Market brief 23/08/2022

VIETNAM STOCK MARKET

1,270.81

1D 0.82%

YTD -15.18%

1,292.00

1D 0.51%

YTD -15.87%

299.14

1D 1.50%

YTD -36.89%

92.78

1D 0.61%

YTD -17.66%

-80.05

1D 0.00%

YTD 0.00%

16,969.13

1D -4.02%

YTD -45.39%

At the end of the session, Foreigners bought 37 mil shares, worth 888 billion dong, while selling 36 mil shares, worth VND968 bil. Total net buying volume stood at 727,472 shares. Foreign investors on HoSE were the strongest net buyers of VNM with VND162 bil, while VHM was sold the most with VND45 bil.

ETF & DERIVATIVES

21,790

1D -0.05%

YTD -15.64%

15,250

1D 0.13%

YTD -15.70%

15,750

1D -11.57%

YTD -17.11%

20,290

1D 1.45%

YTD -11.40%

18,050

1D -3.99%

YTD -19.71%

27,150

1D 0.41%

YTD -3.21%

16,730

1D 1.03%

YTD -22.11%

1,266

1D 0.24%

YTD 0.00%

1,273

1D 0.39%

YTD 0.00%

1,280

1D 0.86%

YTD 0.00%

1,283

1D 0.95%

YTD 0.00%

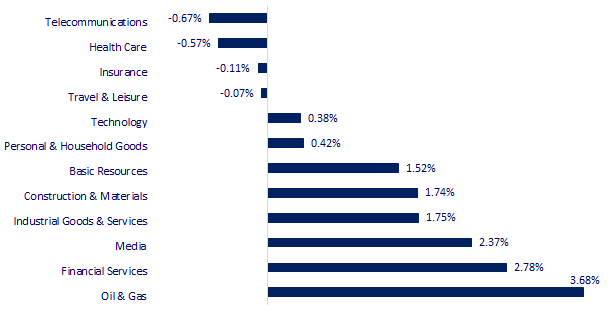

CHANGE IN PRICE BY SECTOR

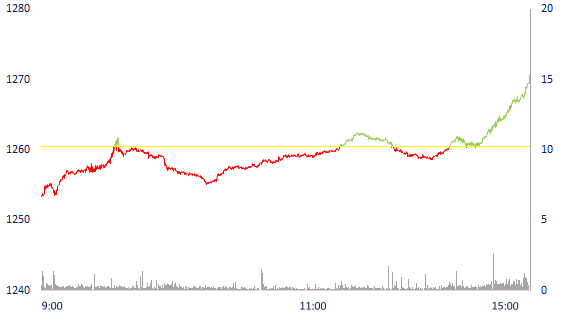

INTRADAY VNINDEX

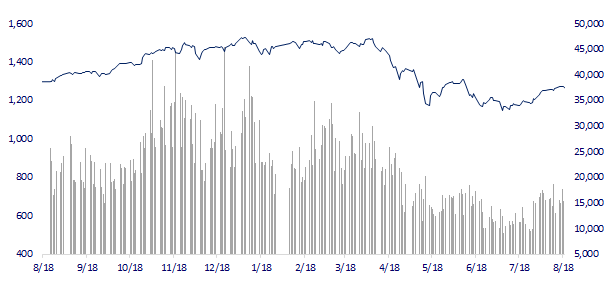

VNINDEX (12M)

GLOBAL MARKET

28,452.75

1D 0.16%

YTD -1.18%

3,276.22

1D -0.05%

YTD -9.99%

2,435.34

1D -1.10%

YTD -18.21%

19,503.25

1D -0.78%

YTD -16.64%

3,246.21

1D -0.50%

YTD 3.92%

1,634.13

1D 1.13%

YTD -1.42%

91.91

1D 1.13%

YTD 20.14%

1,750.65

1D -0.05%

YTD -3.85%

Asian stocks all fell after the "backward" session of US stocks with the Dow Jones and S&P 500 falling the most since mid-June. In Hong Kong, the Hang Seng index fell 0.78%. In South Korea, the Kospi index fell 1.1%. The Shanghai Composite Index fell 0.05%. In contrast, Japan's Nikkei 225 gained 0.16%.

