Market brief 30/06/2022

VIETNAM STOCK MARKET

1,197.60

1D -1.68%

YTD -20.07%

1,248.92

1D -1.92%

YTD -18.67%

277.68

1D -1.65%

YTD -41.42%

88.58

1D -0.34%

YTD -21.39%

8.32

1D 0.00%

YTD 0.00%

13,075.50

1D -6.72%

YTD -57.92%

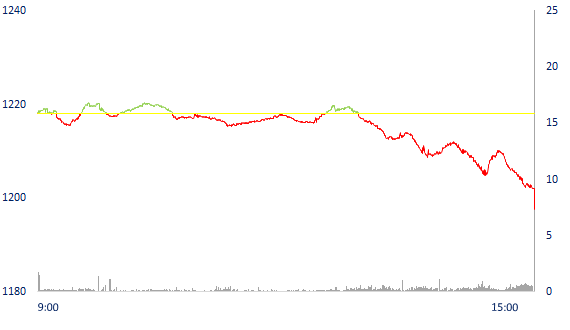

VN-Index dropped more than 20 points in the "closing" session of NAV in the second quarter, losing the milestone of 1,200. Market liquidity was similar to the previous session, total matched value reached 11,922 billion dong, up 1.36%, of which, matched value on HoSE alone increased by 1.36% to 10,561 billion dong.

ETF & DERIVATIVES

21,350

1D -0.47%

YTD -17.34%

14,840

1D -1.26%

YTD -17.97%

15,330

1D -13.92%

YTD -19.32%

17,500

1D -4.58%

YTD -23.58%

16,550

1D 0.30%

YTD -26.38%

27,590

1D -0.40%

YTD -1.64%

16,190

1D 0.43%

YTD -24.63%

1,244

1D -1.31%

YTD 0.00%

1,243

1D -1.16%

YTD 0.00%

1,241

1D -1.40%

YTD 0.00%

1,240

1D -1.62%

YTD 0.00%

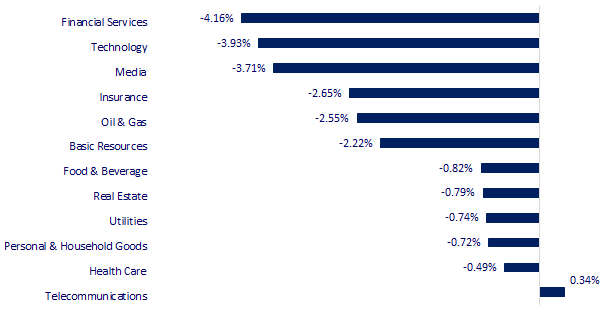

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

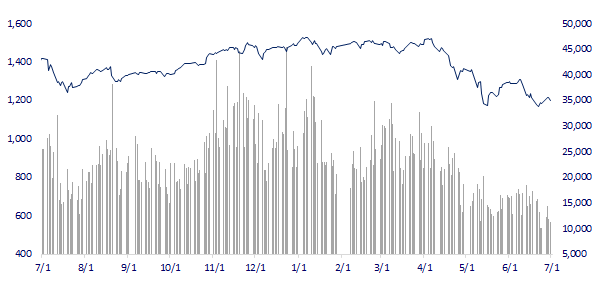

VNINDEX (12M)

GLOBAL MARKET

26,393.04

1D -0.76%

YTD -8.33%

3,398.62

1D 0.55%

YTD -6.63%

2,332.64

1D -1.12%

YTD -21.66%

21,859.79

1D -0.72%

YTD -6.57%

3,102.21

1D -1.03%

YTD -0.69%

1,568.33

1D -1.13%

YTD -5.39%

108.95

1D -0.77%

YTD 42.42%

1,811.95

1D -0.49%

YTD -0.49%

Chinese stocks rose after the country's government announced industrial production activity data increased in June. However, most other Asian markets fell. Accordingly, the Shanghai Composite Index rose 0.55%. Hong Kong's Hang Seng Index fell 0.72%. In Japan, the Nikkei 225 index fell 0.76%. South Korea's Kospi index fell 1.12%.

