Market brief 19/08/2022

VIETNAM STOCK MARKET

1,269.18

1D -0.35%

YTD -15.29%

1,294.93

1D -0.38%

YTD -15.68%

297.94

1D -1.08%

YTD -37.14%

92.77

1D -0.09%

YTD -17.67%

-106.05

1D 0.00%

YTD 0.00%

17,331.35

1D -1.61%

YTD -44.22%

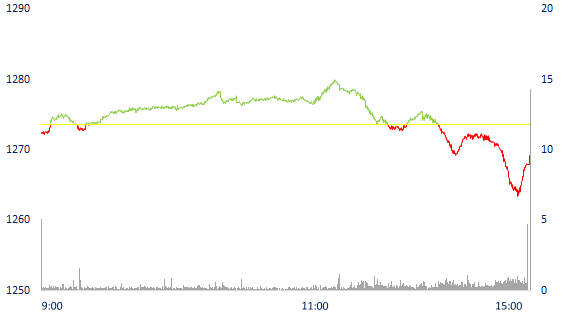

At the end of the session, VN-Index dropped 4.48 points (-0.35%) to 1,269.18 points. The whole floor had 124 gainers, 338 losers and 57 standstill stocks. The total trading value reached VND15,912 bil, down 0.7% compared to the previous session, of which, the matching value on HoSE floor decreased by 3.6% to VND13,574 bil. Foreign investors net sold again VND100 bil on HoSE.

ETF & DERIVATIVES

21,800

1D -0.55%

YTD -15.60%

15,300

1D -0.78%

YTD -15.42%

15,770

1D -11.45%

YTD -17.00%

20,000

1D 4.38%

YTD -12.66%

18,100

1D 0.28%

YTD -19.48%

26,900

1D -0.74%

YTD -4.10%

16,560

1D -0.90%

YTD -22.91%

1,267

1D -0.39%

YTD 0.00%

1,272

1D -0.57%

YTD 0.00%

1,281

1D -0.74%

YTD 0.00%

#N/A

1D -

YTD 0.00%

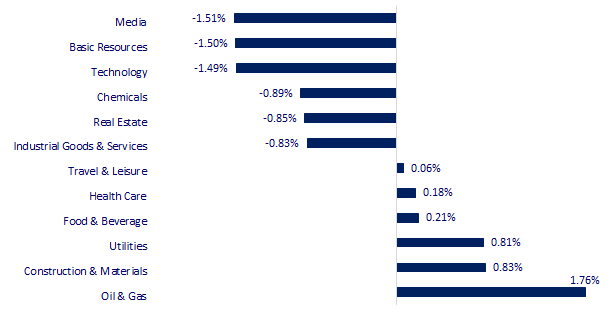

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

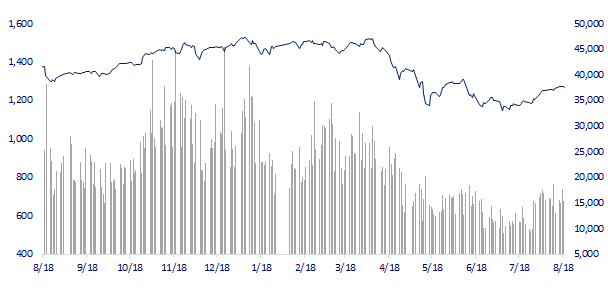

VNINDEX (12M)

GLOBAL MARKET

28,930.33

1D -0.37%

YTD 0.48%

3,258.08

1D -0.59%

YTD -10.49%

2,492.69

1D -0.61%

YTD -16.29%

19,773.03

1D 0.05%

YTD -15.49%

3,246.51

1D -0.82%

YTD 3.93%

1,626.59

1D -0.58%

YTD -1.87%

89.31

1D -1.52%

YTD 16.75%

1,767.00

1D -0.13%

YTD -2.95%

Asia - Pacific stocks mixed in the last session of the week. In Japan, the Nikkei 225 index narrowed gains after the release of inflation data. The index is now down about 0.37%. The Shanghai Composite Index (China) fell 0.37%. Hong Kong's Hang Seng Index rebounded, up 0.05%. In South Korea, the Kospi index fell 0.61%.

