) -4.39%

3,545

1D (%) 0.00%

YTD (%) -3.09%

Figures just released by the Foreign Investment Agency (Ministry of Planning and Investment) show that as of June 20, the total newly registered and adjusted FDI capital and contributed capital to buy shares reached over 14.03 billion USD, down 8.9% over the same period in 2021. This is the 5th consecutive month that FDI has decreased.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- FDI decreased for the 5th month in a row

- The preferential export tariff schedule for the implementation of the CPTPP Agreement is from 8.3%-3.6%

- Great opportunity for Vietnamese goods to be exported to the Americas market

- Bloomberg: Russia defaults on foreign debt for the first time

- G7 announced a $600 billion plan to counterbalance China

- Risks from the race to increase global interest rates

VN30

BANK

74,900

1D -0.13%

5D -1.45%

Buy Vol. 1,450,700

Sell Vol. 1,512,900

31,750

1D 1.76%

5D 7.63%

Buy Vol. 2,339,600

Sell Vol. 1,553,200

25,600

1D 3.43%

5D 13.27%

Buy Vol. 6,163,200

Sell Vol. 6,392,300

35,550

1D 0.14%

5D 7.73%

Buy Vol. 6,152,300

Sell Vol. 7,313,900

28,900

1D 2.66%

5D 6.64%

Buy Vol. 10,751,200

Sell Vol. 10,685,000

24,100

1D 1.69%

5D 7.11%

Buy Vol. 10,977,000

Sell Vol. 8,771,800

23,350

1D 1.52%

5D -1.68%

Buy Vol. 2,484,000

Sell Vol. 2,430,500

26,700

1D 2.69%

5D 6.59%

Buy Vol. 3,545,200

Sell Vol. 3,180,700

21,500

1D 1.42%

5D 14.06%

Buy Vol. 27,401,300

Sell Vol. 23,990,900

23,950

1D 0.63%

5D 4.59%

Buy Vol. 3,666,700

Sell Vol. 4,515,300

CTG: VietinBank sells 300 billion dong of debt mortgaged by factories, a series of real estate in Hai Phong. The debt of Tan Huong company at VietinBank Hai Phong branch as of June 20 is 324.9 billion dong. The collateral for the debt of Tan Huong company is the entire system of factories, machinery assets on 2.5 hectares of leased land in Hong Bang district, Hai Phong city, and a series of other real estate.

REAL ESTATE

78,800

1D 6.49%

5D 4.37%

Buy Vol. 4,934,700

Sell Vol. 6,286,900

39,050

1D 1.56%

5D 1.30%

Buy Vol. 1,389,700

Sell Vol. 1,275,800

52,600

1D 0.19%

5D 5.41%

Buy Vol. 2,343,500

Sell Vol. 2,196,200

PDR: In 2022, Phat Dat plans to launch a large number of products (over 12,000 products) with an expected product value of VND 32,000 billion.

OIL & GAS

114,400

1D 0.35%

5D -8.26%

Buy Vol. 1,571,800

Sell Vol. 1,782,400

13,850

1D 2.21%

5D -7.67%

Buy Vol. 29,011,100

Sell Vol. 29,489,200

41,500

1D 1.72%

5D 5.73%

Buy Vol. 1,016,100

Sell Vol. 922,000

GAS: GAS estimates a strong growth in the first half of 2022. Specifically, the Company estimated total revenue of more than 54.5 trillion dong, 134% of the same period.

VINGROUP

73,800

1D -1.07%

5D -2.38%

Buy Vol. 2,817,900

Sell Vol. 3,576,600

63,500

1D 0.47%

5D -2.31%

Buy Vol. 4,153,000

Sell Vol. 4,153,500

28,750

1D 4.36%

5D 0.17%

Buy Vol. 2,220,500

Sell Vol. 2,133,100

VIC: For the development reserve in Da Nang, Vingroup itself surveyed about 450 hectares in Hoa Chau - Hoa Tien commune.

FOOD & BEVERAGE

71,100

1D -0.56%

5D 3.04%

Buy Vol. 3,373,000

Sell Vol. 3,553,300

113,000

1D 3.20%

5D 1.80%

Buy Vol. 1,328,900

Sell Vol. 1,396,000

156,800

1D 0.77%

5D 3.16%

Buy Vol. 150,200

Sell Vol. 185,600

VNM: From June 30 to July 29, Platinum Victory PTE.LTD registered to buy 20.9 million VNM shares, raising the holding volume to 242.75 million shares, accounting for 11.62% of capital.

