Market brief 30/08/2022

VIETNAM STOCK MARKET

1,279.39

1D 0.68%

YTD -14.61%

1,298.14

1D 0.38%

YTD -15.47%

293.86

1D -0.57%

YTD -38.00%

92.39

1D 0.90%

YTD -18.01%

-11.32

1D 0.00%

YTD 0.00%

16,215.71

1D -33.23%

YTD -47.81%

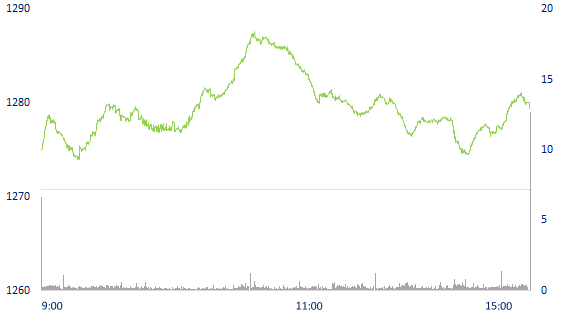

Pulling the pillar stocks at the end of the session, VN-Index gained nearly 9 points. Total matched value reached 14,558 billion dong, down 35% compared to the previous session, of which, matched value on HoSE floor decreased 35% to 12,213 billion dong. Foreign investors net sold more than 11 billion dong in the whole market.

ETF & DERIVATIVES

22,000

1D 0.87%

YTD -14.83%

15,390

1D 0.65%

YTD -14.93%

15,910

1D -10.67%

YTD -16.26%

21,490

1D 6.92%

YTD -6.16%

18,200

1D 3.23%

YTD -19.04%

27,720

1D 0.95%

YTD -1.18%

16,760

1D -2.56%

YTD -21.97%

1,271

1D 0.49%

YTD 0.00%

1,279

1D 0.79%

YTD 0.00%

1,285

1D 0.37%

YTD 0.00%

1,287

1D 0.08%

YTD 0.00%

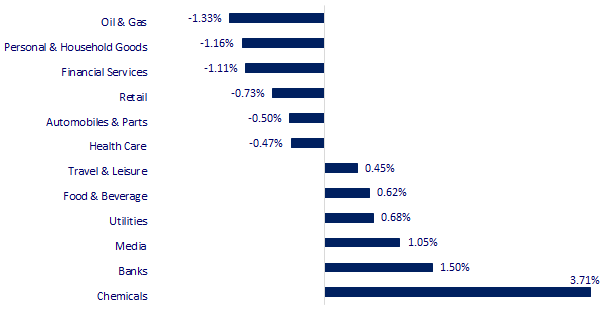

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

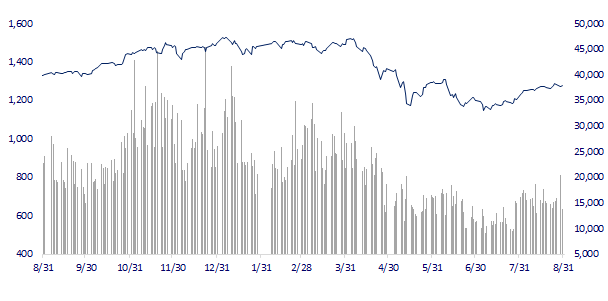

VNINDEX (12M)

GLOBAL MARKET

28,195.58

1D 0.30%

YTD -2.07%

3,227.22

1D -0.42%

YTD -11.33%

2,450.93

1D 0.99%

YTD -17.69%

19,949.03

1D 0.80%

YTD -14.74%

3,239.33

1D 0.53%

YTD 3.70%

1,639.45

1D 0.79%

YTD -1.10%

95.53

1D -1.12%

YTD 24.88%

1,745.40

1D -0.17%

YTD -4.14%

Asian stocks mixed, Japan, Korea recovered. In Japan, the Nikkei 225 index rose 0.3%. South Korea's Kospi index rose 0.99%. Chinese stocks fell. The Shanghai Composite Index fell 0.42%.

