Market brief 29/08/2022

VIETNAM STOCK MARKET

1,270.80

1D -0.92%

YTD -15.18%

1,293.25

1D -1.04%

YTD -15.79%

295.54

1D -1.32%

YTD -37.65%

91.57

1D -1.41%

YTD -18.73%

-363.08

1D 0.00%

YTD 0.00%

24,286.54

1D 26.49%

YTD -21.84%

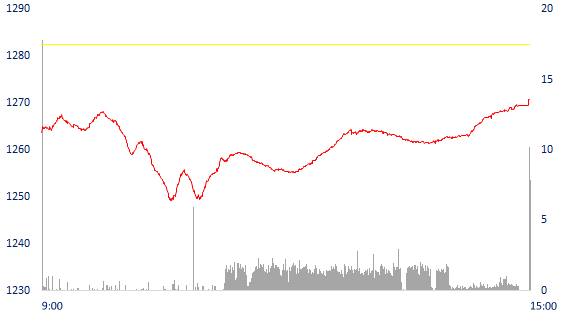

Demand increased strongly at the end, VN-Index also dropped by nearly 12 points. Market liquidity increased sharply compared to the previous session. The total matched value reached 22,525 billion dong, up 30% compared to the previous session, of which, the matched value on HoSE alone increased 28% to 18,807 billion dong. Foreign investors net sold 370 billion dong on HoSE.

ETF & DERIVATIVES

21,810

1D -1.40%

YTD -15.56%

15,290

1D -1.04%

YTD -15.48%

16,230

1D -8.87%

YTD -14.58%

20,100

1D -2.38%

YTD -12.23%

17,630

1D -3.66%

YTD -21.57%

27,460

1D -0.72%

YTD -2.10%

17,200

1D 0.00%

YTD -19.93%

1,264

1D -0.92%

YTD 0.00%

1,269

1D -1.09%

YTD 0.00%

1,280

1D -0.56%

YTD 0.00%

1,286

1D -0.54%

YTD 0.00%

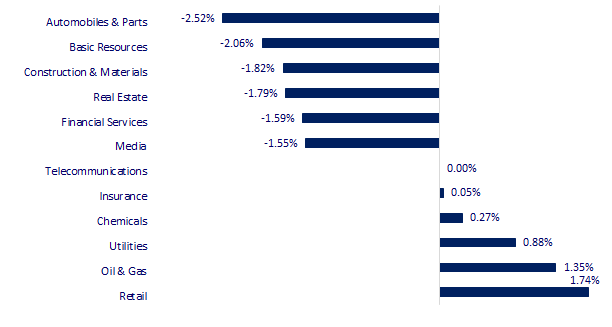

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

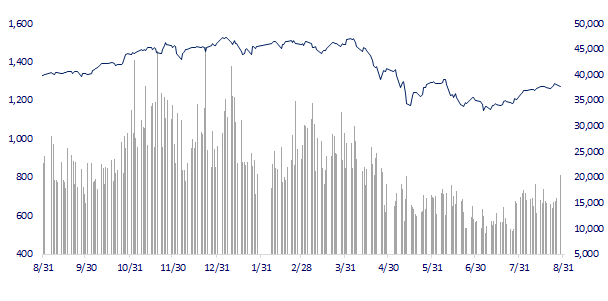

VNINDEX (12M)

GLOBAL MARKET

27,878.96

1D 0.27%

YTD -3.17%

3,240.73

1D 0.14%

YTD -10.96%

2,426.89

1D -2.18%

YTD -18.50%

20,023.22

1D 0.27%

YTD -14.42%

3,222.26

1D -1.05%

YTD 3.16%

1,626.52

1D -1.18%

YTD -1.88%

93.90

1D -0.02%

YTD 22.75%

1,733.85

1D -0.23%

YTD -4.78%

Asian stocks mixed after Mr. Powell's warning. In Japan, the Nikkei 225 index rose 0.27%. South Korea's Kospi index fell 2.18%. The Shanghai Composite Index rose 0.14% to 3,240.73 points. Hong Kong's Hang Seng Index rose 0.27%.

