Market Brief 05/07/2022

VIETNAM STOCK MARKET

1,181.29

1D -1.19%

YTD -21.16%

1,242.05

1D -0.51%

YTD -19.12%

277.94

1D -1.16%

YTD -41.36%

87.19

1D -0.81%

YTD -22.62%

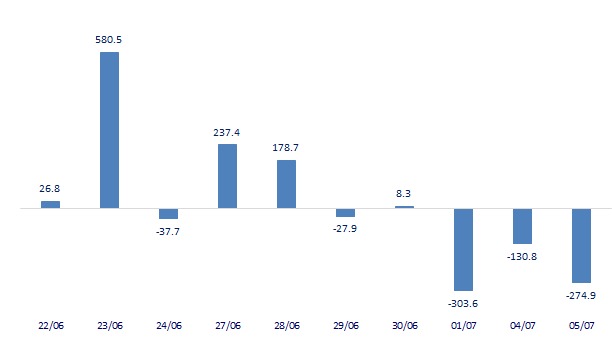

-274.92

1D 0.00%

YTD 0.00%

15,888.16

1D 38.78%

YTD -48.87%

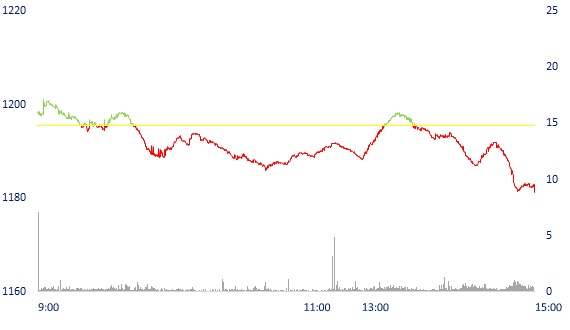

Strong selling pressure at the end of the session, VN-Index lost more than 14 points. Market liquidity improved compared to yesterday. Total matched value reached 14,103 billion dong, up 37.7%, of which, matched value on HoSE alone increased by 38.7% and reached 12,380 billion dong. Foreign investors net sold about 275 billion dong.

ETF & DERIVATIVES

20,900

1D -1.69%

YTD -19.09%

14,650

1D -3.62%

YTD -19.02%

15,410

1D -13.48%

YTD -18.89%

17,800

1D 0.56%

YTD -22.27%

16,600

1D 1.84%

YTD -26.16%

26,300

1D -2.05%

YTD -6.24%

15,860

1D -0.69%

YTD -26.16%

1,231

1D -0.55%

YTD 0.00%

1,230

1D -0.72%

YTD 0.00%

1,234

1D -0.27%

YTD 0.00%

1,235

1D -0.57%

YTD 0.00%

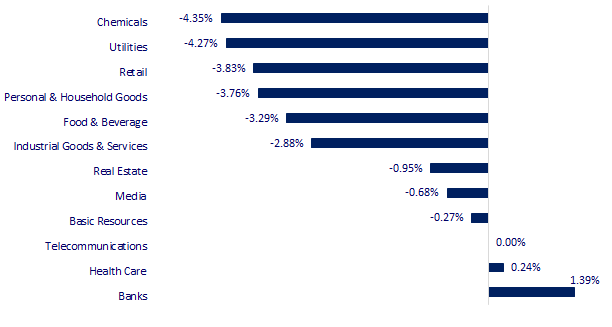

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

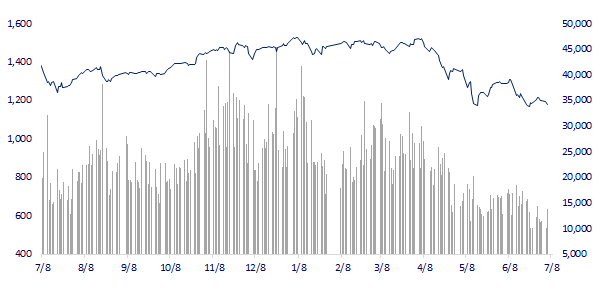

VNINDEX (12M)

GLOBAL MARKET

26,423.47

1D -0.04%

YTD -8.23%

3,404.03

1D -0.04%

YTD -6.48%

2,341.78

1D 1.80%

YTD -21.35%

21,853.07

1D -1.38%

YTD -6.60%

3,104.11

1D -0.52%

YTD -0.63%

1,541.30

1D -1.30%

YTD -7.02%

108.03

1D -2.68%

YTD 41.22%

1,801.35

1D -0.57%

YTD -1.07%

Asian stocks mostly fell in the trading session on July 5. Investors wait for the Reserve Bank of Australia's interest rate decision. Hong Kong's Hang Seng Index fell 1.38%. The Shanghai Composite Index fell 0.04%. In Japan, the Nikkei 225 index fell 0.04%. Only South Korea's Kospi index rose 1.8%.