VIETNAM ECONOMY

3.88%

1D (bps) 30

YTD (bps) 307

5.60%

3.23%

1D (bps) 1

YTD (bps) 222

3.60%

1D (bps) 1

YTD (bps) 160

23,558

1D (%) -0.07%

YTD (%) 2.69%

24,222

1D (%) 0.03%

YTD (%) -8.49%

3,464

1D (%) 0.06%

YTD (%) -5.30%

The latest updated data of the State Bank (SBV) as of mid-August 2022, credit growth of the whole economy increased by 9.62% (in the same period in 2021, it increased by 6.68%). Previously, as of June 30, credit growth announced by the State Bank of Vietnam was up to 9.35%. Thus, over the past month, credit to the economy only increased by 0.27%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Banks attract more depositors

- Prime Minister: No unreasonable tightening of real estate credit

- Businesses are thirsty for business capital

- The US economy may be stagnant, not in recession

- It is difficult for the EU to agree to a visa ban for all Russian citizens

- Europe soon achieves its gas reserve target despite supply cuts from Russia

VN30

BANK

86,000

1D 4.24%

5D 7.23%

Buy Vol. 3,608,200

Sell Vol. 3,934,600

39,800

1D 2.05%

5D 0.76%

Buy Vol. 3,806,400

Sell Vol. 5,169,700

28,400

1D 1.79%

5D 1.43%

Buy Vol. 6,253,300

Sell Vol. 6,760,600

38,750

1D 0.00%

5D -0.13%

Buy Vol. 5,183,000

Sell Vol. 6,261,600

31,350

1D 0.48%

5D 0.48%

Buy Vol. 15,741,800

Sell Vol. 16,990,500

23,650

1D 1.07%

5D 1.94%

Buy Vol. 18,909,400

Sell Vol. 18,121,700

26,300

1D 1.35%

5D 2.33%

Buy Vol. 3,238,200

Sell Vol. 3,093,800

27,900

1D 0.72%

5D -0.36%

Buy Vol. 1,468,200

Sell Vol. 2,275,900

24,650

1D -0.80%

5D -1.40%

Buy Vol. 14,892,100

Sell Vol. 18,434,900

25,000

1D -1.19%

5D -0.79%

Buy Vol. 2,732,400

Sell Vol. 4,034,800

24,550

1D 0.00%

5D -1.01%

Buy Vol. 4,063,300

Sell Vol. 4,700,200

TPB: The international credit rating agency Moody's Investors Service (Moody's) has just announced to maintain the B1 credit rating, a positive outlook for Tien Phong Commercial Joint Stock Bank (TPBank). Specifically, Moody's maintains TPBank's counterparty risk rating at Ba3 - the highest level in this unit's rating for the banking system in Vietnam; Base credit rating, long-term deposit and long-term issuer at B1.

REAL ESTATE

82,200

1D 0.12%

5D 0.24%

Buy Vol. 3,989,400

Sell Vol. 3,797,800

37,700

1D 0.27%

5D 0.00%

Buy Vol. 814,200

Sell Vol. 1,125,600

55,100

1D 2.42%

5D -2.65%

Buy Vol. 3,785,300

Sell Vol. 3,633,800

NVL: business cash flow when it first surpassed VND4,200 billion in Q2/2022, making a great contribution to Novaland's business cash flow that did not come from sales.

OIL & GAS

118,900

1D 1.19%

5D 1.62%

Buy Vol. 1,133,900

Sell Vol. 1,651,800

13,850

1D -0.72%

5D -0.36%

Buy Vol. 27,551,800

Sell Vol. 30,315,400

42,250

1D -1.52%

5D -3.98%

Buy Vol. 3,159,900

Sell Vol. 3,402,300

GAS: According to the leader of PV GAS, in the field of LNG business, the unit is expected to start implementing business activities from the end of 2022 after completing the Thi Vai LNG storage project.

VINGROUP

63,600

1D 0.00%

5D -2.15%

Buy Vol. 1,788,000

Sell Vol. 1,560,800

59,900

1D 0.34%

5D 0.67%

Buy Vol. 2,877,000

Sell Vol. 3,324,900

28,400

1D 0.00%

5D -1.56%

Buy Vol. 1,565,200

Sell Vol. 2,212,900

VIC: Profit before tax in 6M2022 reached VND3,487 billion, and profit after tax of parent company shareholders was VND5,846 billion, up 63% over the same period last year.

