Morning brief 16/08/2022

GLOBAL MARKET

33,912.44

1D 0.45%

YTD -6.83%

4,297.14

1D 0.40%

YTD -10.08%

13,128.05

1D 0.62%

YTD -16.60%

19.95

1D 2.15%

7,509.15

1D 0.11%

YTD 1.43%

13,816.61

1D 0.15%

YTD -13.02%

6,569.95

1D 0.25%

YTD -8.41%

88.53

1D -2.98%

YTD 15.73%

1,793.80

1D -0.95%

YTD -1.48%

US stocks rose in the first session of the week, continuing the upward momentum from many previous weeks. The Dow Jones Industrial Average rose 151.39 points, or 0.45%, to 33,912.44 points. The S&P 500 index rose 0.4 percent to 4,297.14 points. The Nasdaq Composite Index rose 0.62% to 13,128.05. For the first time since April 20, the Dow Jones Industrial Average closed above the 200-day moving average, an important indicator of the possibility of a rally in the near future.

VIETNAM ECONOMY

3.30%

1D (bps) -68

YTD (bps) 249

5.60%

3.22%

1D (bps) -1

YTD (bps) 221

3.60%

YTD (bps) 160

23,545

1D (%) 0.01%

YTD (%) 2.64%

24,495

1D (%) -0.87%

YTD (%) -7.45%

3,525

1D (%) -0.25%

YTD (%) -3.64%

Lending activity grew strongly, causing most banks to have exhausted their temporarily granted credit limits from the beginning of the year, even somes ran out of 'rooms' from the beginning of the 2nd quarter. The data shows that credit growth slowed down in the 2nd quarter when it only increased by 3.38%, much lower than the growth rate of 5.97% in the 1st quarter. Lending activity slowed down causing banks to have to promote sales of other products and services to maintain revenue.

VIETNAM STOCK MARKET

1,274.20

1D 0.94%

YTD -14.96%

1,293.79

1D 1.00%

YTD -15.75%

303.97

1D 0.18%

YTD -35.87%

92.64

1D -0.22%

YTD -17.78%

93.87

17,838.34

1D 16.65%

YTD -42.59%

Bank stocks broke out, VN-Index increased by nearly 12 points with stable liquidity. Liquidity on HOSE increased by 19% compared to the previous session with matched value of VND15,508 bil. The most prominent was BID with a breakthrough of 4.6%. Besides, a series of representatives also made great contributions to leading the index such as CTG, MWG, SHB, FPT.

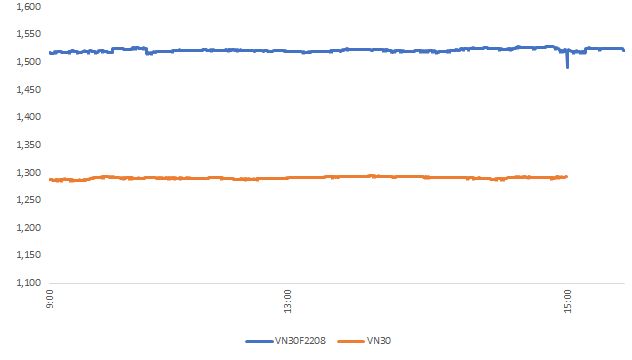

INTRADAY

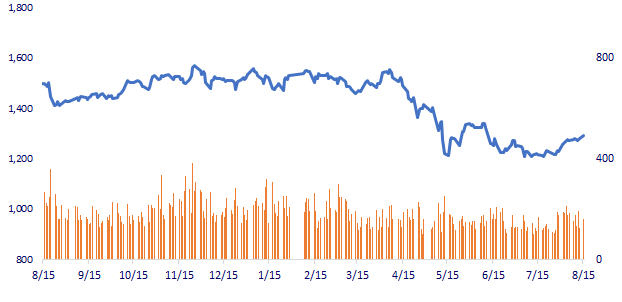

VN30 (12M)

SELECTED NEWS

- Efforts to recover, Binh Thuan tourism reaches nearly 3 million visitors

- At the latest at the beginning of next year, start the project to upgrade Cai Mep - Thi Vai port channel

- Running out of "room" for loans, banks boost sales of insurance and cards to maintain revenue

- China suffers biggest heat wave in 60 years

- Germany achieves 75% gas reserve target earlier than planned

- Japan's GDP returns to pre-pandemic levels

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.