Market Brief 14/09/2022

VIETNAM STOCK MARKET

1,240.77

1D -0.61%

YTD -17.19%

1,260.88

1D -0.91%

YTD -17.90%

279.42

1D -0.77%

YTD -41.05%

90.16

1D -0.27%

YTD -19.99%

-61.64

1D 0.00%

YTD 0.00%

16,730.27

1D 13.55%

YTD -46.16%

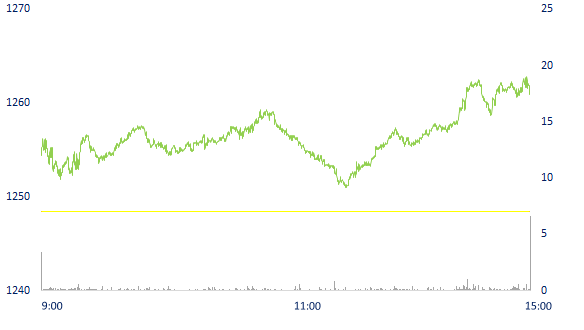

Bottom-fishing demand entered the afternoon session and pulled a series of recovering stocks and VN-Index also significantly slowed down the falling momentum. At the end of the session, VN-Index regained more than half of the lost points compared to the bottom of the day, closing above 1,240 points, the liquidity also improved significantly compared to the first 2 sessions of the week.

ETF & DERIVATIVES

21,390

1D -1.11%

YTD -17.19%

14,900

1D -0.73%

YTD -17.63%

15,590

1D -12.46%

YTD -17.95%

21,900

1D 5.80%

YTD -4.37%

17,240

1D -0.92%

YTD -23.31%

26,800

1D -1.47%

YTD -4.46%

16,200

1D -1.16%

YTD -24.58%

1,243

1D -1.37%

YTD 0.00%

1,251

1D -0.92%

YTD 0.00%

1,253

1D -1.14%

YTD 0.00%

1,259

1D -1.02%

YTD 0.00%

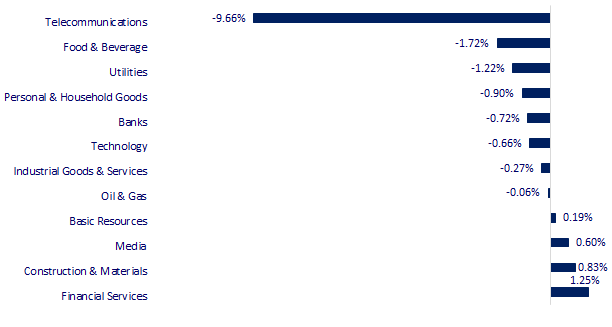

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

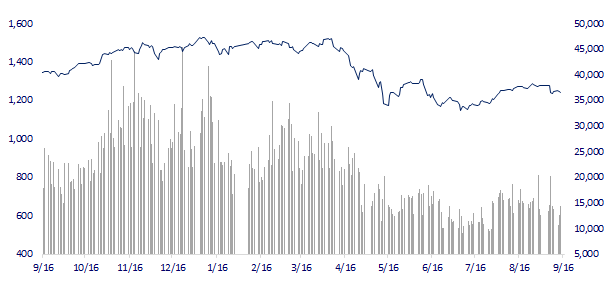

VNINDEX (12M)

GLOBAL MARKET

27,818.62

1D -0.43%

YTD -3.38%

3,237.54

1D -0.80%

YTD -11.05%

2,411.42

1D -1.56%

YTD -19.02%

18,847.10

1D -2.48%

YTD -19.45%

3,258.02

1D -0.97%

YTD 4.30%

1,656.58

1D -0.27%

YTD -0.06%

87.50

1D 0.10%

YTD 14.38%

1,715.35

1D 0.33%

YTD -5.79%

The stock markets of Japan, Korea, China, etc. this morning all went down right after opening, with a popular decrease of 2-3%. The Nikkei 225 index closed down 0.43%. In South Korea, Kospi fell 2.6% early in the session, closing the index narrowing at 1.56%. The movements of Asian stocks were similar to those of the US market last night, inflation in the US in August was higher than expected, making investors worried that the US Federal Reserve (Fed) would continue to raise interest rates strongly.