VIETNAM ECONOMY

0.88%

1D (bps) 17

YTD (bps) 7

5.60%

2.69%

1D (bps) 7

YTD (bps) 168

3.25%

1D (bps) 3

YTD (bps) 125

23,585

1D (%) 0.38%

YTD (%) 2.81%

24,494

1D (%) -2.38%

YTD (%) -7.46%

3,555

1D (%) -0.03%

YTD (%) -2.82%

The Ministry of Planning and Investment said that the realized social investment capital in the first 6 months of 2022 reached 1,301.2tr VND, up 9.6% over the same period in 2021. In which, capital of the state sector reached 328.4tr dong, accounting for 25.2% of total capital and increasing by 9.5% HoH; the non-state sector reached 739.3tr dong, equaling 56.8% and increasing by 9.9%; FDI sector reached 233.5tr dong, equaling 18% and increasing by 8.9%

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Prime Minister: Prioritize macroeconomic stability, control inflation, and ensure major balances

- Economic recovery is positive, the whole year strives for GDP growth of 7%

- In the first half of the year, disbursement of public investment reached 27.86% of the plan

- The G7's proposal to impose a ceiling on Russian oil is controversial for its feasibility

- US-China senior leaders discuss tariff issues

- Rising fuel costs are causing demand destruction

VN30

BANK

74,000

1D -0.13%

5D -3.01%

Buy Vol. 1,833,700

Sell Vol. 1,893,900

36,300

1D 3.57%

5D 7.88%

Buy Vol. 7,585,900

Sell Vol. 7,016,900

27,000

1D 1.50%

5D 1.12%

Buy Vol. 7,091,900

Sell Vol. 10,924,000

37,750

1D 3.85%

5D 2.86%

Buy Vol. 17,383,000

Sell Vol. 18,035,400

29,500

1D 1.03%

5D -1.67%

Buy Vol. 17,972,700

Sell Vol. 19,035,800

25,450

1D 3.46%

5D 3.04%

Buy Vol. 44,022,200

Sell Vol. 25,544,800

24,750

1D 0.81%

5D 2.06%

Buy Vol. 3,668,500

Sell Vol. 4,448,400

27,500

1D 0.73%

5D -0.36%

Buy Vol. 3,642,800

Sell Vol. 4,135,400

23,050

1D 3.13%

5D 2.22%

Buy Vol. 64,575,400

Sell Vol. 49,934,900

24,450

1D 0.82%

5D -0.20%

Buy Vol. 3,971,000

Sell Vol. 5,623,900

TCB: The State Bank of Vietnam has just approved the increase of Techcombank's charter capital. Accordingly, the State Bank of Vietnam approved Techcombank to increase its charter capital up to VND 63.2 billion by issuing shares under the Employee Selection Program (ESOP) approved by the General Meeting of Shareholders at the Resolution decided on April 23, 2022.

REAL ESTATE

73,500

1D -0.68%

5D -2.13%

Buy Vol. 2,410,000

Sell Vol. 2,948,200

35,200

1D -1.68%

5D -1.35%

Buy Vol. 766,900

Sell Vol. 887,500

52,000

1D 0.78%

5D -1.89%

Buy Vol. 1,282,900

Sell Vol. 1,371,600

PDR: Proposal for local adjustment of 5 commercial and service land plots at the Residential Project on Phan Dinh Phung Street, Quang Ngai City - Area of 15.49ha.

OIL & GAS

103,000

1D -5.16%

5D -8.79%

Buy Vol. 2,451,400

Sell Vol. 2,478,200

13,000

1D -3.70%

5D -6.47%

Buy Vol. 45,276,400

Sell Vol. 38,799,000

40,150

1D -0.50%

5D -3.95%

Buy Vol. 696,000

Sell Vol. 852,300

Oil prices fell during the Asian session on Monday (July 4). Brent crude futures fell 35 cents, or 0.3%, to $111.28 a barrel, after surging 2.4% last Friday.

