Market brief 28/07/2022

VIETNAM STOCK MARKET

1,191.04

1D 0.50%

YTD -20.51%

1,219.43

1D 0.08%

YTD -20.60%

284.52

1D 0.58%

YTD -39.97%

88.87

1D 0.52%

YTD -21.13%

662.50

1D 0.00%

YTD 0.00%

11,481.37

1D -1.22%

YTD -63.05%

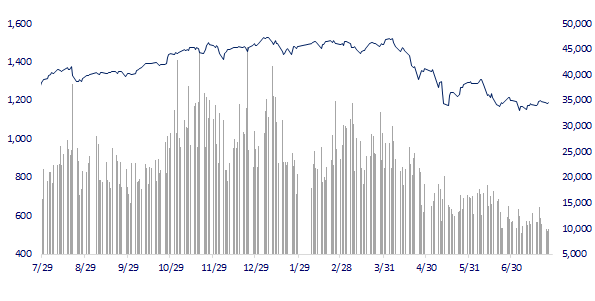

Bank stocks broke out, VN-Index increased by more than 17 points. Market liquidity improved compared to the previous session with a total matched value of VND 16,431 billion, up 76%, of which, matched value on HoSE alone increased 75% to VND 13,964 billion.

ETF & DERIVATIVES

20,920

1D 1.55%

YTD -19.01%

14,550

1D 1.25%

YTD -19.57%

15,220

1D -14.54%

YTD -19.89%

17,450

1D 0.87%

YTD -23.80%

16,890

1D 2.99%

YTD -24.87%

26,080

1D 0.66%

YTD -7.02%

16,000

1D 1.85%

YTD -25.51%

1,231

1D 1.22%

YTD 0.00%

1,232

1D 1.05%

YTD 0.00%

1,232

1D 0.81%

YTD 0.00%

1,232

1D 0.70%

YTD 0.00%

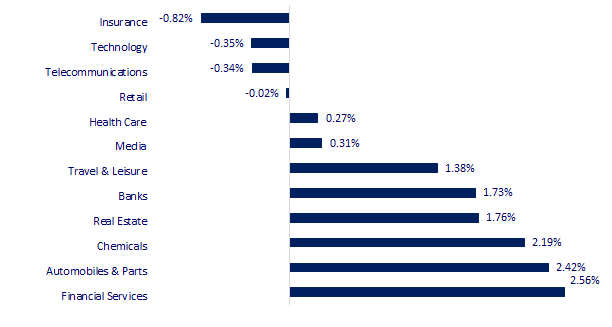

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,815.48

1D -0.06%

YTD -3.39%

3,282.58

1D 0.26%

YTD -9.81%

2,435.27

1D -0.14%

YTD -18.22%

20,622.68

1D -0.23%

YTD -11.86%

3,220.65

1D 0.48%

YTD 3.10%

1,576.41

1D 0.00%

YTD -4.90%

99.25

1D 1.62%

YTD 29.74%

1,739.70

1D 0.01%

YTD -4.45%

Asia-Pacific stocks were mixed after the US Federal Reserve (Fed) decided to raise interest rates by 0.75%, in line with the previous forecast of the market. South Korea's Kospi index fell 0.14%. In Japan, the Nikkei 225 index fell 0.06%. The Hang Seng Index (Hong Kong) dropped 0.23% despite the previous drop. The Shanghai Composite Index rose 0.26%.

VIETNAM ECONOMY

5.13%

1D (bps) 263

YTD (bps) 432

5.60%

3.08%

YTD (bps) 207

3.66%

YTD (bps) 166

23,503

1D (%) -0.07%

YTD (%) 2.45%

24,452

1D (%) -0.38%

YTD (%) -7.62%

3,532

1D (%) 0.09%

YTD (%) -3.44%

According to the Foreign Investment Agency, Ministry of Planning and Investment, in the first half year, Vietnam attracted 16.03 billion USD of FDI, of which FDI invested in the processing and manufacturing industry reached nearly 8.84 billion USD, accounting for 63% of total FDI. Not only attracting a huge amount of investment capital, the processing and manufacturing industry is also attractive to large corporations in the world, such as: Samsung, LG, Canon, Honda, Toyota, etc.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- 15.41 billion USD of foreign investment capital registered in Vietnam