OTHERS

133,000

1D 3.66%

5D 4.72%

Buy Vol. 1,362,200

Sell Vol. 1,151,700

133,000

1D 3.66%

5D 4.72%

Buy Vol. 1,362,200

Sell Vol. 1,151,700

86,500

1D 1.17%

5D -5.98%

Buy Vol. 2,185,100

Sell Vol. 2,723,700

71,500

1D -0.56%

5D -3.25%

Buy Vol. 5,409,000

Sell Vol. 5,323,900

129,500

1D 6.15%

5D 10.32%

Buy Vol. 3,567,300

Sell Vol. 3,279,500

23,350

1D 2.64%

5D 7.11%

Buy Vol. 2,052,000

Sell Vol. 2,301,900

19,850

1D 6.72%

5D 14.44%

Buy Vol. 24,789,600

Sell Vol. 22,114,300

22,900

1D 5.05%

5D 6.02%

Buy Vol. 34,858,700

Sell Vol. 29,364,200

BVH: Bao Viet presents a record dividend plan for 2021 of more than 30% in cash. This year, BVH submitted a plan for the parent company's total revenue to reach VND 1,530 billion, and EAT of VND 1,050 billion, up 2.7% and 1.8% respectively compared to last year.

Market by numbers

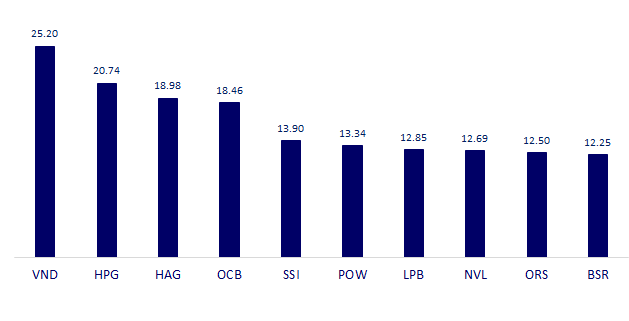

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

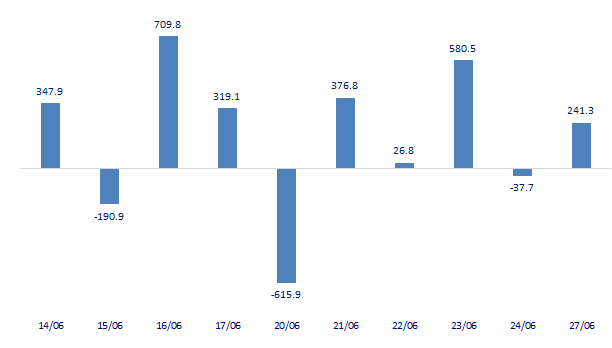

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

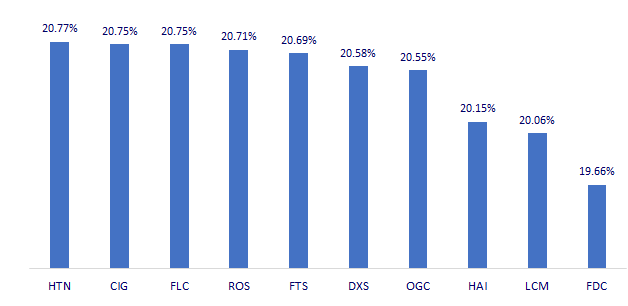

TOP INCREASES 3 CONSECUTIVE SESSIONS

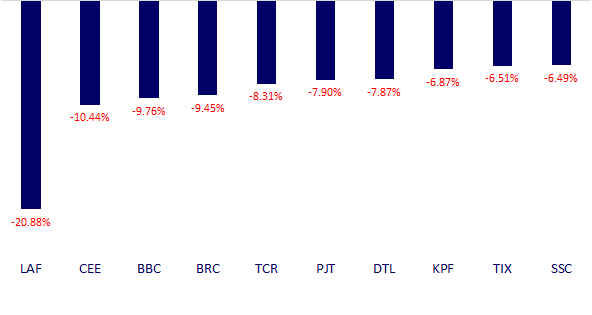

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.