VIETNAM ECONOMY

2.49%

YTD (bps) 168

5.60%

3.19%

1D (bps) -1

YTD (bps) 218

3.57%

1D (bps) 5

YTD (bps) 157

23,577

1D (%) 0.11%

YTD (%) 2.78%

23,988

1D (%) -0.09%

YTD (%) -9.37%

3,493

1D (%) 0.14%

YTD (%) -4.51%

In the report on the assessment of the implementation of the 2022 plan, the expected 2023 plan of the Industry and Trade sector, which has just been sent by the Ministry of Industry and Trade to the Ministry of Planning and Investment, said that in the first 6 months of the year, import and export turnover continued to increase with amount more than 371.3 bil USD. In which, export turnover of goods increased by 17.3% over the same period last year, reaching more than 186 bil USD.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Speeding up site clearance to deploy Bien Hoa-Vung Tau expressway

- Expecting "wave" of FDI in the automotive industry

- Export turnover for the whole year is estimated at about 368 bil USD, up more than 9%.

- China strengthens monetary policy easing to revive the economy that is losing momentum

- Gas prices set record, Belgium warns Europe will face '10 difficult winters'

- Citigroup: UK inflation could surpass 18%

VN30

BANK

80,200

1D 0.25%

5D -1.60%

Buy Vol. 1,016,800

Sell Vol. 1,172,200

39,500

1D 2.73%

5D -2.47%

Buy Vol. 3,198,700

Sell Vol. 2,551,400

28,000

1D 0.00%

5D -4.11%

Buy Vol. 9,414,800

Sell Vol. 5,858,000

38,800

1D 0.26%

5D -0.51%

Buy Vol. 6,175,400

Sell Vol. 5,188,400

31,200

1D -0.16%

5D 3.48%

Buy Vol. 17,786,900

Sell Vol. 16,400,900

23,200

1D 0.43%

5D 2.17%

Buy Vol. 13,340,700

Sell Vol. 9,444,300

25,700

1D 0.98%

5D -2.47%

Buy Vol. 4,903,100

Sell Vol. 3,333,400

28,000

1D 0.36%

5D -2.95%

Buy Vol. 2,534,500

Sell Vol. 2,373,400

25,000

1D 1.21%

5D -2.15%

Buy Vol. 18,445,700

Sell Vol. 17,219,900

25,200

1D 0.80%

5D -4.55%

Buy Vol. 2,713,700

Sell Vol. 2,161,000

24,800

1D 0.61%

5D -0.20%

Buy Vol. 5,175,900

Sell Vol. 4,422,600

MBB: MB Debt Management and Asset Exploitation Company Limited (MBAMC), a subsidiary of MB, announces a competitive offer to sell all debts of Tan Tan JSC and Sing Sing JSC at Sai Gon branch. The properties offered for sale are the entire principal and interest obligations of the two enterprises as of the end of August 17. In which, the total outstanding debt of Sing Sing Joint Stock Company is more than 31.1 bil VND, principal debt is VND 6.8 bil, the remaining more than VND 24.2 bil is interest debt. Tan Tan Joint Stock Company recorded a debt including principal and interest of more than VND 28.7 bil (principal debt of VND 6.3 bil).

REAL ESTATE

82,000

1D 0.24%

5D -1.20%

Buy Vol. 4,671,200

Sell Vol. 4,083,200

37,700

1D 0.00%

5D -2.96%

Buy Vol. 2,146,900

Sell Vol. 1,726,800

56,600

1D 0.89%

5D 3.85%

Buy Vol. 3,846,400

Sell Vol. 3,509,100

The supply of housing scarced in recent years, causing increase of apartment prices, not only in the primary segment, but also in old apartments, including apartments without red books.

OIL & GAS

117,000

1D 1.83%

5D 3.08%

Buy Vol. 885,200

Sell Vol. 1,271,100

13,900

1D 1.83%

5D -1.42%

Buy Vol. 28,671,100

Sell Vol. 21,464,300

44,000

1D 3.90%

5D 1.73%

Buy Vol. 8,694,600

Sell Vol. 6,577,100

Europe is afraid that Russia will lock down the Nord Stream 1 pipeline during this maintenance to push European countries into an unprecedented "cold winter" …

VINGROUP

65,000

1D -1.52%

5D -1.37%

Buy Vol. 2,705,400

Sell Vol. 2,136,200

59,500

1D 0.17%

5D -2.94%

Buy Vol. 3,123,800

Sell Vol. 2,471,900

28,850

1D -0.69%

5D -1.54%

Buy Vol. 3,530,500

Sell Vol. 2,543,900

VIC: Vingroup's General Director said that in the next 2 years, the group needs 100,000 employees, of which 20% are senior personnel at least at university level; about 10% for the production block.