VINGROUP

72,300

1D -0.55%

5D -1.77%

Buy Vol. 2,050,900

Sell Vol. 5,097,600

60,500

1D -0.82%

5D -5.17%

Buy Vol. 4,529,200

Sell Vol. 5,427,300

27,950

1D -1.93%

5D -3.12%

Buy Vol. 1,672,600

Sell Vol. 2,439,000

VIC: Vingroup's second battery factory project in Vung Ang economic zone (Ha Tinh province) has a total investment of up to VND 6,329 billion, expected to start in the fourth quarter of 2022.

FOOD & BEVERAGE

73,100

1D -2.66%

5D 3.25%

Buy Vol. 3,716,300

Sell Vol. 6,134,300

102,000

1D -5.29%

5D -9.87%

Buy Vol. 1,210,800

Sell Vol. 1,344,800

150,800

1D -1.76%

5D -4.01%

Buy Vol. 235,100

Sell Vol. 249,000

MSN: MSN ranks No. 2 with a net selling value of nearly 4,800 billion in the past 6 months (after HPG). In 2021, MSN is also in the top 10 net sellers of foreign investors.

OTHERS

125,900

1D -2.85%

5D -5.34%

Buy Vol. 630,800

Sell Vol. 815,900

125,900

1D -2.85%

5D -5.34%

Buy Vol. 630,800

Sell Vol. 815,900

85,400

1D -1.50%

5D -4.79%

Buy Vol. 2,438,300

Sell Vol. 3,409,700

65,500

1D -3.39%

5D -10.03%

Buy Vol. 5,832,900

Sell Vol. 6,284,600

118,600

1D -4.20%

5D -8.42%

Buy Vol. 2,547,100

Sell Vol. 2,719,000

21,600

1D -3.57%

5D -8.09%

Buy Vol. 1,970,000

Sell Vol. 2,361,700

19,700

1D -2.48%

5D 0.51%

Buy Vol. 24,441,000

Sell Vol. 27,156,400

21,900

1D -0.45%

5D -2.67%

Buy Vol. 29,030,900

Sell Vol. 28,429,600

GVR: The group's total revenue in 6 months is estimated at 11,650b VND (39.2% of the plan), profit before tax is 2,620b VND (40.4% of the plan). As for the parent company, the total revenue of the first 6 months is estimated at 950b VND, profit before tax is 462b VND, reaching 21.3% and 20% of the year plan, respectively. In the second quarter, GVR's revenue was about 6,757b dong, up nearly 19% over the same period, but consolidated pre-tax profit decreased by 17.4% to 1,121b dong.

Market by numbers

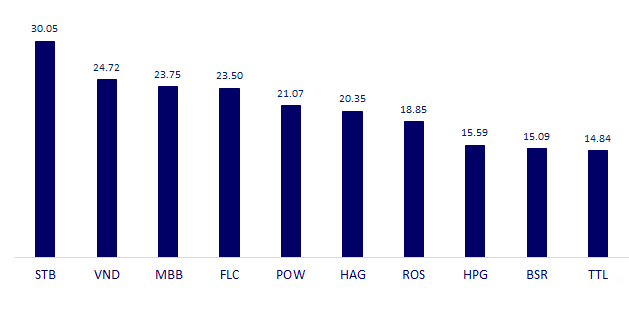

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

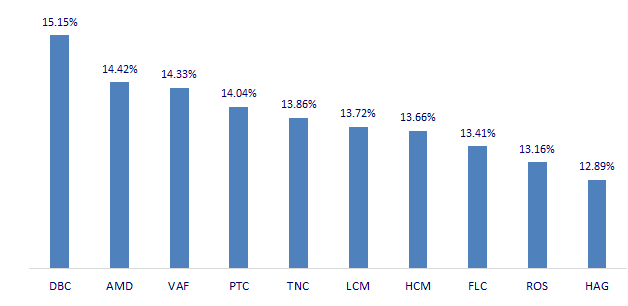

TOP INCREASES 3 CONSECUTIVE SESSIONS

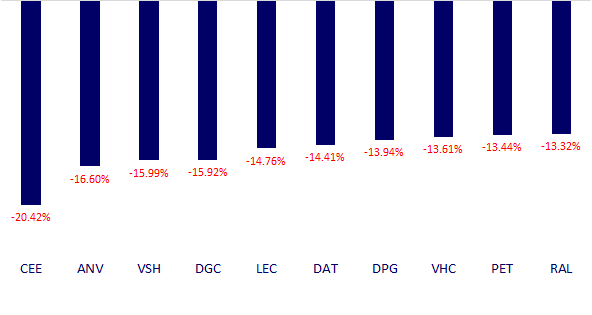

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.