- Interbank overnight interest rate exceeds 5%

- Processing and manufacturing industry "attracts" FDI

- European energy system is 'stretched like a string': Nuclear power, wind, and solar are all disabled due to heat waves

- Refining margins in Asia plummet

- US Senate passes bill to boost chip production to compete with China

VN30

BANK

75,300

1D 0.40%

5D 3.86%

Buy Vol. 1,760,200

Sell Vol. 2,687,600

36,500

1D 2.67%

5D 0.00%

Buy Vol. 3,214,800

Sell Vol. 4,482,500

27,600

1D 2.22%

5D 0.36%

Buy Vol. 14,285,500

Sell Vol. 16,226,200

37,300

1D 1.91%

5D 1.22%

Buy Vol. 8,539,200

Sell Vol. 9,662,700

28,400

1D 2.53%

5D 0.71%

Buy Vol. 31,309,500

Sell Vol. 30,222,100

25,550

1D 2.61%

5D -0.20%

Buy Vol. 20,069,800

Sell Vol. 15,847,300

24,400

1D 2.09%

5D 1.46%

Buy Vol. 4,401,100

Sell Vol. 4,555,700

27,200

1D 0.93%

5D -3.89%

Buy Vol. 4,038,000

Sell Vol. 4,769,900

24,450

1D 6.07%

5D 5.84%

Buy Vol. 70,086,400

Sell Vol. 52,651,000

24,450

1D 1.03%

5D -0.81%

Buy Vol. 4,605,700

Sell Vol. 6,159,800

ACB: pre-tax income of the consolidated bank reached more than VND 9,000 billion in the first 6 months, up 42% compared to the same period in 2021 and completing 60% of the full year plan thanks to strong credit growth. At the beginning of the year, focusing on growth in service fee income and bad debt recovery and especially the reversal of provisions for customer loans.

REAL ESTATE

74,000

1D 0.41%

5D -0.27%

Buy Vol. 2,106,900

Sell Vol. 2,615,300

38,000

1D 1.88%

5D 2.84%

Buy Vol. 1,073,000

Sell Vol. 1,240,300

53,200

1D 1.33%

5D 0.57%

Buy Vol. 1,660,900

Sell Vol. 1,679,400

Experts say that when real estate is already at a high price base after a period of continuous price increases, it is difficult to increase sharply in the next 1-5 years.

OIL & GAS

106,300

1D 1.53%

5D 2.11%

Buy Vol. 1,127,100

Sell Vol. 1,331,800

13,550

1D 3.44%

5D 1.50%

Buy Vol. 68,158,300

Sell Vol. 40,434,400

41,500

1D 0.48%

5D -2.01%

Buy Vol. 1,222,000

Sell Vol. 1,460,200

Vietnam's petroleum exports in June decreased by 20.6% in volume and 12.5% in turnover compared to the previous month, at 144,502 tons, worth 177.3 million USD.

VINGROUP

67,000

1D 0.75%

5D -2.19%

Buy Vol. 1,652,400

Sell Vol. 2,491,000

58,800

1D 0.34%

5D -0.17%

Buy Vol. 2,613,500

Sell Vol. 4,061,200

28,100

1D 6.84%

5D 6.84%

Buy Vol. 7,641,100

Sell Vol. 5,743,600

VHM: pre-tax income in the first 6 months reached VND 7,142 billion, down 68% over the same period last year, because some subdivisions of major projects have not yet been handed over.

FOOD & BEVERAGE

72,600

1D 0.55%

5D -0.82%

Buy Vol. 2,279,200

Sell Vol. 2,699,900

109,900

1D 0.00%

5D 4.17%

Buy Vol. 855,300

Sell Vol. 1,099,100

173,000

1D 3.16%

5D 4.85%

Buy Vol. 371,100

Sell Vol. 434,700

SAB: Sabeco recorded a 25% increase in net revenue yoy to VND9,000 billion, while profit after tax increased by 67% to VND1,793 billion.

