Market brief 12/07/2022

VIETNAM STOCK MARKET

1,174.82

1D 1.69%

YTD -21.59%

1,219.44

1D 0.86%

YTD -20.59%

281.99

1D 1.83%

YTD -40.51%

86.78

1D 0.61%

YTD -22.99%

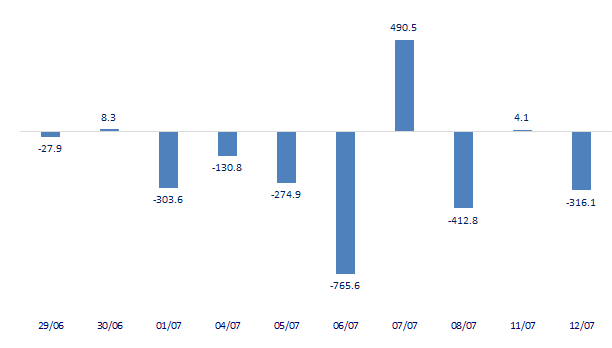

-316.08

1D 0.00%

YTD 0.00%

12,581.92

1D -3.92%

YTD -59.51%

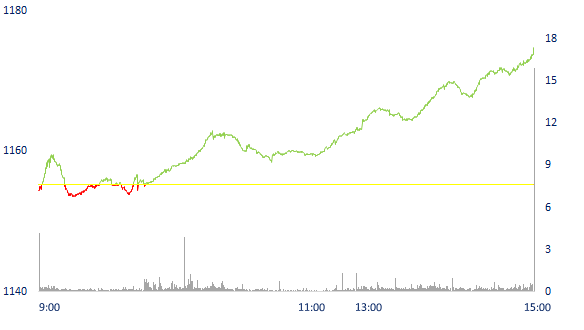

VN-Index broke through nearly 20 points, foreign investors turned to be a net seller of 316 billion dong on the whole market. The recovery momentum covered almost all industry groups such as Real Estate, Securities, Banking, Fertilizer, Oil and Gas, etc. even Fisheries and Industrial Zones recorded many stocks hitting the ceiling.

ETF & DERIVATIVES

20,600

1D 1.13%

YTD -20.25%

14,400

1D 1.41%

YTD -20.40%

15,110

1D -15.16%

YTD -20.47%

18,000

1D 0.84%

YTD -21.40%

16,210

1D -2.11%

YTD -27.89%

25,580

1D -0.23%

YTD -8.81%

16,000

1D 3.90%

YTD -25.51%

1,214

1D 1.97%

YTD 0.00%

1,213

1D 1.14%

YTD 0.00%

1,210

1D 0.04%

YTD 0.00%

1,214

1D 1.07%

YTD 0.00%

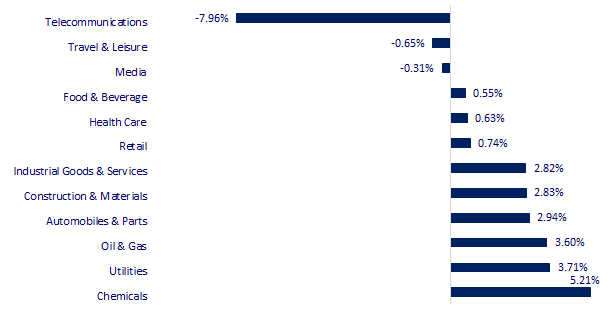

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

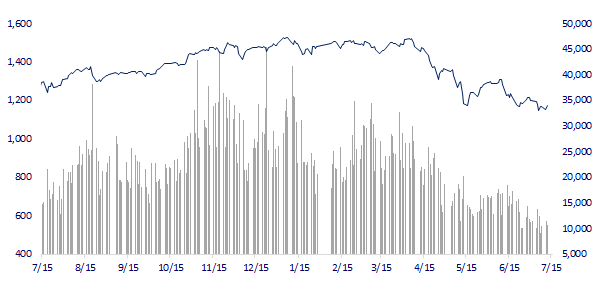

VNINDEX (12M)

GLOBAL MARKET

26,336.66

1D -0.11%

YTD -8.53%

3,281.47

1D -0.97%

YTD -9.84%

2,317.76

1D -0.96%

YTD -22.16%

20,844.74

1D -0.89%

YTD -10.91%

3,145.77

1D 0.46%

YTD 0.71%

1,546.80

1D -0.68%

YTD -6.69%

101.52

1D -1.22%

YTD 32.71%

1,730.60

1D -0.03%

YTD -4.95%

Chinese stocks fell the most in the Asia-Pacific region after the main stock indexes in the US all dropped yesterday. The Nikkei 225 index fell 0.11%. In South Korea, the Kospi index fell 0.96%. Hong Kong's Hang Seng Index fell 0.89%. In China, the Shanghai Composite Index fell 0.97%.

