Market brief 20/07/2022

VIETNAM STOCK MARKET

1,194.14

1D 1.50%

YTD -20.30%

1,225.62

1D 0.93%

YTD -20.19%

288.87

1D 1.49%

YTD -39.06%

88.88

1D 1.62%

YTD -21.12%

199.61

1D 0.00%

YTD 0.00%

16,709.04

1D 27.52%

YTD -46.22%

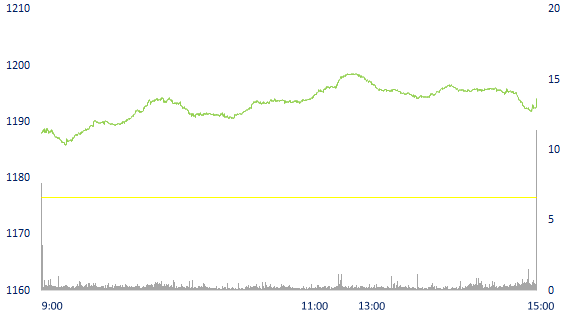

Securities and construction stocks broke out, VN-Index increased by nearly 16 points. Market liquidity improved much compared to previous sessions. Total matched value reached 15,400 billion dong, up 33%, of which, matched value on HoSE increased 34% to 12,941 billion dong. Foreign investors net bought back 199 billion dong.

ETF & DERIVATIVES

20,700

1D 0.98%

YTD -19.86%

14,450

1D 1.19%

YTD -20.12%

15,270

1D -14.26%

YTD -19.63%

17,210

1D -0.46%

YTD -24.85%

16,550

1D 0.91%

YTD -26.38%

25,900

1D 1.57%

YTD -7.66%

15,950

1D 2.31%

YTD -25.74%

1,222

1D 0.85%

YTD 0.00%

1,227

1D 1.43%

YTD 0.00%

1,224

1D 1.07%

YTD 0.00%

1,226

1D 1.08%

YTD 0.00%

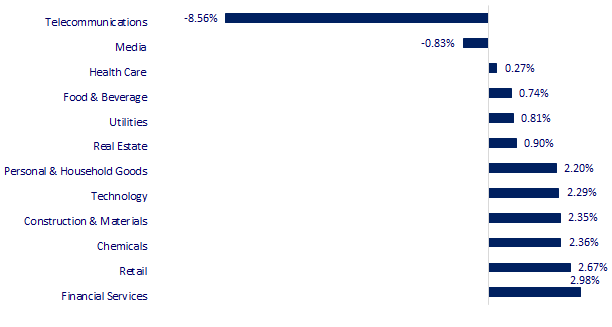

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

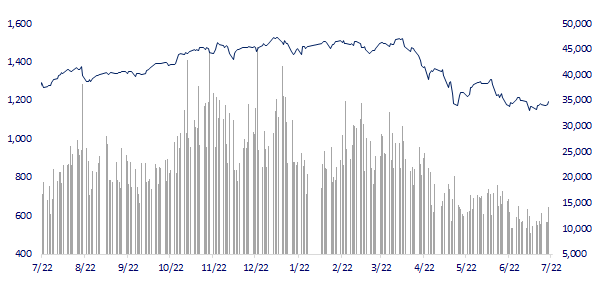

VNINDEX (12M)

GLOBAL MARKET

27,680.26

1D 0.49%

YTD -3.86%

3,304.72

1D 0.77%

YTD -9.21%

2,386.85

1D 0.67%

YTD -19.84%

20,890.22

1D -0.48%

YTD -10.72%

3,170.29

1D 1.68%

YTD 1.49%

1,539.32

1D 0.38%

YTD -7.14%

99.14

1D -0.81%

YTD 29.59%

1,711.35

1D 0.17%

YTD -6.01%

Asia - Pacific stocks mostly gained after the positive session of US stocks. Japan's Nikkei 225 index rose 2.67%. South Korea's Kospi index rose 0.67%. The Shanghai Composite Index rose 0.77%. China decided to keep the interest rates on 1-year and 5-year loans unchanged at 3.7% and 4.45% respectively. Particularly, the Hang Seng index (Hong Kong) fell 0.48%.