VIETNAM ECONOMY

2.05%

YTD (bps) 124

5.60%

3.14%

1D (bps) 1

YTD (bps) 213

3.50%

1D (bps) 17

YTD (bps) 150

23,543

1D (%) 0.01%

YTD (%) 2.63%

24,325

1D (%) 0.03%

YTD (%) -8.10%

3,509

1D (%) -0.26%

YTD (%) -4.07%

At the meeting on disbursement of public investment capital, Vice Chairman of Dong Nai Provincial People's Committee said that the disbursement rate of public investment capital of the province from the beginning of the year until now is still very low. Meanwhile, 16 projects have been allocated capital but not yet disbursed. This year, Dong Nai has been allocated public investment capital of more than VND14,100 bil. As of August 11, the locality has only disbursed nearly VND 4,900 bil.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Enterprises apply to invest 26,680 billion VND in Cam Ranh

- Hanoi and Ho Chi Minh City have labor shortages

- Ca Mau speeds up construction of key projects

- Turkey shocks interest rate cuts despite nearly 80% inflation

- Inflation in Japan rises to fastest pace in more than 7 years

- Emerging countries' economies "struggling" as rich countries scramble to buy gas

VN30

BANK

80,900

1D -0.74%

5D -0.86%

Buy Vol. 1,578,600

Sell Vol. 2,112,800

39,350

1D -0.63%

5D 0.38%

Buy Vol. 2,667,400

Sell Vol. 2,879,900

28,250

1D -1.74%

5D -1.40%

Buy Vol. 7,553,000

Sell Vol. 9,489,300

39,000

1D -0.26%

5D 0.52%

Buy Vol. 4,836,500

Sell Vol. 5,566,000

31,250

1D 3.99%

5D 4.52%

Buy Vol. 60,174,400

Sell Vol. 48,681,300

27,600

1D -0.18%

5D 2.03%

Buy Vol. 15,261,000

Sell Vol. 19,500,200

26,250

1D -2.05%

5D 3.35%

Buy Vol. 5,525,300

Sell Vol. 6,098,800

28,400

1D -1.05%

5D -0.70%

Buy Vol. 2,533,000

Sell Vol. 2,957,000

25,100

1D -0.40%

5D -2.14%

Buy Vol. 13,543,700

Sell Vol. 15,800,500

25,700

1D -1.15%

5D -0.39%

Buy Vol. 3,135,100

Sell Vol. 4,439,100

24,850

1D -1.19%

5D 0.20%

Buy Vol. 3,619,900

Sell Vol. 5,540,800

According to the latest data of the State Bank, as of May, deposits from economic organizations as well as from residents continued to increase and were VND 430,000 bil higher than the level at the end of last year. Specifically, according to the State Bank of Vietnam, as of May, deposits of economic organizations into the credit institution system reached VND 5,806 mil bil, an increase of 2.86% (corresponding to VND 161,615 bil compared to the end of last year. Notably, deposits from economic organizations increased again after a slight decrease in April. Compared to April, deposits from the economic sector increased by VND11,589 bil.

REAL ESTATE

82,300

1D -0.96%

5D 0.98%

Buy Vol. 3,137,300

Sell Vol. 3,755,900

38,700

1D -1.53%

5D -0.26%

Buy Vol. 1,049,300

Sell Vol. 1,525,900

57,600

1D -1.37%

5D 7.06%

Buy Vol. 3,278,500

Sell Vol. 3,565,800

On the afternoon of August 18, Me Linh District Land Fund Development Center successfully held an auction for 18 land plots in Chi Dong town, expected to collect nearly VND 160 bil.

OIL & GAS

115,600

1D 1.67%

5D 1.05%

Buy Vol. 1,038,100

Sell Vol. 1,731,600

13,600

1D -1.45%

5D -2.86%

Buy Vol. 25,759,400

Sell Vol. 28,583,800

42,700

1D 0.71%

5D 1.79%

Buy Vol. 3,249,800

Sell Vol. 3,173,000

Oil prices increased by about 3% when investors received some positive information related to the job market and the demand for fuel of the American people.

VINGROUP

67,900

1D -0.29%

5D 2.57%

Buy Vol. 2,211,800

Sell Vol. 2,409,700

60,100

1D -1.64%

5D -1.80%

Buy Vol. 4,115,800

Sell Vol. 4,861,300

29,300

1D -1.01%

5D -0.17%

Buy Vol. 3,567,000

Sell Vol. 4,358,600

Vinhomes made its mark with a series of sea festivals and large-scale events, attracting a large number of residents to participate in Vinhomes Ocean Park 2 - The Empire.