VIETNAM ECONOMY

0.72%

1D (bps) 4

YTD (bps) -9

5.60%

2.69%

1D (bps) 1

YTD (bps) 168

3.30%

1D (bps) -2

YTD (bps) 130

23,615

1D (%) 0.53%

YTD (%) 2.94%

23,870

1D (%) -1.00%

YTD (%) -9.82%

3,550

1D (%) 0.11%

YTD (%) -2.95%

By the end of April, residents' deposits at credit institutions reached VND 5,532 million, an increase of VND 57,597 billion compared to the end of March and an increase of 4.37% compared to the end of 2021. By the end of April, deposits of economic organizations decreased by 69,446 billion VND compared to March, to more than 5.79 million billion VND, 2.66% higher than the end of 2021.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Fertilizer imports from Russia increased dramatically

- Australia ends anti-dumping tax on Vietnamese aluminum profiles

- Deposits from economic organizations decreased by more than VND 69,400 billion in April

- US, IEA urge Asian countries to diversify energy supply chains

- Asia strives to prevent new Covid-19 wave

- Europe is on high alert when Russia temporarily stops the flow of gas through the main pipeline

VN30

BANK

71,900

1D -0.14%

5D -2.84%

Buy Vol. 1,538,900

Sell Vol. 1,829,000

36,400

1D 5.51%

5D 0.28%

Buy Vol. 3,267,900

Sell Vol. 3,157,200

25,700

1D 0.78%

5D -4.81%

Buy Vol. 10,184,000

Sell Vol. 5,613,500

36,100

1D 1.40%

5D -4.37%

Buy Vol. 7,084,600

Sell Vol. 6,325,200

27,750

1D 0.91%

5D -5.93%

Buy Vol. 11,595,200

Sell Vol. 11,916,600

25,050

1D 2.66%

5D -1.57%

Buy Vol. 23,229,300

Sell Vol. 8,652,900

23,500

1D 2.62%

5D -5.05%

Buy Vol. 2,209,300

Sell Vol. 1,273,600

26,700

1D 2.69%

5D -2.91%

Buy Vol. 1,397,400

Sell Vol. 1,725,500

22,600

1D 2.49%

5D -1.95%

Buy Vol. 27,620,700

Sell Vol. 22,087,200

24,000

1D 2.13%

5D -1.84%

Buy Vol. 1,733,800

Sell Vol. 2,599,400

MBB: At MB, the bank's leaders said that the group's revenue in the first 6 months was approximately 29.9 trillion dong with a profit of 11,920 billion dong. In which, the bank's revenue was nearly 17.8 trillion dong, up 23% and profit was 10,666 billion dong; member companies achieved revenue of nearly 12 trillion dong, up 42% and contributing 13% of the group's profit.

REAL ESTATE

73,400

1D 0.00%

5D -0.14%

Buy Vol. 1,254,900

Sell Vol. 1,759,200

35,600

1D 1.71%

5D 1.14%

Buy Vol. 1,076,500

Sell Vol. 1,065,700

52,600

1D 0.57%

5D 1.15%

Buy Vol. 1,294,200

Sell Vol. 1,275,000

NVL: Accumulated in the first 6 months, real estate group issued 42,583 billion dong. In which, Nova Real Estate Investment Group JSC issued the most (VND 9,857 billion).

OIL & GAS

99,000

1D 4.32%

5D -3.88%

Buy Vol. 1,556,800

Sell Vol. 1,550,200

12,950

1D 3.60%

5D -0.38%

Buy Vol. 32,598,700

Sell Vol. 18,699,300

40,400

1D 2.28%

5D 0.62%

Buy Vol. 964,700

Sell Vol. 986,100

GAS: In the first 6 months of 2022, PV GAS estimates revenue to reach VND 54,560 billion, up 34% over the same period in 2021 and EAT at VND 6,919 billion, up 59%.

