Market brief 26/07/2022

VIETNAM STOCK MARKET

1,185.07

1D -0.29%

YTD -20.90%

1,218.49

1D -0.34%

YTD -20.66%

282.88

1D -0.88%

YTD -40.32%

88.41

1D 0.07%

YTD -21.54%

57.32

1D 0.00%

YTD 0.00%

11,623.18

1D -2.18%

YTD -62.59%

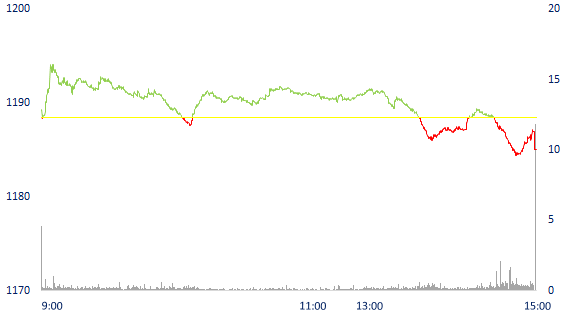

"Selling power increased at the end of the session, VN-Index dropped. In which, VIC decreased by 1.8%, BVH decreased by 1.8%, VNM decreased by 1.2%, HPG decreased by 1.1%.... Besides, stocks with good fundamentals such as VHC, REE... also simultaneously reduced prices.

ETF & DERIVATIVES

20,690

1D -0.14%

YTD -19.90%

14,420

1D 0.14%

YTD -20.29%

15,060

1D -15.44%

YTD -20.74%

17,470

1D 0.11%

YTD -23.71%

16,900

1D 1.75%

YTD -24.82%

26,010

1D -0.34%

YTD -7.27%

15,700

1D -1.26%

YTD -26.91%

1,218

1D -0.03%

YTD 0.00%

1,218

1D -0.16%

YTD 0.00%

1,219

1D -0.19%

YTD 0.00%

1,219

1D -0.25%

YTD 0.00%

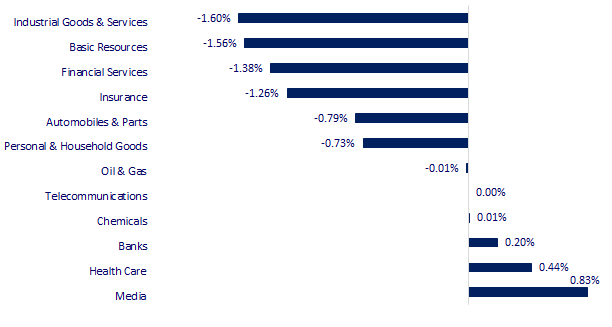

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

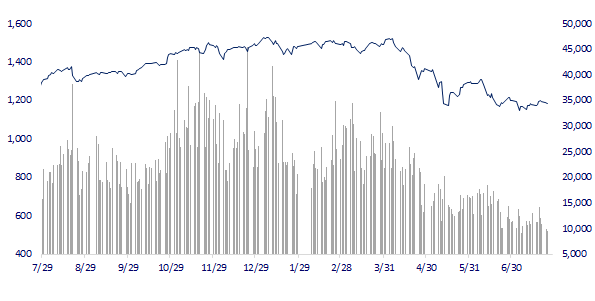

VNINDEX (12M)

GLOBAL MARKET

27,631.88

1D 0.01%

YTD -4.03%

3,277.44

1D 0.83%

YTD -9.95%

2,412.96

1D 0.39%

YTD -18.96%

20,905.88

1D 1.28%

YTD -10.65%

3,192.12

1D 0.37%

YTD 2.19%

1,553.18

1D -0.46%

YTD -6.30%

98.33

1D 1.06%

YTD 28.54%

1,718.40

1D -0.39%

YTD -5.62%

Asian stocks mostly rallied in the trading session on July 26 after South Korea announced GDP growth that exceeded forecasts. . Kospi index recovered after the above information was released, up 0.44% 2,403.69 points. Hong Kong's Hang Seng Index rose 0.51% to 20,641.50. The Shanghai Composite Index fell 0.6 percent to 3,250.39. The Nikkei 225 index fell 0.27% to 27,630 points.