VIETNAM ECONOMY

1.15%

1D (bps) 19

YTD (bps) 34

5.60%

2.79%

1D (bps) 2

YTD (bps) 178

3.33%

1D (bps) -3

YTD (bps) 133

23,558

1D (%) 0.01%

YTD (%) 2.69%

24,738

1D (%) 0.11%

YTD (%) -6.54%

3,539

1D (%) -0.08%

YTD (%) -3.25%

Vietnam's pangasius exports in the first six months of the year grew in most major markets. The total export value of pangasius reached 1.4 billion USD, up 82.4% over the same period last year. However, from the third quarter of 2022, this growth rate is expected to slow down in some markets.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Pangasius exports to the US have slowed down in the past 2 months

- WB Director General: Vietnam has achieved difficult goals at the same time

- Deputy Prime Minister: No increase in electricity price yet

- Inflation in the UK continues to reach new peaks

- Russia and Iran sign a USD40 billion oil and gas deal

- China is no longer America's largest creditor

VN30

BANK

72,500

1D 1.68%

5D 0.97%

Buy Vol. 1,071,700

Sell Vol. 1,830,200

36,400

1D 2.10%

5D 0.97%

Buy Vol. 3,515,800

Sell Vol. 3,738,600

27,050

1D 1.88%

5D 1.88%

Buy Vol. 9,418,800

Sell Vol. 8,745,700

36,300

1D 0.55%

5D 0.55%

Buy Vol. 8,200,400

Sell Vol. 8,421,700

28,150

1D 0.54%

5D 1.44%

Buy Vol. 15,272,900

Sell Vol. 16,182,000

25,550

1D 1.39%

5D 0.99%

Buy Vol. 12,353,500

Sell Vol. 13,061,000

23,850

1D 1.92%

5D 0.63%

Buy Vol. 3,881,700

Sell Vol. 3,191,900

28,450

1D 4.79%

5D 6.75%

Buy Vol. 7,514,600

Sell Vol. 4,813,500

23,050

1D 0.44%

5D 0.00%

Buy Vol. 26,732,800

Sell Vol. 23,486,700

24,300

1D 1.67%

5D 1.25%

Buy Vol. 4,869,500

Sell Vol. 5,577,300

HDB: HDBank has just announced the decision to increase its charter capital to more than VND 25,103 billion by paying a dividend in 2021 by shares at the rate of 25%. By the end of the second quarter, deposit growth reached over 11% compared to December 31, 2021, more than twice the industry average. In the first 6 months of 2022, HDB's credit increased by over 14% with the momentum coming from all major business segments: retail, SME and consumer finance. The individual bad debt ratio is only 0.93%, a low level compared to the industry. Other safety ratios are guaranteed.

REAL ESTATE

73,900

1D 0.41%

5D 0.41%

Buy Vol. 1,585,600

Sell Vol. 1,941,600

36,700

1D 1.94%

5D 3.82%

Buy Vol. 1,461,700

Sell Vol. 1,325,400

53,100

1D 0.00%

5D 1.14%

Buy Vol. 2,190,700

Sell Vol. 2,306,000

The current real estate market has set new price records while the segment of social housing, affordable commercial housing has almost disappeared.

OIL & GAS

103,000

1D 1.08%

5D 6.96%

Buy Vol. 1,353,700

Sell Vol. 1,908,300

13,500

1D 0.37%

5D 3.85%

Buy Vol. 24,537,600

Sell Vol. 30,545,500

42,850

1D 1.78%

5D 7.26%

Buy Vol. 1,564,600

Sell Vol. 2,059,200

PLX: Petrolimex owns 120 million shares in PGBank, equivalent to 40% of charter capital. 120 million PGB shares owned by Petrolimex will be publicly auctioned in the third quarter of 2022

VINGROUP

68,200

1D -0.87%

5D -1.87%

Buy Vol. 1,264,600

Sell Vol. 2,661,600

59,700

1D 1.53%

5D -0.67%

Buy Vol. 3,142,000

Sell Vol. 3,743,900

26,050

1D 0.19%

5D -0.76%

Buy Vol. 2,256,800

Sell Vol. 2,946,300

VIC: VinFast will stop selling petrol cars from July, 5 months earlier than originally planned.

FOOD & BEVERAGE

73,000

1D 0.27%

5D 0.69%

Buy Vol. 1,737,900

Sell Vol. 3,692,900

103,000

1D 0.98%

5D 1.98%

Buy Vol. 990,300

Sell Vol. 1,244,200

159,800

1D 1.91%

5D 4.04%

Buy Vol. 185,100

Sell Vol. 192,300

VNM: At the beginning of July, 1,550 purebred HF dairy cows imported directly from the US were received and brought into the herd by Vinamilk at Vinamilk Green Farm.