VINGROUP

69,900

1D -0.14%

5D -3.32%

Buy Vol. 2,115,600

Sell Vol. 3,088,400

60,200

1D -0.50%

5D -0.50%

Buy Vol. 4,831,200

Sell Vol. 6,178,000

26,200

1D 0.77%

5D -6.26%

Buy Vol. 2,374,000

Sell Vol. 2,167,900

VIC: Leading in the volume of real estate corporate bond issuance in June 2022 is Vingroup with USD 100 million of international bonds (equivalent to more than VND 2,300 billion).

FOOD & BEVERAGE

73,300

1D 0.41%

5D 3.75%

Buy Vol. 1,716,200

Sell Vol. 3,058,500

102,000

1D -0.49%

5D 0.00%

Buy Vol. 515,600

Sell Vol. 634,600

153,600

1D -0.97%

5D 1.86%

Buy Vol. 75,000

Sell Vol. 115,400

MSN: Western Food Industry Center 2 includes 4 subdivisions. In which, subdivision 1 is the largest to build a food factory, with an area of about 20.9 hectares, producing pasta, flat noodles …

OTHERS

125,500

1D -1.49%

5D -0.32%

Buy Vol. 807,200

Sell Vol. 882,900

125,500

1D -1.49%

5D -0.32%

Buy Vol. 807,200

Sell Vol. 882,900

83,500

1D 0.85%

5D -2.22%

Buy Vol. 1,535,100

Sell Vol. 1,369,000

64,400

1D -0.16%

5D -1.68%

Buy Vol. 2,864,100

Sell Vol. 2,758,400

116,800

1D 1.13%

5D -1.52%

Buy Vol. 1,886,500

Sell Vol. 779,800

22,400

1D 6.92%

5D 3.70%

Buy Vol. 5,101,600

Sell Vol. 2,945,000

20,900

1D 1.21%

5D 6.09%

Buy Vol. 22,420,500

Sell Vol. 25,724,500

22,300

1D 1.13%

5D 1.83%

Buy Vol. 19,988,400

Sell Vol. 21,771,600

MWG: as of July 12, the Bach Hoa Xanh consumer goods food chain (BHX) of Mobile World Investment (HoSE: MWG) has 1,972 stores, down 132 stores compared to the end of May and down 168 stores compared to the end of April. In the third quarter, the Bach Hoa Xanh chain aims to change the layout of all existing stores and complete the automation of the back-end platform by the fourth quarter.

Market by numbers

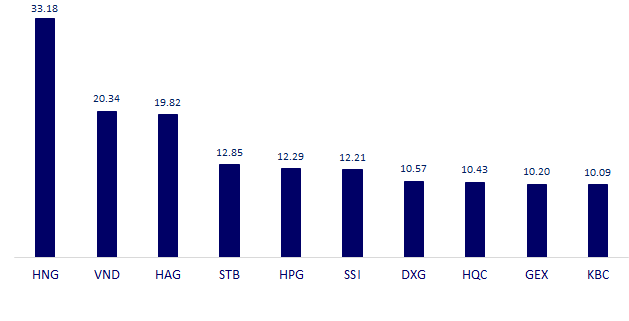

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

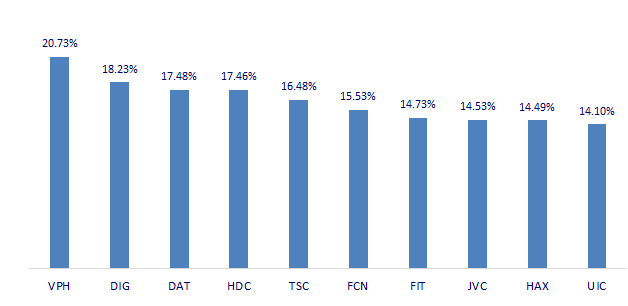

TOP INCREASES 3 CONSECUTIVE SESSIONS

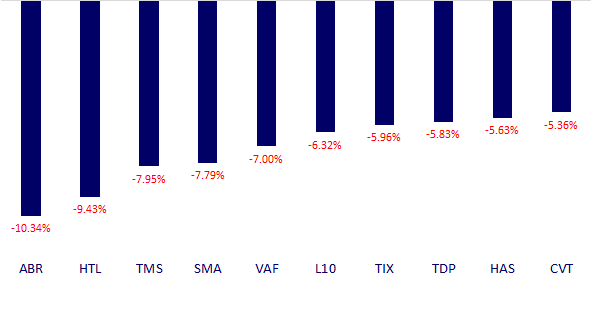

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.