VIETNAM ECONOMY

2.80%

YTD (bps) 199

5.60%

2.88%

1D (bps) 3

YTD (bps) 187

3.41%

1D (bps) 5

YTD (bps) 141

23,494

1D (%) -0.15%

YTD (%) 2.41%

24,509

1D (%) -0.77%

YTD (%) -7.40%

3,525

1D (%) -0.34%

YTD (%) -3.64%

Interbank interest rates increased, the State Bank gave 17 credit institutions a hot loan of nearly 10,000 billion VND as a pledge of valuable papers (OMO) with a term of 7 days, an interest rate of 2.5%. Along with the liquidity injection on the OMO open market channel, the operator also stopped received money through the treasury bill. Previously, the State Bank lent nearly VND 5,000 billion to credit institutions via OMO channel and did not issue new bills last week.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Effective promotion of social housing support policies

- Interbank interest rates skyrocketed, the State Bank gave 17 credit institutions large loans of nearly 10,000 billion VND

- Ho Chi Minh City "racing" for ring road clearance

- USD, gold all fell due to economic concerns

- Epidemiologist warns countries not doing enough to prevent monkeypox

- Russian Oil embargo, Europe "hit his back with his stick"

VN30

BANK

73,900

1D 1.37%

5D 3.65%

Buy Vol. 1,676,200

Sell Vol. 2,595,700

35,550

1D 0.42%

5D -0.28%

Buy Vol. 1,746,400

Sell Vol. 2,252,600

26,550

1D -0.19%

5D 0.00%

Buy Vol. 4,158,300

Sell Vol. 4,442,600

36,600

1D -0.54%

5D 1.39%

Buy Vol. 4,374,600

Sell Vol. 6,184,900

27,700

1D 0.18%

5D -1.07%

Buy Vol. 13,107,100

Sell Vol. 11,589,100

25,150

1D -0.40%

5D -0.20%

Buy Vol. 7,321,600

Sell Vol. 6,947,800

23,600

1D 0.00%

5D 0.85%

Buy Vol. 1,713,500

Sell Vol. 1,746,500

27,000

1D -1.46%

5D -0.55%

Buy Vol. 2,077,300

Sell Vol. 2,465,800

22,950

1D 0.44%

5D 0.00%

Buy Vol. 18,665,000

Sell Vol. 17,849,400

24,050

1D 0.00%

5D 0.63%

Buy Vol. 2,377,500

Sell Vol. 2,948,300

VCB: Vietcombank has just announced its business results for the first half year with pre-tax profit of VND 17.3 trillion, an increase of nearly 28% compared to the same period in 2021. Total accumulated operating income for the first half year was 32,705 billion, up 14.4% compared to that period of 2021. Operating expenses increased by 17.3% to 10,324 billion. Provision expense for credit risk decreased by 9% to VND 5,007 billion.

REAL ESTATE

73,900

1D 0.27%

5D 0.41%

Buy Vol. 1,388,100

Sell Vol. 1,787,700

37,050

1D 2.07%

5D 2.92%

Buy Vol. 1,661,100

Sell Vol. 1,520,100

52,300

1D -0.19%

5D -1.51%

Buy Vol. 1,268,500

Sell Vol. 1,325,500

The selling price of land houses in Hanoi, Ho Chi Minh City and neighboring provinces increased by 21% and 12% respectively over the same period last year.

OIL & GAS

104,700

1D 0.00%

5D 2.75%

Buy Vol. 989,900

Sell Vol. 1,202,700

13,000

1D -1.14%

5D -3.35%

Buy Vol. 19,223,900

Sell Vol. 16,631,500

40,850

1D -0.61%

5D -2.97%

Buy Vol. 628,400

Sell Vol. 567,500

GAS: PV GAS LPG said: in the first 6 months of the year, 120% of the output target plan has been completed; revenue reached 150% of the plan and profit reached 104% of the plan.

VINGROUP

66,100

1D -1.78%

5D -3.92%

Buy Vol. 1,004,900

Sell Vol. 1,749,400

58,700

1D -0.34%

5D -0.17%

Buy Vol. 1,206,400

Sell Vol. 2,423,400

26,050

1D -0.95%

5D 0.19%

Buy Vol. 1,598,100

Sell Vol. 1,798,200

VIC: VinFast received nearly 1,000 committed deposits from users in the last two days from customers who have pre-ordered 10 million VND from the first round of VF 8.

FOOD & BEVERAGE

72,000

1D -1.23%

5D -1.10%

Buy Vol. 1,774,800

Sell Vol. 3,054,400

110,000

1D 1.29%

5D 7.84%

Buy Vol. 944,900

Sell Vol. 986,200

167,700

1D 1.64%

5D 6.95%

Buy Vol. 325,400

Sell Vol. 266,000

MSN: H.C. Starck Tungsten Powders (HCS), an indirect subsidiary of Masan, has signed an agreement to invest in fast-charging lithium-ion battery supplier Nyobolt.