VIETNAM ECONOMY

3.58%

1D (bps) -24

YTD (bps) 277

5.60%

3.22%

YTD (bps) 221

3.59%

1D (bps) -1

YTD (bps) 159

23,575

1D (%) 0.06%

YTD (%) 2.77%

24,076

1D (%) 0.33%

YTD (%) -9.04%

3,457

1D (%) -0.60%

YTD (%) -5.49%

According to information from the General Statistics Office, in August, the total import and export turnover of goods was estimated at 64.34 billion USD, up 5.2% over the previous month and up 17.3% over the same period last year. In the first eight months, the total import and export turnover of goods was estimated at US$497.64 billion, up 15.5% over the same period last year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam has a trade surplus of nearly 4 billion USD in 8 months

- CPI in 8 months of 2022 increased by 2.58% over the same period last year, core inflation increased by 1.64%

- In the first 8 months of the year, the State budget was more than 250 trillion VND

- Bloomberg: Russia may stop exporting natural gas to the EU for 1 year

- Fed accepts to sacrifice growth, continues to raise interest rates to control inflation

- The US may raise interest rates again in September

VN30

BANK

82,500

1D 0.00%

5D 3.13%

Buy Vol. 1,869,600

Sell Vol. 1,529,200

39,000

1D -1.02%

5D 1.43%

Buy Vol. 2,805,100

Sell Vol. 2,358,800

27,900

1D -1.93%

5D -0.36%

Buy Vol. 7,324,100

Sell Vol. 7,365,000

38,750

1D -1.90%

5D 0.13%

Buy Vol. 7,363,200

Sell Vol. 7,523,600

31,200

1D -1.27%

5D -0.16%

Buy Vol. 33,749,300

Sell Vol. 24,802,100

23,400

1D -0.85%

5D 1.30%

Buy Vol. 26,205,600

Sell Vol. 18,596,100

25,950

1D -1.33%

5D 1.96%

Buy Vol. 4,455,100

Sell Vol. 4,664,600

27,700

1D -2.46%

5D -0.72%

Buy Vol. 3,489,000

Sell Vol. 3,688,800

24,850

1D -1.00%

5D 0.61%

Buy Vol. 27,392,300

Sell Vol. 29,787,200

25,300

1D -0.39%

5D 1.20%

Buy Vol. 3,471,400

Sell Vol. 3,383,700

24,550

1D -1.01%

5D -0.41%

Buy Vol. 6,803,600

Sell Vol. 6,354,000

According to aggregated data, by the end Q2, 18/27 banks recorded a decrease in CASA ratio compared to the beginning of the year. The 9 banks that recorded an increase in CASA ratio were MSB, Vietcombank, BIDV, ABBank, Eximbank, NCB, SeABank, Bac A Bank, and VietBank. Currently the champion of CASA is still Techcombank with the rate of 43.4%, although down more than 3.6 percentage points compared to the beginning of the year. Customer deposits by the end of June 30 reached VND 321,634 billion, up 2.2% compared to the beginning of the year, demand deposits at VND 139,512 billion, down 5.6%.

REAL ESTATE

82,100

1D -1.44%

5D 0.37%

Buy Vol. 4,150,700

Sell Vol. 4,563,200

37,600

1D -1.96%

5D -0.27%

Buy Vol. 1,368,000

Sell Vol. 1,696,900

53,800

1D -4.44%

5D -4.10%

Buy Vol. 3,056,500

Sell Vol. 3,379,200

PDR: received the award of Top 10 most prestigious brands in Asia in 2022. The voting council highly appreciates the growth rate and sustainable development strategy that Phat Dat is pursuing.

OIL & GAS

117,500

1D 2.00%

5D 2.26%

Buy Vol. 1,342,800

Sell Vol. 1,326,800

13,950

1D -2.11%

5D 2.20%

Buy Vol. 29,472,900

Sell Vol. 30,660,500

42,900

1D -1.38%

5D 1.30%

Buy Vol. 3,732,500

Sell Vol. 4,187,200

POW: On August 24, POW signed a working capital loan credit contract worth VND 1,500 billion with Vietcombank for Nhon Trach 3 & 4 Thermal Power Project.

VINGROUP

63,600

1D -2.15%

5D -3.64%

Buy Vol. 2,801,000

Sell Vol. 2,446,700

59,700

1D -1.00%

5D 0.51%

Buy Vol. 3,417,300

Sell Vol. 3,626,000

28,400

1D -1.56%

5D -2.24%

Buy Vol. 3,307,600

Sell Vol. 3,145,600

VHM: contributed more than 11,100b VND to establish 3 subsidiaries in Hung Yen. The main business of all 3 companies is real estate business. VHM's capital contribution ratio is 99.99%.