VIETNAM ECONOMY

4.20%

1D (bps) -9

YTD (bps) 339

5.60%

3.26%

1D (bps) -8

YTD (bps) 225

3.60%

1D (bps) -8

YTD (bps) 160

23,738

1D (%) 0.18%

YTD (%) 3.48%

24,356

1D (%) 0.50%

YTD (%) -7.98%

3,460

1D (%) -0.32%

YTD (%) -5.41%

In the morning of September 14, the central exchange rate turned to increase sharply by 13 dong compared to the previous session, this is the first increase in the last four sessions of the central rate. Meanwhile, the USD price at commercial banks this morning was simultaneously adjusted sharply from 20 to 90 dong depending on each bank.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Prime Minister: Enhance publicity, transparency, stable and healthy development of the stock market and corporate bond market

- Nearly VND100,000b of government bonds have been raised

- VND3,888B to expand the national highway connecting Can Tho - Hau Giang

- Inflation in the UK unexpectedly weakened in August

- Falling forex reserves create challenges for Asian central bank

- Top 6 US technology companies lose more than 500 billion in capitalization because of inflation reports

VN30

BANK

78,300

1D -0.38%

5D -2.13%

Buy Vol. 2,099,600

Sell Vol. 1,518,500

36,500

1D -0.82%

5D -3.44%

Buy Vol. 2,710,300

Sell Vol. 2,357,600

27,000

1D -1.82%

5D -1.28%

Buy Vol. 3,581,900

Sell Vol. 4,845,500

36,800

1D -1.34%

5D -2.00%

Buy Vol. 5,213,900

Sell Vol. 4,181,000

30,300

1D -0.66%

5D 0.00%

Buy Vol. 26,433,800

Sell Vol. 19,921,500

22,400

1D -0.67%

5D -2.61%

Buy Vol. 19,086,100

Sell Vol. 11,827,600

25,200

1D -2.70%

5D -3.45%

Buy Vol. 3,807,600

Sell Vol. 3,649,600

26,550

1D -1.12%

5D -2.75%

Buy Vol. 2,038,000

Sell Vol. 1,631,700

23,050

1D 0.00%

5D -5.34%

Buy Vol. 24,603,300

Sell Vol. 14,398,800

23,150

1D -0.86%

5D -5.51%

Buy Vol. 2,872,300

Sell Vol. 2,364,100

23,500

1D -1.26%

5D -3.29%

Buy Vol. 4,754,000

Sell Vol. 3,533,300

CASA of the banking system increased by more than VND 35,200 billion after 6 months. As of June 30, 2022, Techcombank (TCB) was the bank with the highest CASA ratio in the system, reaching 42.6%, down from 45.6% at the beginning of the year, mainly because the CASA balance still reached VND 152,659 billion, down 4%, equivalent to a decrease of VND6,200 billion compared to the beginning of the year. Behind Techcombank in terms of CASA ratio is MBB, with the ratio falling from 40.6% to 36%. Next is Vietcombank (VCB) with a CASA ratio of 34%, up from 32.4% at the beginning of the year, when the amount of CASA from customers increased by 10%, equivalent to an increase of VND 38,303 billion.

REAL ESTATE

83,500

1D 0.00%

5D -0.36%

Buy Vol. 5,052,700

Sell Vol. 4,346,300

35,700

1D -0.28%

5D 1.13%

Buy Vol. 1,605,100

Sell Vol. 1,182,900

50,900

1D -1.74%

5D -5.39%

Buy Vol. 2,281,700

Sell Vol. 2,125,100

NVL: 3 projects to be launched for sale by the end of this year, including co-development of project in the Central region; Grand Sentosa project and a new project in HCMC

OIL & GAS

112,500

1D -1.49%

5D 0.45%

Buy Vol. 822,300

Sell Vol. 747,100

14,150

1D 0.00%

5D 1.07%

Buy Vol. 65,071,700

Sell Vol. 45,195,000

39,400

1D -1.75%

5D -1.50%

Buy Vol. 2,722,800

Sell Vol. 1,713,600

POW: total revenue in August reached VND1,868b, up 3% over the same period last year and exceeding 16% of the plan. Accumulating 8 months, POW recorded VND18,540b in total revenue, down 7.6% over the same period

VINGROUP

63,400

1D -1.09%

5D 1.44%

Buy Vol. 1,842,700

Sell Vol. 1,329,300

60,000

1D -1.15%

5D 0.84%

Buy Vol. 2,987,100

Sell Vol. 2,852,500

28,500

1D 0.53%

5D 3.07%

Buy Vol. 2,519,600

Sell Vol. 2,209,800

VIC: Reuters, Nikkei Asia and world famous car websites simultaneously reported on VinFast handing over the first 100 VF 8 cars to Vietnamese customers.