OTHERS

125,500

1D 0.80%

5D 0.56%

Buy Vol. 642,700

Sell Vol. 604,200

125,500

1D 0.80%

5D 0.56%

Buy Vol. 642,700

Sell Vol. 604,200

84,900

1D 2.29%

5D 2.91%

Buy Vol. 5,064,200

Sell Vol. 5,619,700

61,200

1D 2.00%

5D -3.77%

Buy Vol. 17,296,900

Sell Vol. 11,910,600

113,600

1D 2.81%

5D -1.22%

Buy Vol. 2,586,300

Sell Vol. 1,984,300

23,800

1D 2.59%

5D 5.54%

Buy Vol. 4,440,400

Sell Vol. 4,660,100

21,300

1D 3.15%

5D 2.90%

Buy Vol. 34,511,400

Sell Vol. 45,120,600

22,350

1D 0.90%

5D 0.22%

Buy Vol. 33,343,600

Sell Vol. 32,539,500

FPT: FPT recorded a revenue of VND 19,826 billion in the first 6 months of the year, and a profit before tax of VND 3,637 billion, up 22.2% and 23.9% respectively over the same period in 2021. First 6 months of 2022, converted revenue for FPT was VND 3,484 billion, up 64.6% over the same period.

Market by numbers

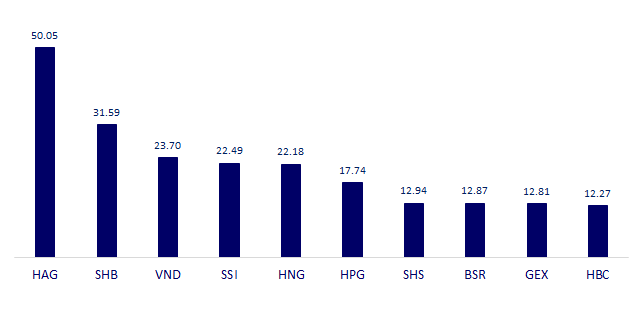

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

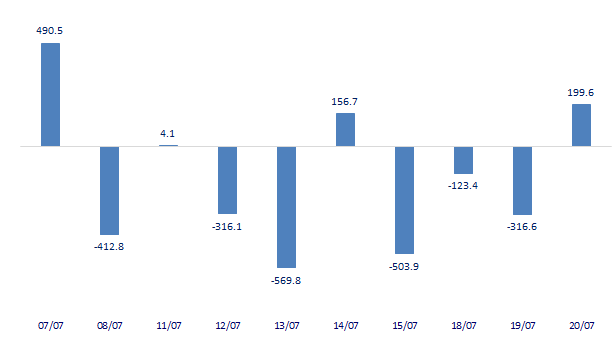

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

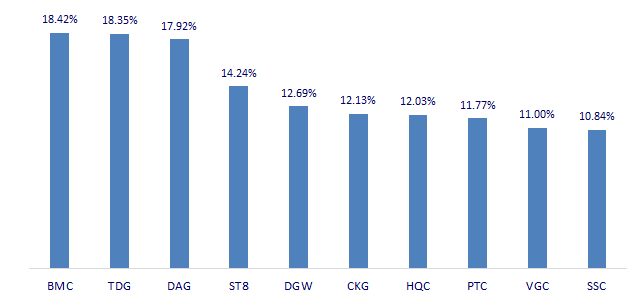

TOP INCREASES 3 CONSECUTIVE SESSIONS

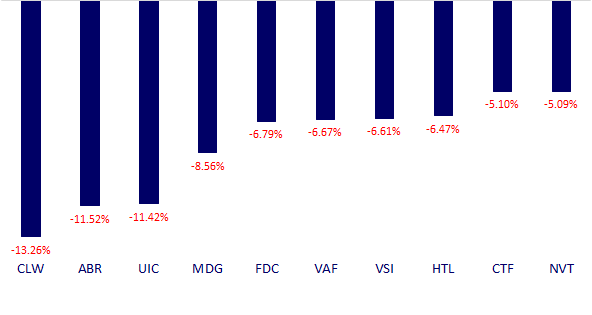

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.