Market Brief 27/09/2022

VIETNAM STOCK MARKET

1,166.54

1D -0.67%

YTD -22.14%

1,182.46

1D -0.40%

YTD -23.00%

255.52

1D -0.06%

YTD -46.09%

86.71

1D 0.03%

YTD -23.05%

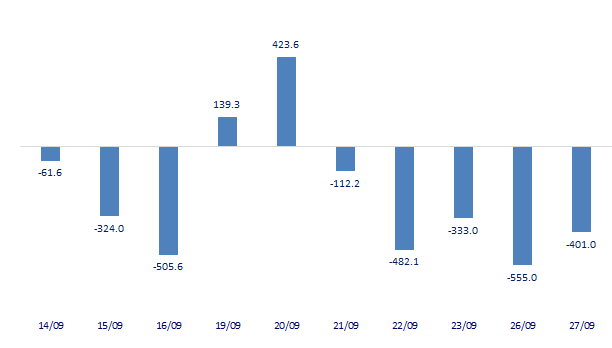

-401.02

1D 0.00%

YTD 0.00%

12,734.24

1D -36.61%

YTD -59.02%

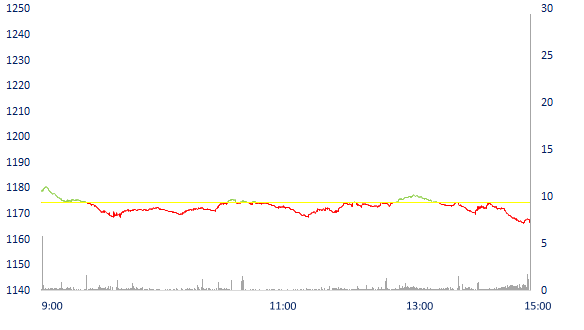

After the strong downward pressure at the beginning of the week, the Vietnamese stock market experienced a continuous struggle and reversal. Selling pressure still prevailed and increased strongly at the end of the session, causing VN-Index to drop nearly 8 points. The whole market recorded 477 decliners, while 414 gainers. Some industry groups recovered and kept the green color such as electricity, banking, securities

ETF & DERIVATIVES

20,230

1D -0.20%

YTD -21.68%

13,950

1D -0.36%

YTD -22.89%

14,280

1D -19.82%

YTD -24.84%

18,410

1D -6.78%

YTD -19.61%

15,650

1D 1.56%

YTD -30.38%

25,170

1D 0.04%

YTD -10.27%

15,200

1D -1.81%

YTD -29.24%

1,189

1D -0.04%

YTD 0.00%

1,185

1D -0.46%

YTD 0.00%

1,183

1D -0.04%

YTD 0.00%

1,185

1D -0.59%

YTD 0.00%

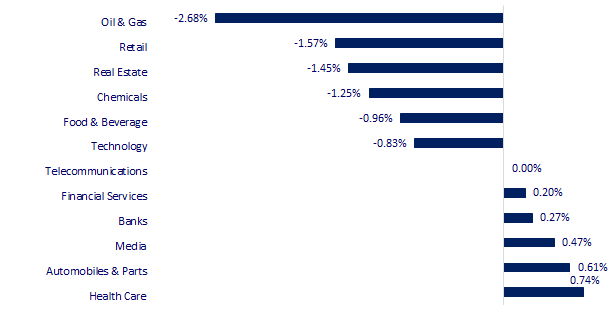

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

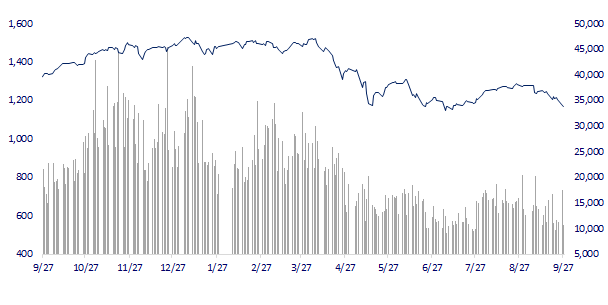

VNINDEX (12M)

GLOBAL MARKET

26,571.87

1D -0.16%

YTD -7.71%

3,093.86

1D 1.40%

YTD -15.00%

2,223.86

1D 0.13%

YTD -25.31%

17,860.31

1D 0.21%

YTD -23.67%

3,165.50

1D -0.52%

YTD 1.34%

1,610.58

1D -0.66%

YTD -2.84%

77.53

1D 0.61%

YTD 1.35%

1,641.50

1D 0.28%

YTD -9.85%

After several volatile sessions, Asian stock markets were more "quiet" in the session 27/9, in the context of most assets falling in price. In Japan, the Nikkei 225 index fell 0.16% to 26,571.87 points. Korea's Kospi index also ended a series of "red floor" sessions in a row to reverse and increase 0.13% to 2,223.86 points. In China, the Hang Seng index increased 0.21% to 17,860.31 points