FOOD & BEVERAGE

75,800

1D 2.85%

5D 5.57%

Buy Vol. 10,510,300

Sell Vol. 6,754,700

112,600

1D 0.72%

5D 3.30%

Buy Vol. 1,103,300

Sell Vol. 1,347,900

190,000

1D -2.06%

5D 1.06%

Buy Vol. 154,600

Sell Vol. 169,000

MSN: Phuc Long is valued at 450 million USD by Masan

OTHERS

123,500

1D -0.32%

5D 0.08%

Buy Vol. 794,400

Sell Vol. 939,300

123,500

1D -0.32%

5D 0.08%

Buy Vol. 794,400

Sell Vol. 939,300

87,000

1D 0.23%

5D -1.92%

Buy Vol. 2,534,400

Sell Vol. 1,691,200

66,900

1D 0.60%

5D 1.36%

Buy Vol. 6,906,900

Sell Vol. 8,624,800

23,950

1D 1.27%

5D -3.43%

Buy Vol. 2,798,700

Sell Vol. 1,962,100

25,400

1D 2.83%

5D 3.25%

Buy Vol. 62,558,600

Sell Vol. 55,141,200

23,650

1D 1.28%

5D -3.67%

Buy Vol. 41,658,400

Sell Vol. 32,783,500

MWG: Mobile World has recently updated its business situation until July 2022. Specifically, the company's revenue reached VND11 tril, up 16% over the same period. In which, the main contribution was the phone and electronics segment with VND 8,400 bil, up 63% over the same period.

Market by numbers

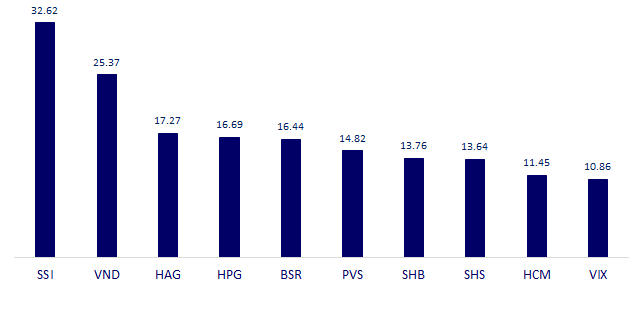

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

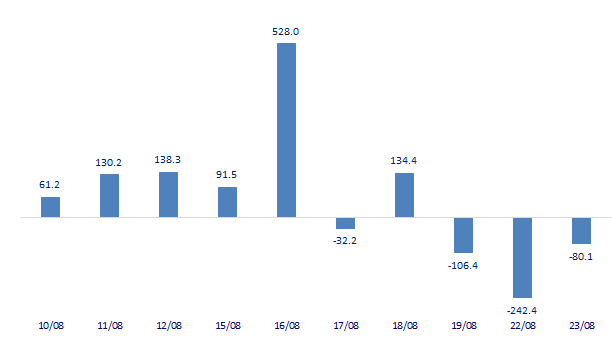

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

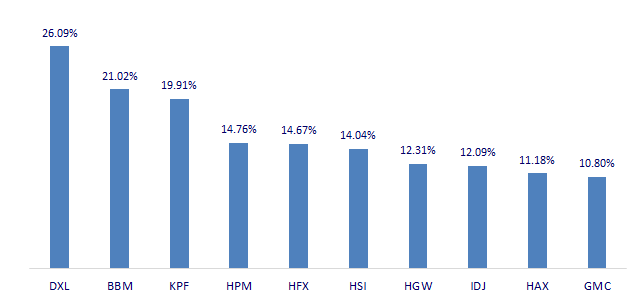

TOP INCREASES 3 CONSECUTIVE SESSIONS

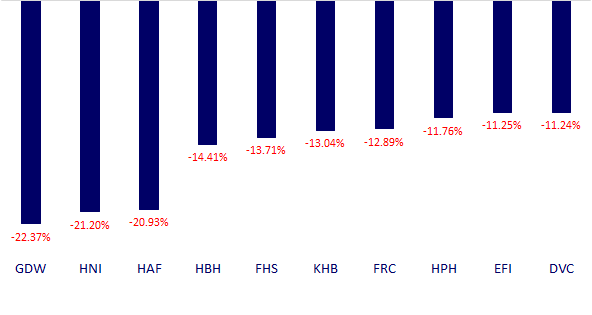

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.