FOOD & BEVERAGE

74,000

1D -2.25%

5D -2.25%

Buy Vol. 3,138,600

Sell Vol. 3,148,400

112,000

1D -1.75%

5D 0.00%

Buy Vol. 897,200

Sell Vol. 961,300

184,000

1D -3.66%

5D -2.13%

Buy Vol. 374,700

Sell Vol. 327,300

In today's trading session, VNM and SAB were both among the top net sellers of foreign investors with a value of 22 billion dong and 18 billion dong, respectively.

OTHERS

116,200

1D -1.02%

5D 2.02%

Buy Vol. 738,900

Sell Vol. 849,800

116,200

1D -1.02%

5D 2.02%

Buy Vol. 738,900

Sell Vol. 849,800

84,000

1D -0.71%

5D 0.00%

Buy Vol. 2,902,300

Sell Vol. 2,494,400

73,700

1D -0.54%

5D 4.24%

Buy Vol. 8,743,900

Sell Vol. 7,171,700

25,000

1D -0.20%

5D -3.10%

Buy Vol. 5,126,900

Sell Vol. 3,251,500

21,950

1D 1.39%

5D -2.66%

Buy Vol. 58,159,400

Sell Vol. 43,360,600

23,700

1D 0.00%

5D 3.04%

Buy Vol. 51,378,900

Sell Vol. 42,779,500

VJC: The expected proceeds from the upcoming private placement of shares is 4,698 billion dong, which will be used by the company to buy 1,136 billion dong of aircraft; VND 1,242 billion to lease and purchase aircraft repair engines and an additional VND 2,320 billion to supplement liquidity and working capital for business activities.

Market by numbers

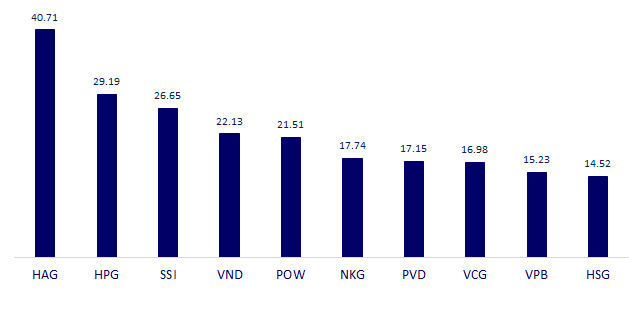

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

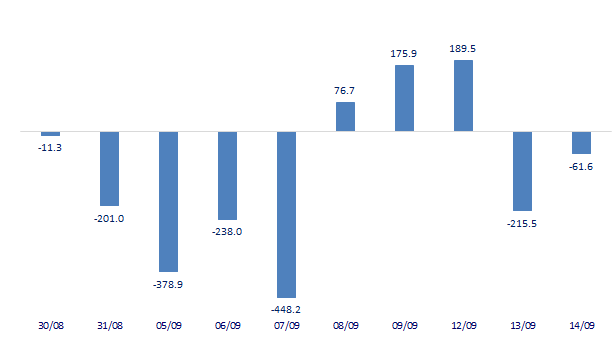

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

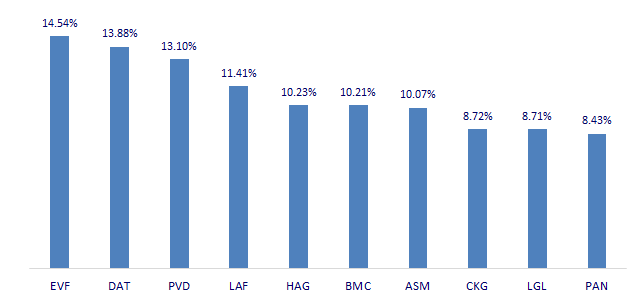

TOP INCREASES 3 CONSECUTIVE SESSIONS

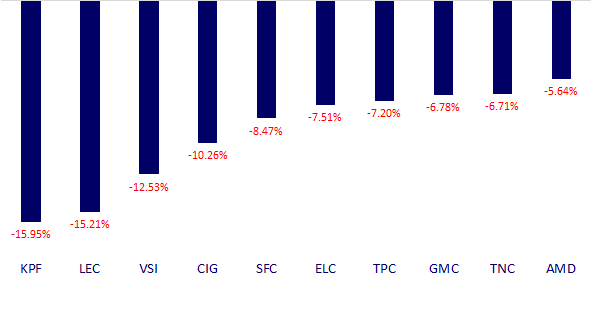

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.