Morning Brief 23/09/2022

GLOBAL MARKET

30,076.68

1D -0.35%

YTD -17.37%

3,757.99

1D -0.84%

YTD -21.36%

11,066.80

1D -1.37%

YTD -29.70%

27.35

1D -2.29%

7,159.52

1D -1.08%

YTD -3.29%

12,531.63

1D -1.84%

YTD -21.11%

5,918.50

1D -1.87%

YTD -17.49%

83.81

1D 1.59%

YTD 9.56%

1,682.85

1D 1.00%

YTD -7.58%

US stocks continued to decline as the US Federal Reserve (Fed) and several other central banks raised interest rates, raising concerns that the fight against inflation would trigger a recession. Accordingly, the Dow Jones Industrial Average fell 107.1 points, or 0.35%, to 30,076.68 points. The S&P 500 fell 0.84% to 3,757.99 while the Nasdaq Composite fell 1.37% to 11,066.80.

VIETNAM ECONOMY

4.68%

1D (bps) 7

YTD (bps) 387

5.60%

3.73%

1D (bps) 19

YTD (bps) 272

4.14%

1D (bps) 24

YTD (bps) 214

23,845

1D (%) 0.04%

YTD (%) 3.95%

24,077

1D (%) 0.35%

YTD (%) -9.03%

3,419

1D (%) -0.35%

YTD (%) -6.53%

On September 22, the State Bank increased a series of operating interest rates including ceiling deposit rates, discount rates, and refinancing rates. For demand deposits with terms of less than 1 month, the ceiling interest rate was raised from 0.2% to 0.5% per year. Besides, two other types of operating interest rates include refinancing rate; rediscount also increased by 5% a year and 3.5% a year, respectively. These decisions take effect from September 23

VIETNAM STOCK MARKET

1,214.70

1D 0.34%

YTD -18.93%

1,228.94

1D 0.06%

YTD -19.98%

265.64

1D 0.21%

YTD -43.96%

88.55

1D 0.36%

YTD -21.41%

-486.75

13,522.01

1D 20.19%

YTD -56.48%

Vietnam's stock market suddenly gained 4 points despite concerns about the Fed's move to raise interest rates. Before the upstream movement of the market, many industry groups also changed from red to green. Prominent is the Securities group with a breakthrough in most stocks. Leading the recovery is Ho Chi Minh City with an impressive increase of 4.45%.

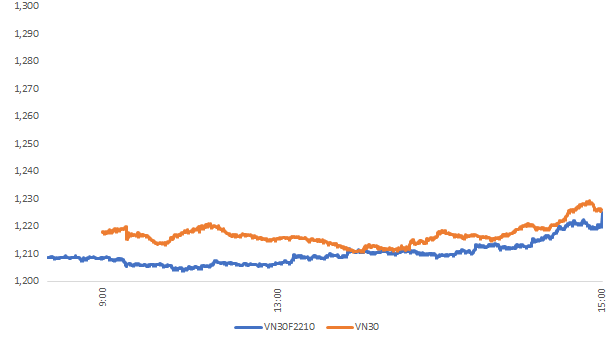

INTRADAY

VN30 (12M)

SELECTED NEWS

- State Bank raised the ceiling deposit interest rate

- Vietnam's rice exports are likely to exceed the plan

- JP Morgan: Vietnam will produce 65% of Airpods, 20% of iPad globally and become an important production center for Apple

- Many countries simultaneously adjusted interest rates after the Fed's move

- Oil rises on concerns about oil supplies from Russia

- Plant-based meat is stuck in the way of recovery because of inflation

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.