FOOD & BEVERAGE

74,100

1D 0.95%

5D 3.06%

Buy Vol. 8,017,400

Sell Vol. 8,847,300

112,000

1D 0.00%

5D 4.48%

Buy Vol. 804,700

Sell Vol. 1,408,100

195,000

1D 0.78%

5D 7.14%

Buy Vol. 178,300

Sell Vol. 263,400

VNM: Vinamilk has surpassed 2 other big brands to take the leading position in the Top 3 most potential global dairy brands.

OTHERS

124,000

1D 0.00%

5D -0.24%

Buy Vol. 723,600

Sell Vol. 831,800

124,000

1D 0.00%

5D -0.24%

Buy Vol. 723,600

Sell Vol. 831,800

86,900

1D -1.59%

5D 0.46%

Buy Vol. 3,041,500

Sell Vol. 3,145,900

64,100

1D -0.62%

5D 1.75%

Buy Vol. 4,738,000

Sell Vol. 5,277,200

24,200

1D -0.62%

5D -2.62%

Buy Vol. 2,970,100

Sell Vol. 3,026,600

25,150

1D 0.20%

5D 1.00%

Buy Vol. 32,577,500

Sell Vol. 34,678,300

23,750

1D -1.66%

5D -0.84%

Buy Vol. 45,554,800

Sell Vol. 58,152,400

HPG: Hoa Phat sets the selling price of HRC steel (CFR) at $595/ton for both SAE 1006 and SS400, down $15/ton from last month, a source from Hoa Phat said. According to the announcement on August 17, this steel company said that the price of HRC for October delivery in October 2022 was at VND 14,000/kg and asked customers to confirm the order before August 23. This price applies to both HCMC and Hai Phong.

Market by numbers

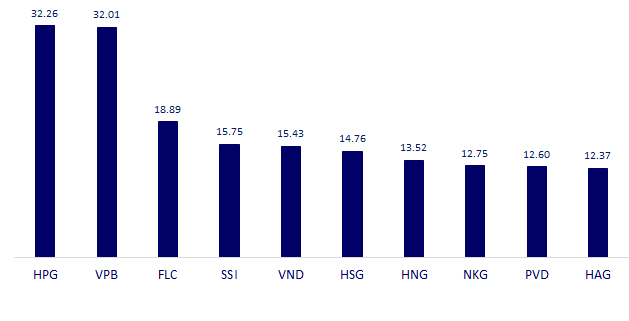

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

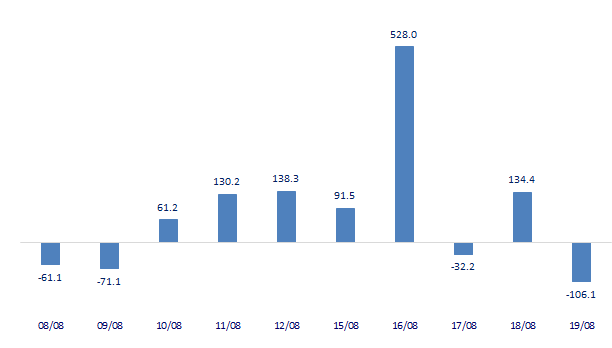

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

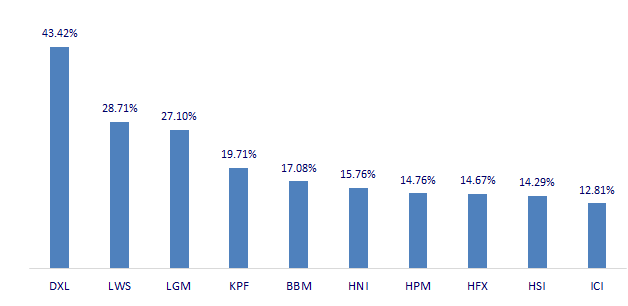

TOP INCREASES 3 CONSECUTIVE SESSIONS

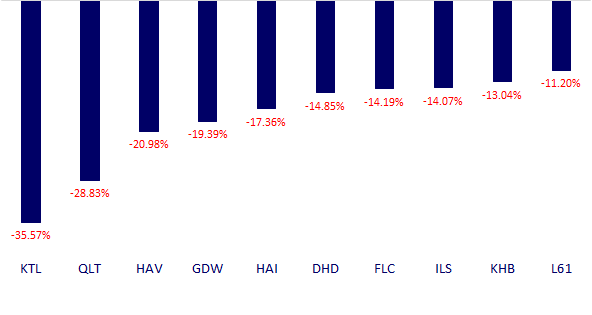

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.