OTHERS

125,100

1D -0.56%

5D 0.48%

Buy Vol. 486,900

Sell Vol. 536,400

125,100

1D -0.56%

5D 0.48%

Buy Vol. 486,900

Sell Vol. 536,400

84,800

1D -0.70%

5D 2.17%

Buy Vol. 2,111,600

Sell Vol. 3,238,600

63,000

1D -0.47%

5D 5.00%

Buy Vol. 4,169,600

Sell Vol. 5,296,700

112,000

1D -1.06%

5D 1.36%

Buy Vol. 605,800

Sell Vol. 653,300

22,750

1D -0.22%

5D -1.94%

Buy Vol. 1,816,000

Sell Vol. 2,713,700

20,250

1D -0.98%

5D -1.94%

Buy Vol. 27,185,800

Sell Vol. 31,647,800

21,650

1D -1.14%

5D -2.26%

Buy Vol. 40,672,700

Sell Vol. 43,381,000

HPG: In the first half year, Hoa Phat has recorded 82,118 billion VND in revenue and 12,229 billion VND in PAT, respectively down 27% compared to the same period last year, thereby completing 46% of the year plan. Hoa Phat Group produced 4.3 million tons of crude steel, up 8% over the same period. Consumption of construction steel, billet and HRC reached nearly 4 million tons, up 6% over the same period. In which, construction steel is 2.38 million tons, up 29% compared to the first 6 months of 2021.

Market by numbers

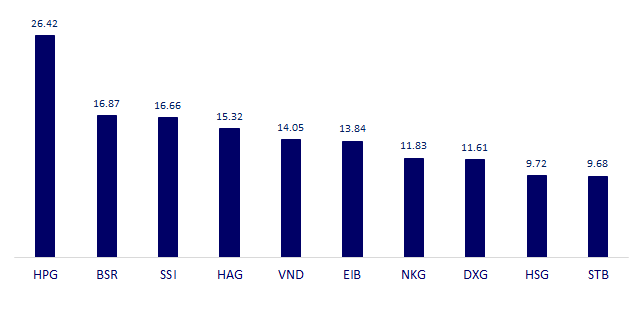

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

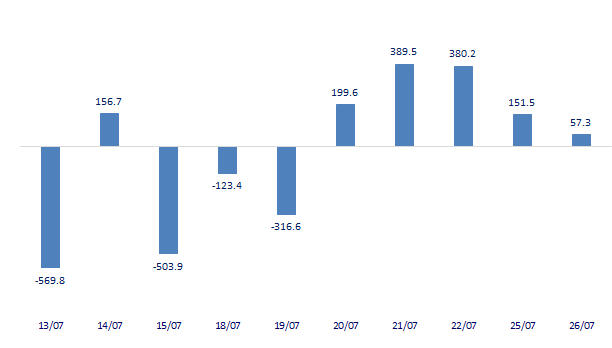

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

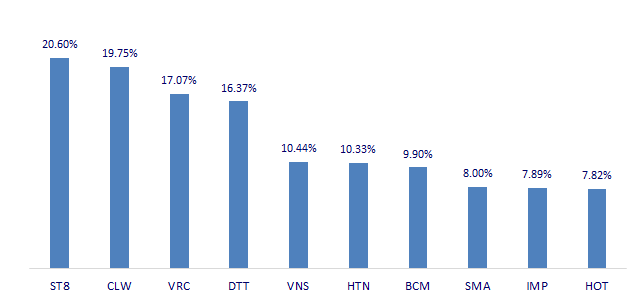

TOP INCREASES 3 CONSECUTIVE SESSIONS

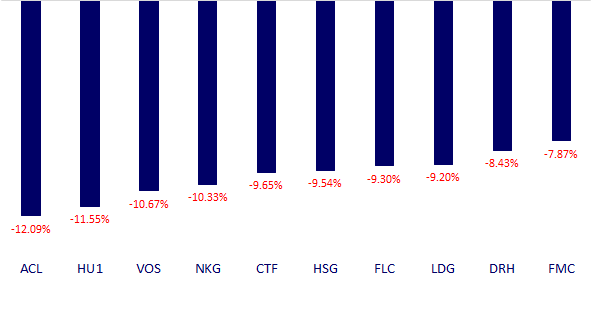

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.