VIETNAM ECONOMY

5.12%

1D (bps) 23

YTD (bps) 431

5.60%

4.13%

1D (bps) 10

YTD (bps) 312

4.56%

1D (bps) 20

YTD (bps) 256

23,883

1D (%) 0.08%

YTD (%) 4.11%

23,545

1D (%) -0.14%

YTD (%) -11.04%

3,382

1D (%) -0.03%

YTD (%) -7.55%

Last week, the State Bank (SBV) increased a series of operating interest rates by 1%. Besides, the SBV net withdrew a total of 34.6 trillion dong through the open market channel and more than 23 trillion dong through the foreign currency sale channel. With the above adjustment, the operating interest rate has returned to the same level as in March 2020 and is 50 basis points lower than before Covid (except for the ceiling of deposit interest rates under 6 months).

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- VCCI proposes to reduce the entire excise tax on gasoline

- Seafood export turnover in 8 months increased by 37%

- Invested more than VND 2,238 billion to build infrastructure of Dong Soc industrial park

- Reuters: America faces the possibility of a natural gas shortage

- Two Nord Stream pipelines 1 and 2 have problems together

- India wants to become a semiconductor powerhouse

VN30

BANK

74,300

1D -0.93%

5D -6.19%

Buy Vol. 891,200

Sell Vol. 1,785,600

33,700

1D 0.90%

5D -4.13%

Buy Vol. 1,334,800

Sell Vol. 1,329,400

23,450

1D -0.21%

5D -9.81%

Buy Vol. 4,997,200

Sell Vol. 5,224,700

33,500

1D 0.75%

5D -4.42%

Buy Vol. 4,636,000

Sell Vol. 4,037,700

27,400

1D -0.72%

5D -8.67%

Buy Vol. 22,152,800

Sell Vol. 20,758,700

20,200

1D 0.50%

5D -5.39%

Buy Vol. 10,343,400

Sell Vol. 6,790,700

19,300

1D 2.88%

5D -2.72%

Buy Vol. 2,448,600

Sell Vol. 2,927,500

24,900

1D 0.00%

5D -1.97%

Buy Vol. 1,654,100

Sell Vol. 1,689,700

20,500

1D 0.00%

5D -7.45%

Buy Vol. 10,171,900

Sell Vol. 9,577,900

23,250

1D 3.10%

5D 4.26%

Buy Vol. 6,725,300

Sell Vol. 6,664,600

22,400

1D 0.90%

5D -2.18%

Buy Vol. 2,647,900

Sell Vol. 2,694,600

VCB, CTG, Agribank have just increased deposit interest rates by more than 1%/year. The big 4 interest rate increase will significantly affect the interest rate level of the market because these banks account for more than 45% of the deposit market share of the whole system. Specifically, on September 27, VCB updated the new deposit interest rate schedule and increased sharply by 0.8-1.3%/year in many terms. Accordingly, CTG's 1 month - 3 months term interest rate also increased by 1% to 4.1%/year, and the 3-months - 6 months term interest rate increased to 4.4%/year. For periods of 12 months or more, this bank applies a new interest rate of 6.4%/year, 0.8%/year higher than before

REAL ESTATE

84,500

1D 0.00%

5D -0.12%

Buy Vol. 3,891,100

Sell Vol. 3,729,400

29,400

1D -0.68%

5D -11.98%

Buy Vol. 5,070,300

Sell Vol. 4,040,800

50,000

1D -0.79%

5D -3.29%

Buy Vol. 1,745,200

Sell Vol. 1,937,200

OIL & GAS

111,500

1D -1.85%

5D 2.20%

Buy Vol. 461,900

Sell Vol. 1,034,000

12,950

1D 1.17%

5D -5.47%

Buy Vol. 22,515,400

Sell Vol. 19,462,600

35,400

1D -1.94%

5D -6.84%

Buy Vol. 2,313,700

Sell Vol. 2,149,500

GAS: In 9M/2022, PV Gas is expected to reach VND 76,500 billion in revenue (up 30% over the same period) and VND 14,000 billion in pre-tax profit (up 61.8% over the same period)