OTHERS

127,400

1D 1.68%

5D 1.11%

Buy Vol. 714,300

Sell Vol. 661,700

127,400

1D 1.68%

5D 1.11%

Buy Vol. 714,300

Sell Vol. 661,700

84,900

1D -0.35%

5D -0.12%

Buy Vol. 2,480,800

Sell Vol. 3,381,900

62,000

1D -0.16%

5D -3.28%

Buy Vol. 3,564,100

Sell Vol. 3,967,300

113,000

1D 0.71%

5D -0.88%

Buy Vol. 1,136,800

Sell Vol. 1,405,700

23,950

1D 3.68%

5D 1.05%

Buy Vol. 4,212,900

Sell Vol. 4,759,500

21,150

1D 3.68%

5D -0.70%

Buy Vol. 34,056,500

Sell Vol. 38,289,900

21,400

1D 0.71%

5D -5.73%

Buy Vol. 35,515,000

Sell Vol. 41,120,300

VJC: Vietjet's representative said that the airline opened for sale nearly 30,000 promotional tickets from only 0 VND (excluding taxes and fees) for 17 routes connecting the largest cities of Vietnam - India: From Hanoi, Ho Chi Minh City, Da Nang, Phu Quoc to New Delhi, Mumbai, Ahmedabad, Hyderabad, Bangalore. Promotional tickets are open for sale unlimited time for 3 days (Wednesday, Thursday, Friday) every week from now until the end of August 26.

Market by numbers

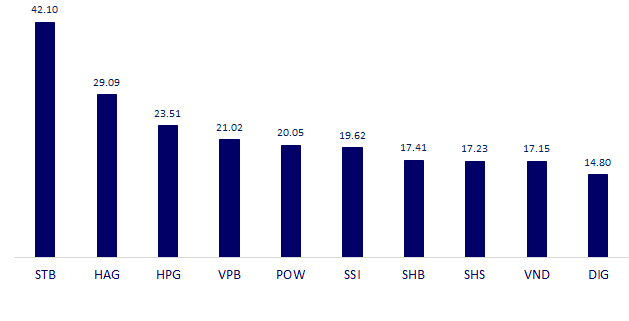

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

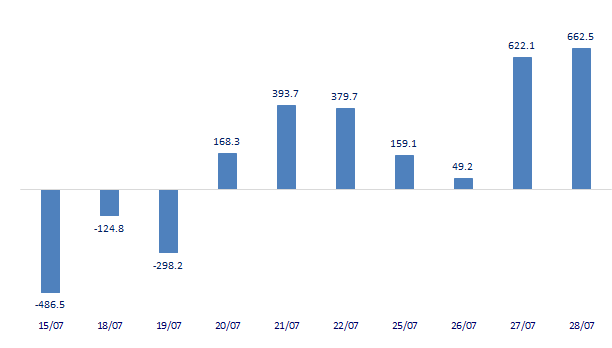

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

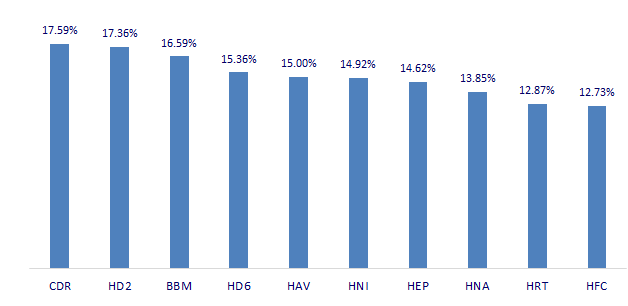

TOP INCREASES 3 CONSECUTIVE SESSIONS

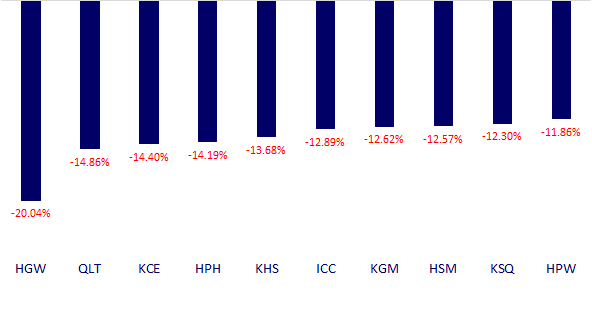

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.