Market brief 19/07/2022

VIETNAM STOCK MARKET

1,178.33

1D 0.16%

YTD -21.35%

1,211.70

1D -0.21%

YTD -21.10%

284.43

1D -0.07%

YTD -39.99%

87.89

1D 0.49%

YTD -22.00%

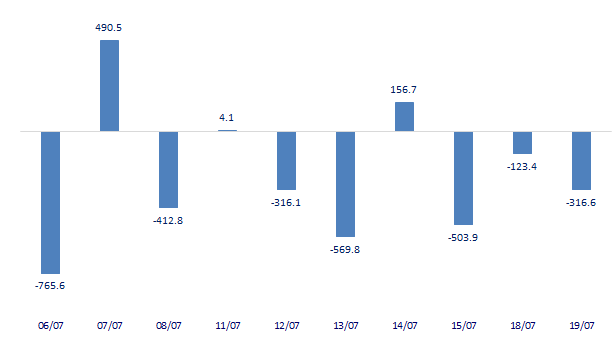

-316.58

1D 0.00%

YTD 0.00%

13,236.64

1D 1.02%

YTD -57.40%

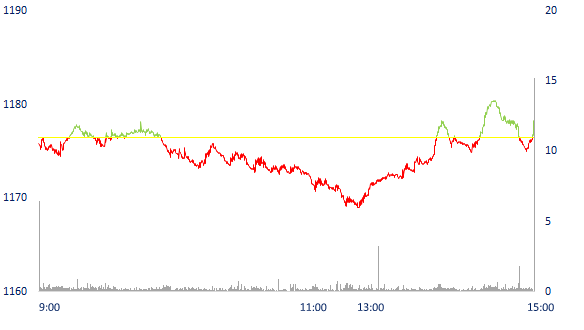

Petroleum stocks supported the index, VN-Index ended in green. Market liquidity decreased slightly compared to the previous session. The total matched value reached 11,591 billion dong, down 2%, of which, the matched value on HoSE alone decreased 4% to 9,652 billion dong. Foreign investors net sold about 316 billion dong.

ETF & DERIVATIVES

20,500

1D -0.10%

YTD -20.63%

14,280

1D -0.42%

YTD -21.06%

15,020

1D -15.67%

YTD -20.95%

17,290

1D -1.82%

YTD -24.50%

16,400

1D -0.61%

YTD -27.05%

25,500

1D -0.78%

YTD -9.09%

15,590

1D -0.32%

YTD -27.42%

1,212

1D 0.02%

YTD 0.00%

1,210

1D -0.19%

YTD 0.00%

1,211

1D -0.19%

YTD 0.00%

1,213

1D -0.20%

YTD 0.00%

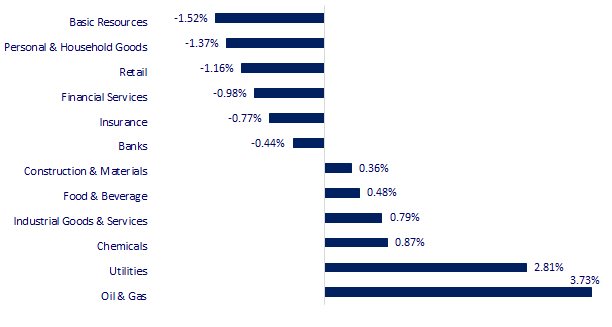

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

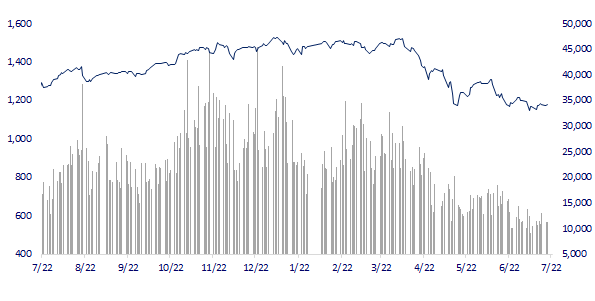

VNINDEX (12M)

GLOBAL MARKET

26,961.68

1D -0.27%

YTD -6.36%

3,279.43

1D 0.04%

YTD -9.90%

2,370.97

1D -0.18%

YTD -20.37%

20,661.06

1D -0.33%

YTD -11.70%

3,117.79

1D -0.13%

YTD -0.19%

1,533.43

1D -0.74%

YTD -7.49%

98.69

1D -0.59%

YTD 29.01%

1,712.20

1D 0.45%

YTD -5.96%

Asian stocks mostly dropped in the session of July 19 after a positive start to the new week yesterday. Japanese stocks reopened for trading after the holiday. The Nikkei 225 index fell 0.27%. South Korea's Kospi index fell 0.18%. Hong Kong's Hang Seng Index fell 0.33%. In China, the Shanghai Composite Index rose 0.04%.