FOOD & BEVERAGE

76,000

1D 0.66%

5D 0.26%

Buy Vol. 3,782,200

Sell Vol. 3,981,900

113,700

1D 1.34%

5D 0.98%

Buy Vol. 1,054,200

Sell Vol. 1,234,800

187,900

1D -0.05%

5D -1.11%

Buy Vol. 150,200

Sell Vol. 150,700

MSN: In 2022 and 2023, Masan will continue to expand investment in technology with a focus on applying AI and ML technologies to truly become a Consumer – Technology ecosystem.

OTHERS

122,400

1D 0.33%

5D -0.89%

Buy Vol. 453,400

Sell Vol. 511,600

122,400

1D 0.33%

5D -0.89%

Buy Vol. 453,400

Sell Vol. 511,600

86,400

1D -0.12%

5D 0.47%

Buy Vol. 2,250,900

Sell Vol. 3,513,300

73,300

1D -0.95%

5D 9.57%

Buy Vol. 7,840,900

Sell Vol. 9,170,100

26,650

1D 6.81%

5D 11.27%

Buy Vol. 15,450,900

Sell Vol. 9,543,800

23,950

1D -1.84%

5D -5.71%

Buy Vol. 20,996,100

Sell Vol. 28,373,700

23,050

1D 0.22%

5D -2.54%

Buy Vol. 24,520,600

Sell Vol. 28,728,700

HPG: in Dak Nong province, HPG has proposed to survey investment projects including: Alumin project, capacity of 2 million tons of Alumin/year; ore refinery with a capacity of 5 million tons/year. The construction site of the selection factory is located in Dak D'rung commune, Alumin and Aluminum factory is adjacent to 2 communes Nam N'Jang and Truong Xuan (Dak Song district).

Market by numbers

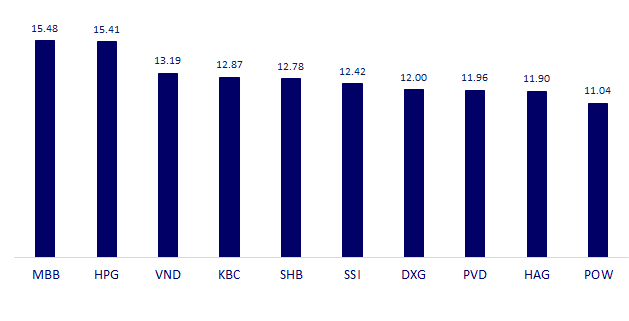

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

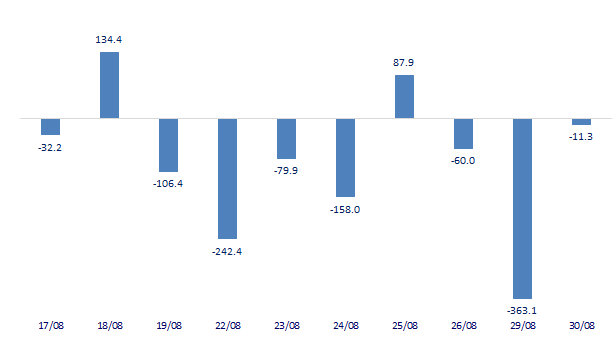

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

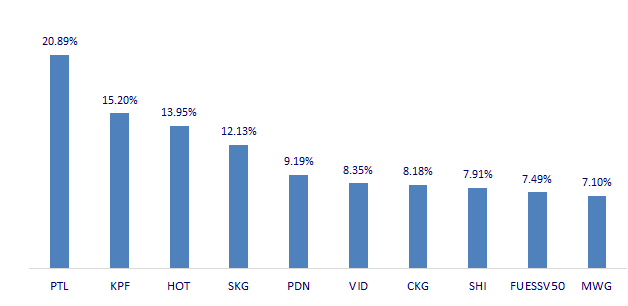

TOP INCREASES 3 CONSECUTIVE SESSIONS

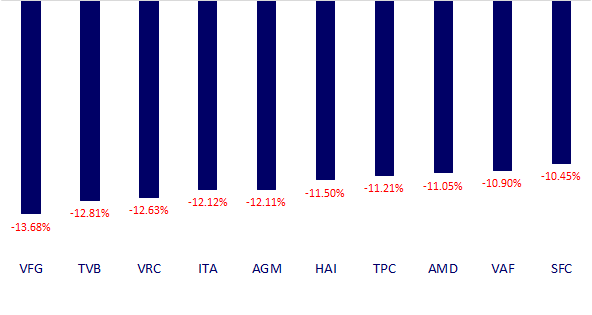

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.