VIETNAM ECONOMY

0.71%

1D (bps) 3

YTD (bps) -10

5.60%

2.66%

1D (bps) -3

YTD (bps) 165

3.19%

1D (bps) -6

YTD (bps) 119

23,490

1D (%) 0.34%

YTD (%) 2.40%

24,645

1D (%) -1.54%

YTD (%) -6.89%

3,543

1D (%) -0.03%

YTD (%) -3.14%

Total state budget revenue by the end of the second quarter reached 932.9 trillion dong, equaling 66.1% of the yearly estimate and up 18.8% over the same period last year. In which, revenue from crude oil exceeded 21.3% of the yearly estimate and increased by 80.8% over the same period.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Attracting FDI in the first 6 months of 2022: Samsung continues to score points

- The Ministry of Finance proposes to reduce excise tax and value added tax on gasoline

- The state budget has a big bumper, revenue from crude oil soars

- Fed Chairman affirmed to accept the risk of economic recession to control inflation

- In the second quarter of 2022, Asian currencies have the most negative performance since 1997

- China continues to import Russian coal at a high discount

VN30

BANK

74,800

1D -0.93%

5D -1.45%

Buy Vol. 1,073,000

Sell Vol. 1,480,800

33,500

1D -4.01%

5D 8.06%

Buy Vol. 2,237,300

Sell Vol. 3,405,400

26,150

1D -2.61%

5D 3.56%

Buy Vol. 4,960,600

Sell Vol. 7,213,100

35,550

1D -3.27%

5D -1.11%

Buy Vol. 5,334,000

Sell Vol. 8,225,700

29,000

1D -3.33%

5D 1.93%

Buy Vol. 11,090,900

Sell Vol. 16,698,700

24,200

1D -2.02%

5D 0.62%

Buy Vol. 10,414,300

Sell Vol. 12,686,000

24,000

1D -1.64%

5D 2.13%

Buy Vol. 3,157,200

Sell Vol. 4,668,500

27,150

1D -0.91%

5D 2.45%

Buy Vol. 2,956,200

Sell Vol. 4,013,900

21,500

1D -4.87%

5D 0.94%

Buy Vol. 34,843,300

Sell Vol. 39,755,200

24,000

1D -0.83%

5D 1.05%

Buy Vol. 2,961,200

Sell Vol. 4,420,900

Profit after tax of parent company shareholders (net profit) of 27 listed banks in the second quarter may increase by 36% over the same period last year. However, compared to the previous quarter, it decreased by 9%. The expected decrease in profit compared to the previous quarter was mainly due to the high first quarter profit due to the contribution of unusual non-interest income, notably the prepaid fee from the exclusive bancassurance deal worth approx more than VND 5,000 billion of VPBank.

REAL ESTATE

74,500

1D -0.80%

5D -0.53%

Buy Vol. 2,223,600

Sell Vol. 3,391,300

38,900

1D -1.02%

5D 2.10%

Buy Vol. 777,800

Sell Vol. 1,369,100

51,800

1D -1.15%

5D -0.77%

Buy Vol. 1,709,500

Sell Vol. 1,755,100

PDR: Investors expect the new senior management team to steer PDR in the context that the total business and investment cash flow has just gone through a negative more than trillion dong.

OIL & GAS

115,500

1D -1.28%

5D -1.11%

Buy Vol. 1,751,100

Sell Vol. 1,814,600

13,600

1D -1.09%

5D -2.16%

Buy Vol. 24,017,900

Sell Vol. 33,329,900

40,300

1D -1.71%

5D -0.98%

Buy Vol. 1,071,300

Sell Vol. 1,504,600

GAS: In the second quarter only, revenue is estimated at VND 27,872 billion, up 23%; profit after tax is 3,425 billion dong, up 49% over the same period last year.

VINGROUP

73,500

1D 0.14%

5D -0.94%

Buy Vol. 2,688,500

Sell Vol. 3,687,100

62,100

1D -1.90%

5D -1.74%

Buy Vol. 3,421,100

Sell Vol. 4,732,700

28,550

1D 0.35%

5D 1.78%

Buy Vol. 2,688,700

Sell Vol. 3,556,100

VIC: With the opening of more factories in the US, VinFast also aims to sell 750,000 cars by 2026, with 150,000 cars produced in North Carolina and the rest from the Vietnamese factory.