VIETNAM ECONOMY

0.96%

1D (bps) 13

YTD (bps) 15

5.60%

2.77%

1D (bps) 4

YTD (bps) 176

3.36%

1D (bps) 7

YTD (bps) 136

23,635

1D (%) 0.19%

YTD (%) 3.03%

24,452

1D (%) -0.18%

YTD (%) -7.62%

3,543

1D (%) -0.06%

YTD (%) -3.14%

The export value of wood and forest products in the first 6 months of 2022 reached about USD9.1 billion, up 3% over the same period last year and reaching 56% of the plan. Entering the third quarter of 2022, the wood industry recorded a deceleration in growth and export due to many difficulties, many wood enterprises have downsized or had to stop production.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Input materials increased, cement production faced difficulties

- Exports decelerate, many wood enterprises suspend production

- Government requires early report on petrol tax reduction plan

- Ukraine sells more than 12 billion USD of gold reserves

- China reduces its holdings of US bonds below the $1 trillion mark

- Reuters: ECB talks about raising interest rates by 50 basis points this week

VN30

BANK

71,300

1D -0.97%

5D -0.83%

Buy Vol. 1,295,800

Sell Vol. 1,792,100

35,650

1D 0.42%

5D -2.06%

Buy Vol. 2,031,600

Sell Vol. 2,702,400

26,550

1D -1.30%

5D 3.31%

Buy Vol. 5,073,600

Sell Vol. 5,258,100

36,100

1D -0.55%

5D 0.00%

Buy Vol. 4,065,800

Sell Vol. 4,427,400

28,000

1D -0.53%

5D 0.90%

Buy Vol. 10,626,300

Sell Vol. 10,127,000

25,200

1D -0.79%

5D 0.60%

Buy Vol. 10,529,800

Sell Vol. 9,202,300

23,400

1D -0.43%

5D -0.43%

Buy Vol. 1,824,900

Sell Vol. 1,688,900

27,150

1D -0.37%

5D 1.69%

Buy Vol. 1,480,400

Sell Vol. 1,777,700

22,950

1D 1.77%

5D 1.55%

Buy Vol. 33,073,700

Sell Vol. 21,874,800

23,900

1D 0.00%

5D -0.42%

Buy Vol. 2,254,900

Sell Vol. 3,081,700

VPB: Approved the investment to buy/receive 47.85m common shares in OPES Insurance JSC from existing shareholders. The bank does not have specific information about the time to carry out this transaction. It is expected that, after transferring 47.85m OPES shares (equivalent to 87% of charter capital) at an average price of 12,200 VND/share, the total amount VPBank needs to spend on this deal is 585b VND. VPBank is currently a shareholder of OPES with a holding rate of 11% of capital, if the deal is successful, VPBank's ownership rate in OPES will increase to 98% of charter capital and OPES will become a subsidiary of VPBank.

REAL ESTATE

73,600

1D 0.00%

5D 0.27%

Buy Vol. 2,337,200

Sell Vol. 3,068,900

36,000

1D -0.55%

5D 1.12%

Buy Vol. 963,800

Sell Vol. 1,148,700

53,100

1D 0.00%

5D 0.95%

Buy Vol. 1,436,200

Sell Vol. 1,507,800

KDH: Additional listing of nearly 739m shares due to the issue of shares to pay dividends in 2021 and ESOP, bringing the total number of outstanding shares to more than 7,168m shares.

OIL & GAS

101,900

1D 4.51%

5D 2.93%

Buy Vol. 1,750,300

Sell Vol. 1,867,500

13,450

1D 2.67%

5D 3.86%

Buy Vol. 35,605,900

Sell Vol. 33,099,100

42,100

1D 4.60%

5D 4.21%

Buy Vol. 2,004,700

Sell Vol. 1,765,400

PLX: SBV approved the transfer of all shares of Petrolimex major shareholder at PG Bank through a public auction at the Stock Exchange.