VINGROUP

61,000

1D -1.61%

5D -4.54%

Buy Vol. 935,900

Sell Vol. 1,529,700

54,100

1D -3.22%

5D -8.15%

Buy Vol. 1,677,900

Sell Vol. 2,136,500

26,650

1D 0.00%

5D -8.26%

Buy Vol. 2,182,600

Sell Vol. 2,100,900

VIC: Vingroup has just issued a notice of payment guarantee for bonds issued in 2022 for its subsidiary VinFast with a maximum amount of VND 13,000 billion

FOOD & BEVERAGE

72,400

1D -2.16%

5D -4.49%

Buy Vol. 3,592,000

Sell Vol. 4,148,100

107,700

1D 0.00%

5D -4.94%

Buy Vol. 648,800

Sell Vol. 611,700

185,300

1D 0.16%

5D -1.17%

Buy Vol. 116,200

Sell Vol. 168,800

MSN: Masan has just announced that it has successfully mobilized 2 bonds worth 1,500 billion VND before the bond lot of equivalent value matures on September 25, 2022

OTHERS

110,500

1D 0.36%

5D -4.82%

Buy Vol. 389,100

Sell Vol. 452,200

110,500

1D 0.36%

5D -4.82%

Buy Vol. 389,100

Sell Vol. 452,200

80,500

1D -1.23%

5D -3.48%

Buy Vol. 2,020,900

Sell Vol. 1,956,500

67,100

1D -1.32%

5D -6.42%

Buy Vol. 3,610,000

Sell Vol. 3,811,600

22,750

1D -1.09%

5D -3.19%

Buy Vol. 1,894,500

Sell Vol. 2,161,100

19,550

1D 0.26%

5D -5.56%

Buy Vol. 20,049,600

Sell Vol. 21,988,200

22,400

1D 0.00%

5D -2.61%

Buy Vol. 16,373,100

Sell Vol. 16,218,400

MWG: MWG has just announced its business results for the first 8M/2022 with revenue of VND 92,283b and profit after tax of VND 3,176b, up 17% and 6% respectively over the same period in 2021. Compared to the year target, MWG has fulfilled 66% of revenue and 50% of profit target. In 8M/2022, The Gioi Di Dong and Dien May Xanh chains contributed VND 24,500b and VND 48,800b, accounting for a total of 79.5% of the group's revenue

Market by numbers

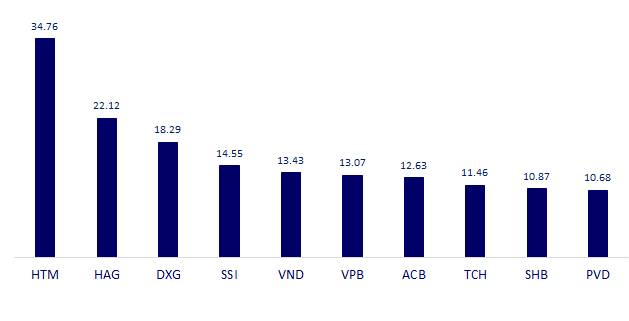

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

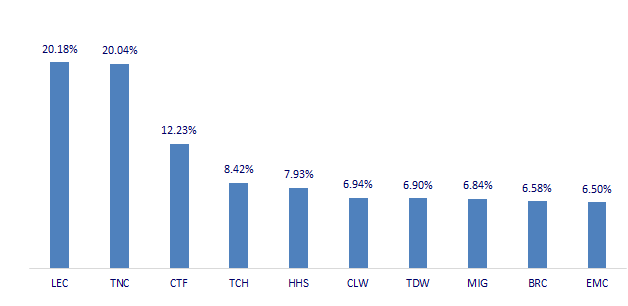

TOP INCREASES 3 CONSECUTIVE SESSIONS

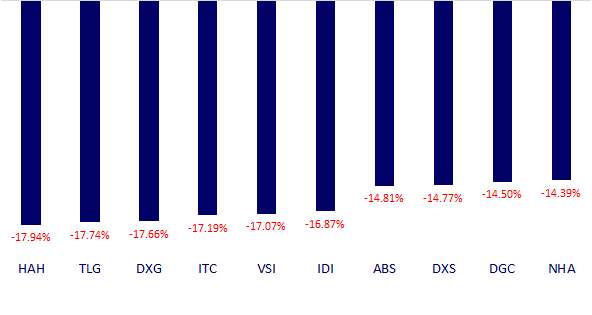

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.