FOOD & BEVERAGE

72,200

1D -0.14%

5D 2.12%

Buy Vol. 5,964,500

Sell Vol. 7,704,100

112,000

1D -1.75%

5D 1.82%

Buy Vol. 819,500

Sell Vol. 1,234,200

154,600

1D 0.39%

5D 0.78%

Buy Vol. 81,600

Sell Vol. 84,700

MSN: In Q1/2022, WinCommerce recorded a net revenue of VND 7,297 billion, QoQ. Gross profit is 1,620 billion dong, up 25.3%. EBITDA reached VND 164 billion, up 25%.

OTHERS

130,000

1D -1.74%

5D 1.40%

Buy Vol. 701,900

Sell Vol. 786,600

130,000

1D -1.74%

5D 1.40%

Buy Vol. 701,900

Sell Vol. 786,600

86,200

1D -4.22%

5D 0.82%

Buy Vol. 3,174,400

Sell Vol. 3,936,300

71,500

1D -2.05%

5D -1.38%

Buy Vol. 4,405,800

Sell Vol. 5,624,200

128,500

1D -0.77%

5D 6.64%

Buy Vol. 1,169,400

Sell Vol. 1,837,500

22,550

1D -1.53%

5D -0.66%

Buy Vol. 2,296,900

Sell Vol. 2,594,200

18,800

1D -4.81%

5D 1.62%

Buy Vol. 20,459,900

Sell Vol. 25,022,500

22,300

1D -1.98%

5D 2.29%

Buy Vol. 32,730,700

Sell Vol. 36,759,300

HPG: announced that the issuance of shares has been completed to pay dividends at the rate of 30%, investors holding 100 HPG shares on the closing date will receive 30 new shares. Accordingly, 1.34 billion HPG shares were issued, bringing the total outstanding shares to 5.81 billion shares. Hoa Phat plans to transfer these shares to shareholders on July 20.

Market by numbers

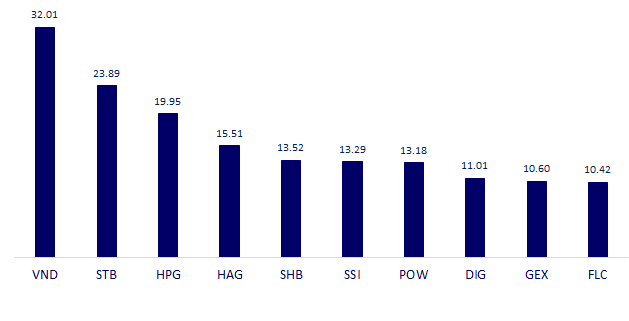

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

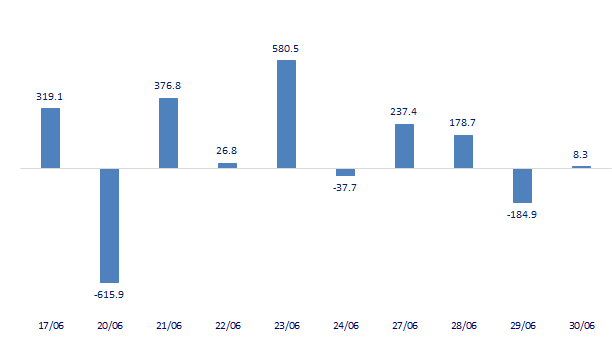

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

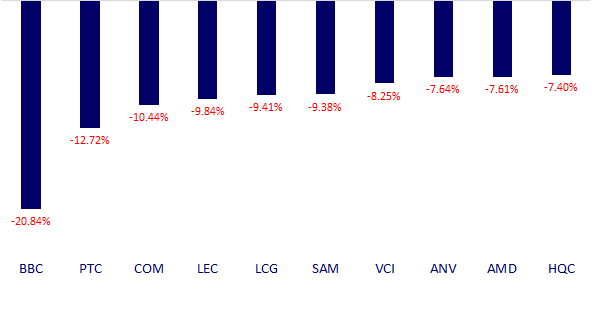

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.