VINGROUP

68,800

1D 1.18%

5D -1.57%

Buy Vol. 1,163,400

Sell Vol. 1,935,600

58,800

1D -0.34%

5D -2.33%

Buy Vol. 2,928,000

Sell Vol. 3,623,600

26,000

1D -0.19%

5D -0.76%

Buy Vol. 1,791,200

Sell Vol. 2,033,600

VIC: Writers and veteran automotive experts from Europe believe that the Vietnamese automaker owns "the competitive advantage of leading European models.

FOOD & BEVERAGE

72,800

1D 1.53%

5D -0.68%

Buy Vol. 2,285,100

Sell Vol. 3,270,300

102,000

1D -0.58%

5D 0.00%

Buy Vol. 608,300

Sell Vol. 638,200

156,800

1D 1.69%

5D 2.08%

Buy Vol. 262,000

Sell Vol. 208,200

MSN: Masan continues to invest in the project of Masan Western Food Industry Center 2 with a total investment of 3,500 billion VND on an area of about 46ha.

OTHERS

124,500

1D 0.24%

5D -0.80%

Buy Vol. 501,100

Sell Vol. 581,400

124,500

1D 0.24%

5D -0.80%

Buy Vol. 501,100

Sell Vol. 581,400

83,000

1D 0.00%

5D -0.60%

Buy Vol. 2,252,200

Sell Vol. 2,035,900

60,000

1D -1.64%

5D -6.83%

Buy Vol. 4,215,900

Sell Vol. 4,093,600

110,500

1D -2.64%

5D -5.39%

Buy Vol. 3,317,700

Sell Vol. 1,410,500

23,200

1D 0.00%

5D 3.57%

Buy Vol. 2,349,500

Sell Vol. 3,260,400

20,650

1D -1.20%

5D -1.20%

Buy Vol. 35,082,200

Sell Vol. 36,119,100

22,150

1D -1.99%

5D -0.67%

Buy Vol. 27,915,800

Sell Vol. 27,577,000

VJC: Vietjet opens a series of new routes from Hanoi/HCMC/Da Nang to 3 capital cities of the West Indies and Central - South India including Ahmedabad, Hyderabad and Bangalore (Bengaluru). With a total flight network between Vietnam and India of 17 routes, Vietjet is the airline serving the most direct routes between the two countries. These routes bring passengers from India's 1.4 billion people to Vietnam, contributing to promoting economic recovery and tourism of localities

Market by numbers

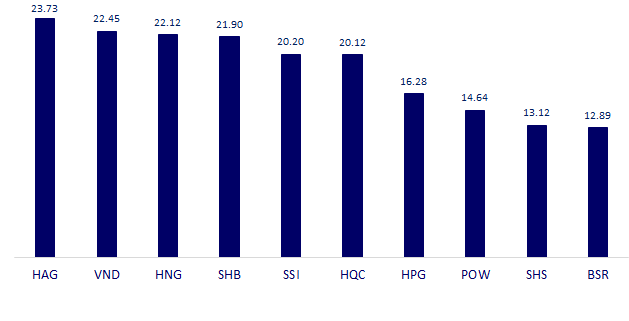

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

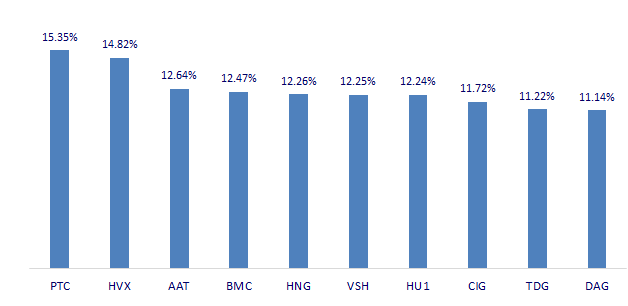

TOP INCREASES 3 CONSECUTIVE SESSIONS

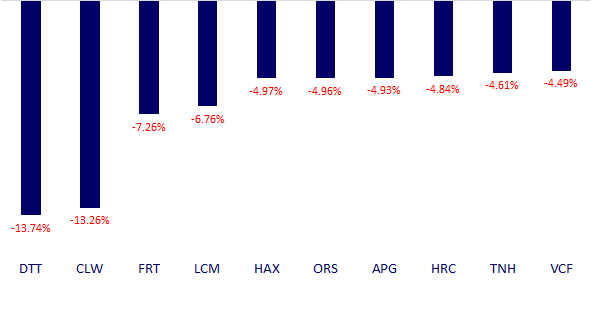

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.