FOOD & BEVERAGE

75,500

1D -1.82%

5D 2.44%

Buy Vol. 5,798,100

Sell Vol. 4,850,800

112,200

1D 0.00%

5D 0.36%

Buy Vol. 941,700

Sell Vol. 1,020,900

188,000

1D 0.00%

5D -3.09%

Buy Vol. 302,200

Sell Vol. 220,500

MSN: Vision 2025 Masan expects to save 15% of the cost of the value chain from producer to retailer to consumer.

OTHERS

122,000

1D -0.81%

5D -1.53%

Buy Vol. 639,200

Sell Vol. 754,000

122,000

1D -0.81%

5D -1.53%

Buy Vol. 639,200

Sell Vol. 754,000

86,500

1D -0.80%

5D 0.81%

Buy Vol. 3,903,200

Sell Vol. 4,175,200

74,000

1D 2.49%

5D 11.28%

Buy Vol. 16,264,700

Sell Vol. 12,040,700

24,950

1D -1.77%

5D 5.50%

Buy Vol. 4,058,500

Sell Vol. 4,854,400

24,400

1D -1.61%

5D -1.21%

Buy Vol. 56,582,600

Sell Vol. 45,946,400

23,000

1D -2.13%

5D -1.50%

Buy Vol. 51,646,400

Sell Vol. 55,864,300

MWG: recently updated its business situation in 7 months of 2022. In terms of revenue structure, the total revenue of Mobile World (including Topzone) and Dien May Xanh (DMX) chains after 7 months is 65,500b, up 21% over the same period. In which, TGDD contributed 21,500b VND while DMX brought in 44 r VND. In July alone, the total sales of MWG's phone and electronics retail chains increased by 63% compared to the low year level in 2021.

Market by numbers

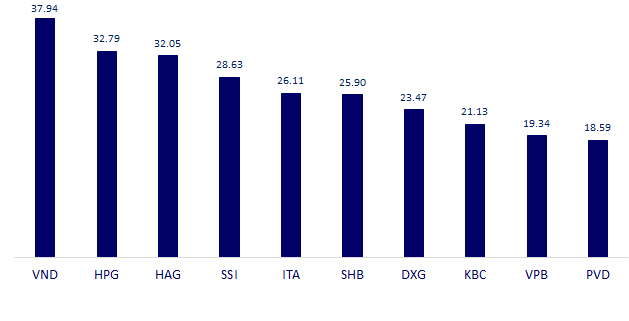

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

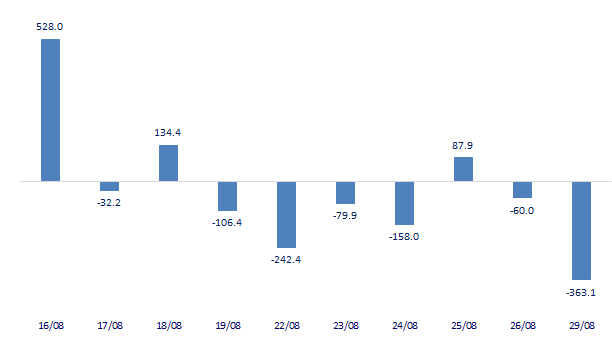

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

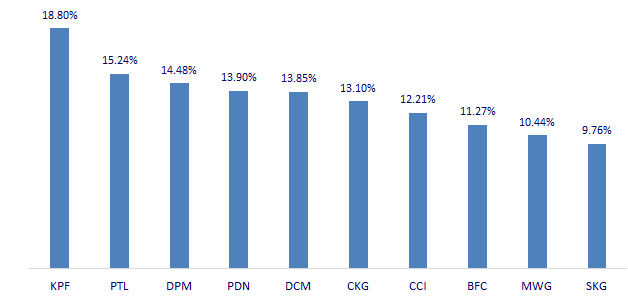

TOP INCREASES 3 CONSECUTIVE SESSIONS

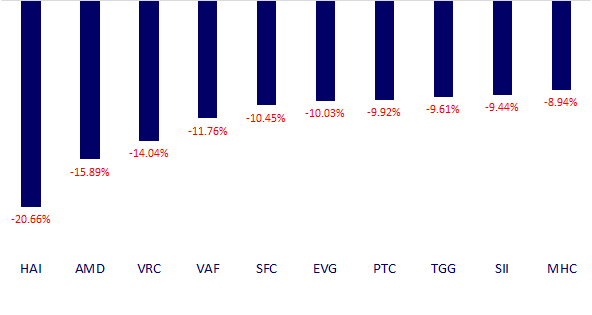

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.